Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

Global Equity ETF \ Bonds

-

MartynC27

- Lemon Pip

- Posts: 89

- Joined: November 20th, 2016, 8:44 pm

- Has thanked: 51 times

- Been thanked: 4 times

Global Equity ETF \ Bonds

Stocks & Shares ISA

I am moving my existing Stocks & Shares ISA to a Global ETF 90 /10 split based on Warren Buffet's Portfolio. My existing Stocks & Shares ISA has been built over many years using Investment Trusts and OEIC Funds (sold to me in the past by an IFA)

Over the last year I have been progressively selling the Investment Trusts and Funds to build a Global ETF portfolio using individual ETFs to roughly copy the breakdown of the All World ETF (VWRL) but with a 15% UK bias. I have now completed Global Equity ETF 90% portion.

I am thinking about the remaining 10% of the portfolio following all of the recent news of Bond prices falling in value which has recently accelerated following election of Donald Trump and USA (0.25%) rate rise.

With regard to 'safe' Bond funds for the 10% portion.

How safe are these ETF's ;- Short dated gilts (GLTS @0.15 ocf) or Ultrashort Corporate Bond (ERNS @0.09 ocf) – The coupon is low < 1% before costs

I understand these are supposed to be equivalent to cash .

Alternatively I could put 5% of the cash in say 0-5 year Corporate Bond ETF (IS15 @0.2 ocf) which I understand is a bit higher return but higher risk or an index-Linked Gilt ETF ?.

Does anyone have any experience of these ETF's and the risk / reward of each or any other suggestions for the 'safe' / hedge part of the portfolio ?

Thanks in advance,

Martyn

Note: Note am 63, with Mortgage paid off. I have a Final Salary pension in payment which covers basic needs and I have a year’s emergency Cash reserve in a separate Cash ISA (0.75%). I also have a separate SIPP which is still growing and invested in ETFs with the aim of a similar 90/10 split portfolio. I plan to take the natural income from the Stock s& Shares ISA (described above) and reinvest any unused income s back into my separate SIPP with the aim of drawing down in a few years time.

I am moving my existing Stocks & Shares ISA to a Global ETF 90 /10 split based on Warren Buffet's Portfolio. My existing Stocks & Shares ISA has been built over many years using Investment Trusts and OEIC Funds (sold to me in the past by an IFA)

Over the last year I have been progressively selling the Investment Trusts and Funds to build a Global ETF portfolio using individual ETFs to roughly copy the breakdown of the All World ETF (VWRL) but with a 15% UK bias. I have now completed Global Equity ETF 90% portion.

I am thinking about the remaining 10% of the portfolio following all of the recent news of Bond prices falling in value which has recently accelerated following election of Donald Trump and USA (0.25%) rate rise.

With regard to 'safe' Bond funds for the 10% portion.

How safe are these ETF's ;- Short dated gilts (GLTS @0.15 ocf) or Ultrashort Corporate Bond (ERNS @0.09 ocf) – The coupon is low < 1% before costs

I understand these are supposed to be equivalent to cash .

Alternatively I could put 5% of the cash in say 0-5 year Corporate Bond ETF (IS15 @0.2 ocf) which I understand is a bit higher return but higher risk or an index-Linked Gilt ETF ?.

Does anyone have any experience of these ETF's and the risk / reward of each or any other suggestions for the 'safe' / hedge part of the portfolio ?

Thanks in advance,

Martyn

Note: Note am 63, with Mortgage paid off. I have a Final Salary pension in payment which covers basic needs and I have a year’s emergency Cash reserve in a separate Cash ISA (0.75%). I also have a separate SIPP which is still growing and invested in ETFs with the aim of a similar 90/10 split portfolio. I plan to take the natural income from the Stock s& Shares ISA (described above) and reinvest any unused income s back into my separate SIPP with the aim of drawing down in a few years time.

-

GeoffF100

- Lemon Quarter

- Posts: 4746

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1372 times

Re: Global Equity ETF \ Bonds

Why not put the 10% in a cash ISA? Higher rate of interest and guaranteed by the government.

-

MartynC27

- Lemon Pip

- Posts: 89

- Joined: November 20th, 2016, 8:44 pm

- Has thanked: 51 times

- Been thanked: 4 times

Re: Global Equity ETF \ Bonds

Thanks for the reply GeoffF100,

Unfortunately I have used my ISA allowance this year so if I transferred 10% out of the ISA platform it would probably loose its ISA status.

Having said that a non-ISA savings account pays just as good rates as cash ISA's at present with a guarantee by the government.

I assume Short dated gilt ETFs or Ultrashort Corporate Bond ETfs which are claimed to be low risk are not guaranteed at all.

