Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

How was your week?

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

How was your week?

Quite depressing portfolio numbers for this last week. In fact the only good news was a decent increase in HSBC shares. They are now my biggest holding by some margin. I might even consider trimming them before long but am reluctant to do so as everything else seems to be gently sliding down in value. The only other positives news was £50 from a modest holding of premium bonds.

Dod

Dod

-

doug2500

- Lemon Slice

- Posts: 664

- Joined: November 4th, 2016, 11:51 am

- Has thanked: 288 times

- Been thanked: 249 times

Re: How was your week?

Terrible, really terrible, but then I held XPP and SPT both of which had awful trading updates and got rightly hammered. Both got sold asap, rightly in one case and just possibly hastily in the other.

I only work things out quarterly which happened to be last weekend and I was down 3.8% on the quarter and up 1% over the last 12mths. That will be worse now.

I'm not beaten, some of the proceeds got reinvested and some I'm sitting on pending updates, but it's certainly tough out there. The most confidence sapping conditions I've experienced in 17 years of being properly active, and they include some interesting times.

And I've never won a thing on premium bonds, which we buy instead of pet insurance.

I only work things out quarterly which happened to be last weekend and I was down 3.8% on the quarter and up 1% over the last 12mths. That will be worse now.

I'm not beaten, some of the proceeds got reinvested and some I'm sitting on pending updates, but it's certainly tough out there. The most confidence sapping conditions I've experienced in 17 years of being properly active, and they include some interesting times.

And I've never won a thing on premium bonds, which we buy instead of pet insurance.

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: How was your week?

