Got a credit card? use our Credit Card & Finance Calculators

Thanks to Anonymous,bruncher,niord,gvonge,Shelford, for Donating to support the site

Switching to a decumulation mindset

Re: Switching to a decumulation mindset

vand -I think the point I was trying to make was that a portfolio that was successful in accumulating will also be successful in deaccumulation-after all growth of the portfolio is what you need in accumulation and deaccumulation ie same assets re equities,bonds etc should continue to be used

However what usually does change is the Asset Allocation

100% equities is not usual in a retirement portfolio as volatility and risk are too great for most retirees

Personally a few years out from retirement my Asset Allocation changed from 80/20 to 30/70 at retirement plus….

2+ years of living expenses in cash

Thus ready to have a reasonable chance to cope with that retiree’s nightmare-a market drop at retirement

Luckily for me that didn’t happen and now 21 retirement years later Asset Allocation is currently 34/60/6 where 6. = cash=2+ years living expenses

One can only prepare so far -retiring in 3022 where equities and bonds went down wouldn’t have been very pleasant-sadly an extreme scenario that can happen

xxd09

However what usually does change is the Asset Allocation

100% equities is not usual in a retirement portfolio as volatility and risk are too great for most retirees

Personally a few years out from retirement my Asset Allocation changed from 80/20 to 30/70 at retirement plus….

2+ years of living expenses in cash

Thus ready to have a reasonable chance to cope with that retiree’s nightmare-a market drop at retirement

Luckily for me that didn’t happen and now 21 retirement years later Asset Allocation is currently 34/60/6 where 6. = cash=2+ years living expenses

One can only prepare so far -retiring in 3022 where equities and bonds went down wouldn’t have been very pleasant-sadly an extreme scenario that can happen

xxd09

-

Gilgongo

- Lemon Slice

- Posts: 427

- Joined: November 5th, 2016, 6:51 pm

- Has thanked: 158 times

- Been thanked: 130 times

Re: Switching to a decumulation mindset

This isn't the first time I've heard of this difficultly in decumulation so I was sort of mindful of it when I recently retired. In my case, I defend myself against it by living primarily off dividends rather than selling anything. And yes, I know this isn't what's actually happening because total return is just as effective if not more so etc. etc. - but it's the mindset/feels that counts I think.

Re: Switching to a decumulation mindset

Gilgongo-you put you finger on the problem

An investor must be comfortable with and understand their deaccumulation policy

Dividends are comforting to a retiree because they superficially resemble that lost income stream from work

Unfortunately it is not a true analogy and could unnecessarily stint a retirees withdrawal rate during retirement which would be unfortunate

xxd09

An investor must be comfortable with and understand their deaccumulation policy

Dividends are comforting to a retiree because they superficially resemble that lost income stream from work

Unfortunately it is not a true analogy and could unnecessarily stint a retirees withdrawal rate during retirement which would be unfortunate

xxd09

Re: Switching to a decumulation mindset

I am also not a good spender.

I am actually fairly poor ànd very much out of place here materially but perhaps the psychological similarities are the draw. The relative poverty is easily fixed by continuing to work as like the OP I get a lot from it beyond the index linked cash.

I tend to focus on value when I am spending and some things demonstrate greater value to me and I can get on board with the expenditure. A more expensive version of what I already have that is deep into law of diminishing returns territory is a problem for me and I suspect that is at the core of the problem for many of you more professionally successful than me. You are in a good place already and the case for more expensive stuff is flimsy.

I have been considering a Casio 5610u, now that the date can be set the 'correct' way round, for 2 years now.

it is 100 quid for Christ's sake, but I already know the time from my phone so it may never happen.

It doesn't help being 'on the spectrum', but then a casual glance at the HYP board would suggest I'm not alone.

W.

I am actually fairly poor ànd very much out of place here materially but perhaps the psychological similarities are the draw. The relative poverty is easily fixed by continuing to work as like the OP I get a lot from it beyond the index linked cash.

