Nimrod103 wrote:I refuse to believe that the lack of investment by UK industry is due to government indecision, though it doesn't help. I would blame very high corperate taxation, and taxation in general.

Argument from personal disbelief is no argument, it's just theology. Why not

ask 8000 CEOs what they think? [in July 2019]

[*]More than half, 54%, of businesses said Brexit was one of their top three sources of uncertainty.

[*]Anticipation of Brexit is estimated to have gradually reduced investment by about 11% over the three years since the June 2016 vote.

[*]Reduced UK productivity by between 2% and 5% since the referendum.

I don't want to make this about Brexit, it's just a specific cause of uncertainty that has been studied more than most. But just generally it's hard to look at HMG and see any kind of stability in the last 10 years or so, and that's seldom good for outcomes.

Nimrod103 wrote:Hallucigenia wrote:Policy stability is perhaps the number 1 requirement - a major cause of the lack of investment has been industry not knowing what government is doing from one week to the next.

Policy stability is a great idea. Starting from when? Interest rates have been near zero for 15 years because they were needed to counter a massive financial heart attack, for which the BoE and the government of the time must share the blame (along with those from other countries). Interest rates have subsequently risen to over 5%, and are unlikely to fall by much in the future. And as for taxation, that has risen to unprecedented post war levels, and under Labour will only go higher.

Jürgen Klopp became manager of Liverpool on 8 October 2015 and since then has won every trophy at least once. But in that time we have had 9 education secretaries, 8 foreign secretaries, 7 Home Secretaries (one twice), 7 Chancellors, 7 health secretaries, 5 PMs, 5 defence secretaries and 5 transport secretaries to mention but a few. That doesn't look like a trophy-winning approach, how can you have any kind of consistency in policy making when you have so many cooks stirring the broth? These are big, complex departments, it takes a year just to understand what's going on - and then they get moved on.

Nimrod103 wrote:In today's Telegraph:

https://www.telegraph.co.uk/business/20 ... s-economy/The same shift in mindset is required to address the nation’s wider savings deficit. The numbers here are stark. As a proportion of national income, Britain has one of the lowest savings rates – the part of disposable income that is available to acquire financial and non-financial assets – in the OECD at just 1.7pc. This compares with 6.1pc for the European Union, and 9.1pc for Germany. Like Aesop’s grasshopper, we prefer to live high on the hog and trust in the future to take care of itself.

It's complicated as despite a low savings rate, the average Brit has accumulated much more financial assets than the average German

https://www.ft.com/content/ba96c8ea-b34 ... 002965bce8our apparent recklessness has an unexpected upside. Brits are better investors. They take risks, they are in some ways better diversified, and they are more appreciative of the need to invest. By contrast, Germans keep far too much in cash, and when they do invest it is usually in high-cost, poor-value products. German incomes are among the highest in Europe, but median net household wealth is actually slightly below that of Greece, according to European Central Bank figures. In some respects, it should not be a surprise that Germans just pile up cash for rainy days. There is much less need for them to save for the three big financial events that Brits must plan for: getting a degree, getting a house and getting a pension.Nimrod103 wrote:But the principal problem is that we are not saving enough, so there is not enough for investment.

But again you're making assertions without evidence. If the problem was the UK was not saving enough and political chaos had no effect, then FDI would not be affected. But it has been

