Got a credit card? use our Credit Card & Finance Calculators

Thanks to Anonymous,bruncher,niord,gvonge,Shelford, for Donating to support the site

Bonds

Bonds

So I've read Tim Hale's book - great info!

One takeaway was: invest your age in bonds, and the rest in equities.

Now I've got a few index tracker fund candidates to cover the equity side of things, but I'm not sure where I should be looking to cover the bonds side of things.

I saw a few bonds products on Vanguard, though they look quite bumpy and unappealing. Is there a "go to" place to buy bonds to complete my portfolio? Any recommendations?

Cheers in advance

G

One takeaway was: invest your age in bonds, and the rest in equities.

Now I've got a few index tracker fund candidates to cover the equity side of things, but I'm not sure where I should be looking to cover the bonds side of things.

I saw a few bonds products on Vanguard, though they look quite bumpy and unappealing. Is there a "go to" place to buy bonds to complete my portfolio? Any recommendations?

Cheers in advance

G

-

Alaric

- Lemon Half

- Posts: 6130

- Joined: November 5th, 2016, 9:05 am

- Has thanked: 21 times

- Been thanked: 1427 times

Re: Bonds

Gpop321 wrote:One takeaway was: invest your age in bonds, and the rest in equities.

That's by no means a generally accepted idea.

Bond funds are plentiful emough, both as ETFs and OEICs. There's a handful of ITs as well.

Otherwise you should be able to buy individual bonds through a popular platform such as ii, Hargreaves, AJ Bell and others. They vary as to the extent you can deal online and some may only deal by telephone.

-

tjh290633

- Lemon Half

- Posts: 8394

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 926 times

- Been thanked: 4224 times

Re: Bonds

Gpop321 wrote:So I've read Tim Hale's book - great info!

One takeaway was: invest your age in bonds, and the rest in equities.

Forget it. That theory has been discredited for years. There are short periods when fixed interest beat equities, but over long periods equities win hands down. I'm approaching 91 and am 100% in equities. I would be much poorer if I had followed that rule. How old are you, anyway?

TJH

-

1nvest

- Lemon Quarter

- Posts: 4601

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 734 times

- Been thanked: 1458 times

Re: Bonds

tjh290633 wrote:Gpop321 wrote:So I've read Tim Hale's book - great info!

One takeaway was: invest your age in bonds, and the rest in equities.

Forget it. That theory has been discredited for years. There are short periods when fixed interest beat equities, but over long periods equities win hands down. I'm approaching 91 and am 100% in equities. I would be much poorer if I had followed that rule. How old are you, anyway?

TJH

100% equities isn't the ideal, have only won hands down due to some cases of exceptional rewards typically following large declines, otherwise have been more inclined to align to stock/bond blends in most cases.