I tend to focus on value when I am spending and some things demonstrate greater value to me and I can get on board with the expenditure. A more expensive version of what I already have that is deep into law of diminishing returns territory is a problem for me and I suspect that is at the core of the problem for many of you more professionally successful than me. You are in a good place already and the case for more expensive stuff is flimsy.

I have been considering a Casio 5610u, now that the date can be set the 'correct' way round, for 2 years now.

it is 100 quid for Christ's sake, but I already know the time from my phone so it may never happen.

It doesn't help being 'on the spectrum', but then a casual glance at the HYP board would suggest I'm not alone.

W.

-

DrFfybes

- Lemon Quarter

- Posts: 3865

- Joined: November 6th, 2016, 10:25 pm

- Has thanked: 1225 times

- Been thanked: 2023 times

Re: Switching to a decumulation mindset

Wuffle wrote:I am also not a good spender.

I am actually fairly poor ànd very much out of place here materially but perhaps the psychological similarities are the draw. The relative poverty is easily fixed by continuing to work as like the OP I get a lot from it beyond the index linked cash.

'Frugal' people have a tendency to think they earn/have less than others, we tend to associate spending with affluence, rather than debt.

Being 'not a good spender' is certainly how we got where we are. Not only that, but being brought up like that meant our parents were the same, and consequently left us money we didn't expect or plan on. Apart from a brief spell at Astra/Zeneca/Syngenta I never earned the national Average salary. MrsF fared better, clawing hersef up to management the last 15 years which of course made a difference to her 37 years in the LGPS.

I tend to focus on value when I am spending and some things demonstrate greater value to me and I can get on board with the expenditure. A more expensive version of what I already have that is deep into law of diminishing returns territory is a problem for me and I suspect that is at the core of the problem for many of you more professionally successful than me. You are in a good place already and the case for more expensive stuff is flimsy.

It's the LBYM mindset, you either have it or you don't, replacing things that "work" is a dilemma. We finally got new pans at Xmas as the teflon was flaking off the ones we got for our wedding, and only one lid didn't have a glued handle.

And there's the issue switching to Decumulation. even if all measures suggest you're fine, there's always the 'what if'. With our inheritances we now need under 1.5% from our investments to top up our DB pensions - pretty much the dividend on a Global Tracker. We're happy to cash in investments for things like home improvements, as we can justify the spend as an investment in the property, but cashing it in for a World Cruise or an Aston Martin won't happen until we're too old to enjoy it.

It doesn't help being 'on the spectrum', but then a casual glance at the HYP board would suggest I'm not alone.

W.

I don't think you need to restrict yourself to the HYP board for that

Paul

Re: Switching to a decumulation mindset

I have been retired for three and a half years. Life is busy and fun. I have :-

Moved to Spain, learned Spanish. I cycle and do weights every morning. Play Padel twice a week. Host a guitar group and play with that group in a bar. Joined a choir. Yoga twice a week. Play petanque. Tried salsa. Eat lots of tapas. You can find a can of beer for 27p in the supermarket which is a slippery slope. I could spend all my time tending the garden. With over 300 days of sunshine a year I sometimes go to the beach.

Moved to Spain, learned Spanish. I cycle and do weights every morning. Play Padel twice a week. Host a guitar group and play with that group in a bar. Joined a choir. Yoga twice a week. Play petanque. Tried salsa. Eat lots of tapas. You can find a can of beer for 27p in the supermarket which is a slippery slope. I could spend all my time tending the garden. With over 300 days of sunshine a year I sometimes go to the beach.

-

Gilgongo

- Lemon Slice

- Posts: 427

- Joined: November 5th, 2016, 6:51 pm

- Has thanked: 158 times

- Been thanked: 130 times

Re: Switching to a decumulation mindset

Gilgongo wrote:This isn't the first time I've heard of this difficultly in decumulation so I was sort of mindful of it when I recently retired. In my case, I defend myself against it by living primarily off dividends rather than selling anything. And yes, I know this isn't what's actually happening because total return is just as effective if not more so etc. etc. - but it's the mindset/feels that counts I think.

