Lootman wrote:mc2fool wrote:Sounds like you've got it covered, and if there is anything else that fits your "have cake and eat it" requirements I'd like to hear about it too.

Depends on the amount. For a very large amount, say ten million, you could stick the lot in a 0.125% gilt and, despite earning about £500,000 annually in gains and interest, you might pay no tax. The interest at about £12,500 a year is within the personal and savings allowances. And the gains are CGT-free. I am not sure you would even have to submit a tax return.

I cannot think of another way of achieving that. Put the lot in Berkshire Hathaway (if you do not need income) and sell up to the CGT allowance annually perhaps?

That said, there are downsides:

1) The opportunity cost of not being in equities or other securities that can grow organically rather than just accrete at a predetermined rate.

2) The 100% exposure to sterling.

3) Reinvestment risk, if rates drop and gilts are trading back above par when your current holding matures.

just to mention that with index linked gilts the income rises in nominal terms, the 0.125% is on the inflation adjusted original 100 nominal bond value.

CPI/RPI inflation will tend to lag house, stock, gold inflation rates, CPI (RPI) incorporate productivity gains, lower prices as machines do the work of many. Higher surplus capital/increased demand (population) is inclined to drive house/stock/gold prices higher - ahead of CPI/RPI.

Some prefer to shift bond risk over to the stock side, Larry Swedroe for instance proposes something like 33/67 small cap value/bonds instead of 50/50 total stock market/bonds, where SCV is seen as being higher volatility/risk, higher reward, so less is needed. Zvi Bodie scales that even further, suggesting 10% in 10x leveraged Traded Options instead of stock.

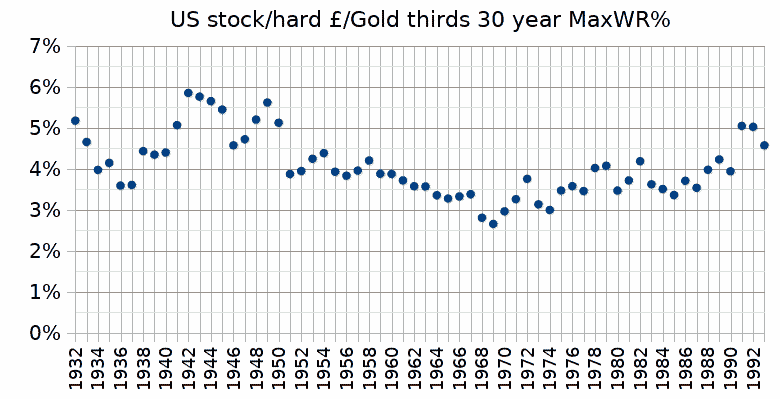

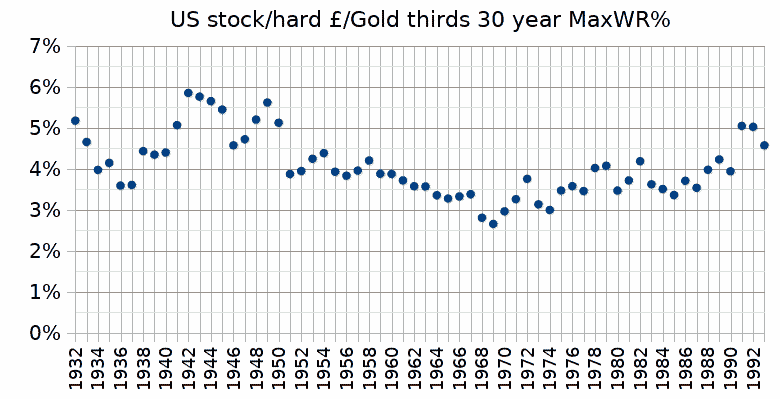

Stocks might broadly yield a price that rises with inflation, and pay a dividend similar to cash deposits and where that also rises with inflation. Stocks could be considered a 2i (twice inflation) asset. Gold a 1i, cash deposits a 1i, hard cash a 0i. Someone holding a third each in stocks, gold and cash ... is in effect holding a 1i investment. Might reasonably anticipate a 3.33% 30 year SWR (3.33% of the initial portfolio value drawn as income in the first year, where that amount is uplifted by inflation as the amount drawn in subsequent years). The return of their inflation adjusted money via 30 yearly instalments. And where the gold and hard cash, perhaps US dollars, are stored in their safe/wherever, no counter-party risk, no footprints.

Applying Zvi Bodie's approach to that, 3.33% in 10x stocks (Options), 30% in Index Linked Gilts (to cover the time value of the Options, 33% in US dollars, 33% in gold.

Or maybe US dollars - invested in US stocks, hard Pound currency, gold. Mostly that was a 'inflation bond', supported 30 years of 3.33% SWR, not always, in many cases better ...