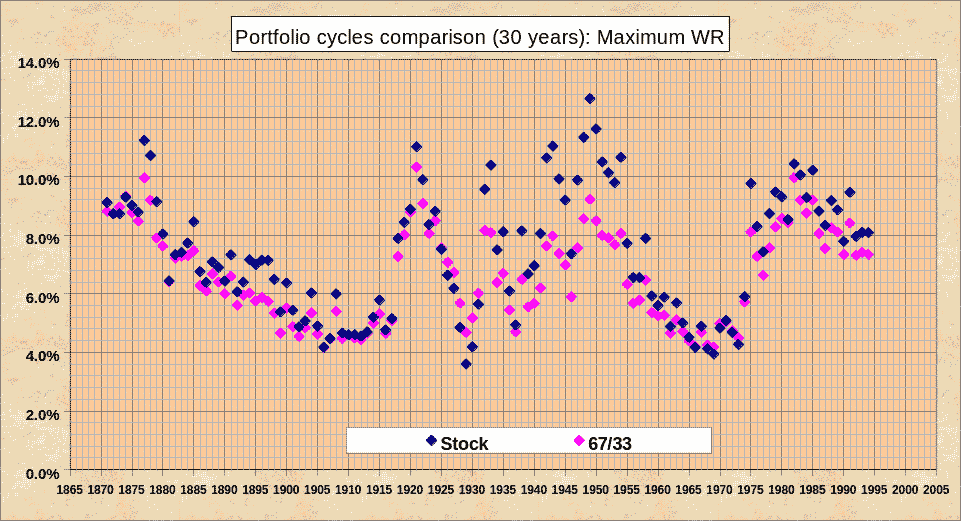

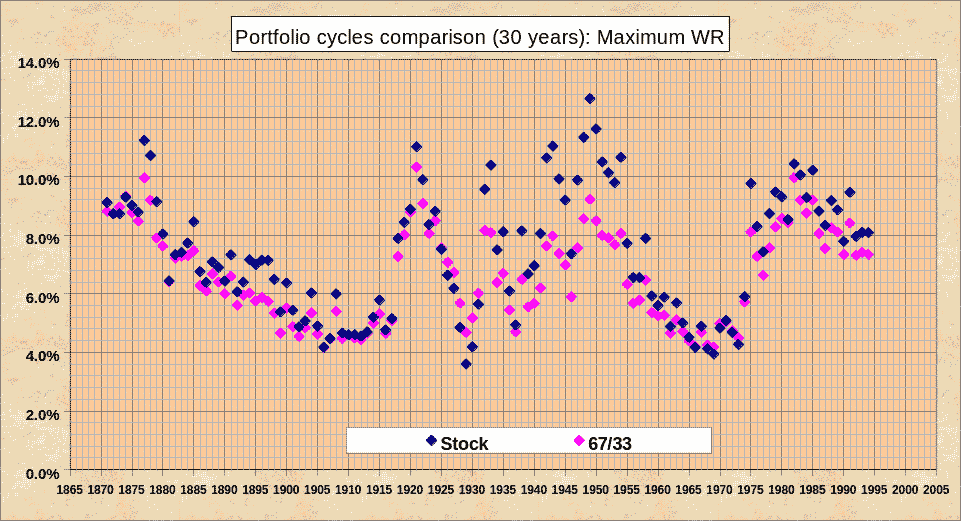

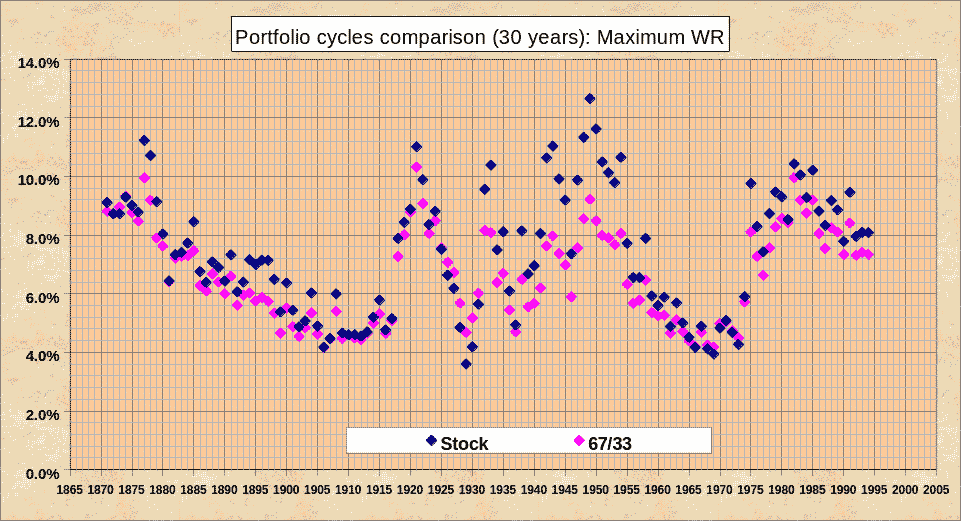

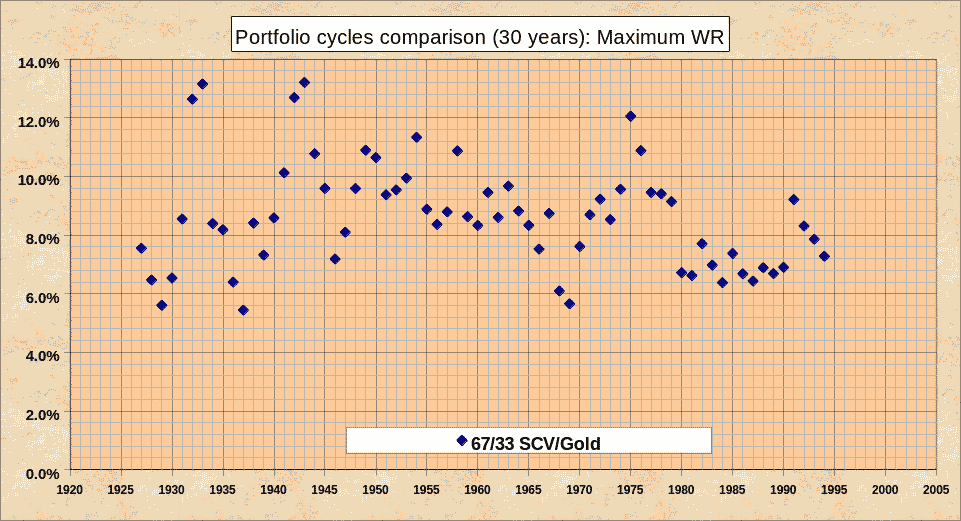

US data (easier availability, UK pattern is similar) via simba's backtest spreadsheet

comparing 30 year values. In some cases all-stock and 67/33 stock/bonds ended up with similar amounts, in some cases all-stock was worse, in other cases all-stock was significantly better - driven largely by a few exceptional years that across all of time many investors missed, but where the inclusion of which to measure broad 'average' returns distorts that average. Average height of a room full of nine individuals each six feet tall = 6 feet, if a 10th person joins them whose ten feet tall the average height increases to near 6' 5" however 90% of the room fall outside of that (are 'below average').

For those in retirement reducing the risk of a bad case is often the priority and from the above chart we see that all-stock had the worst stock (and the collective blue/stock dots spread around more - were more volatile).

