Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

HYP1 is 21

Forum rules

Tight HYP discussions only please - OT please discuss in strategies

Tight HYP discussions only please - OT please discuss in strategies

-

pyad

- Lemon Slice

- Posts: 450

- Joined: November 4th, 2016, 10:17 am

- Been thanked: 1119 times

HYP1 is 21

Income hits a new record

Here is the data for the year ended 12 November 2021, the twenty first year of this non-tinker portfolio.

..........................................Income......................Value

Anglo American.......................1,207.18....................13,846

BA Tobacco............................1,849.41....................22,580

BT Group ...................................0.00.....................9,478

Currys......................................37.23.....................1,720

Glaxo.....................................281.60.....................5,601

InterCon Hotels............................0.00...................20,649

Land Sex.................................229.50.....................4,774

Lloyds......................................95.41.....................3,799

Mitch & But................................0.00......................1,657

M&G.......................................79.36......................2,561

Persimmon............................3,223.85....................28,793

Pearson..................................176.42......................5,679

RD Shell B...............................232.73......................6,498

Rio Tinto..............................3,581.41.....................23,629

United Utilities........................344.19.......................8,509

Total £...............................11,338.29....................159,773

Cost 75,000

Gain 84,773

.........................................+113.0%

FTSE100 at start 6,274.8

Now 7,347.9

Gain 1,073.1

...........................................+17.1%

HYP1 capital outperformance.......+ 81.9%

Income History

2001 3,451

2002 3,474

2003 3,197

2004 3,205

2005 3,546

2006 4,131

2007 4,452

2008 5,040

2009 3,187

2010 3,297

2011 3,843

2012 4,289

2013 5,828

2014 5,601

2015 6,093

2016 6,124

2017 7,327

2018 8,882

2019 10,557

2020 5,533

2021 11,338

Total to date £ 112,395

Corporate events in year

RSA taken over for cash which was reinvested in M&G. There were no dividends from RSA in the period and only one from M&G due to timing of the trades.

Anglo American demerged Thungela Resources at 1 for 10. This was far too small to be worth retaining so it was sold and the proceeds treated as income of Anglo.

Dixons Carphone changed name to Currys with no effect on the holding value or income.

Income

This is the purpose of HYPs and the £11,338 for 2021 was outstanding, easily a new record. It's up a massive 104.9% on last year's low figure and ahead by 7.4% on the £10,557 of the previous record year of 2019.

Total income to date is £112,395, averaging £5,352 per year which is 7.14% pa on the £75,000 cost.

Rio Tinto was the single largest income contributor with 31.6% of total income and second was Persimmon with 28.4%. All others were well below these two. At the other end, there were three zeros, BT Group, InterContinental Hotels, and Mitchells & Butlers.

This record year was helped by large payouts and specials from miners Rio Tinto and Anglo American whilst Persimmon paid out three large dividends as it caught up with a missed payment from last year.

Capital

This is irrelevant or very much secondary depending on your viewpoint.

The value of £159,773 is up 113.0% since the outset and continues to slaughter the market with the FTSE100 over the 21 years up only 17.1%. Thus HYP1 is outperforming it by 81.9%. These results do not include any reinvested dividends.

In the last twelve months the FTSE100 has risen 15.9% whilst HYP1 is up 7.5%, thus underperforming the index this year.

Persimmon remains the largest holding at 18.0% of portfolio value with Rio Tinto at 14.8% and BA Tobacco at 14.1%. The smallest holdings are Mitchells and Butlers at 1.0%, Currys at 1.1% with M&G at 1.6%.

Conclusions

As I said last year in order to pre-empt the inevitable critics following the severely reduced income:

"No I don't think the HYP strategy is dead"

And following the big improvement in income this year, which I predicted in last year's review, my quote is even more relevant.

Here is the data for the year ended 12 November 2021, the twenty first year of this non-tinker portfolio.