Yes (and I think we're still on topic), I tell my future self that for now it's dividends, but if/when the outgoings ramp up for things like medical care, we'll switch out to total return (we have some "growthy" investments for this) but it's hard to know how I'll react to that despite applying things like a 3% withdrawal rate from that point etc.

-

tjh290633

- Lemon Half

- Posts: 8386

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 927 times

- Been thanked: 4224 times

Re: Switching to a decumulation mindset

Gilgongo wrote:Gilgongo wrote:This isn't the first time I've heard of this difficultly in decumulation so I was sort of mindful of it when I recently retired. In my case, I defend myself against it by living primarily off dividends rather than selling anything. And yes, I know this isn't what's actually happening because total return is just as effective if not more so etc. etc. - but it's the mindset/feels that counts I think.

Yes (and I think we're still on topic), I tell my future self that for now it's dividends, but if/when the outgoings ramp up for things like medical care, we'll switch out to total return (we have some "growthy" investments for this) but it's hard to know how I'll react to that despite applying things like a 3% withdrawal rate from that point etc.

3% may well be less than your existing flow of dividend income. If you are getting less than that, it sounds like you need to review your investment policy.

TJH

-

vand

- Lemon Slice

- Posts: 821

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 189 times

- Been thanked: 383 times

Re: Switching to a decumulation mindset

You could, equally, swap a chunk of your portfolio for an annuity if you withdrawal rate falls below 3%, because realistically you will die with much more money than you currently have. The only reason to sustain such a low withdrawal rate is that you want to pass a large amount onto your heirs.

-

kempiejon

- Lemon Quarter

- Posts: 3650

- Joined: November 5th, 2016, 10:30 am

- Has thanked: 1 time

- Been thanked: 1221 times

Re: Switching to a decumulation mindset

Gilgongo wrote:Yes (and I think we're still on topic), I tell my future self that for now it's dividends, but if/when the outgoings ramp up for things like medical care, we'll switch out to total return (we have some "growthy" investments for this) but it's hard to know how I'll react to that despite applying things like a 3% withdrawal rate from that point etc.

My dividend income is about enough to live off, perhaps a little excess which is nice. I am still accumulating but for a while focussing on expanding my global cover with the vanguard accumulating ETF VWRP or recently spotted VHVG. This holding could be available for selling to top up cash, make specific purchases, I guess that's my growthy cover but also depending on how much it grows for indulgent luxuries or swapping for an immediate needs annunity.

-

dealtn

- Lemon Half

- Posts: 6123

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 446 times

- Been thanked: 2349 times

Re: Switching to a decumulation mindset

dingdong wrote:Having spent so long building up my portfolio its quite a mental shift to actually start spending a sensible proportion of it each year without worrying about the impact on my portfolio!

How have others managed this shift from decades of trying to build up wealth and then suddenly being in the world where you should now be enjoying the rewards?

Owning a football club (I think I'm enjoying it!)

-

tjh290633

- Lemon Half

- Posts: 8386

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 927 times

- Been thanked: 4224 times

Re: Switching to a decumulation mindset

dealtn wrote:dingdong wrote:Having spent so long building up my portfolio its quite a mental shift to actually start spending a sensible proportion of it each year without worrying about the impact on my portfolio!

How have others managed this shift from decades of trying to build up wealth and then suddenly being in the world where you should now be enjoying the rewards?

Owning a football club (I think I'm enjoying it!)

That's not my idea of enjoyment. Holidays and cruises are. You can choose upmarket cruise lines and hotels. You could fly first class. Celebrating significant anniversaries by taking the immediate family to a very nice hotel, for a weekend stay and a celebratory meal, can be very satisfying.

Chacun a son gout.