During accumulation and averaging into stocks over many years is a common choice, but then switching to stock/bonds when nearing/in retirement. To factor in however is that if you do or will receive pension(s) income then that might be considered as a form of bond, assuming inflation linked then that's like a inflation bond ladder that totally exhausts (is all spent) the day you die. Some like to supplement such pension income with more assured inflation bonds of their own, create a ladder of Index Linked Gilts where for each £10,000 put into a rung that matures in 5, whatever years time you get a inflation adjusted 10K back again, or if real yields are positive it costs less than 10K, perhaps 9K to buy the same (or if real yields are positive it costs more, perhaps 11K).

Personally I would suggest using leverage during younger years, buy a house using a mortgage, and as that leverage declines add stocks, averaged into over many years, also contribute to state/occupational pensions if your can. Once you have enough wealth to retire then look more to protect/preserve that wealth, I have enough in pensions to be considered 'enough bonds' and so prefer to hold some gold as a protective hedge element.

TJH isn't 100% in stocks, he owns a home, has pension income streams, where with his 'rent' all paid and liability matched along with pension income leaves stocks paying for additional niceties (or so I guess). For another who had no pension and is renting all-stock wouldn't be appropriate.

-

1nvest

- Lemon Quarter

- Posts: 4601

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 734 times

- Been thanked: 1458 times

Re: Bonds

To add to that chart

you may see 'W' type motions in outcomes. Being 30 year outcome measures you need at least 30 year of history, however I would predict that the next low occurred in/around 2003 i.e. at the dot-com bubble burst lows, and/or 2008 financial crisis lows. For those starting at those lows their 30 year outcome is more inclined to be towards the upper end. Fundamentally a broad range of history where 4% SWR was around the lower end, upper cases of 10% SWR or more, average cases in the 6% to 8% type of region.

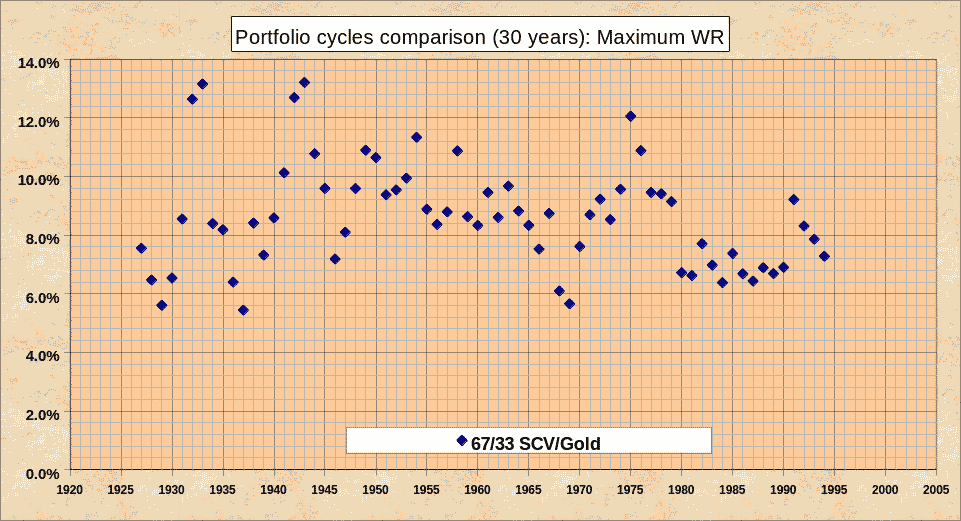

In this next chart we swap out a broad major stock index for small cap value stocks, that historically tended to be more volatile, but blend that with some gold, so 67/33 SCV/gold

Whatever might drive stocks to halve could see the price of gold double, 67/33 stock/gold -> 33/67 stock/gold with no loss, and rebalancing has you back at 67/33 again, but where after stocks had halved you'd doubled up on the number of shares being held. And where historically rather than a lower end 4% SWR most cases supported a 6% SWR

SWR is where you initially draw a percentage of the total portfolio value at the start of the first year as that years spending/income, and then uplift that amount by inflation in subsequent years as the amount drawn as spending in subsequent years - so a regular/consistent inflation adjusted income.

Again US data

https://www.portfoliovisualizer.com/bac ... CK1tcoWO0j

Note that in 67/33 SCV/gold and a 6% SWR Monte-Carlo indicates >91% success rate and in the 50th percentile case still ended with over 3.8 times more that the start date portfolio value in inflation adjusted terms

https://www.portfoliovisualizer.com/mon ... WLz8L8Rgs8

Avoiding starting retirement at extremes, such as after large/fast (exceptional) gains in stocks, or better still starting at lows - after stocks had been hit hard, is more inclined to further reduce the risks.

you may see 'W' type motions in outcomes. Being 30 year outcome measures you need at least 30 year of history, however I would predict that the next low occurred in/around 2003 i.e. at the dot-com bubble burst lows, and/or 2008 financial crisis lows. For those starting at those lows their 30 year outcome is more inclined to be towards the upper end. Fundamentally a broad range of history where 4% SWR was around the lower end, upper cases of 10% SWR or more, average cases in the 6% to 8% type of region.

