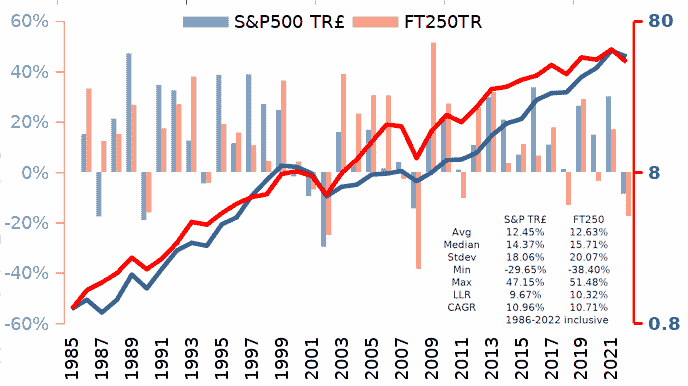

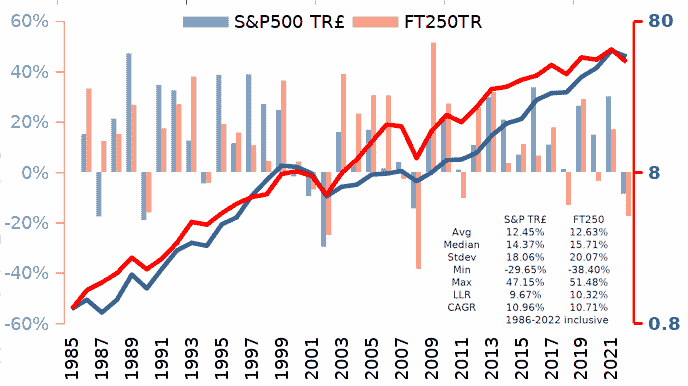

Our FTSE250 stock index has somewhat aligned with both HYP1 and TJH HYP total returns (accumulation/dividends reinvested). In turn it has also somewhat aligned with the US S&P500 total return (prior to any US dividend withholding taxes).

I see it as somewhat like a tweaked HYP, reduce/top-slice winners, where the better performers are ejected out of the FT250 and into the FT100. The broader distribution also means that its more equal weighted than the FT100, single stocks don't rise to being anywhere near 10% of the index. It 'buys' 'value' stocks as replacements for those that are top-sliced, i.e. stocks that have dipped back down into the FT250 from the FT100. Yes the yield is lower, because its somewhat like having some of dividends reinvested rather than being paid out, price appreciation is faster at the expense of lower dividends, but you have the option to DIY dividends (sell some shares to create your own additional dividends at times/amount of your own choosing).

Whilst it may seem that over recent years, since Brexit, that US stocks have performed much better than UK stocks, as this chart indicates from another angle it might be considered as the US having caught back up with the prior better performing FT250

That aside and my primary reason for posting is as a warning. If you directly hold US assets such as stocks to a value of more than £45K or so, then should you drop dead with a heart attack due to the surprise/delight of receiving 12.5% type dividends then your heirs will have to file for and have accepted your US Estate Tax form. Under UK/US tax treaty Brits get the same generous allowances as Americans for Estate Tax (inheritance tax), north of $12M before any tax becomes payable. For others with no such tax treaty agreement US Estate Tax can be much more punitive and covers total global assets/estate value. The default is that you're not exempted, has to be filed for within the correct timescales, using the correct version of forms, correctly completed. Potentially prone to being rejected - sorry you used a older version of the form and the time has passed where you might resubmit another. If you do end up paying US Estate tax then the UK will be inclined to offset that against UK inheritance taxation, but potentially the US tax might be considerably more than what UK IHT might be.

Yet another caution is that if you buy a fund stock rather than a actual stock, then HMRC may charge capital gains (price appreciation) as income tax. I held CHY for many years, a mutual that primarily focused upon Convertibles, and had a nice monthly 10%/year type dividend being provided from that, however the EU changed the rules such that it was no longer really an appropriate holding anymore for me and I disposed of it. Mostly its price broadly flat lined, and the 10% yield was pretty much its total return, but where I bought the dips/reduced-at-highs using Robert Lichello's AIM to bolster that.

Yet another caution, inside a ISA and you can't offset US withholding tax against UK dividend tax. Also you can't hold US$ inside a ISA so you'll get hit with the brokers FX costs, which maybe 1.5% each way, 3% round trip (ii for instance with smaller amounts). Interactive Broker are good on that front with near zero FX rates small fractional percent).

SIPP's are counted as being a pension fund by the US, so have dividend withholding taxes exempt. I believe you may be permitted to hold US$ within a SIPP, not sure as I don't have one myself, but that could entail the 3% type round trip FX costs.

Not trying to put you off, US stocks are a great place to invest provided you go in with your eyes wide open. There are UK solicitors that are well versed in dealing with the likes of US Estate Tax and establishing one of those whilst your still alive to deal with your probate (and US assets) would be 'good practice', aid your heirs (just make sure they know to contact/use that solicitor asap in the event of your sudden death). They should file the correct forms, within the correct timescale, correctly completed - or otherwise be at risk of being sued for such a failing. If death is imminent, such as you're informed you have six months at most for instance, then obviously you might sell out of US assets yourself to simplify matters for your heirs, however that could entail a sizeable taxable event rather than having a step-up average cost/share for heirs.

At least that is my understanding, but I'm just a layman stranger on some message board that may have incorrectly understood things, so as ever DYOR.

I had hoped by now that Brexit might have led to a reversion to older ways, outside of the US/EU tit for tat. KIDD documentation requirements for instance where without such near useless piece of paperwork EU citizens cannot reasonably buy/trade US funds, such that most US entities simply don't bother getting involved in 'European reporting/documentation' requirements. Similar IMO to the annoyance of having to click 'accept cookies' EU induced bother on pretty much every web page you visit. When we left the EU we rolled EU law into UK law, and so far UK/US stock trading laws have yet to be 'reviewed'. Here's hoping for the better sooner rather than later as yes the US can be a great market both for costs and range of options. Sadly the UK (or rather predominance of Remainers within Parliament) has opted to eject the beneficial changes that might have been made to instead redirect the UK back towards possible re-entry back into the EU. Such that given investment windows of ten plus years perhaps looking to buy/hold US stocks/funds may not be best of choices, maybe instead looking towards European stock holding instead

(good luck with that, as its far more Socialist and far less inclined to be reasonably regulated towards capitalism/investors).