TJH

-

1nvest

- Lemon Quarter

- Posts: 4591

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 730 times

- Been thanked: 1453 times

Re: Switching to a decumulation mindset

tjh290633 wrote:Gilgongo wrote:

Yes (and I think we're still on topic), I tell my future self that for now it's dividends, but if/when the outgoings ramp up for things like medical care, we'll switch out to total return (we have some "growthy" investments for this) but it's hard to know how I'll react to that despite applying things like a 3% withdrawal rate from that point etc.

3% may well be less than your existing flow of dividend income. If you are getting less than that, it sounds like you need to review your investment policy.

TJH

SWR is based on historic measures of total returns, of which dividends are (typically but not exclusively) just a part. Care should be taken not to assume that dividends are some form of get out of jail free card. Dividends can induce additional risk such as ongoing taxation rates are inclined to rise during times of stress. Capital gains might be deferred across periods of high CGT and income taxation, if a large proportion of total returns arise out of regular interest/dividends and taxation levels are increased to the likes of when the Beatles released/sang 'Taxman' (95% taxation rates) !!!

-

1nvest

- Lemon Quarter

- Posts: 4591

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 730 times

- Been thanked: 1453 times

Re: Switching to a decumulation mindset

vand wrote:You could, equally, swap a chunk of your portfolio for an annuity if you withdrawal rate falls below 3%, because realistically you will die with much more money than you currently have. The only reason to sustain such a low withdrawal rate is that you want to pass a large amount onto your heirs.

A 3% withdrawal rate from a reasonable asset allocation is no different to taking a 4% withdrawal rate and saving/reinvesting some, is inclined to both cover your spending needs and grow a residual, as you suggest more often for heirs or wherever you might prefer to direct that capital. Continuing to grow capital after spending needs also adds-in greater safety, having more than enough when unexpected high costs might suddenly hit -perhaps a treatment/cure for some condition being available in the US for a $1M cost, or the addition of a forward time anticipated $1M cost for care due to a accident/condition etc.

4% SWR is a indicative lower end withdrawal rate that tended to sustain 30+ years of spending, in the average case more could have been drawn, 6%, 8%, whatever. If you're only spending 3% of that then your effective 'savings' rate might be 3%, 5%, whatever. Nothing wrong with dying with 'too much' capital still available, in contrast too-little/no capital has significant implications.

-

vand

- Lemon Slice

- Posts: 821

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 189 times

- Been thanked: 383 times

Re: Switching to a decumulation mindset

1nvest wrote:vand wrote:You could, equally, swap a chunk of your portfolio for an annuity if you withdrawal rate falls below 3%, because realistically you will die with much more money than you currently have. The only reason to sustain such a low withdrawal rate is that you want to pass a large amount onto your heirs.

A 3% withdrawal rate from a reasonable asset allocation is no different to taking a 4% withdrawal rate and saving/reinvesting some, is inclined to both cover your spending needs and grow a residual, as you suggest more often for heirs or wherever you might prefer to direct that capital. Continuing to grow capital after spending needs also adds-in greater safety, having more than enough when unexpected high costs might suddenly hit -perhaps a treatment/cure for some condition being available in the US for a $1M cost, or the addition of a forward time anticipated $1M cost for care due to a accident/condition etc.

4% SWR is a indicative lower end withdrawal rate that tended to sustain 30+ years of spending, in the average case more could have been drawn, 6%, 8%, whatever. If you're only spending 3% of that then your effective 'savings' rate might be 3%, 5%, whatever. Nothing wrong with dying with 'too much' capital still available, in contrast too-little/no capital has significant implications.

I am just putting it out there as an way to actually allow people to spend their nest-egg guilt free and without the fear of going broke because "the future plays out worse than the past worst case" scenario. Yes, you are right that it is worth considering that for many people unfortunately they need late life care that can be very expensive. OTOH the data also shows that we tend to spend less over our retirement as we advance in age up to that point.

Inheritance is a nice bonus for your offspring, but personally I think they will much more appreciate financial help at key stages in their own lives - college fund, house deposit, wedding, etc. If you don't help on these but leave them a lumpsump when they're hitting 50 or 60 then you're doing it wrong.