In this next chart we swap out a broad major stock index for small cap value stocks, that historically tended to be more volatile, but blend that with some gold, so 67/33 SCV/gold

Whatever might drive stocks to halve could see the price of gold double, 67/33 stock/gold -> 33/67 stock/gold with no loss, and rebalancing has you back at 67/33 again, but where after stocks had halved you'd doubled up on the number of shares being held. And where historically rather than a lower end 4% SWR most cases supported a 6% SWR

SWR is where you initially draw a percentage of the total portfolio value at the start of the first year as that years spending/income, and then uplift that amount by inflation in subsequent years as the amount drawn as spending in subsequent years - so a regular/consistent inflation adjusted income.

Again US data

https://www.portfoliovisualizer.com/bac ... CK1tcoWO0j

Note that in 67/33 SCV/gold and a 6% SWR Monte-Carlo indicates >91% success rate and in the 50th percentile case still ended with over 3.8 times more that the start date portfolio value in inflation adjusted terms

https://www.portfoliovisualizer.com/mon ... WLz8L8Rgs8

Avoiding starting retirement at extremes, such as after large/fast (exceptional) gains in stocks, or better still starting at lows - after stocks had been hit hard, is more inclined to further reduce the risks.

Re: Bonds

tjh290633 wrote:Gpop321 wrote:So I've read Tim Hale's book - great info!

One takeaway was: invest your age in bonds, and the rest in equities.

Forget it. That theory has been discredited for years. There are short periods when fixed interest beat equities, but over long periods equities win hands down. I'm approaching 91 and am 100% in equities. I would be much poorer if I had followed that rule. How old are you, anyway?

TJH

Thanks for the advice.

I'm the big 4-6!

-

vand

- Lemon Slice

- Posts: 824

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 191 times

- Been thanked: 385 times

Re: Bonds

The idea behind increasing bond allocation as you get older, while much maligned in recent years, needs to be put into context...

It's not unreasonable to want to protect yourself from a market crash as you move closer to retirement, as you may not have enough working years left for the portfolio to recover before you need to live off it, and bonds, at least historically, tended to fulfill this "de-risking" role pretty well. That didn't work out in 2022 which is where a lot of the current criticism of the line of thinking comes in... the problems with bonds coming into 2022 were obvious to see in hindsight, but you have to go on what is in the data up to that point, right?

Also, traditionally, people would more often buy an annuity with their pension pot rather than go into drawdown, and as annuity rates are hugely correlated with bonds/interest rates, it made sense that you would want to somewhat harmonize your portfolio to the annuity market as you got closer to retirement, which increasing the bond allocation served.

What has become more popular in recent years is the "bond tent" - yes, you want to derisk as you head into decumulation, and for a few years after that, but then - provided that the market doesn't crash and your portfolio isn't in the danger zone - you want to increase back up your equity allocation to take advantage of the higher growth potentially available by higher equity allocations.

It's not unreasonable to want to protect yourself from a market crash as you move closer to retirement, as you may not have enough working years left for the portfolio to recover before you need to live off it, and bonds, at least historically, tended to fulfill this "de-risking" role pretty well. That didn't work out in 2022 which is where a lot of the current criticism of the line of thinking comes in... the problems with bonds coming into 2022 were obvious to see in hindsight, but you have to go on what is in the data up to that point, right?

Also, traditionally, people would more often buy an annuity with their pension pot rather than go into drawdown, and as annuity rates are hugely correlated with bonds/interest rates, it made sense that you would want to somewhat harmonize your portfolio to the annuity market as you got closer to retirement, which increasing the bond allocation served.

What has become more popular in recent years is the "bond tent" - yes, you want to derisk as you head into decumulation, and for a few years after that, but then - provided that the market doesn't crash and your portfolio isn't in the danger zone - you want to increase back up your equity allocation to take advantage of the higher growth potentially available by higher equity allocations.

Last edited by vand on May 20th, 2024, 12:19 pm, edited 1 time in total.

-

GeoffF100

- Lemon Quarter

- Posts: 4831

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 181 times

- Been thanked: 1391 times

Re: Bonds

Gpop321 wrote:So I've read Tim Hale's book - great info!

One takeaway was: invest your age in bonds, and the rest in equities.

Now I've got a few index tracker fund candidates to cover the equity side of things, but I'm not sure where I should be looking to cover the bonds side of things.

I saw a few bonds products on Vanguard, though they look quite bumpy and unappealing. Is there a "go to" place to buy bonds to complete my portfolio? Any recommendations?

Cheers in advance

G

Investing your age is bonds is a widely accepted rule of thumb, but the people who post on forums like this are typically blind to equity risk and put all their money in equities. What is bumpy and unappealing about Vanguard's bond funds? They are market leaders. VAGP and its accumulating version VAGS are popular choices.

Perhaps you should take a step back, and consider your objectives tax position etc. Have you consulted a financial adviser? Given your level of knowledge, you might be better off buying a Vanguard Target Retirement Fund, or perhaps Vanguard LifeStrategy.

-

tjh290633

- Lemon Half

- Posts: 8394

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 926 times

- Been thanked: 4224 times

Re: Bonds

Some of this needs to be put into context. Back in the time when you had no option but to buy an annuity, the logic was that moving into bonds as retirement neared protected you from a sudden market crash just when you wanted to buy the annuity. 1974 was the classic example, when the market fell like a stone. Bear in mind that gilts at that time had coupons in the teens. I bought my mother-in-law some with yields of about 15%, having coupons of about 13% and being quoted below par.

