Page 1 of 1

Dump cash ISA?

Posted: May 6th, 2020, 8:49 pm

by BellaHubby

I've got around £100k in a cash ISA which will be paying a derisory 0.05% interest. Definitely needs to move.

Although I can find a better rate by going to a non-mainstream provider, I don't really want to overcomplicate my finances. I (well, I and my wife) already have more than enough different bank and stockbroking accounts. I'm getting on in years and don't want to overcomplicate things for my wife when I become transformed to a cloud of smoke (no kids to help out), so I thought I'd transfer it to National Savings, where we already have an account.

But.... National Savings don't allow transfer in to an ISA.

So, how about I just forget the ISA aspect and transfer to a National Savings Income Bond? 1.15% gross variable, so taxable of course, but far better than 0.05% and not too far below the best rates. I'm not too fussed about getting the best rate, more concerned about minimising complexity.

OK, there's a risk that tax rates might go up for the interest, but I guess there's also a risk that ISAs may become less sheltered in the future.

Simply put, for now or the foreseeable future, is there any major benefit in keeping a cash ISA?

BH

Re: Dump cash ISA?

Posted: May 6th, 2020, 10:22 pm

by Redmires

Have you considered Premium Bonds ? You could buy £50k each for you and your wife. A recent prize rate reduction has been postponed so they are still pegged at 1.4% (on average). You're money is 100% safe and you are not locked in, so can be moved if and when interest rates improve (probably not in my life time). I binned my cash ISA's many moons ago as fixed interest rates were preferable to ISA's, even after tax is taken into consideration. We have most of our cash in 3 year National Savings bonds at 2.17% (AER). This comes to end in December so will face the dilemma of finding a new home for it. There's a thread on this very board on Premium Bonds and you will see that most people on max holdings do get near to the prize rate. My wife won £10k last year which certainly bumped up our averages.

Re: Dump cash ISA?

Posted: May 6th, 2020, 11:24 pm

by XFool

Redmires wrote:Have you considered Premium Bonds ? You could buy £50k each for you and your wife. A recent prize rate reduction has been postponed so they are still pegged at 1.4% (on average).

I was going to suggest Premium Bonds as well. One small point though - that 1.4% is often given in the media, it is actually the Bond Fund rate, but a holder cannot reasonably

expect that return, The yearly expected return itself would depend on how many bonds you hold, for the maximum holding of £50,000 I think your expected yearly return would be 1.2% for comparative purposes, though like an ISA it is tax free and does not contribute to the Personal Savings limit.

Re: Dump cash ISA?

Posted: May 6th, 2020, 11:43 pm

by BellaHubby

Thanks for the thoughts on Premium Bonds but we're already max'd out, plus a bunch of Guaranteed Growth Bonds and whatever.

Personally I'd prefer to drip it into ITs, but wife is rather more risk averse and prefers to keep current cash as cash

BH

Re: Dump cash ISA?

Posted: May 6th, 2020, 11:46 pm

by Alaric

BellaHubby wrote:Simply put, for now or the foreseeable future, is there any major benefit in keeping a cash ISA?

It's possible to transfer a cash ISA to a Stocks and Shares ISA. The money transferred could be invested in funds which almost behaved like cash. I'm thinking short dated Gilt or Bond funds or ETFs.

Re: Dump cash ISA?

Posted: May 7th, 2020, 1:20 am

by PinkDalek

BellaHubby wrote:So, how about I just forget the ISA aspect and transfer to a National Savings Income Bond? 1.15% gross variable, ...

Be careful though, that rate was all set to be reduced to 0.70% BC (Before Coronavirus), as you may already be aware, before they relented.

Is there any reason you don't wish to split the pot into a mixture of one, two or even three years fixed rate, fixed term bank accounts? Also dividing the pot between different FCA Registered outfits, such that you are covered for any potential losses under the FSCS per registration limit of £85,000.

Plenty of comparison websites available, if you are interested, but the last time I looked, of the better known names, Investec were offering 1.60% 2 years fixed. Not massive, especially after any tax applicable, but better than 1.15% gross

variable.

I missed your latter mention of wishing to avoid complexity when I started this reply but I'll let my reply stand. The Investec route is not that complex, I helped someone with one application the other month, but we don't know your expertise in completing such online forms.

I also missed your

already have more than enough different bank and stockbroking accounts so I'm not doing well but are any of those bank accounts fixed term?