-

tjh290633

- Lemon Half

- Posts: 8386

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 927 times

- Been thanked: 4224 times

Re: Switching to a decumulation mindset

vand wrote:Inheritance is a nice bonus for your offspring, but personally I think they will much more appreciate financial help at key stages in their own lives - college fund, house deposit, wedding, etc. If you don't help on these but leave them a lumpsump when they're hitting 50 or 60 then you're doing it wrong.

What I have done for my grandchildren is to set up a bare trust for each, to which I donate the same sum each month. Two have now taken control of their funds, which they regard as a means of getting on the housing ladder when the time comes. Regular gifts out of income are, of course, outside the scope of IHT.

My own children benefited from their grandmother's estate, which put them both on the housing ladder. Their education and college expenses were taken care of by my wife's earnings. My daughter's wedding was taken care of by a timely maturing of an endowment policy.

As you say, it is better to be generous in their younger days, rather than them waiting for your demise.

TJH

-

vand

- Lemon Slice

- Posts: 821

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 189 times

- Been thanked: 383 times

Re: Switching to a decumulation mindset

tjh290633 wrote:vand wrote:Inheritance is a nice bonus for your offspring, but personally I think they will much more appreciate financial help at key stages in their own lives - college fund, house deposit, wedding, etc. If you don't help on these but leave them a lumpsump when they're hitting 50 or 60 then you're doing it wrong.

What I have done for my grandchildren is to set up a bare trust for each, to which I donate the same sum each month. Two have now taken control of their funds, which they regard as a means of getting on the housing ladder when the time comes. Regular gifts out of income are, of course, outside the scope of IHT.

My own children benefited from their grandmother's estate, which put them both on the housing ladder. Their education and college expenses were taken care of by my wife's earnings. My daughter's wedding was taken care of by a timely maturing of an endowment policy.

As you say, it is better to be generous in their younger days, rather than them waiting for your demise.

TJH

No grandkids on my part yet, but I have a JISA in place for our daughter, and she will be getting assistance for big life events.

Also have a JSIPP set up, but I am wary of putting more than a bare amount into this, as I don't want to take away their own opportunity to benefit from tax relief during their own career... and - used correctly - the money handed to them in other ways will still compound for them in a roundabout way over their lifetime.. just not in a neatly labelled SIPP wrapper.

And although its not a nice thing to mention, you also have to consider that there are unfortunate cases of parents outliving their offspring.

