Aminatidi wrote:Quick question on YTM which I think I understand but not entirely sure.

Is this number "safe" to use for compounding calculations?

For example if I buy TN28 yeldgimp shows 4.59% as the YTM so let's use that for now.

Using a compound interest calculator shows £120K being worth £147,539.51 in 4 years six months.

Obviously it will be a bit less as there's a small 0.125% coupon but that final figure just looks a lot more than my gut reaction thought it would.

Either I'm wrong or Einstein obviously had a point

https://www.yieldgimp.com/gilt-yields indicates a recent price of 82.31 and a yield of 0.125%, matures 31st January 2028, when you get the 100 value back. So on price appreciation alone 100 - 82.31 = 17.69. Or in gain factor terms 100 / 82.31 = 21.5%. With approximately 4 and 5/12 years (4.33 years) left before it matures, the annualised (compounded) price only gain factor = 1.215^(1/4.33) - 1 = 4.6%. That is tax exempt, so for a basic rate taxpayer at 20% tax they'd have to earn 5.75% gross to compare. So on £120,000 that gained 100/82.31 = £145,800 returned at maturity.

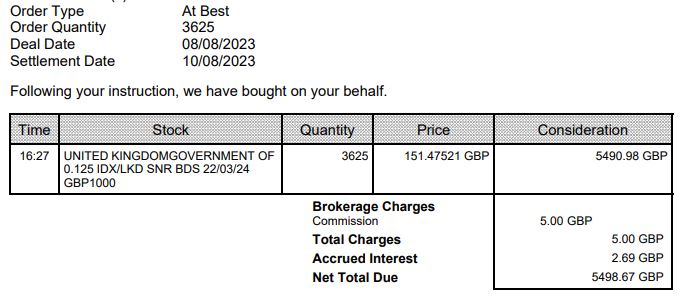

A factor is however that the guy that sold you the Gilt would have got some interest for the period between the last interest payment and the time you bought it, so the price you end up paying is increased by that interest payment amount, to cover the sellers fair share of the next interest payment amount, you in effect split that next interest payment amount in time weighted proportions. So adjusting for that and the compounded gain is less than that 4.6% figure as the price you paid was actually higher than the indicated price.

Additionally you'll get interest payments, 0.125% yield relative to 100 face value, which when you've only paid 82.31 = 0.125 / 0.8231 = 0.152% interest, where interest payments are taxable. But at so low yield the amount of tax is negligible. £120,000 invested, 0.152% interest = £182.40 interest, and 20% tax on that = £36.48/year tax type value.

So yes, the YTM figure is a indicator of the actual gain you'll get when the gilt is held to maturity.

If you compare that to a Index Linked Gilt

https://www.yieldgimp.com/index-linked-gilt-yieldsthe T28 matures later in 2028, 10th August. also pays 0.125%, and a recent indicated price of 95.97. Now that's not the actual price you pay, as index linked gilts are all inflation adjusted, so you have to scale that by however much inflation there's been since the Gilt was originally issued (back in June 2018) and the present date. Similarly when it matures you wont get back 100, but 100 scaled by however much inflation there's been since its issue and maturity. A unknown amount, but at least you know you'll offset inflation and also get around a 100/95.97 gain on top, in real (inflation adjusted terms). Along with interest payments, that also rise with inflation. But again where you have to adjust that for the higher price paid in reflection of the sellers fair share of the next interest payment.

Comparing the two on price only, the nominal Gilt gains more, however with the index linked gilt you also have inflation added on top. Whichever of the two turns out to be better is subject to however much inflation there is between now and maturity. The Break-Even column provides a indicator for the comparison that currently indicates 3.83%. Which suggests that if inflation between now and maturity is higher than 3.83% then the Index Linked Gilt was the better choice, If lower than 3.83% then you'd have done better with a conventional Gilt. At a 95.97 price the Index linked Gilt is guaranteed to pay inflation, however that might be x 100 / 95.97 (again I haven't increased the actual price in reflection of paying the seller their share of the next interest payment), around 1% annualised real.

All rough values, for the actual accurate amounts you have to factor in all of the different elements, interest received, the sellers interest amount, the precise timing to maturity ...etc. Where that actual more precise calculation is presented in that yieldgimp table.