I'd better leave it there but at least someone has managed to address the question at the foot of the OP but not exactly in the terms you asked it!

Re: Dump cash ISA?

Posted: May 7th, 2020, 8:16 am

by Parky

BellaHubby wrote:I've got around £100k in a cash ISA which will be paying a derisory 0.05% interest. Definitely needs to move.

Simply put, for now or the foreseeable future, is there any major benefit in keeping a cash ISA?

BH

No, in my opinion.

I have dumped some National Savings Guaranteed Growth Bonds and reinvested in Investment Trusts in my ISA. If you already have the maximum amount of Premium Bonds, you should be well covered for accessible ready cash.

Re: Dump cash ISA?

Posted: May 7th, 2020, 10:15 am

by stevensfo

BellaHubby wrote:I've got around £100k in a cash ISA which will be paying a derisory 0.05% interest. Definitely needs to move.

Although I can find a better rate by going to a non-mainstream provider, I don't really want to overcomplicate my finances. I (well, I and my wife) already have more than enough different bank and stockbroking accounts. I'm getting on in years and don't want to overcomplicate things for my wife when I become transformed to a cloud of smoke (no kids to help out), so I thought I'd transfer it to National Savings, where we already have an account.

But.... National Savings don't allow transfer in to an ISA.

So, how about I just forget the ISA aspect and transfer to a National Savings Income Bond? 1.15% gross variable, so taxable of course, but far better than 0.05% and not too far below the best rates. I'm not too fussed about getting the best rate, more concerned about minimising complexity.

OK, there's a risk that tax rates might go up for the interest, but I guess there's also a risk that ISAs may become less sheltered in the future.

Simply put, for now or the foreseeable future, is there any major benefit in keeping a cash ISA?

BH

Last time I looked, Investec and Chartered were doing 1 year fixed at 1.25% via my Monzo account. I realise that I can get a slightly higher rate by going directly to the banks themselves, but it makes it so much easier this way. I assume that you know there is a £1000 allowance for interest from savings accounts, so a cash ISA isn't much use these days. Though if you're already at this stage (lucky you) then I agree with the others. Premium bonds probably the best way.

Or just keep a lot of cash in a safe. Or spend it?

Steve

Re: Dump cash ISA?

Posted: May 7th, 2020, 10:52 am

by xeny

BellaHubby wrote:I

Simply put, for now or the foreseeable future, is there any major benefit in keeping a cash ISA?

Have you got any investments not in an ISA wrapped account?

If so, and at the risk of grandmothers and eggs, you could use this to buy those assets inside a wrapper, and sell the unwrapped, thus not wasting the ISA sheltering.

Re: Dump cash ISA?

Posted: May 7th, 2020, 11:27 am

by dealtn

Alaric wrote:BellaHubby wrote:Simply put, for now or the foreseeable future, is there any major benefit in keeping a cash ISA?

It's possible to transfer a cash ISA to a Stocks and Shares ISA. The money transferred could be invested in funds which almost behaved like cash. I'm thinking short dated Gilt or Bond funds or ETFs.

Or just leave it as cash earning interest depending on the rate applicable.

Re: Dump cash ISA?

Posted: May 7th, 2020, 12:57 pm

by 1nvest

Transfer some/all of the cash ISA to a self select ISA and drop 20% into a US stock tracker, 20% into gold. 20% in the primary reserve currency (US$) invested in stock, 20% in global currency (gold), will better protect wealth if/when the Pound sinks (and/or inflation spikes). Alternatively just transfer 20% (into US stock) and buy physical gold (legal tender gold coins such as Sovereign's/Britannia's) with another 20%.

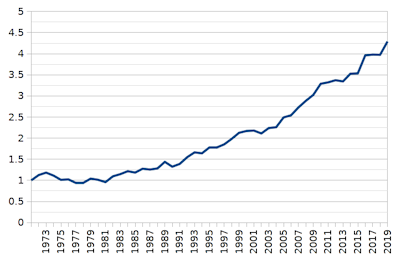

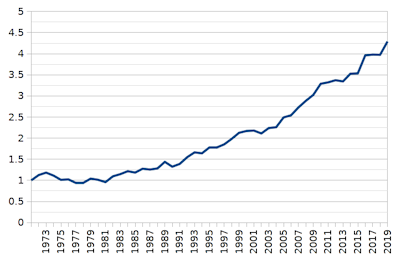

With the 60% in Building Society, 20% in US stock, 20% gold (yearly rebalanced) the since 1972 yearly % returns from that were respectively ...

