The present UK tax system is being directed towards levels of extreme invasions of privacy, where the state will have detailed sight into all your wealth/actions and demand insight into each and every transaction (along with your movement/thoughts etc.). A factor there is that the state repeatedly 'loses' large amounts of data so that might equally be assumed to be public/open information, which in the wrong hands is valuable data, enabling individuals to be highly/specifically targeted by thieves. That also leads to a tax rule-book that is very thick and micro managed, along with all of the investigators and lawyers/courts that involves. Labour have made its intent in that direction clear, £500 million more being thrown at expanding HMRC/investigators, by a entity that has a history of imposing a 130% historic highest taxation rate (Labour government 1968) - potentially confiscatory. Fair taxes are reasonable, unfair/punitive taxation is theft. IMO its unreasonable that to buy/sell the likes of gold requires that your name, address, photo, bank details etc. are all recorded both by the dealership and forwarded on to the state, and then perhaps passed on to be public, rightfully IMO you should be able to make such transactions privately, but the state sees that as being a potential for money-laundering or hiding wealth away from state confiscation, in effect are saying that its not your wealth - that perhaps was built up over years of your own work/effort, but the states, is just a loan to you, all of your efforts were not for your own/family, but for the state.

The way in which some generational families have countered such individual state controls was to acquire land (homes) in multiple countries along with the likes of art and gold, physical in-hand items that could be rolled up into a tube/bagged and moved. If a third of your wealth is in land (homes) spread across three different states/countries then the loss of one is a 11% wealth hit, maybe less if some residual value remains, relatively trivial given that even a regular portfolio value might vary by that or more in a single year.

If one investor achieves a 5% annualised real for a decade then sees that wealth being hit with a 40% death duties taxation, the residual is worse than another who achieved a 0% real over those same years elsewhere where no such 40% taxation occurs. In expanding micro-management/state control that's a push-away of capital - that is inclined to flight that state/country for more favourable terms/conditions elsewhere. The extreme controls of 'Pounds' is also a push-away from that currency, and the flight away from that currency weakens the ability of the central bank to direct/control the domestic economy. Global collaboration methods have/are being instated for 'data sharing', the likes of FATCA, but as ever that more serves the US who expect others to forward data onto them but are less open to sharing data in the other direction. It wont take much however for other options to arise in reflection of such controls, where instead of common exchange of Dollars or Pounds or whatever that instead some other form of common currency is generally preferred, maybe a entity based in international waters where from anywhere in the world a exchange of SMS messages between two parties facilitates 'currency' being transferred between those two parties.Likely states would prohibit usage of such 'currency' but overwhelming (and possibly rapid) uptake might make that unenforceable (if one retailer doesn't accept it they lose out to a local competitor who does accept it).

Better would be simplification, such as a simple sales tax. No income tax or micro-management etc. The more you have/spend the more you pay. 40% to the state, 10% to the local authority or whatever. The claim of clamping down on money laundering is behind the curve, those that are money laundering are more likely still being just as successful via other methods. AML claims are more a case of a misdirection for greater state control over individuals and potential theft of their wealth by the state.

Got a credit card? use our Credit Card & Finance Calculators

Thanks to gpadsa,Steffers0,lansdown,Wasron,jfgw, for Donating to support the site