-

1nvest

- Lemon Quarter

- Posts: 4591

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 730 times

- Been thanked: 1453 times

Re: Switching to a decumulation mindset

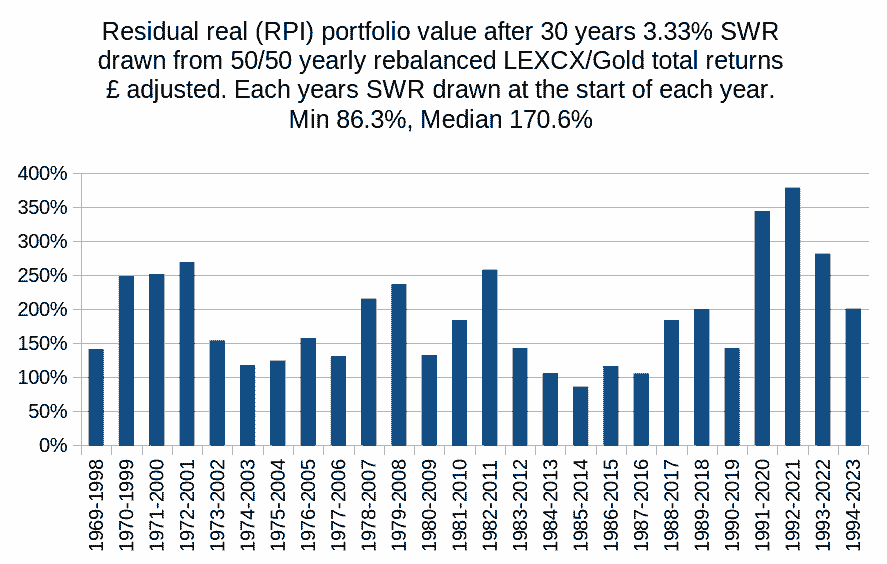

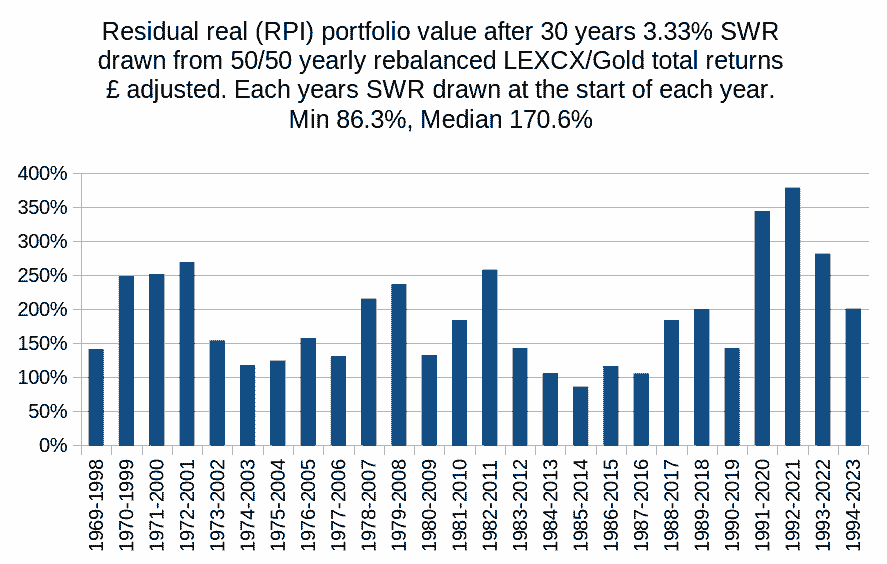

US LEXCX operates under similar setup to the standard (non-tweaked) HYP. Bought 30 original stocks, left as-is. Has become highly concentrated into certain single stock(s) since it started in the 1930's. Using reliable total return data since 1969 for that, blended 50/50 with gold and looking at a 30 year 3.33% SWR (return of inflation adjusted money) for a British investor (£ adjusted, RPI inflation rate) for all 30 year start years since 1969, and in the worst case (1985 to 2014) that ended the 30 years with 86% of the inflation adjusted start date portfolio value still remaining at the end of the 30 years. In the median case it ended with 170%. Near-as a have cake and eat it, return of your inflation adjusted money via yearly installments (SWR) and still ending with your money.

It appeared that there was scope to give away some of the typical surplus/gains along the way, whilst having a constant/regular inflation adjusted income. A risk however is that you don't know what the actual sequence of returns will be, what may appear to be running/working well can slam into a period of high inflation or other such difficulties.

Retired age 65 at the start of 1973 drawing a 3.33% SWR and 12 years later aged 77 at the end of 1984 your residual portfolio value was worth nearly 180% of the inflation adjusted start date value - you decide you don't need that as you're older with fewer years remaining so you generously gift 120% of that 180% amount away to leave yourself with 60% ... which subsequently ended up barely making it to cover the full 30 years. This example is just a quick by-eye assessment, I suspect there are other worse cases where earlier years good gains that potentially resulted in gifting/over-spending might have subsequently slammed into a wall.

I measure a 4.4% SWR for the above period, if 3% is enough for your spending needs you could either have saved/reinvested that 1.4% (minimum) difference, or gifted it away via regular (albeit relatively smaller than a larger lump sum) amounts. But you are still increasing your own risk, and across a time when your human capital is in decline/ending, for the earlier benefit for others. Not saying don't do it, just that care needs to be taken.