21.1

16.3

12.0

13.6

16.4

2.8

9.1

29.3

12.1

5.9

20.6

10.3

10.9

2.8

11.7

2.2

7.3

18.7

0.5

11.7

14.9

9.8

1.0

11.3

3.0

6.3

8.9

9.0

3.3

1.8

-1.5

7.5

2.6

12.6

5.0

9.8

9.0

7.0

12.2

4.6

4.0

1.1

6.2

0.8

14.1

3.2

1.9

9.3

and compounded to around a 3% annualised real (after inflation) since 1972 (3.6% annualised real since both Jan 2000 and since Jan 2010).

This is US data for a similar portfolio

https://tinyurl.com/yc937tu6 - that provides a broad 'feel' - and that also yielded 3% annualised real.

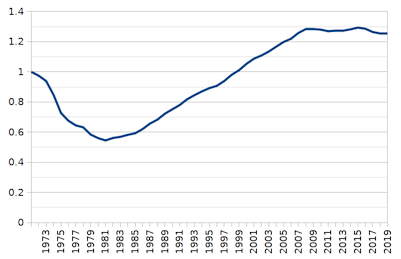

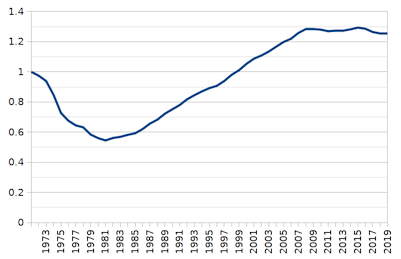

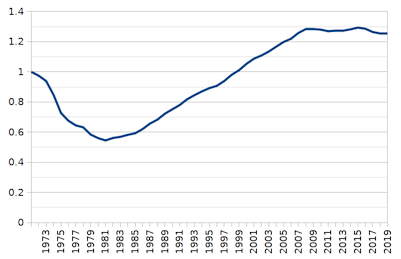

Gross cash (100% building society) rewards since 1972 after adjusting for inflation looked like ...

where the higher inflation of the 1970's wiped out nearly half of the value.

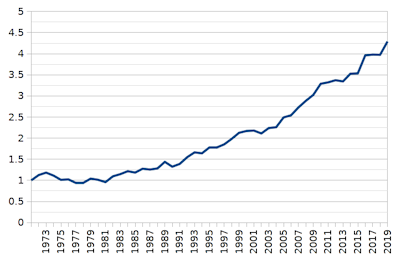

whilst in contrast the above looked like ...

and your wife still sees 60% of the cash in a 'cash' account, and maybe has 20% of physical gold in her hands, that might be comfortable enough to accept having 20% in a US stock index tracker. Whilst collectively being less risk than just 100% cash holdings in £'s alone.

Re: Dump cash ISA?

Posted: May 7th, 2020, 1:05 pm

by dealtn

1nvest wrote:Transfer some/all of the cash ISA to a self select ISA and drop 20% into a US stock tracker, 20% into gold. 20% in the primary reserve currency (US$) invested in stock, 20% in global currency (gold), will better protect wealth if/when the Pound sinks (and/or inflation spikes). Alternatively just transfer 20% (into US stock) and buy physical gold (legal tender gold coins such as Sovereign's/Britannia's) with another 20%.

With the 60% in Building Society, 20% in US stock, 20% gold (yearly rebalanced) the since 1972 yearly % returns from that were respectively ...

[long stream of numbers edited out by me, dspp]and compounded to around a 3% annualised real (after inflation) since 1972 (3.6% annualised real since both Jan 2000 and since Jan 2010).

This is US data for a similar portfolio

https://tinyurl.com/yc937tu6 - that provides a broad 'feel' - and that also yielded 3% annualised real.

Gross cash (100% building society) rewards since 1972 after adjusting for inflation looked like ...

where the higher inflation of the 1970's wiped out nearly half of the value.

whilst in contrast the above looked like ...

and your wife still sees 60% of the cash in a 'cash' account, and maybe has 20% of physical gold in her hands, that might be comfortable enough to accept having 20% in a US stock index tracker. Whilst collectively being less risk than just 100% cash holdings in £'s alone.