..........................................Income......................Value

Anglo American.......................1,207.18....................13,846

BA Tobacco............................1,849.41....................22,580

BT Group ...................................0.00.....................9,478

Currys......................................37.23.....................1,720

Glaxo.....................................281.60.....................5,601

InterCon Hotels............................0.00...................20,649

Land Sex.................................229.50.....................4,774

Lloyds......................................95.41.....................3,799

Mitch & But................................0.00......................1,657

M&G.......................................79.36......................2,561

Persimmon............................3,223.85....................28,793

Pearson..................................176.42......................5,679

RD Shell B...............................232.73......................6,498

Rio Tinto..............................3,581.41.....................23,629

United Utilities........................344.19.......................8,509

Total £...............................11,338.29....................159,773

Cost 75,000

Gain 84,773

.........................................+113.0%

FTSE100 at start 6,274.8

Now 7,347.9

Gain 1,073.1

...........................................+17.1%

HYP1 capital outperformance.......+ 81.9%

Income History

2001 3,451

2002 3,474

2003 3,197

2004 3,205

2005 3,546

2006 4,131

2007 4,452

2008 5,040

2009 3,187

2010 3,297

2011 3,843

2012 4,289

2013 5,828

2014 5,601

2015 6,093

2016 6,124

2017 7,327

2018 8,882

2019 10,557

2020 5,533

2021 11,338

Total to date £ 112,395

Corporate events in year

RSA taken over for cash which was reinvested in M&G. There were no dividends from RSA in the period and only one from M&G due to timing of the trades.

Anglo American demerged Thungela Resources at 1 for 10. This was far too small to be worth retaining so it was sold and the proceeds treated as income of Anglo.

Dixons Carphone changed name to Currys with no effect on the holding value or income.

Income

This is the purpose of HYPs and the £11,338 for 2021 was outstanding, easily a new record. It's up a massive 104.9% on last year's low figure and ahead by 7.4% on the £10,557 of the previous record year of 2019.

Total income to date is £112,395, averaging £5,352 per year which is 7.14% pa on the £75,000 cost.

Rio Tinto was the single largest income contributor with 31.6% of total income and second was Persimmon with 28.4%. All others were well below these two. At the other end, there were three zeros, BT Group, InterContinental Hotels, and Mitchells & Butlers.

This record year was helped by large payouts and specials from miners Rio Tinto and Anglo American whilst Persimmon paid out three large dividends as it caught up with a missed payment from last year.

Capital

This is irrelevant or very much secondary depending on your viewpoint.

The value of £159,773 is up 113.0% since the outset and continues to slaughter the market with the FTSE100 over the 21 years up only 17.1%. Thus HYP1 is outperforming it by 81.9%. These results do not include any reinvested dividends.

In the last twelve months the FTSE100 has risen 15.9% whilst HYP1 is up 7.5%, thus underperforming the index this year.

Persimmon remains the largest holding at 18.0% of portfolio value with Rio Tinto at 14.8% and BA Tobacco at 14.1%. The smallest holdings are Mitchells and Butlers at 1.0%, Currys at 1.1% with M&G at 1.6%.

Conclusions

As I said last year in order to pre-empt the inevitable critics following the severely reduced income:

"No I don't think the HYP strategy is dead"

And following the big improvement in income this year, which I predicted in last year's review, my quote is even more relevant.

-

Lootman

- The full Lemon

- Posts: 18938

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 636 times

- Been thanked: 6677 times

Re: HYP1 is 21

pyad wrote:Capital

This is irrelevant or very much secondary depending on your viewpoint.

The value of £159,773 is up 113.0% since the outset and continues to slaughter the market with the FTSE100 over the 21 years up only 17.1%. Thus HYP1 is outperforming it by 81.9%. These results do not include any reinvested dividends.

In the huge time period when HYP1 has barely doubled, the S&P 500 has quadrupled and thereby "slaughtered" HYP1. Getting your low level asset allocation right does you little good if your high-level decisions are flawed.

Yeah, capital doesn't matter, only the income. Except that HYP1 has routinely seen an income loss year-over-year.

Anyone following this strategy needs to open their eyes. Why restrict your investments to a mere 2% of global market cap? Especially at a time when the UK has dramatically under-performed the global markets?

