Puzzled by XIRR - larger than expected?

Posted: March 31st, 2023, 12:22 pm

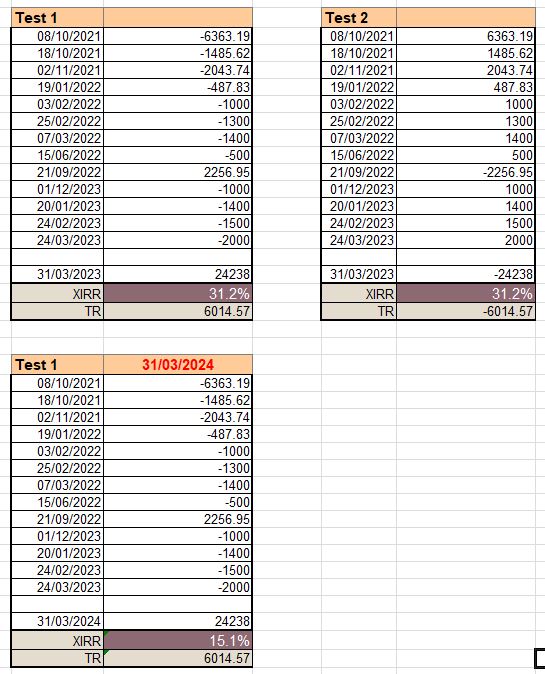

I have started to look into creating a spreadsheet for my S&S ISA, and trying to get to grips with how to calculate XIRR.

I have recorded this:

XIRR reports as 29.96%

Annualised reports as 19.43%

Time period is 1.48 years.

Is this actually correct value for the XIRR? Various places online seemed to report wildly different values.

Is the large XIRR due to a short timespan for the calculation?

Thanks

I have recorded this:

Date Cashflows Notes

2021-10-08 6,363.19 Initial

2021-10-18 1,485.62

2021-11-02 2,043.71

2022-01-19 487.83

2022-02-03 1,000.00

2022-02-25 1,300.00

2022-03-07 1,400.00

2022-06-15 500.00

2022-09-21 -2,256.95 Widthdrawal

2022-12-01 1,000.00

2023-01-20 1,400.00

2023-02-24 1,500.00

2023-03-24 2,000.00

2023-03-31 -24,238.00 Current

XIRR reports as 29.96%

Annualised reports as 19.43%

Time period is 1.48 years.

Is this actually correct value for the XIRR? Various places online seemed to report wildly different values.

Is the large XIRR due to a short timespan for the calculation?

Thanks