And what part of "I don't want to overcomplicate my finances..." are you failing to understand?

Re: Dump cash ISA?

Posted: May 7th, 2020, 1:20 pm

by kiloran

I'm in a rather similar position to you. I can't see any major benefit in Cash ISAs these days so moving out of the ISA to National Savings seems a credible idea.

--kiloran

Re: Dump cash ISA?

Posted: May 7th, 2020, 3:37 pm

by GrahamPlatt

Raisin (backed by ICICI) have a 95 day notice account offering 1.6% until the end of June, 1.4% thereafter.

Usual £85k protection limit. Have been tempted myself.

Re: Dump cash ISA?

Posted: May 7th, 2020, 4:37 pm

by jackdaww

i have kept out of these .

i have always thought that while you gain via the tax savings , you may lose that much and more by generally not getting a great interest rate .

and they were not very flexible , lockins etc .

Re: Dump cash ISA?

Posted: May 7th, 2020, 4:40 pm

by 1nvest

dealtn wrote:And what part of "I don't want to overcomplicate my finances..." are you failing to understand?

So something like 13 Britannia coins, 140 odd BRK-B shares, and a cash account of whatever kind - is complicated IYO. Tax return - no income from either the gold or stock, just the cash deposit interest to record/report, or not - if held inside ISA. For a heir, inheriting that and doing nothing (no rebalancing) would be fine. And when money was required to pay for a new roof/whatever, only then might they look to see what/where to spend down. Started in 1972 for instance, and if in 1980 looking to spend some on a new roof, then gold made up 65% of the overall 4 times larger total portfolio value (2x larger in inflation adjusted terms). Wouldn't be surprised if a roofer back then might even have done the job for cash in hand (a bunch of gold coins). Clearly Bella's hubby is capable of setting that up, and that leaves Bella with little concern for management of that should she outlive him.

Re: Dump cash ISA?

Posted: May 7th, 2020, 4:48 pm

by dealtn

1nvest wrote:dealtn wrote:And what part of "I don't want to overcomplicate my finances..." are you failing to understand?

So something like 13 Britannia coins, 140 odd BRK-B shares, and a cash account of whatever kind - is complicated IYO. Tax return - no income from either the gold or stock, just the cash deposit interest to record/report, or not - if held inside ISA. For a heir, inheriting that and doing nothing (no rebalancing) would be fine. And when money was required to pay for a new roof/whatever, only then might they look to see what/where to spend down. Started in 1972 for instance, and if in 1980 looking to spend some on a new roof, then gold made up 65% of the overall 4 times larger total portfolio value (2x larger in inflation adjusted terms). Wouldn't be surprised if a roofer back then might even have done the job for cash in hand (a bunch of gold coins). Clearly Bella's hubby is capable of setting that up, and that leaves Bella with little concern for management of that should she outlive him.

Not in my opinion if it was for me (although I still wouldn't do it).

Let's leave it to him (and her) to decide.

Re: Dump cash ISA?

Posted: May 7th, 2020, 6:17 pm

by fca2019

Yes sounds a good idea, simplify your holdings, and put in your wife's name in national savings.

Re: Dump cash ISA?

Posted: May 7th, 2020, 8:05 pm

by BellaHubby

Thank you all for your responses and ideas. Much appreciated.

Some of the ideas failed the complexity test (sorry). We already have more different providers and accounts than I would prefer. I have no problem with that but my wife is very much a technophobe and the number of accounts, though well documented by me, is a worry. I'm also gradually reducing the number of individual company shares in favour of ITs and ETFs, to minimise issues like rights issues and the like. Long gone are the days when all of the financial bits and pieces could be handled by a friendly chat with the local bank manager.

I've seen no compelling reason to stick with a cash ISA, so I think I'll dump it and move the cash to National Savings. Not ideal, and I know the interest will not overcome inflation, but emotionally I can't tolerate being ripped off with a rate of 0.05%

BH

Re: Dump cash ISA?

Posted: May 7th, 2020, 11:59 pm

by 1nvest

I know the interest will not overcome inflation

Depends upon what inflation rate you're comparing it against. Recently cash that earned nothing since the start of 2020 buys over 30% more FT All Share index shares now than it did at the start of the year. Compared to a typical grocery shop and (pure guess) its buying perhaps 10% less groceries than at the start of the year.