If you do go in for bonds, you can consider fixed interest and index linked varieties. The interest on fixed interest does just that. It stays fixed. If you buy below par you get some capital gains, which shows up in the yield to maturity. Indexed linked, on the other hand, will have its maturity value linked to inflation, as is the interest. However the interest rate is usually derisory.

You may find it better to hold gilts directly, rather than via a fund, as funds are often opaque about how they manage their holdings. If you want US Treasury bonds, a fund may be better.

The real change came about when annuity purchase was no longer compulsory. Now people could build up their own fund in a SIPP or an ISA and live off the income from dividends. The advantage of equities is that the dividends tend to rise with time. Some of the well known investment trusts have records of over 50 years of dividend increases. The yield can vary with ITs, but careful choice can give you 4% or more, with the prospect of at least keeping pace with inflation. 2008-9 saw a lot of dividends cut or reduced, my own income falling by about 50%, but it recovered in a few years. This emphasises the need for a reserve fund to cover such eventualities. If your income exceeds your needs, the surplus can be used to build a cash reserve or to reinvest to enhance dividends income. Many ITs used their income reserve to avoid having to cut their dividends at that time.

Some will argue that this demonstrates the value of bonds at such a time. It all depends when you started.

TJH

If you do go in for bonds, you can consider fixed interest and index linked varieties. The interest on fixed interest does just that. It stays fixed. If you buy below par you get some capital gains, which shows up in the yield to maturity. Indexed linked, on the other hand, will have its maturity value linked to inflation, as is the interest. However the interest rate is usually derisory.

You may find it better to hold gilts directly, rather than via a fund, as funds are often opaque about how they manage their holdings. If you want US Treasury bonds, a fund may be better.

The real change came about when annuity purchase was no longer compulsory. Now people could build up their own fund in a SIPP or an ISA and live off the income from dividends. The advantage of equities is that the dividends tend to rise with time. Some of the well known investment trusts have records of over 50 years of dividend increases. The yield can vary with ITs, but careful choice can give you 4% or more, with the prospect of at least keeping pace with inflation. 2008-9 saw a lot of dividends cut or reduced, my own income falling by about 50%, but it recovered in a few years. This emphasises the need for a reserve fund to cover such eventualities. If your income exceeds your needs, the surplus can be used to build a cash reserve or to reinvest to enhance dividends income. Many ITs used their income reserve to avoid having to cut their dividends at that time.

Some will argue that this demonstrates the value of bonds at such a time. It all depends when you started.

TJH

Re: Bonds

GeoffF100 wrote:Gpop321 wrote:So I've read Tim Hale's book - great info!

One takeaway was: invest your age in bonds, and the rest in equities.

Now I've got a few index tracker fund candidates to cover the equity side of things, but I'm not sure where I should be looking to cover the bonds side of things.

I saw a few bonds products on Vanguard, though they look quite bumpy and unappealing. Is there a "go to" place to buy bonds to complete my portfolio? Any recommendations?

Cheers in advance

G

Investing your age is bonds is a widely accepted rule of thumb, but the people who post on forums like this are typically blind to equity risk and put all their money in equities. What is bumpy and unappealing about Vanguard's bond funds? They are market leaders. VAGP and its accumulating version VAGS are popular choices.

Perhaps you should take a step back, and consider your objectives tax position etc. Have you consulted a financial adviser? Given your level of knowledge, you might be better off buying a Vanguard Target Retirement Fund, or perhaps Vanguard LifeStrategy.

Thanks for the reply. The Vanguard bonds returns record looked quite low in positive years (3-4%) and there were an equal number of negative years. That wasn't what I was expecting. I thought bonds would deliver lower returns and have a safe majority of positive years. Not blaming Vanguard for that, more my own naivete!

I'm currently on the 'step back'. I've been with a financial adviser for nearly 10 years, but I'm looking to reduce my costs by going passive (another argument sold strongly to me by Tim Hale). I have a pretty simple objective: to double my money within 10 years. Achieving that meets my retirement needs, and if I can achieve it with a balance of risky equity and safer bonds, all the better.

I'll check out the two VG products you mention, thank you.

-

Newroad

- Lemon Quarter

- Posts: 1133

- Joined: November 23rd, 2019, 4:59 pm

- Has thanked: 17 times

- Been thanked: 354 times

Re: Bonds

Hi GPop321.

I subscribe to a more nuanced view on this.

Allegedly, there is not much point going above about 80%* equities/20% bonds - taking account opportunities to rebalance after falls, you get statistically get the same return but with more volatility (risk).

Similarly, the lowest volatility (risk) portfolio is allegedly about 50%* equities/50% bonds.

What to do with this information, if accurate? That's a very personal and situationally dependent question.

My solution is pro-rate by age. 80% equities at birth and 50% at age 100 (in the unlikely event I make it), i.e. drop the equity holding by 0.3% each year. This means everyone in my family has a different target equity allocation (which I maintain by spreadsheet). My solution may not suit you, but at least, I hope it will help enable you to think about the problem with an additional lens.