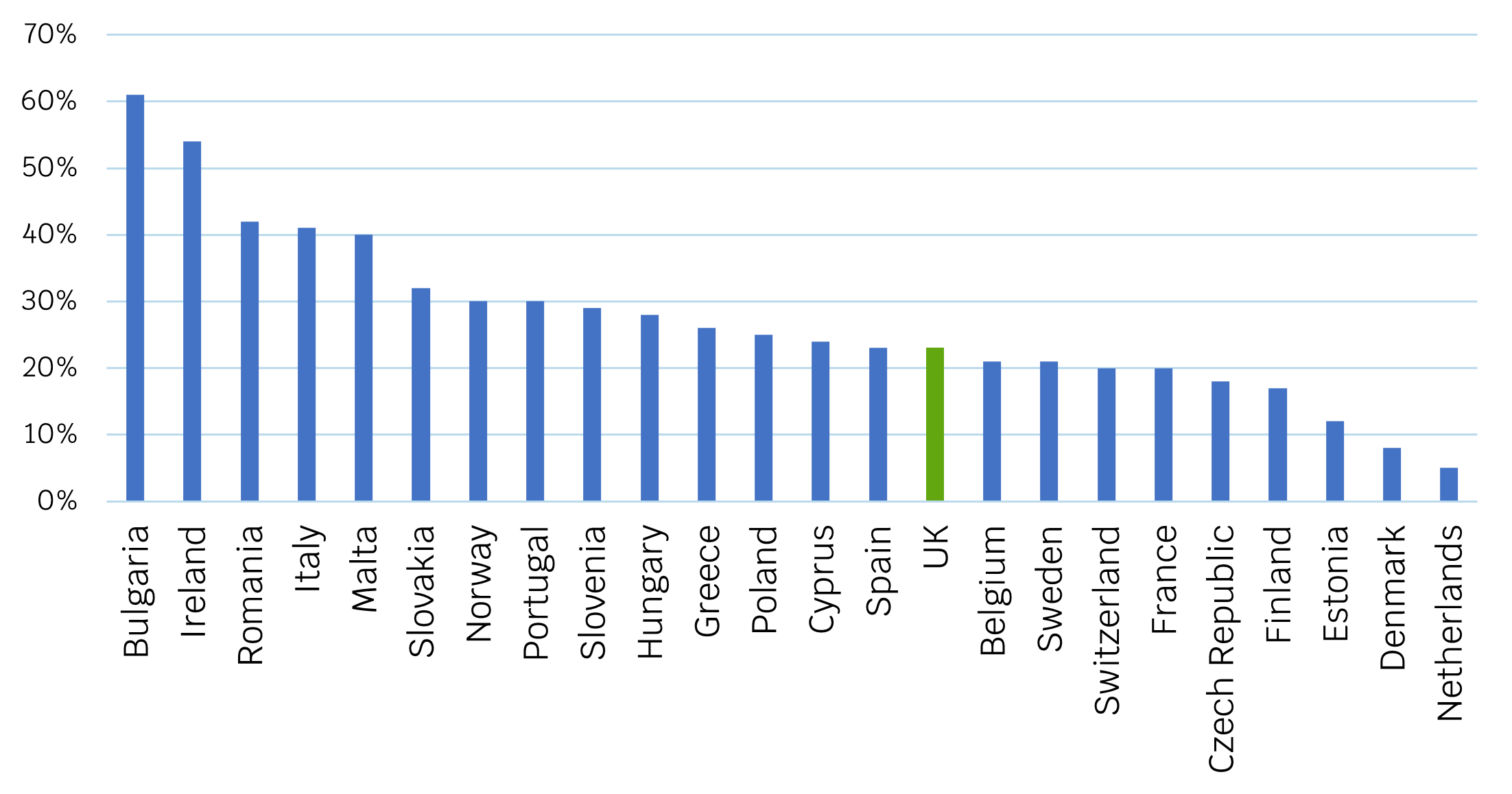

declining since 2016 - and that's ignoring the withdrawals like Honda :

Nimrod103 wrote:Too many in the UK are unproductive, receive benefits which are too high, and don't do anything useful. As a result our taxes are too high, and there are a lot of productive people who are saying to themselves - why bother?

The biggest group of unproductive people are pensioners, tying up housing and consuming vast amounts of healthcare without producing things that can help the UK pay her way in the world. So what do you suggest - a cull of everyone over 75, or merely send them somewhere like Rwanda, where they can eke out an existence at a much lower cost to the pension-payer's purse?