Time to put this (deleted) to bed.

Moderator Message:

Epithet removed.

TJH

Epithet removed.

TJH

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: HYP1 is 21

Lootman is correct but at the same time, who on earth as has been said before would leave the income profile the way it is with 60% of the income coming from 2 shares and 87% from 4 shares out of a total of 15 shares?

Put it another way, the largest contributor to income produces 31% of the total.

This exercise proves nothing except that non tinkering is not an option in real life.

Dod

Put it another way, the largest contributor to income produces 31% of the total.

This exercise proves nothing except that non tinkering is not an option in real life.

Dod

-

moorfield

- Lemon Quarter

- Posts: 3552

- Joined: November 7th, 2016, 1:56 pm

- Has thanked: 1585 times

- Been thanked: 1416 times

Re: HYP1 is 21

pyad wrote:Income hits a new record

Remarkable. Looking at last year's income it seems to be Anglo American, Persimmon and Rio Tinto that have delivered the bumper income this year - but note 70% of overall. One cannot rely on those special dividends forever, though?

-

Lootman

- The full Lemon

- Posts: 18938

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 636 times

- Been thanked: 6677 times

Re: HYP1 is 21

moorfield wrote:pyad wrote:Income hits a new record

Looking at last year's income it seems to be Anglo American, Persimmon and Rio Tinto that have delivered the bumper income this year.

Looking at all the years' income figures I note that there were 8 years when the income level was below a previous year.

So for 38% of all the years, you get a pay cut.

-

moorfield

- Lemon Quarter

- Posts: 3552

- Joined: November 7th, 2016, 1:56 pm

- Has thanked: 1585 times

- Been thanked: 1416 times

Re: HYP1 is 21

Lootman wrote:moorfield wrote:pyad wrote:Income hits a new record

Looking at last year's income it seems to be Anglo American, Persimmon and Rio Tinto that have delivered the bumper income this year.

Looking at all the years' income figures I note that there were 8 years when the income level was below a previous year.

So for 38% of all the years, you get a pay cut.

I think that crops up regularly on these annual reports sooner or later. Certainly I recognize it to be a problem/flaw with doing nothing long term which is why I decided to track against an extrapolated income curve - if I'm below that, that is my cue to do something.

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: HYP1 is 21

Despite the ire and venom of the naysayers, it is well worth carrying on with this experiement. I shows that overall HYP does what it set out to do: deliver a high and rising income with some chance of capital growth, and by using a method which can be applied by a relative investment ignoramus. It has also ridden out two of the biggest financial crises in modern history by returning to dividend growth in a minimum of time.

It also shows that with some tweaks it may be improved - which is what most of us do in practice - for example withdrawing a "safe" amount of income and rfeinvesting the rest.

As I've often said, one can always find other investments with go faster stripes over particular time periods, and investments with a higher capital growth. But so what? That was never the issue.

Sour grapes do not undermine the conclusion that HYP still does what it said on the tin.

BTW, as to the criticism that the income is concentrated in a few companies: yes, that's why some of us have modified the method in practice to add extra safety. However, I can remember a few years ago we were alarmed that 25% of the income came from a single company, and the important point to note is that the three companies now in the spotlight do not include that company. In other words, the income profile varies over time, which is in itself a comfort which proves the method.

Arb.

It also shows that with some tweaks it may be improved - which is what most of us do in practice - for example withdrawing a "safe" amount of income and rfeinvesting the rest.

As I've often said, one can always find other investments with go faster stripes over particular time periods, and investments with a higher capital growth. But so what? That was never the issue.

Sour grapes do not undermine the conclusion that HYP still does what it said on the tin.

BTW, as to the criticism that the income is concentrated in a few companies: yes, that's why some of us have modified the method in practice to add extra safety. However, I can remember a few years ago we were alarmed that 25% of the income came from a single company, and the important point to note is that the three companies now in the spotlight do not include that company. In other words, the income profile varies over time, which is in itself a comfort which proves the method.

Arb.