Thanks,

MartynC27

Unfortunately I have used my ISA allowance this year so if I transferred 10% out of the ISA platform it would probably loose its ISA status.

Having said that a non-ISA savings account pays just as good rates as cash ISA's at present with a guarantee by the government.

I assume Short dated gilt ETFs or Ultrashort Corporate Bond ETfs which are claimed to be low risk are not guaranteed at all.

Thanks,

MartynC27

-

AJC5001

- Lemon Slice

- Posts: 448

- Joined: November 4th, 2016, 4:55 pm

- Has thanked: 161 times

- Been thanked: 158 times

Re: Global Equity ETF \ Bonds

MartynC27 wrote:Stocks & Shares ISA

With regard to 'safe' Bond funds for the 10% portion.

I have a Final Salary pension in payment which covers basic needs

Some posters consider a Final Salary pension to be the equivalent of a bond fund, without some of the risks. This allows the investments to be 100% equity.

If you did so, how would that affect the %age split?

Adrian

-

GeoffF100

- Lemon Quarter

- Posts: 4746

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1372 times

Re: Global Equity ETF \ Bonds

You should be able to transfer funds from your stocks and shares ISA to a cash ISA. A quick Google search brought up this:

https://www.which.co.uk/money/investing ... -transfers

https://www.which.co.uk/money/investing ... -transfers

-

hiriskpaul

- Lemon Quarter

- Posts: 3893

- Joined: November 4th, 2016, 1:04 pm

- Has thanked: 698 times

- Been thanked: 1524 times

Re: Global Equity ETF \ Bonds

Buffet stipulated the highest quality short dated paper for the 10% - effectively cash, but I suspect large cash deposits are problematic in the US for some reason (no FSCS equivalent protection?), hence short dated treasuries. You could go for GLTS or even IGLS, but the charges are such that the expected returns are less than 0.5%. If things get really messy, short yields could go even lower, but you would still struggle to make more than 1% on these after running costs. On the other hand, you could potentially lose money should yields start heading back up again (but not much money). Stepping up the risk to short dated corporates would be likely to give a better return, but with increased downside risk. This is your portfolio insurance policy and volatility reducer, as such it is best to not take credit risk with it.

Like others I think for the moment you would be better off in a cash ISA for this element of the portfolio, assuming you do not want to move away from Buffet. NS&I are offering 1% on their ISA at the moment (instant access, transfers in accepted) and there are no problems with FSCS limits with them either.

Like others I think for the moment you would be better off in a cash ISA for this element of the portfolio, assuming you do not want to move away from Buffet. NS&I are offering 1% on their ISA at the moment (instant access, transfers in accepted) and there are no problems with FSCS limits with them either.

-

GeoffF100

- Lemon Quarter

- Posts: 4746

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1372 times

Re: Global Equity ETF \ Bonds

Buffet stipulated the highest quality short dated paper for the 10% - effectively cash, but I suspect large cash deposits are problematic in the US for some reason (no FSCS equivalent protection?), hence short dated treasuries.

It may simply be a question of the sums of money involved. The FSCS is not much use if you are investing billions. If you are a small investor, however, the FSCS is free protection for what may be a risky deposit in a second line bank. As a small investor, you can also profit from a premium interest rate at the expense of other investors who cannot be bothered to keep moving their account.

-

mc2fool

- Lemon Half

- Posts: 7888

- Joined: November 4th, 2016, 11:24 am

- Has thanked: 7 times

- Been thanked: 3044 times

Re: Global Equity ETF \ Bonds

hiriskpaul wrote:...I suspect large cash deposits are problematic in the US for some reason (no FSCS equivalent protection?)...

Depends on what you call "large". The Federal Deposit Insurance Corporation (a US govt body) offers much better protection than the FSCS, covering $250,000 per depositor for each account category in a bank. Single accounts, joint accounts and retirement accounts are separate categories, and for joint accounts it's £250K per co-owner, so a couple could have up to $1.5million covered. https://www.fdic.gov/deposit/deposits/b ... glish.html

The National Credit Union Administration offers similar protection for depositors in credit unions (their equivalent to building societies).