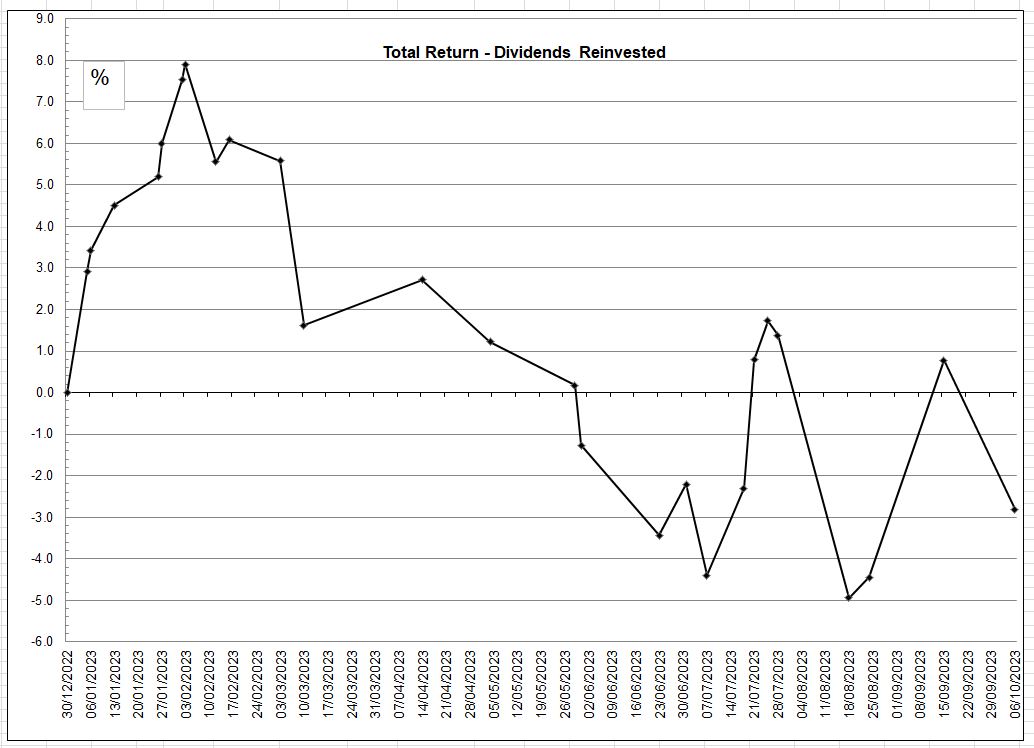

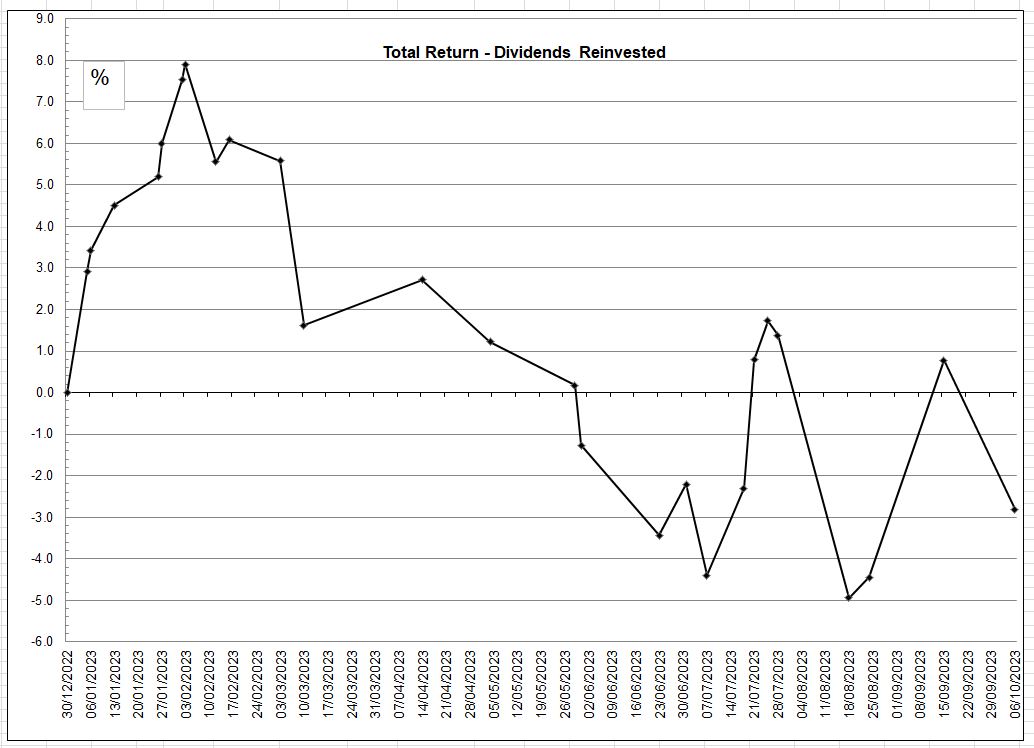

I track my portfolio in terms of total return. The graph of TR since the start of the year has been...dissapointing, particularly when the graph reflects that dividends have been re-invested. The malaise is difficult to track down- I suppose I could do a snapshot comparison of valuations start of year versus now but nothing stands out as having really fallen off a cliff in the last year....just most things have drifted down. Income units are holding up well (shareprice falls, yields 'on offer' increasing combined with reinvested dividends). I've recently (this year) started to buy some fixed income in the form of Prefs (a basket of several Prefs) and some short dated index linked Gilts (I have a need for cash early next year, have exceeded savings allowances).

My portfolio is skewed towards "income" and also has a strong UK bias (67%)..as detailed (pl. ignore the small rounding errors to 100%).

"LTH" represents UK shares which wouldn't feature in HYP-land (eg Diageo, Sprirax-Sarco, Segro).

edit: I'm sure someone will be along to say...'well, you will invest in rubbish UK HYP shares..."

My portfolio is skewed towards "income" and also has a strong UK bias (67%)..as detailed (pl. ignore the small rounding errors to 100%).

"LTH" represents UK shares which wouldn't feature in HYP-land (eg Diageo, Sprirax-Sarco, Segro).

edit: I'm sure someone will be along to say...'well, you will invest in rubbish UK HYP shares..."

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10032 times

Re: How was your week?

Dod101 wrote:

Quite depressing portfolio numbers for this last week.

In fact the only good news was a decent increase in HSBC shares. They are now my biggest holding by some margin.

HSBC are one of the few single-share income-investments that I'm happy to continue holding. They've certainly had a good run over the past 12 months, and I intend to stick with them for the long term.

Since the start of the year my invested-capital chart has displayed a peculiar set of characteristics that I can only really describe as 'regular chunky see-saws over a broadly flat level', but I've got to be honest and say that a flattish year wouldn't be too disappointing an outcome, and I'm fairly sanguine about markets having to spend some periods consolidating, and I think that's more or less where we're at to be honest, and I'll try to stick resolutely to my largely hands-off approach to things, I should imagine.