Physical Gold

-

1nvest

- Lemon Quarter

- Posts: 4496

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 717 times

- Been thanked: 1396 times

-

1nvest

- Lemon Quarter

- Posts: 4496

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 717 times

- Been thanked: 1396 times

Re: Physical Gold

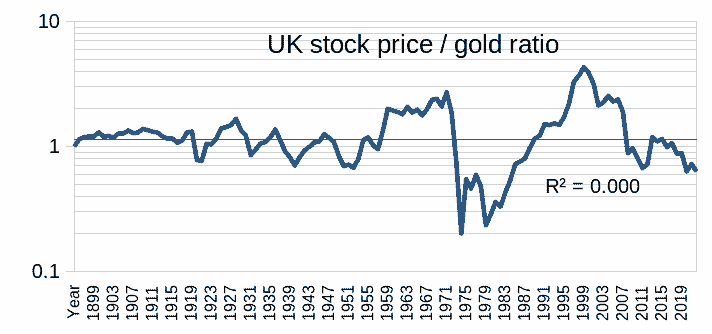

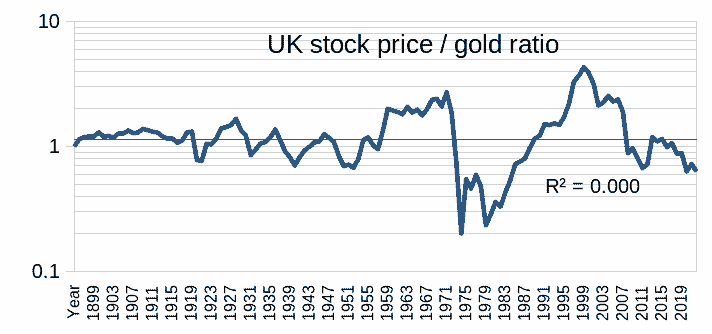

CPI/RPI is inclined to be slowed by productivity/technology. Other asset price inflation is inclined to incorporate that growth factor. Comparing FT All Share price with gold and to the end of 2023 that had transitioned into reflecting gold to be moderately expensive, with further widening year to date (gold up more than FTAS) ... even more so

Interesting to see how 1960's/early 1970's saw gold as relatively cheap/stocks expensive that rapidly transitioned to gold expensive/stocks cheap in mid/late 1970's. And then a long transition back to stocks expensive/gold cheap by the end of the 1990's. But where since the new millennium stocks have again transitioned to being relatively cheap and gold having become more relatively expensive. Also noteworthy is now broadly the log scaled exponential trend line has been so broadly flat across 1896 to recent.

Another point of note is that 100% FTAS yields 100% of stock dividends. Comparing that with 67/33 yearly rebalanced stock/gold (price only) where a 1% SWR was drawn - relative to 100% FTAS price only with 0% SWR drawn, so as though gold paid a constant 3% inflation adjusted dividend yield, had similar overall 30 year total return reward outcomes across all 30 year periods since 1896. Reasonably close to being the same, but where the variance in the 67/33 was lower than all-stock, so was the better 'risk-adjusted' choice. The tendency for no/low/inverse correlation between stocks and gold in effect provided a trading (rebalancing) gain similar to net stock dividends. Generally having income sourced in part from dividends, part from SWR (constant inflation adjusted income) is more diverse than relying upon income being sourced from dividends alone (if dividends halved 67/33 endures total income being down just a third).

Interesting to see how 1960's/early 1970's saw gold as relatively cheap/stocks expensive that rapidly transitioned to gold expensive/stocks cheap in mid/late 1970's. And then a long transition back to stocks expensive/gold cheap by the end of the 1990's. But where since the new millennium stocks have again transitioned to being relatively cheap and gold having become more relatively expensive. Also noteworthy is now broadly the log scaled exponential trend line has been so broadly flat across 1896 to recent.

Another point of note is that 100% FTAS yields 100% of stock dividends. Comparing that with 67/33 yearly rebalanced stock/gold (price only) where a 1% SWR was drawn - relative to 100% FTAS price only with 0% SWR drawn, so as though gold paid a constant 3% inflation adjusted dividend yield, had similar overall 30 year total return reward outcomes across all 30 year periods since 1896. Reasonably close to being the same, but where the variance in the 67/33 was lower than all-stock, so was the better 'risk-adjusted' choice. The tendency for no/low/inverse correlation between stocks and gold in effect provided a trading (rebalancing) gain similar to net stock dividends. Generally having income sourced in part from dividends, part from SWR (constant inflation adjusted income) is more diverse than relying upon income being sourced from dividends alone (if dividends halved 67/33 endures total income being down just a third).