-

MartynC27

- Lemon Pip

- Posts: 89

- Joined: November 20th, 2016, 8:44 pm

- Has thanked: 51 times

- Been thanked: 4 times

Re: Global Equity ETF \ Bonds

Thanks for the replies,

There was an article in CItywire on Sep 28, 2016 comparing Buffet's 90/10 with a Target retirement fund.

http://citywire.co.uk/money/buffett-vs- ... er/a953009

Whatever ratio or other assets I finally decide I need to use ETF's unless I hold some cash in a separate bank account instead of using GLTS or IGLS (in addition my emergency cash fund)

I seem to remember an article on Bogleheads advising not to consider a final salary pension like a bond but to consider it as a regular salary. In my case my final salary pension only covers my bills, food and basic needs so I think I would only consider a pension to be like a bond if there was an excess amount above my basic needs)

There was an article in CItywire on Sep 28, 2016 comparing Buffet's 90/10 with a Target retirement fund.

http://citywire.co.uk/money/buffett-vs- ... er/a953009

Whatever ratio or other assets I finally decide I need to use ETF's unless I hold some cash in a separate bank account instead of using GLTS or IGLS (in addition my emergency cash fund)

I seem to remember an article on Bogleheads advising not to consider a final salary pension like a bond but to consider it as a regular salary. In my case my final salary pension only covers my bills, food and basic needs so I think I would only consider a pension to be like a bond if there was an excess amount above my basic needs)

-

1nvest

- Lemon Quarter

- Posts: 4414

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 691 times

- Been thanked: 1346 times

Re: Global Equity ETF \ Bonds

MartynC27 wrote:I am moving my existing Stocks & Shares ISA to a Global ETF 90 /10 split based on Warren Buffet's Portfolio. My existing Stocks & Shares ISA has been built over many years using Investment Trusts and OEIC Funds (sold to me in the past by an IFA)

Over the last year I have been progressively selling the Investment Trusts and Funds to build a Global ETF portfolio using individual ETFs to roughly copy the breakdown of the All World ETF (VWRL) but with a 15% UK bias. I have now completed Global Equity ETF 90% portion.

I am thinking about the remaining 10% of the portfolio

.

.

Note: Note am 63, with Mortgage paid off. I have a Final Salary pension in payment which covers basic needs and I have a year’s emergency Cash reserve in a separate Cash ISA (0.75%). I also have a separate SIPP which is still growing and invested in ETFs with the aim of a similar 90/10 split portfolio. I plan to take the natural income from the Stock s& Shares ISA (described above) and reinvest any unused income s back into my separate SIPP with the aim of drawing down in a few years time.

50/50 Vanguard LifeStrategy 80% stock/20% Bonds and a Global stock fund might have a overall 0.14% expense rate (0.22% for LS80, 0.06% for a global stock fund)

However on a £1M portfolio, 0.14% expense = £1400. If the 90% stock part were invested solely in a 0.06% expense = £540. A difference of £860, such that even if the cash 10% were hard cash under the bed that's like it providing a 0.86% equivalent 'interest' return.

-

JohnW

- Lemon Slice

- Posts: 517

- Joined: June 1st, 2019, 7:00 am

- Has thanked: 5 times

- Been thanked: 185 times

Re: Global Equity ETF \ Bonds

GeoffF100 wrote:Why not put the 10% in a cash ISA? Higher rate of interest and guaranteed by the government.

hiriskpaul wrote:Like others I think for the moment you would be better off in a cash ISA for this element of the portfolio

Since those early posts almost four years ago the total return of a U.K. Gilt UCITS ETF has been 6.7% (/year presumably). Readers will know what their own high interest savings accounts have returned over that period - less I would guess.

Should one's asset allocation be guided by principles one thinks are suitable for one's circumstances, or try to guess where the market is going?

"Yes, 100% of economists were dead wrong about yields" https://www.marketwatch.com/story/yes-1 ... 2014-10-21

-

GeoffF100

- Lemon Quarter

- Posts: 4746

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1372 times

Re: Global Equity ETF \ Bonds

JohnW wrote:GeoffF100 wrote:Why not put the 10% in a cash ISA? Higher rate of interest and guaranteed by the government.hiriskpaul wrote:Like others I think for the moment you would be better off in a cash ISA for this element of the portfolio

Since those early posts almost four years ago the total return of a U.K. Gilt UCITS ETF has been 6.7% (/year presumably). Readers will know what their own high interest savings accounts have returned over that period - less I would guess.

Should one's asset allocation be guided by principles one thinks are suitable for one's circumstances, or try to guess where the market is going?

"Yes, 100% of economists were dead wrong about yields" https://www.marketwatch.com/story/yes-1 ... 2014-10-21

It depends on precisely when you bought. Here is the chart for VGOV:

https://markets.ft.com/data/etfs/tearsh ... OV:LSE:GBP

You would have got very little if you had bought VGOV at the peak on 1st August 2016. If you had got in at the bottom on 1st January 2016, you would have got a return of:

25.56 / 22.9 = 1.116

That is about 4.5 years, so the annualised return is:

1.116^(1/4.5) = 1.025

i.e. 2.5% p.a. That is a little better than you would have got in a cash ISA at no risk, but you would have had to guess the direction of the market correctly, and time your entry perfectly.