-

monabri

- Lemon Half

- Posts: 8427

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: HYP1 is 21

I agree with Arb's views and would add that If one tots up the dividends received + current valuation, the total return ain't that bad.

Personally I'd have been addressing the imbalances in the portfolio but that wasn't the "object of the project".

Personally I'd have been addressing the imbalances in the portfolio but that wasn't the "object of the project".

-

Bouleversee

- Lemon Quarter

- Posts: 4654

- Joined: November 8th, 2016, 5:01 pm

- Has thanked: 1195 times

- Been thanked: 903 times

Re: HYP1 is 21

I have all of those apart from Curry's, M&G and Pearson, chosen without reference to HYP1 however. BT has been a basket case for years, largely held back by the size of its pension fund, but has bucked up a bit recently and there is a hint of a takeover and dividends are to be restored. InterCon and M&B have been hit hard by Covid but note the increase in value of IC nevertheless; I feel sure it will do well again if this wretched virus ever gets sufficiently under control to really open up the travel trade. I am quite happy to have the bulk of my dividends coming from such a few and don't feel inclined to sell any of them. More inclined to sell the laggards but I will give them a chance to recover for the time being. I have quite a number of other holdings as well and as equity investment is such a gamble, with vertical drops suddenly arising as a result of unforeseeable events, I can only hope that in the number will be some like the heroes shown here today. Long may they continue to do so and if any drop back, may others jump up to fill the hole. Isn't that the point of diversification?

One of these days I will get around to listing my real dogs. At least this HYP of Pyad's doesn't include any of those so far as I am aware.

I've held on to my Thungela shares so far and they have gone up a lot in the short time since demerged. Unfortunately, not a huge amount invested.

One of these days I will get around to listing my real dogs. At least this HYP of Pyad's doesn't include any of those so far as I am aware.

I've held on to my Thungela shares so far and they have gone up a lot in the short time since demerged. Unfortunately, not a huge amount invested.

-

vrdiver

- Lemon Quarter

- Posts: 2574

- Joined: November 5th, 2016, 2:22 am

- Has thanked: 552 times

- Been thanked: 1212 times

Re: HYP1 is 21

Pyad,

Thanks for the update. Some of us appreciate your reporting, warts 'n' all.

I'm sure that somebody will be along in a moment to say that if you'd invested it all in Bitcoin, blah blah blah, but then, whatever their strategy, it would have been more useful if they'd mentioned it 21 years ago, so as to compare against HYP1 without hindsight. It would have been even more useful if they'd actually posted yearly updates of their "better" investment strategy so we could learn from it, rather than just criticise others for actually bothering to propose, explain and demonstrate.

it takes all sorts.

VRD

Thanks for the update. Some of us appreciate your reporting, warts 'n' all.

I'm sure that somebody will be along in a moment to say that if you'd invested it all in Bitcoin, blah blah blah, but then, whatever their strategy, it would have been more useful if they'd mentioned it 21 years ago, so as to compare against HYP1 without hindsight. It would have been even more useful if they'd actually posted yearly updates of their "better" investment strategy so we could learn from it, rather than just criticise others for actually bothering to propose, explain and demonstrate.

it takes all sorts.

VRD

-

1nvest

- Lemon Quarter

- Posts: 4451

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 697 times

- Been thanked: 1367 times

Re: HYP1 is 21

Dod101 wrote:Lootman is correct but at the same time, who on earth as has been said before would leave the income profile the way it is with 60% of the income coming from 2 shares and 87% from 4 shares out of a total of 15 shares?

Put it another way, the largest contributor to income produces 31% of the total.

This exercise proves nothing except that non tinkering is not an option in real life.

Dod

IYO, and Lootman's (who perhaps would rather you pay others (Investment Trusts) perhaps 1%+/year to handle your soap for you).

Your money is like a bar of soap. The more you handle it, the less you’ll have. [Gene Fama]

In real life others opine differently, for instance US stock/fund LEXCX was formed in 1935 from 30 stocks, buy and hold, its original definition/classification pretty much bars any trading. As of recent its down to around 19 holdings and where 1 makes up near half the total portfolio. Comparing its total return performance with the S&P500 total return since 1985 and just noise of differences. Given its weighting relative to the others I guess near half of the income comes from the single largest weighted stock.

