Page 1 of 1

Arbit, HYP and OEICs 2023 Q2

Posted: July 18th, 2023, 9:31 am

by Arborbridge

Here's the latest quarterly state of affairs for my three income streams:-

I think we can all spot the remarkable increase in OEIC income, with ITs coming second and HYP a reasonable third. In terms of total accumulated income for a £100 in each in 2011, the OEICs come out on top with the other two very close to one another.

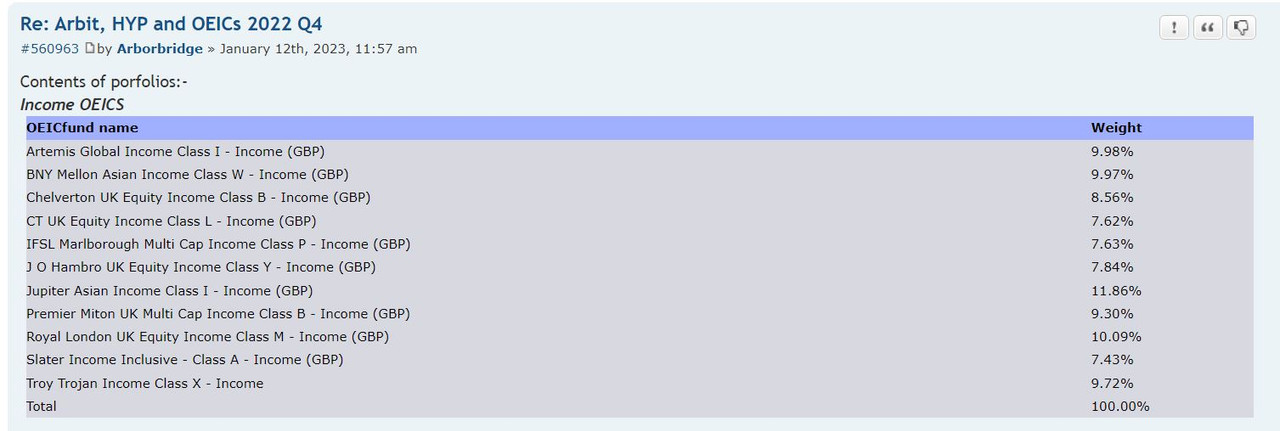

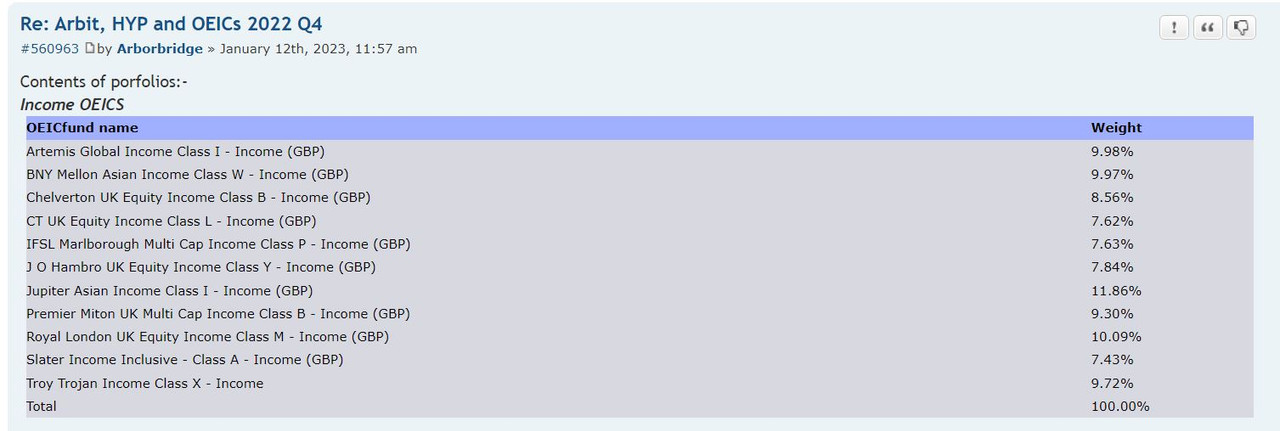

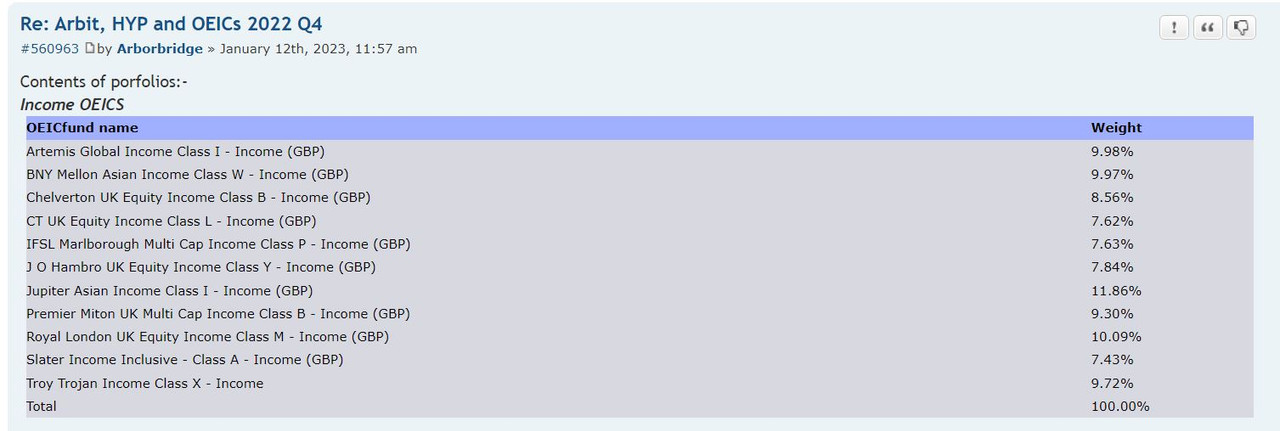

The composition of each portfolio is largely unchanged from that report in the 22 Q4 thread, here