Regards, Newroad

* the actual figures are around 78% and 48% respectively IIRC, based on Carver's work in the book Smart Portfolios, but 80% and 50% are near enough and nice round numbers

I subscribe to a more nuanced view on this.

Allegedly, there is not much point going above about 80%* equities/20% bonds - taking account opportunities to rebalance after falls, you get statistically get the same return but with more volatility (risk).

Similarly, the lowest volatility (risk) portfolio is allegedly about 50%* equities/50% bonds.

What to do with this information, if accurate? That's a very personal and situationally dependent question.

My solution is pro-rate by age. 80% equities at birth and 50% at age 100 (in the unlikely event I make it), i.e. drop the equity holding by 0.3% each year. This means everyone in my family has a different target equity allocation (which I maintain by spreadsheet). My solution may not suit you, but at least, I hope it will help enable you to think about the problem with an additional lens.

Regards, Newroad

* the actual figures are around 78% and 48% respectively IIRC, based on Carver's work in the book Smart Portfolios, but 80% and 50% are near enough and nice round numbers

-

LooseCannon101

- Lemon Slice

- Posts: 257

- Joined: November 5th, 2016, 2:12 pm

- Has thanked: 317 times

- Been thanked: 152 times

Re: Bonds

tjh290633 wrote:Some of this needs to be put into context. Back in the time when you had no option but to buy an annuity, the logic was that moving into bonds as retirement neared protected you from a sudden market crash just when you wanted to buy the annuity. 1974 was the classic example, when the market fell like a stone. Bear in mind that gilts at that time had coupons in the teens. I bought my mother-in-law some with yields of about 15%, having coupons of about 13% and being quoted below par.

If you do go in for bonds, you can consider fixed interest and index linked varieties. The interest on fixed interest does just that. It stays fixed. If you buy below par you get some capital gains, which shows up in the yield to maturity. Indexed linked, on the other hand, will have its maturity value linked to inflation, as is the interest. However the interest rate is usually derisory.

You may find it better to hold gilts directly, rather than via a fund, as funds are often opaque about how they manage their holdings. If you want US Treasury bonds, a fund may be better.

The real change came about when annuity purchase was no longer compulsory. Now people could build up their own fund in a SIPP or an ISA and live off the income from dividends. The advantage of equities is that the dividends tend to rise with time. Some of the well known investment trusts have records of over 50 years of dividend increases. The yield can vary with ITs, but careful choice can give you 4% or more, with the prospect of at least keeping pace with inflation. 2008-9 saw a lot of dividends cut or reduced, my own income falling by about 50%, but it recovered in a few years. This emphasises the need for a reserve fund to cover such eventualities. If your income exceeds your needs, the surplus can be used to build a cash reserve or to reinvest to enhance dividends income. Many ITs used their income reserve to avoid having to cut their dividends at that time.

Some will argue that this demonstrates the value of bonds at such a time. It all depends when you started.

TJH

I totally agree with TJH in that equities have beaten bonds over the long term e.g. 10+ years.

I only invest in F&C Investment Trust (FCIT) - a well known investment trust, which has trebled in value over the past 10 years, assuming dividends were re-invested. A bond fund would probably have increased by 50% over the past 10 years, if you were lucky. Compound growth over many years will increase this differential. FCIT has increased it's dividend every year for the past 50 years.

The rule of 72 is very useful when considering how long it would take an investment to double. Average annual return (%) multiplied by number of years equals 72. For example, it would take 8 years at 9% per year for an investment to double.

I am 99% in FCIT (GIA and ISA) and only 1% in cash, and intend to keep at about this ratio for the foreseeable future.

-

Newroad

- Lemon Quarter

- Posts: 1133

- Joined: November 23rd, 2019, 4:59 pm

- Has thanked: 17 times

- Been thanked: 354 times

Re: Bonds

Hi LooseCannon101.

For more than a decade, I did the same with my children's JISA's - 100% FCIT. They did very well.

However, it is a useful thought process to consider what if you had been 80% FCIT and 20% (say) VAGP? Take a look at the effect this would have had during the 2020 Feb/Mar 2020 crash. Looking at weekly data, FCIT peaked around 788p before dropping as low as 472p (if I've read my charts correctly). VAGP only dropped from £26.59 to £24.52 before rising again (whilst, as it happens, FCIT was still dropping for a bit).

So, you might not have caught all that upside from the rebalance, depending on how/when you did it, but even if you caught most or even a fair bit of it, you would have been well placed.

Same again for the GFC. Looking at monthly data this time, FCI peaked around 328p and bottomed around 192p (there is a seemingly aberrant reading of 118p the following month, which I'm assuming was an anomaly).

It's considerations like the above which make the difference in, say, a 100-0 vs 80-20 view.

Regards, Newroad

PS I'm reading some old charts - so my apology for any inadvertent errors above.

For more than a decade, I did the same with my children's JISA's - 100% FCIT. They did very well.

However, it is a useful thought process to consider what if you had been 80% FCIT and 20% (say) VAGP? Take a look at the effect this would have had during the 2020 Feb/Mar 2020 crash. Looking at weekly data, FCIT peaked around 788p before dropping as low as 472p (if I've read my charts correctly). VAGP only dropped from £26.59 to £24.52 before rising again (whilst, as it happens, FCIT was still dropping for a bit).