Jack/John Boggle's ultimate choice was to buy 50 of the largest S&P500 stocks, again buy and hold. But Vanguard can't profitably market/manage that.

Bogle recommends the ultimate in buy-and-hold investing: a completely static portfolio. He would buy the 50 largest companies in the S&P 500 and then never buy another.

-

1nvest

- Lemon Quarter

- Posts: 4451

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 697 times

- Been thanked: 1367 times

Re: HYP1 is 21

Lootman wrote:pyad wrote:Capital

This is irrelevant or very much secondary depending on your viewpoint.

The value of £159,773 is up 113.0% since the outset and continues to slaughter the market with the FTSE100 over the 21 years up only 17.1%. Thus HYP1 is outperforming it by 81.9%. These results do not include any reinvested dividends.

In the huge time period when HYP1 has barely doubled, the S&P 500 has quadrupled and thereby "slaughtered" HYP1. Getting your low level asset allocation right does you little good if your high-level decisions are flawed.

If you don't compare total accumulated returns your comparisons are flawed.

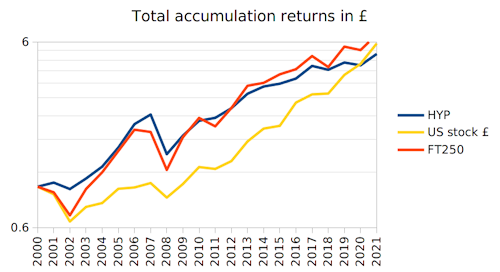

Figures I'm seeing for total return and HYP1 accumulation as of last year was ahead of TJH HYP accumulation. As of more recent it looks to also be ahead of World, lagging S&P500 total return from a UK perspective (£), is thrashing the FT100 as are most things, has given the FT250 a good run for its money and zig-zagged around it, but where the FT250 total return is in more recent years zigging ahead of HYP1 total return. Somewhat misaligned comparisons as I record calendar year data and I'm comparing to HYP1 Nov year data.

Nov 2001 and £/$ 1.42, more recently 1.35. Since Dec 2001 to end of October 2021 SPY total return in $ around 5.9 gain factor, adjusting to £ = 6.2 gain factor. So HYP 8.1% annualised versus S&P500 £ TR 9.1% annualised. BUT where for many years since 2001 HYP was considerably ahead of the S&P500 TR £

The flaw for me is that many hereabouts don't report total/accumulated returns. Terry does for his TJH HYP. For others, including HYP1 the data isn't easily available and without such you can't easily make total return based comparisons between different portfolios/styles.

The choice of a FTSE100 benchmark is also misplaced IMO. At times that can have 10% weighing in single stocks and sometimes several heavily weighted stocks in the same sector. Not a good choice of style for a benchmark as such concentration risk periodically presents and causes a pull-down. The S&P500 in contrast has never had a single stock at greater than 5% and is more broadly diversified, but equally at times its concentration risk pulldowns have presented. The FT250 is a better benchmark IMO, more diversified, rarely do single stock weights rise to 5%, and even includes around 50 Investment Trusts.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

-

1nvest

- Lemon Quarter

- Posts: 4451

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 697 times

- Been thanked: 1367 times

Re: HYP1 is 21

moorfield wrote:Lootman wrote:moorfield wrote:Looking at last year's income it seems to be Anglo American, Persimmon and Rio Tinto that have delivered the bumper income this year.

Looking at all the years' income figures I note that there were 8 years when the income level was below a previous year.

So for 38% of all the years, you get a pay cut.

I think that crops up regularly on these annual reports sooner or later. Certainly I recognize it to be a problem/flaw with doing nothing long term which is why I decided to track against an extrapolated income curve - if I'm below that, that is my cue to do something.

I very much suspect Terry will give me a slap (shhh! Maybe if I keep the image small enough he might not notice, or be kind enough to let it slip), but using a alternative income production method

and on a regular inflation adjusted uplifted income basis the HYP has served very well.