viewtopic.php?f=31&t=37369My HYP income is down slightly compared with 2022 (around 3%) and that is roughly true of the total income of the three streams. My actual income this 6 months is 3-4% down on the same period in 2022 - but sadly, my expenditure has increased, and my reinvestments have almost ground to a halt. Some of you may have noticed that, as I haven't posted about portfolio changes on the HYP practical board for some time. Proportionally more investment has been funnelled into ITs than HYP.

Arb.

Re: Arbit, HYP and OEICs 2023 Q2

Posted: July 18th, 2023, 10:15 am

by BullDog

Thanks for this. The OEIC income stream is impressive. But for me the steady Eddie investment trust income is the winner so far.

As an aside, care to comment briefly on capital performance of the pots? Thanks again.

Re: Arbit, HYP and OEICs 2023 Q2

Posted: July 18th, 2023, 10:22 am

by monabri

The recovery in the OEICs is quite marked compared to the others. Has it been a uniform improvement in all of the OEICS or are there certain ones that are contibuting more/less? Is it by geographical area, perhaps?

Re: Arbit, HYP and OEICs 2023 Q2

Posted: July 18th, 2023, 11:08 am

by Arborbridge

monabri wrote:The recovery in the OEICs is quite marked compared to the others. Has it been a uniform improvement in all of the OEICS or are there certain ones that are contibuting more/less? Is it by geographical area, perhaps?

I haven't delved into that, but I will take a look. The OEICs aren't equal for capital, as you know and off the top of my head I think the ex-UK ones have done better.

I'll need a longer break in household committments to take a look.

Arb.

Re: Arbit, HYP and OEICs 2023 Q2

Posted: July 18th, 2023, 11:09 am

by Arborbridge

BullDog wrote:Thanks for this. The OEIC income stream is impressive. But for me the steady Eddie investment trust income is the winner so far.

As an aside, care to comment briefly on capital performance of the pots? Thanks again.

I'll post something in a while - family calls at the moment.

Re: Arbit, HYP and OEICs 2023 Q2

Posted: July 19th, 2023, 10:42 am

by Arborbridge

I should report a significant change from the previously posted OEICs collection. I made some changes in May and they were as follows: complete disposal of Chelverton UK Equity Income, IFSL Marlborough Multi Cap Income,Premier Miton UK Multi Cap Income. Partial disposal of Slater Income.

The current basket is as follows:

I needed to make these changes for family reasons, and chose on the basis of which I felt were laggards in total return over several periods. Luckily, I do not actually use these for my pension withdrawals!

Here is who the unit prices have varied for all three baskets:-

The HYP basket shows no real sign of closing the gap, while the ITs are just slightly on top.

Arb.

Re: Arbit, HYP and OEICs 2023 Q2

Posted: October 6th, 2023, 5:17 am

by Itsallaguess

Hi Arb,

Just checking if you're planning on updating the above chart for Q3 2023?

Cheers,

Itsallaguess

Re: Arbit, HYP and OEICs 2023 Q2

Posted: October 16th, 2023, 8:59 am

by Arborbridge

Itsallaguess wrote:Hi Arb,

Just checking if you're planning on updating the above chart for Q3 2023?

Cheers,

Itsallaguess

Yes - I've had a very interrupted time lately and just returned from a river cruise which started on 4th October, so there wasn't time to colate the info before I left.

I

do hate all that packing and last minute arrnagments which have to be made before leaving! But then when away, the investments all look after themselves, so I wonder why I bother to intervene.

Re: Arbit, HYP and OEICs 2023 Q2

Posted: October 16th, 2023, 10:01 am

by Charlottesquare

Arborbridge wrote:Itsallaguess wrote:

Hi Arb,

Just checking if you're planning on updating the above chart for Q3 2023?

Cheers,

Itsallaguess

Yes - I've had a very interrupted time lately and just returned from a river cruise which started on 4th October, so there wasn't time to colate the info before I left.

I

do hate all that packing and last minute arrnagments which have to be made before leaving! But then when away, the investments all look after themselves, so I wonder why I bother to intervene.

But the plus point of a river cruise is you get to see myriad places without having to pack/unpack during the holiday and unlike other cruises there are things to see besides sea. Downside seems to be they never seem to stop long enough at any one place.

Re: Arbit, HYP and OEICs 2023 Q2

Posted: October 16th, 2023, 10:38 am

by Arborbridge

Charlottesquare wrote:

But the plus point of a river cruise is you get to see myriad places without having to pack/unpack during the holiday and unlike other cruises there are things to see besides sea. Downside seems to be they never seem to stop long enough at any one place.

The other downside is that I've put on several pound in weight - so I'm on the wagon for a while.

Nowadays, an additional difficulty is climate change and water levels. We couldn't finish our trip to the Black Sea and the Cruise Director had a really tough time arranging trips for 150 people "on the fly" when we couldn't get as far as expected. In fact, it got worse, because we became stuck for a second day due to a barge running aground in mid channel a few miles ahead of us, blocking the next port of call.

However, I digress.... I will take a look at Q3 today or tomorrow.

Arb.