So, you might not have caught all that upside from the rebalance, depending on how/when you did it, but even if you caught most or even a fair bit of it, you would have been well placed.

Same again for the GFC. Looking at monthly data this time, FCI peaked around 328p and bottomed around 192p (there is a seemingly aberrant reading of 118p the following month, which I'm assuming was an anomaly).

It's considerations like the above which make the difference in, say, a 100-0 vs 80-20 view.

Regards, Newroad

PS I'm reading some old charts - so my apology for any inadvertent errors above.

Last edited by Newroad on May 20th, 2024, 5:51 pm, edited 2 times in total.

-

GeoffF100

- Lemon Quarter

- Posts: 4831

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 181 times

- Been thanked: 1391 times

Re: Bonds

Gpop321 wrote:GeoffF100 wrote:Investing your age is bonds is a widely accepted rule of thumb, but the people who post on forums like this are typically blind to equity risk and put all their money in equities. What is bumpy and unappealing about Vanguard's bond funds? They are market leaders. VAGP and its accumulating version VAGS are popular choices.

Perhaps you should take a step back, and consider your objectives tax position etc. Have you consulted a financial adviser? Given your level of knowledge, you might be better off buying a Vanguard Target Retirement Fund, or perhaps Vanguard LifeStrategy.

Thanks for the reply. The Vanguard bonds returns record looked quite low in positive years (3-4%) and there were an equal number of negative years. That wasn't what I was expecting. I thought bonds would deliver lower returns and have a safe majority of positive years. Not blaming Vanguard for that, more my own naivete!

I'm currently on the 'step back'. I've been with a financial adviser for nearly 10 years, but I'm looking to reduce my costs by going passive (another argument sold strongly to me by Tim Hale). I have a pretty simple objective: to double my money within 10 years. Achieving that meets my retirement needs, and if I can achieve it with a balance of risky equity and safer bonds, all the better.

I'll check out the two VG products you mention, thank you.

We have just lived through the biggest bond market crash in history. That is not normal. Equity prices rose when interest rates fell and should fall back when they rise again. That has not happened. Equity valuations are now very high, particularly in the US. That is usually the harbinger of poor returns over the next ten years. Not many people alive remember the 1929 crash, and there has not been a really long lived crash in the UK or US markets since. There was one in Japan, and the returns in France and Germany have not been at all exciting.

If you have paid a IFA lots of dosh to assess your risk tolerance and capacity to absorb risk, and recommend a bond percentage, you could do worse than to follow that advice. It is illegal for us to offer you personal financial advice, and we could not reasonably do that anyway unless we knew your personal situation in great detail. Nonetheless, of course you can cut costs by DIY. IFAs sometimes recommend unnecessarily complicated portfolios to make it look as though they are doing something clever that you cannot replicate yourself. As I have said, one fund may do the job. After that, it is usually true that the fewer changes you make the better.

-

vand

- Lemon Slice

- Posts: 824

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 191 times

- Been thanked: 385 times

Re: Bonds

Just zooming back and bit, and I'd add that Asset Allocation should be the first thing you consider when building a portfolio. It's absolutely fundamental to engendering good (ideally perfect) investor behaviour. The difference between a "conservative portfolio" eg 100% stocks vs a very defense portfolio such permanent portfolio (25/25/25/25 stocks/long bonds/bills/gold) would be about 6-7% vs 3-4% per year real return over the long run. Of course that extra 3% compounds out to a lot over many years (and if you are not in drawdown mode), but - and here is the key thing I want to emphasize - only if you have perfect investor behaviour. If not, you are far better off investing in less risky portfolio with perfect investor behaviour that you are into an agressive portfolio where can't manage such behaviour.

The data backs this up - just look at fund flows in ETFs where there is always a huge rush of money in at the top, and then people desert it like rats when the price has collapsed. Dalbar has done good research to suggest that most people who invest in the stock market only end up capturing about half to 2/3rds of the returns of the stock market - that pretty much wipes out your risk premium over a less aggressive portfolio, and you also sucked up all the risk.

https://www.dalbar.com/Portals/dalbar/C ... 024_PR.pdf

What is poor investor behaviour? Chasing performance, switching stratetgies, panic selling, FOMO buying, trying to time the market etc.

Fees are important, too. If you pay too much for the highest expected return you fall back into the pack of other mixes except you have sucked up all the risk, too.

Absolute guarantee of mediocre performance is to be a stock only investor, ignore fees, and have imperfect investor behaviour due to poor temperament.

The data backs this up - just look at fund flows in ETFs where there is always a huge rush of money in at the top, and then people desert it like rats when the price has collapsed. Dalbar has done good research to suggest that most people who invest in the stock market only end up capturing about half to 2/3rds of the returns of the stock market - that pretty much wipes out your risk premium over a less aggressive portfolio, and you also sucked up all the risk.

https://www.dalbar.com/Portals/dalbar/C ... 024_PR.pdf

What is poor investor behaviour? Chasing performance, switching stratetgies, panic selling, FOMO buying, trying to time the market etc.