-

1nvest

- Lemon Quarter

- Posts: 4451

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 697 times

- Been thanked: 1367 times

Re: HYP1 is 21

Dod101 wrote:This is HYP. Income is all that matters right?

Capital : This is irrelevant or very much secondary depending on your viewpoint.

The original HYP introductory postings did indicate that capital should be considered as secondary, the primary being income, but where capital remained available in contrast to a annuity where it was spent/unavailable. As a alternative to a annuity you could perhaps (assuming cash paced inflation) drawdown that cash at 4%/year for 25 years to see a 70 year old through to 95 (likely outlive them). Very few I suspect of those inclined to adopt/use HYP would consider capital as irrelevant, and instead might ponder that it could be called upon in the case of a emergency, or to fund late life care, or to pass onto heirs ... whatever.

-

idpickering

- The full Lemon

- Posts: 11378

- Joined: November 4th, 2016, 5:04 pm

- Has thanked: 2476 times

- Been thanked: 5800 times

Re: HYP1 is 21

Thanks for the update Stephen.

I fully support you continuing to update us as you do, it’s certainly of interest hereabouts, despite the differing views of others, which they’re entitled to air of course.

Ian.

I fully support you continuing to update us as you do, it’s certainly of interest hereabouts, despite the differing views of others, which they’re entitled to air of course.

Ian.

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: HYP1 is 21

Those who compare HYP with pot building growth instruments are missing the point and no doubt causing some amusement amongst HYPers.

HYP was developed as a long term income provider, not a capital builder, furthermore with the scheme being devised for a John Doe, not very sophisticated investor. I would add to that, that it is inherent in the base scheme that the investor is one who is happy to see income arriving in dividends and not interested in the choice-making dictated by asset harvesting - this is an unsophisticated investor and prefers to be "hands off" Comparisons with instruments which do not have the same purpose are therefore irrelevant. The principal comparison, some would say, could be to an annuity or some similar investment which provides simplicity and ease of use. Indeed, HYP has often been described as an annuity substitute, although I'm not sure Pyad did originally.

Comparison with the FTSE 100 is natural. It comes about because pyad's suggestion was that we should invest in the largest UK companies. Comparison with its original brief is also valid: did the HYP plan succeed in what it set out to do? Comparison with SMT, for example, is a red herring. If I plan to climb Snowdon, what point would there be in saying I had failed because I hadn't climbed Ben Nevis? If I reach the top of Snowdon, it may be unambitious, but I have succeeded in what I wanted to do.

HYP1 is also a "special case" being a single dose, one off experiment. It is valuable in the sense that it is the only example which shows what would, what did, happen. Most people believe they have learnt from this and come up with schemes to modify slightly the original scheme to add safety features, or make them feel the result is better from their POV. Whether they are actually better, only the various individuals can test. Interestingly, I've never thought to compare my HYP with HYP1 - I have always tested mine against HYP's original "what it says on the tin" criteria - and until recently, it did fulfill that target and will do again.

HYP is an income provider, that's all. If you want to build a pot, go for ideas around high growth: not HYP.

Conversely, if you want to test HYP, do not do so against high growth instruments, but choose simple income providers. (For John Doe, that would at one time have included NS&I and Building Societies: I know many people who did just that in retirement and then tore their hair out. These alternatives have fallen by the wayside, unlike HYP).

Arb.

HYP was developed as a long term income provider, not a capital builder, furthermore with the scheme being devised for a John Doe, not very sophisticated investor. I would add to that, that it is inherent in the base scheme that the investor is one who is happy to see income arriving in dividends and not interested in the choice-making dictated by asset harvesting - this is an unsophisticated investor and prefers to be "hands off" Comparisons with instruments which do not have the same purpose are therefore irrelevant. The principal comparison, some would say, could be to an annuity or some similar investment which provides simplicity and ease of use. Indeed, HYP has often been described as an annuity substitute, although I'm not sure Pyad did originally.