-

1nvest

- Lemon Quarter

- Posts: 4496

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 717 times

- Been thanked: 1396 times

Re: Physical Gold

Extending my prior post, you might consider house+imputed to broadly compare/be-similar to stock+dividends. An asset allocation of thirds UK house/US stocks/gold has asset diversity of land/stocks/commodity, currency diversify of £, $, gold, income diversity of imputed, dividends, SWR. And be considered a form of 67/33 equity/gold asset allocation, where two-thirds of assets are in-hand (and where the stock element can be liquidated in T+2 time).

If you measure that relative to a 'inflation rate' of thirds each (price only) house, stock and CPI/RPI) then that's a relatively stable/consistent real rate of return, and where the tendency is for that inflation rate to accelerate away from just CPI/RPI alone.

If you measure that relative to a 'inflation rate' of thirds each (price only) house, stock and CPI/RPI) then that's a relatively stable/consistent real rate of return, and where the tendency is for that inflation rate to accelerate away from just CPI/RPI alone.

-

jaizan

- Lemon Slice

- Posts: 411

- Joined: September 1st, 2018, 10:21 pm

- Has thanked: 234 times

- Been thanked: 122 times

Re: Physical Gold

1nvest wrote:You'll likely get a better price with one of the other major/trusted dealers and get the best price by shopping around at the time. Don't buy from ebay. For numismatics paying a premium for 'Royal Mint' purchases may be preferred, commemorations/proofs. I personally wouldn't buy from the Royal Mint, as for me gold is fungible, only interested in the bullion value as a investment, not concerned about the quality/appearance of that gold. I also live within the London tube region so for me buying/selling in person is nicer than conveyance via special delivery/post

Which dealers in London do you use ?

So far, I've always used Sharps Pixley, on St James. I'm quite happy with them, although they are only open from Monday to Friday.

I would always like to hear of reputable alternatives.

-

Seasider

- Lemon Pip

- Posts: 68

- Joined: May 4th, 2022, 8:18 pm

- Has thanked: 4 times

- Been thanked: 19 times

Re: Physical Gold

You've probably heard of these but what about

Atkinsons

ATS Bullion

Chards

Hatton Garden Metals

Atkinsons

ATS Bullion

Chards

Hatton Garden Metals

-

stevensfo

- Lemon Quarter

- Posts: 3504

- Joined: November 5th, 2016, 8:43 am

- Has thanked: 3891 times

- Been thanked: 1424 times

Re: Physical Gold

Seasider wrote:You've probably heard of these but what about

Atkinsons

ATS Bullion

Chards

Hatton Garden Metals

I also used Guernsey Mint in the past, but I have the feeling that they changed their name.

I simply used to decide more or less what I wanted, then open each site up in a different tab and compare the prices and p/p. Although the price of the gold itself should be the same, there are surprising differences in the mark up of some coins.

The Royal Mint was generally avoided. I felt that they were the most expensive and liable to charge more especially if it was a new coin in a plastic case!

Steve

-

1nvest

- Lemon Quarter

- Posts: 4496

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 717 times

- Been thanked: 1396 times

Re: Physical Gold

Seasider wrote:You've probably heard of these but what about

Atkinsons

ATS Bullion

Chards

Hatton Garden Metals

+ Tavex https://tavexbullion.co.uk/

For singles, thesilverforum web site typically has individuals trading at around a common spot premium, so no spread at all, both happy, but with post/insurance factors on top. There are individuals with high form/reliable/safe. But by the time you factor in post/insurance (and time/bother)! I prefer paper-gold until enough value warrants moving some from/to physical and 'bulk purchase/sell' in person (dealerships).

As a retirement plan its generally many smaller sales. 50/50 initial stock accumulation fund and gold, and thereafter spend using your credit cards and a week or so before that bills due for payment sell some of stock or gold (or maybe some of both) according to whichever is the higher value at the time. As though your (e)wallet contained stock and gold 'notes' that you FX'd into Pounds to pay for something, but where unlike Pounds that tend to be debased over time those 'notes' are inclined to see their purchase power increase over time. That also negates the likes of ii brokerage monthly account fee, same either way - no fee and £10/trade once/month, or £10/month fee and one free trade.

Who is online

Users browsing this forum: No registered users and 12 guests