Fees are important, too. If you pay too much for the highest expected return you fall back into the pack of other mixes except you have sucked up all the risk, too.

Absolute guarantee of mediocre performance is to be a stock only investor, ignore fees, and have imperfect investor behaviour due to poor temperament.

Re: Bonds

vand wrote:Just zooming back and bit, and I'd add that Asset Allocation should be the first thing you consider when building a portfolio. It's absolutely fundamental to engendering good (ideally perfect) investor behaviour. The difference between a "conservative portfolio" eg 100% stocks vs a very defense portfolio such permanent portfolio (25/25/25/25 stocks/long bonds/bills/gold) would be about 6-7% vs 3-4% per year real return over the long run. Of course that extra 3% compounds out to a lot over many years (and if you are not in drawdown mode), but - and here is the key thing I want to emphasize - only if you have perfect investor behaviour. If not, you are far better off investing in less risky portfolio with perfect investor behaviour that you are into an agressive portfolio where can't manage such behaviour.

The data backs this up - just look at fund flows in ETFs where there is always a huge rush of money in at the top, and then people desert it like rats when the price has collapsed. Dalbar has done good research to suggest that most people who invest in the stock market only end up capturing about half to 2/3rds of the returns of the stock market - that pretty much wipes out your risk premium over a less aggressive portfolio, and you also sucked up all the risk.

https://www.dalbar.com/Portals/dalbar/C ... 024_PR.pdf

What is poor investor behaviour? Chasing performance, switching stratetgies, panic selling, FOMO buying, trying to time the market etc.

Fees are important, too. If you pay too much for the highest expected return you fall back into the pack of other mixes except you have sucked up all the risk, too.

Absolute guarantee of mediocre performance is to be a stock only investor, ignore fees, and have imperfect investor behaviour due to poor temperament.

The last line is spot on. I'm aiming for passive 'buy and hold' and 'lose the fewest points'.

Tim Hale has sold me on the folly of destroying your own wealth by chasing the latest hot fund or by paying high fees.

I'm currently invested in the Fidelity Index World tracker*, which is mostly equities, but also has a tiny allocation of bonds/less risky elements:

Cash: 3.65%

Property: 2.26%

International Bonds: 0.3%

I'm guessing this is that tracker's approach to balance/safeguard in case of equity downturn? It is a 6 out of 7 risk tracker, so that would probably explain the <10% defensive allocation. I feel perhaps this tracker plus a separate bonds-only product might be for me. I'm just not clear on what overall bonds percentage would be ideal. Some good suggestions on here: 80/20, Age in bonds/Rest in Equities etc.

*Plus, it has these rather vague allocations:

Alternative Trading Strategies: 1.04%

Other(?!?): 8.44%

-

tjh290633

- Lemon Half

- Posts: 8394

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 926 times

- Been thanked: 4224 times

Re: Bonds

vand wrote:What is poor investor behaviour? Chasing performance, switching stratetgies, panic selling, FOMO buying, trying to time the market etc.

Fees are important, too. If you pay too much for the highest expected return you fall back into the pack of other mixes except you have sucked up all the risk, too.

Absolute guarantee of mediocre performance is to be a stock only investor, ignore fees, and have imperfect investor behaviour due to poor temperament.

I think you could have included chasing the latest fashion in poor investor behaviour. We saw the effect of that in the dot-com crash at the turn of the century. If you stuck to the good old reliable shares, you suffered far less. Regarding fees, the answer is to be your own portfolio manager by avoiding collective investments in whatever form.

The highest expected return can come from high yield, capital gain or a combination of both. There is no way to be sure which will give the desired result, but if the objective is income in retirement, then the emphasis should be on yield. Dividends vary much less than share prices and this reduces the need to draw on capital to provide income. At a time of severe market fall, this can be disastrous and such events support the need for a cash reserve. Reinvestment of surplus income in higher yielding shares is the best way to boost income.

Practical experience has shown that being a prudent investor in shares can be far superior to investing in tracker funds. It is not just occasional outperformance, but getting ahead and staying ahead over long periods.

TJH

-

Newroad

- Lemon Quarter

- Posts: 1133

- Joined: November 23rd, 2019, 4:59 pm

- Has thanked: 17 times

- Been thanked: 354 times

Re: Bonds

Thanks, GPop321.

That's the one I suspected you meant, but I couldn't reconcile its asset allocation with what you describe above.

From here: https://www.fidelity.co.uk/factsheet-data/factsheet/GB00BJS8SJ34-fidelity-index-world-fund-p-acc/portfolio

it appears to be

with a 0.01% rounding error.

What is the source of your alternate breakdown?

Regards, Newroad

That's the one I suspected you meant, but I couldn't reconcile its asset allocation with what you describe above.

From here: https://www.fidelity.co.uk/factsheet-data/factsheet/GB00BJS8SJ34-fidelity-index-world-fund-p-acc/portfolio

it appears to be

- 97.31% equities

2.53% cash

0.10% bonds

0.05% other

with a 0.01% rounding error.

What is the source of your alternate breakdown?

Regards, Newroad

Who is online

Users browsing this forum: No registered users and 5 guests