Here's a market-cap and sector-based map for the FTSE100 this week, and we can see that there's been some fairly chunky drops in many popular holdings -

Source - https://www.marketbeat.com/market-data/sector-performance/uk/

When we look at the same chart on a 12-month basis, there's some even chunkier falls in quite a few main-market sectors - https://i.imgur.com/XWODyio.png

Interesting times...

Cheers,

Itsallaguess

-

DrFfybes

- Lemon Quarter

- Posts: 3792

- Joined: November 6th, 2016, 10:25 pm

- Has thanked: 1198 times

- Been thanked: 1987 times

Re: How was your week?

My week?

No idea.

Investing is a long term thing, markets go up and down. Sometimes log in to look at a Corporate action or similar twice in a week and see my ISA is £20k or so in one direction or the other, but I only do a 'total assets' audit 3 or 4 times a year.

But I'm mainly in trackers and some ITs, I'm trying not to tinker, I just let the Global Tracker auto-sell happen each month and the unsheltered Divis roll in, the cash interest accumulates, and I know that we've had a few good years and are now likely to get a few flat one poor ones.

Unlike in Politics, a week is the blink of an eye in investing.

Paul

No idea.

Investing is a long term thing, markets go up and down. Sometimes log in to look at a Corporate action or similar twice in a week and see my ISA is £20k or so in one direction or the other, but I only do a 'total assets' audit 3 or 4 times a year.

But I'm mainly in trackers and some ITs, I'm trying not to tinker, I just let the Global Tracker auto-sell happen each month and the unsheltered Divis roll in, the cash interest accumulates, and I know that we've had a few good years and are now likely to get a few flat one poor ones.

Unlike in Politics, a week is the blink of an eye in investing.

Paul

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: How was your week?

DrFfybes wrote:My week?

No idea.

Investing is a long term thing, markets go up and down. Sometimes log in to look at a Corporate action or similar twice in a week and see my ISA is £20k or so in one direction or the other, but I only do a 'total assets' audit 3 or 4 times a year.

But I'm mainly in trackers and some ITs, I'm trying not to tinker, I just let the Global Tracker auto-sell happen each month and the unsheltered Divis roll in, the cash interest accumulates, and I know that we've had a few good years and are now likely to get a few flat one poor ones.

Unlike in Politics, a week is the blink of an eye in investing.

Paul

I do a check every Saturday morning and have done for years but that does not mean to say I tinker very much, but I like to see what is going on. If you have had a few good years in recent times good for you. 2021 was the last decent year I had and that was a recovery from the Covid problems. 2022 was down about 10% and this year so far I am down another 5% or so. That is more than just market noise. If there is a bit of stirring in the takeover front especially from overseas, that may help. Certainly I think by most standards it is agreed that the UK market is very cheap.

I am though more interested in income and thankfully that has more than held up. I have seen increasing income since 2020, well in excess of inflation without putting in any new money.

It is though quite depressing to see capital values going backwards.

Dod

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: How was your week?

Itsallaguess wrote:Dod101 wrote:

Quite depressing portfolio numbers for this last week.

In fact the only good news was a decent increase in HSBC shares. They are now my biggest holding by some margin.

HSBC are one of the few single-share income-investments that I'm happy to continue holding. They've certainly had a good run over the past 12 months, and I intend to stick with them for the long term.

Since the start of the year my invested-capital chart has displayed a peculiar set of characteristics that I can only really describe as 'regular chunky see-saws over a broadly flat level', but I've got to be honest and say that a flattish year wouldn't be too disappointing an outcome, and I'm fairly sanguine about markets having to spend some periods consolidating, and I think that's more or less where we're at to be honest, and I'll try to stick resolutely to my largely hands-off approach to things, I should imagine.

Here's a market-cap and sector-based map for the FTSE100 this week, and we can see that there's been some fairly chunky drops in many popular holdings -

Source - https://www.marketbeat.com/market-data/sector-performance/uk/

When we look at the same chart on a 12-month basis, there's some even chunkier falls in quite a few main-market sectors - https://i.imgur.com/XWODyio.png

Interesting times...

Cheers,

Itsallaguess

I am not much into graphs although people seem to like them and your graph is certainly one of the more interesting ones, thank you. I like the market capitalisation aspect particularly. For instance, I did not realise that Astrazeneca was such a big company nowadays. No Shell?

