Page 1 of 1

Oil markets

Posted: July 6th, 2022, 4:40 pm

by hiriskpaul

Unusually large backwardation in oil futures has opened recently. Anyone know why, or have good links discussing possible reasons?

Re: Oil markets

Posted: July 6th, 2022, 5:15 pm

by Hallucigenia

Market is really tight in the short term - I think it was Goldman suggesting we were 1MMbbl/day short at the moment what with Libya and everything, but general assumption of recession in the medium term is hitting the market further out.

Anyway, who cares about oil any more, it's all about gas these days....

Re: Oil markets

Posted: July 6th, 2022, 5:49 pm

by BullDog

I don't know. But I suspect the growing likelihood of a deep and very sharp recession in the near future is depressing the outlook on the demand side of things. With Brent trading under $100 a barrel, I think that's the case most likely. I think China is going to be acting like a giant sponge soaking up as much discounted Russian crude as they can pump. But I suppose that's difficult to account for in the near term.

Re: Oil markets

Posted: July 6th, 2022, 7:36 pm

by Hallucigenia

Ooh - the 3-2-1 crack spread has collapsed from $50 to a "mere" $40 :

Re: Oil markets

Posted: July 7th, 2022, 5:03 pm

by hiriskpaul

Still in backwardation, but has narrowed. AUG/SEP spread about $4, down from $6 yesterday. 6% jump in AUG future today as well.

All very strange. Saudi manipulation?

Re: Oil markets

Posted: July 7th, 2022, 6:17 pm

by Hallucigenia

I've seen it suggested that the weakness of the financial markets versus the tightness in the physical markets is down to some big forced sellers, which given the stresses some players must be experiencing, is plausible. We've already seen eg the rest of EDF being nationalised for instance, and TTF is going even more bonkers than it's been in recent weeks.

Re: Oil markets

Posted: July 30th, 2022, 2:23 am

by Proselenes

More and more people catching on that OPEC cannot increase oil supply much as its "fabled" spare capacity is all fantasy and not real. They can only replace the decline and not increase the supply.

People had predicted the spare capacity would be fully utilised by end of 2022. I wonder if its actually already done and there is no more spare capacity, which is why Biden is dumping oil from the SPR to hide this, until after the November mid-terms, at which point all will be revealed and oil prices rocket.......

https://www.reuters.com/business/energy ... 022-07-29/.

Re: Oil markets

Posted: July 30th, 2022, 9:49 am

by monabri

Expecting a supply shortage, maybe? Mr P turning off the taps?

Re: Oil markets

Posted: July 30th, 2022, 11:00 am

by Proselenes

People are blaming Russia and Ukraine.....however Russia is now exporting more oil than before the war started. Russia has not made oil prices high.....that is pure supply and demand issues.

Russia has made gas prices high....yes........

Re: Oil markets

Posted: July 30th, 2022, 12:42 pm

by 88V8

Was much commentary on the lack of spare capacity here

https://blog.gorozen.com/blog/running-out-of-spare-oil-capacity?_hsmi=218218396&_hsenc=p2ANqtz-8ncbE9TB8AJy1ZuLpEE7bFijQwhWYumdt-RocJrofz7f4oT5YNwL1jNaEghQ7gSAnkTTzMqiDfPwuBowXhPFIr0iM01g which makes good or alarming reading, depending on one's investment position.

With demand running higher than expectations and non-OPEC+ supply disappointing, all eyes are on OPEC+. President Biden asked the cartel to produce more oil in November 2021 and again in February 2022 and both requests were ignored. Most analysts we speak with believe that OPEC+ (led by Saudi Arabia) chose not to increase production; however we believe they tried but were ultimately unable to. and it's not only OPEC....

Conventional US production continues to fall precipitously, having declined by 16% since its peak while Gulf of Mexico production is off 20%. Higher oil prices have not helped either source of supply: conventional US production is off 7% year-to-date while the Gulf of Mexico is down 6%.Unless there is a recession, I expect both oil & gas to be high this winter. Does anyone really think otherwise?

V8

Re: Oil markets

Posted: February 19th, 2024, 8:30 pm

by Hallucigenia

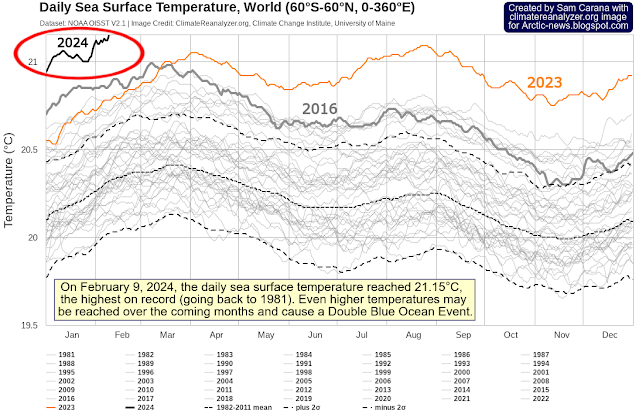

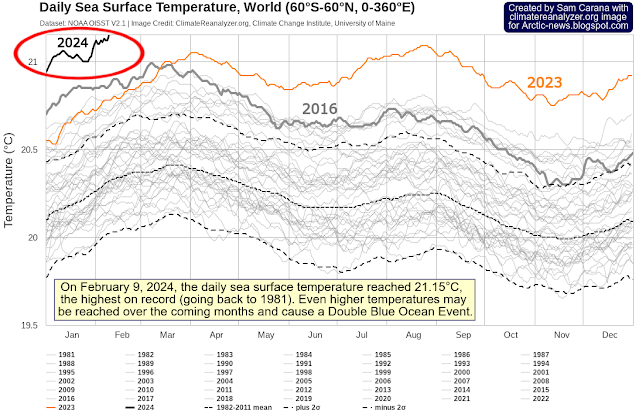

I guess this is the most recent thread on commodity prices, so I'll just throw this one in here.

Brent currently $83.32, Nymex gas $1.56, NBP 57.7p, TTF €23.59, JKM $8.57

That compares with the following in my last RNS roundup (sorry, no time to fix at the moment) 13 months ago :

Brent=$84.57(January) WTI=$79.19(January,Brent-5.38) Nymex gas=$3.76(January)

NBP =136.76p(January,Nymex+12.92) TTF=€56.705(February,Nymex+14.22) JKM=$20.170

So Brent is roughly where it was, but gas is ~40% of where it was last winter, you can't give it away at the moment, thanks to the mild weather we've been having. And when you look at charts of ocean temperatures, it's obvious that 11 months ago Something Weird happened, leading to a break out of ocean temperatures. There's been lots of debate about whether this is down to restrictions on sulphur emissions, or some deeper problem with the circulation in the Atlantic - but as a non-climatologist this feels like something that isn't going to settle down within a couple of months, which means it's probably going to be a mild winter in 2024/5 as well. So whilst some of the bargains on offer in the gas sector may look attractive, there's probably more pain to come there?