9M20 operating highlights

Trading

· Life PVNBP £32.1 billion (9M19: £32.4 billion)

· Value of new business (VNB)‡ 714 million (9M19: £828 million)

· General insurance net written premiums (NWP) £7.1 billion (9M19: £7.0 billion)

· Controllable costs‡ £2.8 billion (9M19: £3.0 billion)

Dividend

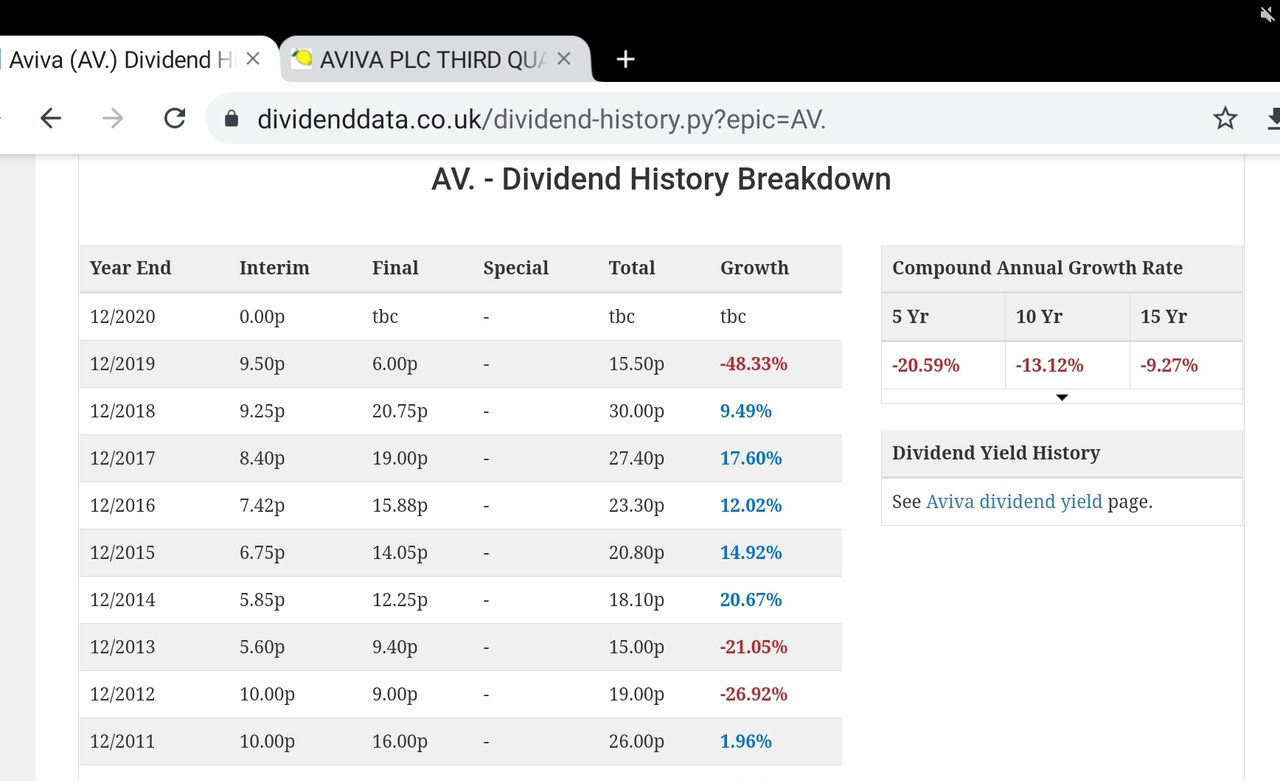

· 2020 interim dividend of 7.0 pence per share

· 2020 final dividend expected to be 14.0 pence per share, 21.0p total, subject to a board decision in March 2021

· No 2019 final dividend (2019 total dividend:15.5 pence per share)

Dividend policy and capital framework

· We are announcing a new dividend policy and capital framework that align with the Group's strategy to focus on the core markets of the UK, Ireland and Canada.

· As we focus the portfolio, we expect to build excess capital over time. We will deliver further value to shareholders by returning excess capital over a 180% Solvency II cover ratio# once our debt leverage target of <30% has been reached. We expect to exceed our original target of £1.5 billion debt deleveraging by 2022.

· The Board has declared a 7.0 pence per share interim dividend in respect of the 2020 financial year, which will be paid in January 2021. The Board expects to recommend a FY20 final dividend of 14.0 pence per share subject to a final decision to be taken in March 2021. This level of dividend is sustainable and resilient in times of stress, and is covered by the capital and cash generated from the core markets of the UK, Ireland and Canada. Future dividends per share are expected to grow by low to mid-single digits over time.

· A second interim dividend of 6 pence per share in respect of 2019 was paid in the third quarter of 2020. There will be no further payment in respect of FY2019.

https://www.investegate.co.uk/aviva-plc ... 00055450G/