Dod

-

YeeWo

- Lemon Slice

- Posts: 424

- Joined: November 5th, 2016, 10:12 am

- Has thanked: 297 times

- Been thanked: 118 times

Re: How was your week?

Code: Select all

| SP | % PF | XIRR

CASH | NA | 4.8% |

BATS | £24.83 | 12.3% | -7.8%

DGE | £30.44 | 26.4% | 4.9%

HSPX | £35.21 | 2.5% |

INCH | £7.25 | 12.6% | 28.8%

REL | £28.63 | 15.2% | 19.0%

RIO | £50.08 | 13.8% | 2.3%

ULVR | £39.26 | 12.4% | 8.5%

- Diageo is my outsized position at the moment. RR & VOD having been disposed of.

- Looks like a sustained war in the middle-east is going to decimate the markets next week.

- I've never before had circa 5% of PF in cash. Some dry powder may be useful over the coming weeks.

- Good Luck All........

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: How was your week?

YeeWo wrote:- YTD +7.8% which is far lower than it has been earlier in the year.Code: Select all

| SP | % PF | XIRR

CASH | NA | 4.8% |

BATS | £24.83 | 12.3% | -7.8%

DGE | £30.44 | 26.4% | 4.9%

HSPX | £35.21 | 2.5% |

INCH | £7.25 | 12.6% | 28.8%

REL | £28.63 | 15.2% | 19.0%

RIO | £50.08 | 13.8% | 2.3%

ULVR | £39.26 | 12.4% | 8.5%

- Diageo is my outsized position at the moment. RR & VOD having been disposed of.

- Looks like a sustained war in the middle-east is going to decimate the markets next week.

- I've never before had circa 5% of PF in cash. Some dry powder may be useful over the coming weeks.

- Good Luck All........

INCH and REL (whatever they may be) are doing well. If Unilever is 8.5% up, that does not accord with my holding. At 31 December it was quoted at £41.82; at 7 October 2023 it was £39.252. Down about 6%. It does not yield that so where do you get up 8.5%? Presumably I am misunderstanding your cryptic numbers.

Dod

-

Bubblesofearth

- Lemon Quarter

- Posts: 1111

- Joined: November 8th, 2016, 7:32 am

- Has thanked: 12 times

- Been thanked: 452 times

Re: How was your week?

Dod101 wrote:

I am not much into graphs although people seem to like them and your graph is certainly one of the more interesting ones, thank you. I like the market capitalisation aspect particularly. For instance, I did not realise that Astrazeneca was such a big company nowadays. No Shell?

Dod

And no BP either. Shurely shum mishtake....

-

BullDog

- Lemon Quarter

- Posts: 2482

- Joined: November 18th, 2021, 11:57 am

- Has thanked: 2003 times

- Been thanked: 1212 times

Re: How was your week?

Another typically awful week, for sure.

Since I retired and had little new cash to invest, it feels like I've been engaged in a financial war of attrition. About 15% down in capital terms over three years feels about right. Thankfully dividends have held up rather well, broadly.

An expensive lesson in owning some of the highest yielding stocks has been painfully learned here too. The very high yields are great. Until they aren't. Or there's a corresponding loss in capital. Not on my own there.

At least my dividend income isn't needed to live off. I'm curtailing drawing a portion of dividend income for the next couple of years to reinvest and rebuild some of the losses from the too good to be true high yield shares. I'm fortunate I can do that with zero impact on lifestyle.

A more modest but growing income from shares is the future here.

Since I retired and had little new cash to invest, it feels like I've been engaged in a financial war of attrition. About 15% down in capital terms over three years feels about right. Thankfully dividends have held up rather well, broadly.

An expensive lesson in owning some of the highest yielding stocks has been painfully learned here too. The very high yields are great. Until they aren't. Or there's a corresponding loss in capital. Not on my own there.

At least my dividend income isn't needed to live off. I'm curtailing drawing a portion of dividend income for the next couple of years to reinvest and rebuild some of the losses from the too good to be true high yield shares. I'm fortunate I can do that with zero impact on lifestyle.

A more modest but growing income from shares is the future here.

-

Gerry557

- Lemon Quarter

- Posts: 2057

- Joined: September 2nd, 2019, 10:23 am

- Has thanked: 173 times

- Been thanked: 569 times

Re: How was your week?

I check most Saturday mornings. It's mainly to see if we have dipped and it's worth buying more.