Another factor is that even seemingly loving children/grandchildren can turn to be pretty bitter/nasty when it comes to caring/helping elderly relatives that have already gifted much/most of their wealth around the family. Often despite promises of helping/sharing care tasks it is just one of the siblings that is 'lumbered' near full-time 24/7/365. The appeal of a inheritance can become a bribe/benefit when the longer surviving partner who cared for their other-half in turn sees their health fading. If not being self-funded then the choice of care home can be (very) poor. There are some nursing/care homes that are primarily having occupants costs funded by the Council - where the care standard and environment are what many wouldn't even consider to be fit for animals.

It appeared that there was scope to give away some of the typical surplus/gains along the way, whilst having a constant/regular inflation adjusted income. A risk however is that you don't know what the actual sequence of returns will be, what may appear to be running/working well can slam into a period of high inflation or other such difficulties.

Retired age 65 at the start of 1973 drawing a 3.33% SWR and 12 years later aged 77 at the end of 1984 your residual portfolio value was worth nearly 180% of the inflation adjusted start date value - you decide you don't need that as you're older with fewer years remaining so you generously gift 120% of that 180% amount away to leave yourself with 60% ... which subsequently ended up barely making it to cover the full 30 years. This example is just a quick by-eye assessment, I suspect there are other worse cases where earlier years good gains that potentially resulted in gifting/over-spending might have subsequently slammed into a wall.

I measure a 4.4% SWR for the above period, if 3% is enough for your spending needs you could either have saved/reinvested that 1.4% (minimum) difference, or gifted it away via regular (albeit relatively smaller than a larger lump sum) amounts. But you are still increasing your own risk, and across a time when your human capital is in decline/ending, for the earlier benefit for others. Not saying don't do it, just that care needs to be taken.

Another factor is that even seemingly loving children/grandchildren can turn to be pretty bitter/nasty when it comes to caring/helping elderly relatives that have already gifted much/most of their wealth around the family. Often despite promises of helping/sharing care tasks it is just one of the siblings that is 'lumbered' near full-time 24/7/365. The appeal of a inheritance can become a bribe/benefit when the longer surviving partner who cared for their other-half in turn sees their health fading. If not being self-funded then the choice of care home can be (very) poor. There are some nursing/care homes that are primarily having occupants costs funded by the Council - where the care standard and environment are what many wouldn't even consider to be fit for animals.

Re: Switching to a decumulation mindset

Hi Dingdong, you may find this article helpful.

https://www.mrmoneymustache.com/2023/04 ... y-model-y/

I like the idea of a dedicated money wasting account and treating it as someone else's money - you can't funnel it back into savings. And the follow up idea to "find the truly negative aspects of your life and focus any additional spending on improving those things. But it’s a subtle art so you have to get it right if you want lasting results in happiness." Don't spend additional money to upgrade things that already good in your life.

https://www.mrmoneymustache.com/2023/04 ... y-model-y/

I like the idea of a dedicated money wasting account and treating it as someone else's money - you can't funnel it back into savings. And the follow up idea to "find the truly negative aspects of your life and focus any additional spending on improving those things. But it’s a subtle art so you have to get it right if you want lasting results in happiness." Don't spend additional money to upgrade things that already good in your life.

-

jaizan

- Lemon Slice

- Posts: 446

- Joined: September 1st, 2018, 10:21 pm

- Has thanked: 256 times

- Been thanked: 136 times

Re: Switching to a decumulation mindset

1nvest wrote:Retired age 65 at the start of 1973 drawing a 3.33% SWR

Firstly, I think you are looking at this the right way and a 3.33% SWR is probably in the right ballpark.

However, so may investment graphs start around 1973, just because that was near the low of one of the worst bear markets in UK history.

Investment returns are very likely to look good if starting from such a point.

I think it's best to take some sort of SWR projection and then consider an adjustment if the starting valuation is abnormally high or low.

Having said that, I also suffer from a problem switching to a decumulation mindset. I'm typically spending less than half of what I could spend, if applying a 3% SWR. Yet I'm still very careful with expenditure, in most cases.

Return to “Retirement Investing (inc FIRE)”

Who is online

Users browsing this forum: No registered users and 9 guests