-

GeoffF100

- Lemon Quarter

- Posts: 4746

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1372 times

Re: Global Equity ETF \ Bonds

That is just the capital return for VGOV, we have to add in the interest received. That interest would have been less than we would have got in a five year cash ISA. As it happened, interest rates fell, but they could have gone the other way. Going for the best rate of interest over the duration concerned should win in the long run. VGOV had a longer duration than that available for a cash ISA bond.

-

1nvest

- Lemon Quarter

- Posts: 4414

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 691 times

- Been thanked: 1346 times

Re: Global Equity ETF \ Bonds

Buffett holds T-Bills for the 10% part, primarily because they're liquid and as good as fully insured (US can print money or raise taxes rather than default). A risk factor there however is that at times monetary policy has in effect drive partial (substantial) defaults, T-Bill yields haven't kept up with inflation rates such that the real (after inflation) value of T-Bills were substantially reduced.

For a UK investor since 1932 if they'd stuffed a third each of £'s, $'s and gold under their mattress, yearly rebalancing back to a third each, they'd have lagged inflation by -1% annualised, but with variance around that (0.8 to 1.2 type swings around 1.0, so you could selectively pick periods where that was relatively good, or bad - if you wanted to paint a particular picture).

If instead of holding hard £ currency you deposited those £'s into interest paying T-Bills then broadly the portfolio yielded 0% real. A form of 'risk-free', but again with variances.

If instead of holding hard $'s those $'s were invested in US T-Bills, then for a UK investor the third in £ T-Bills, third in $ T-Bills, third in gold portfolio broadly provided a +1.7% annualised real.

A factor with gold is that it does move through longer periods (decades) of in and out of vogue. It tends to do well during periods of both deflation and high inflation, which come and go. A good counterbalance to gold is stocks. A 50/50 stock/gold barbell is somewhat like holding 50/50 short dated and long dated gilts, it combines to a central bullet, and could be considered as being a form of currency unhedged global bond.

Extending that to partner a third each in £'s deposited into interest paying accounts/investment, gold and US stocks and the rewards were pretty decent. 3% PWR type reward i.e. draw 3% initial portfolio value in the first year and uplift that amount by inflation as the amount drawn in subsequent years, and in the worst case you ended up with a comparable inflation adjusted amount as at the start. In the average case you saw the portfolio gain 1.5% to 2% real on top of that.

A third in domestic £'s earning interest, a third in US$ primary reserve currency - invested in US stocks, a third in gold (global currency and a commodity), is a reasonably safe 'global bond' type choice IMO.

For a US investor whose domestic currency is the same as the primary reserve currency the additional benefit of 90/10 above and beyond that 'safe' asset allocation was a difference of around 1.2% higher annualised reward since 1972

Of the order of around a 6% annualised real gain from 90/10 compared to 4.8%, at the expense of considerably more unease at times. If you're holding £'s. $'s and gold in equal amounts, cash, precious metals and stocks in equal amounts, then in Markowitz type thought train the comfort should any one be rising substantially or falling substantially may still feel comfortable. If you're 60+ and 90% loading into stocks were to see substantial declines a risk is that some in the past in such situation have opted to bail out at the lows in order "to save what little remained". Such events periodically come along - such as three consecutive years of greater than 20% losses in each year and a sensation of yet further declines to come with all the negativity around, less than half the retirement fund value you formerly held, and it can become too-much (a capitulation trigger event).

For a UK investor since 1932 if they'd stuffed a third each of £'s, $'s and gold under their mattress, yearly rebalancing back to a third each, they'd have lagged inflation by -1% annualised, but with variance around that (0.8 to 1.2 type swings around 1.0, so you could selectively pick periods where that was relatively good, or bad - if you wanted to paint a particular picture).

If instead of holding hard £ currency you deposited those £'s into interest paying T-Bills then broadly the portfolio yielded 0% real. A form of 'risk-free', but again with variances.

If instead of holding hard $'s those $'s were invested in US T-Bills, then for a UK investor the third in £ T-Bills, third in $ T-Bills, third in gold portfolio broadly provided a +1.7% annualised real.

A factor with gold is that it does move through longer periods (decades) of in and out of vogue. It tends to do well during periods of both deflation and high inflation, which come and go. A good counterbalance to gold is stocks. A 50/50 stock/gold barbell is somewhat like holding 50/50 short dated and long dated gilts, it combines to a central bullet, and could be considered as being a form of currency unhedged global bond.