I noted that my PF was close the the yearly low back in July I think. The weekly drop was largeish and follows last week's also largeish drop. Again another might be worth buying indication.

I did a quick check to see if I'd invested anything in between the dates and I'd bought some LGEN that if taken into account might mean I'm actually back to relatively yearly lows.

This doesn't account for dividends spent or holding so I'm probably up.... Just.

It's more mental notes for myself but doesn't detail individual shares. I did top up a few holdings last week but from the sale of some EPIC that will be taken from me soon anyway. These had fallen more than the small potential gain from holding to the end at Christmas.

I noted that my PF was close the the yearly low back in July I think. The weekly drop was largeish and follows last week's also largeish drop. Again another might be worth buying indication.

I did a quick check to see if I'd invested anything in between the dates and I'd bought some LGEN that if taken into account might mean I'm actually back to relatively yearly lows.

This doesn't account for dividends spent or holding so I'm probably up.... Just.

It's more mental notes for myself but doesn't detail individual shares. I did top up a few holdings last week but from the sale of some EPIC that will be taken from me soon anyway. These had fallen more than the small potential gain from holding to the end at Christmas.

-

moorfield

- Lemon Quarter

- Posts: 3553

- Joined: November 7th, 2016, 1:56 pm

- Has thanked: 1587 times

- Been thanked: 1417 times

Re: How was your week?

I haven't paid much attention to whats been going on this week.

I don't need to, the single share holdings I still have were already trashed some time ago.

I don't need to, the single share holdings I still have were already trashed some time ago.

-

Lootman

- The full Lemon

- Posts: 18952

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 636 times

- Been thanked: 6684 times

Re: How was your week?

Gerry557 wrote:I check most Saturday mornings. It's mainly to see if we have dipped and it's worth buying more.

I feel sure that you know this but much the same can be achieved by leaving in place a series of buy limit orders, to capture any drop in share price to a point where you would like to add. Then you might not feel any need to look at all.

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: How was your week?

Dod101 wrote:YeeWo wrote:- YTD +7.8% which is far lower than it has been earlier in the year.Code: Select all

| SP | % PF | XIRR

CASH | NA | 4.8% |

BATS | £24.83 | 12.3% | -7.8%

DGE | £30.44 | 26.4% | 4.9%

HSPX | £35.21 | 2.5% |

INCH | £7.25 | 12.6% | 28.8%

REL | £28.63 | 15.2% | 19.0%

RIO | £50.08 | 13.8% | 2.3%

ULVR | £39.26 | 12.4% | 8.5%

- Diageo is my outsized position at the moment. RR & VOD having been disposed of.

- Looks like a sustained war in the middle-east is going to decimate the markets next week.

- I've never before had circa 5% of PF in cash. Some dry powder may be useful over the coming weeks.

- Good Luck All........

INCH and REL (whatever they may be) are doing well. If Unilever is 8.5% up, that does not accord with my holding. At 31 December it was quoted at £41.82; at 7 October 2023 it was £39.252. Down about 6%. It does not yield that so where do you get up 8.5%? Presumably I am misunderstanding your cryptic numbers.

Dod

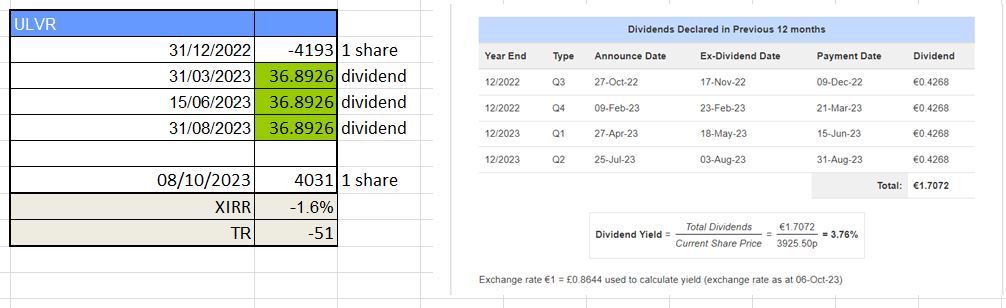

YTD ...are the XIRR values quoted correct ? A quick look at Unilever, for example...if one bought a single share at the very last day of 2022 the price was £40.31. I have not included buying costs here neither. Then 3 dividends have been received - I've estimated the values based on the exchange rate shown in the table from Dividend Data (I don't have the exact ULVR dividend figures).