In the cases of when it did fail to return all of your inflation adjusted money, the hard Pounds that lost out to inflation could have been deposited/invested at some pretty high rates of return (high interest rates)

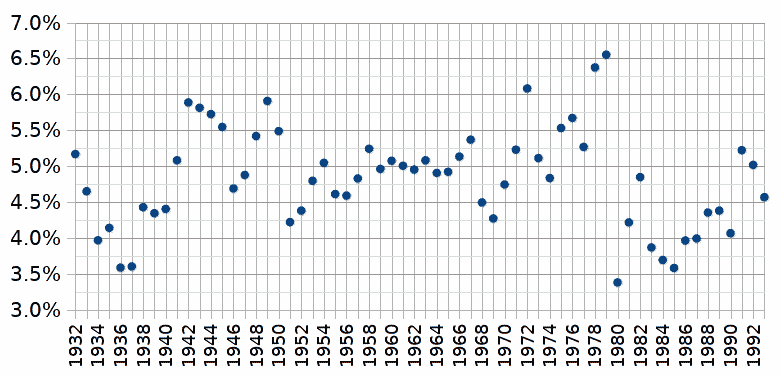

The same, but where instead of a third in hard Pounds those were deposited into T-Bills during the 1970's and 1980's period when interest rates spiked into double digit levels ...

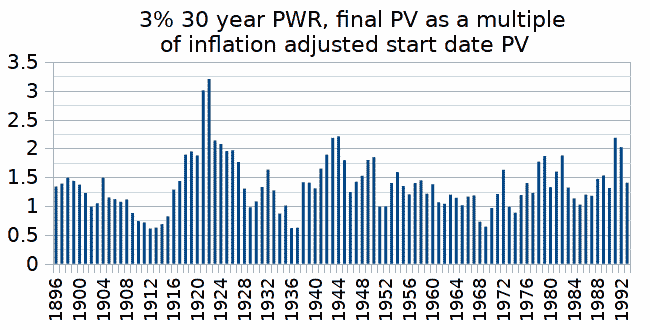

In many cases there was a decent residual amount left over. If you're drawing 3.33% and the portfolio is sourcing/supporting a 4.3% SWR, then that's like saving 1%/year, such that after 30 years there's 30% of the inflation adjusted start date portfolio still left (a bit more when compounded).

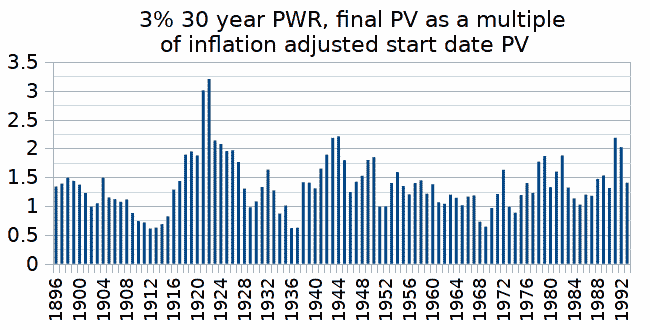

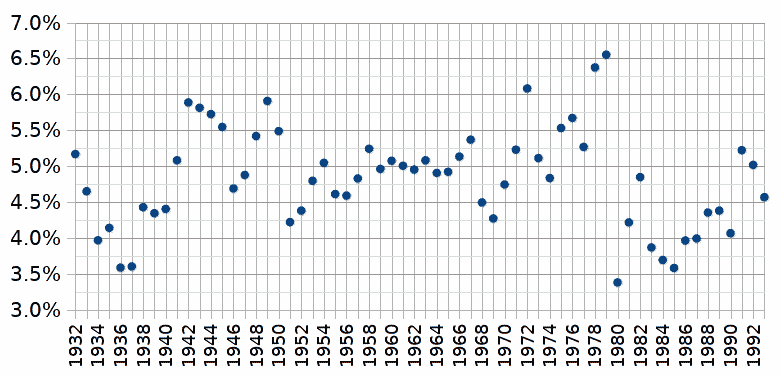

For a mostly have-cake-and-eat-it, you could have got close by accepting a slightly lower SWR, 3% instead of 3.33%, so 90% return of your money over 30 years, and deposited the hard Pounds into short term Gilts (T-Bills) ... that mostly left a residual of around 100% of the inflation adjusted start date amount still available at the end of 30 years

but sometimes less (half) sometimes more (double).

But again that is all relative to RPI, which lagged house, stock and gold price appreciation/inflation.

As a sideline you might see how US sanctions against Russia are relatively ineffective. For stocks they'll hold direct interest businesses, in Africa or domestically owned oil/gas/commodity fields. Along with hard US dollars and gold, that they'll ship/fly around in private yachts/jets. As soon as any one country looks like they might impound - the gold/cash/art will have been moved out of that realm. The state(s) know that, however its a great excuse for the state to open up exposure of all of its citizens assets/wealth/transactions (monitoring). Paramount to confiscation (when others know where your wealth is, it is no longer yours - but a loan, open to being called in either fully or partially at any time).