Extending that to partner a third each in £'s deposited into interest paying accounts/investment, gold and US stocks and the rewards were pretty decent. 3% PWR type reward i.e. draw 3% initial portfolio value in the first year and uplift that amount by inflation as the amount drawn in subsequent years, and in the worst case you ended up with a comparable inflation adjusted amount as at the start. In the average case you saw the portfolio gain 1.5% to 2% real on top of that.

A third in domestic £'s earning interest, a third in US$ primary reserve currency - invested in US stocks, a third in gold (global currency and a commodity), is a reasonably safe 'global bond' type choice IMO.

For a US investor whose domestic currency is the same as the primary reserve currency the additional benefit of 90/10 above and beyond that 'safe' asset allocation was a difference of around 1.2% higher annualised reward since 1972

Of the order of around a 6% annualised real gain from 90/10 compared to 4.8%, at the expense of considerably more unease at times. If you're holding £'s. $'s and gold in equal amounts, cash, precious metals and stocks in equal amounts, then in Markowitz type thought train the comfort should any one be rising substantially or falling substantially may still feel comfortable. If you're 60+ and 90% loading into stocks were to see substantial declines a risk is that some in the past in such situation have opted to bail out at the lows in order "to save what little remained". Such events periodically come along - such as three consecutive years of greater than 20% losses in each year and a sensation of yet further declines to come with all the negativity around, less than half the retirement fund value you formerly held, and it can become too-much (a capitulation trigger event).

-

1nvest

- Lemon Quarter

- Posts: 4414

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 691 times

- Been thanked: 1346 times

Re: Global Equity ETF \ Bonds

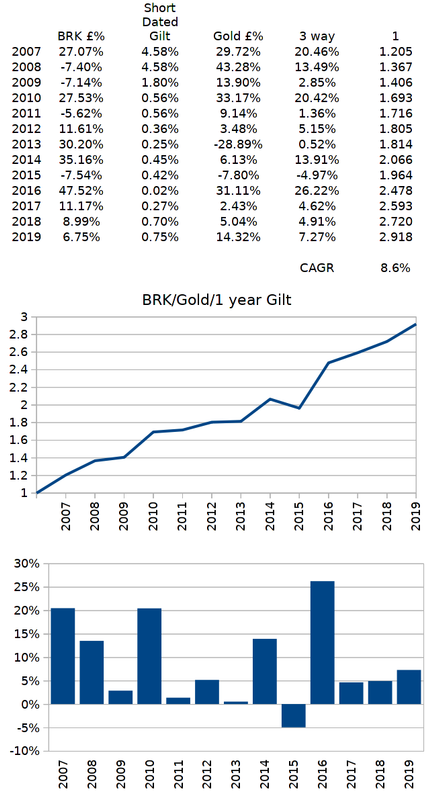

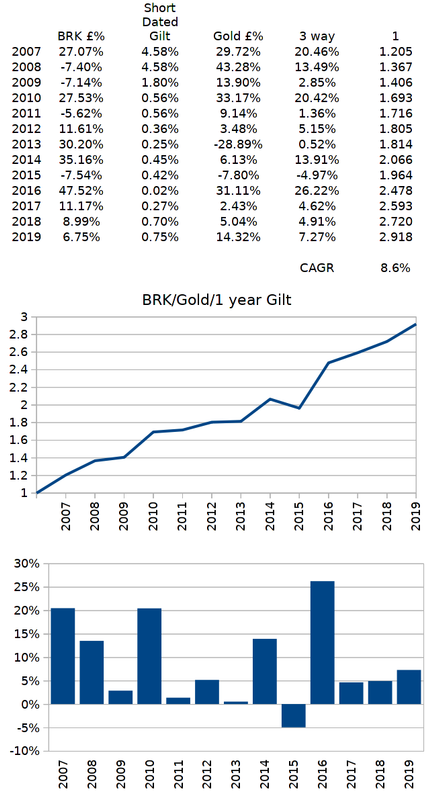

This is for third each Berkshire Hathaway (US$/stock), gold and buying a gilt a year or so out from maturity, holding to maturity and then rebalancing and rolling the 'cash' element into another 1 year or so to maturity Gilt

Up 49% across 2016 to 2019 inclusive years (around 10.5% annualised over those 4 years). 5.6% annualised if you count just 2017 to 2019 inclusive (3 years).

Up 49% across 2016 to 2019 inclusive years (around 10.5% annualised over those 4 years). 5.6% annualised if you count just 2017 to 2019 inclusive (3 years).

Who is online

Users browsing this forum: No registered users and 28 guests