INCH - Inchcape https://www.fundslibrary.co.uk/FundsLib ... d6SIa8&r=1 (good luck in the translation of the CEO's management babble!)

REL - RELX ("Rel-Ex") https://www.relx.com/ (A Nick Train holding).

Last edited by monabri on October 8th, 2023, 11:00 am, edited 1 time in total.

-

YeeWo

- Lemon Slice

- Posts: 424

- Joined: November 5th, 2016, 10:12 am

- Has thanked: 297 times

- Been thanked: 118 times

Re: How was your week?

Sorry, in retrospect the XIRR figure is cryptic indeed to everybody except me! The XIRR figure is for the whole duration of the investment! Inchcape (INCH) I've held on-&-off since 2004, however, I bought back in 11 Apr 22 and that is the basis of the XIRR figure shown. RELX (REL) I've held and kept buying since 01 Aug 10. Dividend payers that are held with a decent margin of safety are probably not best to evaluate on the basis of one year alone.Dod101 wrote:INCH and REL (whatever they may be) are doing well. If Unilever is 8.5% up, that does not accord with my holding. At 31 December it was quoted at £41.82; at 7 October 2023 it was £39.252. Down about 6%. It does not yield that so where do you get up 8.5%? Presumably I am misunderstanding your cryptic numbers. Dod

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: How was your week?

YeeWo wrote:Sorry, in retrospect the XIRR figure is cryptic indeed to everybody except me! The XIRR figure is for the whole duration of the investment! Inchcape (INCH) I've held on-&-off since 2004, however, I bought back in 11 Apr 22 and that is the basis of the XIRR figure shown. RELX (REL) I've held and kept buying since 01 Aug 10. Dividend payers that are held with a decent margin of safety are probably not best to evaluate on the basis of one year alone.Dod101 wrote:INCH and REL (whatever they may be) are doing well. If Unilever is 8.5% up, that does not accord with my holding. At 31 December it was quoted at £41.82; at 7 October 2023 it was £39.252. Down about 6%. It does not yield that so where do you get up 8.5%? Presumably I am misunderstanding your cryptic numbers. Dod

To be fair, I was thinking of another of Dod's post looking at the change in portfolio value "year to date". The original post here doesn't specify "year to date"

-

tjh290633

- Lemon Half

- Posts: 8290

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 919 times

- Been thanked: 4138 times

Re: How was your week?

Dod101 wrote:Quite depressing portfolio numbers for this last week. In fact the only good news was a decent increase in HSBC shares. They are now my biggest holding by some margin. I might even consider trimming them before long but am reluctant to do so as everything else seems to be gently sliding down in value. The only other positives news was £50 from a modest holding of premium bonds.

Dod

Dod, you get good days and bad days, good weeks and bad weeks, good years and bad years. That's why looking at the income rather than the capital is a good idea. Special dividends can distort the picture, so it's best to count them separately

My three biggest holdings are BAE Systems, Admiral and BHP, but there are ups and downs. A few weeks ago BA. was heading for a top slicing but fell back. Aviva is currently the subject of speculation. It's time we had some excitement.

TJH

-

88V8

- Lemon Half

- Posts: 5844

- Joined: November 4th, 2016, 11:22 am

- Has thanked: 4199 times

- Been thanked: 2603 times

Re: How was your week?

Dod101 wrote:Quite depressing portfolio numbers for this last week.

Three of my larger holdings are in Metro Bank, Diversified Energy and Gulf Keystone.

Had better weeks

V8

-

simoan

- Lemon Quarter

- Posts: 2109

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1467 times

Re: How was your week?

Lootman wrote:Gerry557 wrote:I check most Saturday mornings. It's mainly to see if we have dipped and it's worth buying more.

I feel sure that you know this but much the same can be achieved by leaving in place a series of buy limit orders, to capture any drop in share price to a point where you would like to add. Then you might not feel any need to look at all.

But why would anyone buy based on price alone? To completely ignore valuation is the very essence of stupidity. Maybe for an index tracker with a long term perspective that approach wouldn’t be ruinous, but for individual company shares your limit order is more than likely going to trigger when there has been a profit warning in the current market conditions. The first profit warning is rarely the last in my experience. It’s almost a guaranteed method for capital erosion.

Return to “Portfolio Management & Review”

Who is online

Users browsing this forum: No registered users and 46 guests