Comparison with the FTSE 100 is natural. It comes about because pyad's suggestion was that we should invest in the largest UK companies. Comparison with its original brief is also valid: did the HYP plan succeed in what it set out to do? Comparison with SMT, for example, is a red herring. If I plan to climb Snowdon, what point would there be in saying I had failed because I hadn't climbed Ben Nevis? If I reach the top of Snowdon, it may be unambitious, but I have succeeded in what I wanted to do.

HYP1 is also a "special case" being a single dose, one off experiment. It is valuable in the sense that it is the only example which shows what would, what did, happen. Most people believe they have learnt from this and come up with schemes to modify slightly the original scheme to add safety features, or make them feel the result is better from their POV. Whether they are actually better, only the various individuals can test. Interestingly, I've never thought to compare my HYP with HYP1 - I have always tested mine against HYP's original "what it says on the tin" criteria - and until recently, it did fulfill that target and will do again.

HYP is an income provider, that's all. If you want to build a pot, go for ideas around high growth: not HYP.

Conversely, if you want to test HYP, do not do so against high growth instruments, but choose simple income providers. (For John Doe, that would at one time have included NS&I and Building Societies: I know many people who did just that in retirement and then tore their hair out. These alternatives have fallen by the wayside, unlike HYP).

Arb.

-

Lootman

- The full Lemon

- Posts: 18938

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 636 times

- Been thanked: 6677 times

Re: HYP1 is 21

Arborbridge wrote:HYP is an income provider, that's all. If you want to build a pot, go for ideas around high growth: not HYP.

Conversely, if you want to test HYP, do not do so against high growth instruments, but choose simple income providers. (For John Doe, that would at one time have included NS&I and Building Societies: I know many people who did just that in retirement and then tore their hair out. These alternatives have fallen by the wayside, unlike HYP).

It might not be entirely fair to compare a HYP to a growth portfolio. Although it depends how you define the word "income". You can, say, support yourself in retirement via a growth portfolio by selling off a few percent each year. In fact that is closer to the "income" that I live off, at least until my pensions kick in.

But I do think it is legitimate to compare a HYP with an index fund, because an index fund is a neutral and diversified mix of growth and income/value names. And because an index fund is very simple and cheap to hold. Certainly simpler than any portfolio of shares would be. Which is where your John Doe analogy comes in because, whilst HYP might be designed for the man in the street, it actually requires a fair amount of knowledge and sophistication to run any portfolio of shares, certainly for someone starting from scratch. If it really was trivially easy to run a HYP then why are there so many long and complicated discussions on TMF and TLF about it?

Whereas holding a single index fund, whether UK or global, really is trivially simple. I would contend that even the most ardent HYP fan owes it to himself or herself to occasionally compare their outcomes with the alternative of, say, a global index fund. With drawdown of an equivalent yield if appropriate. And in fact Pyad does compare his returns to the FTSE-100, although whether he would if HYP1 had under-performed it is another matter.

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: HYP1 is 21

Lootman wrote:Arborbridge wrote:HYP is an income provider, that's all. If you want to build a pot, go for ideas around high growth: not HYP.

Conversely, if you want to test HYP, do not do so against high growth instruments, but choose simple income providers. (For John Doe, that would at one time have included NS&I and Building Societies: I know many people who did just that in retirement and then tore their hair out. These alternatives have fallen by the wayside, unlike HYP).

It might not be entirely fair to compare a HYP to a growth portfolio. Although it depends how you define the word "income". You can, say, support yourself in retirement via a growth portfolio by selling off a few percent each year. In fact that is closer to the "income" that I live off, at least until my pensions kick in.

But I do think it is legitimate to compare a HYP with an index fund, because an index fund is a neutral and diversified mix of growth and income/value names. And because an index fund is very simple and cheap to hold. Certainly simpler than any portfolio of shares would be. Which is where your John Doe analogy comes in because, whilst HYP might be designed for the man in the street, it actually requires a fair amount of knowledge and sophistication to run any portfolio of shares, certainly for someone starting from scratch. If it really was trivially easy to run a HYP then why are there so many long and complicated discussions on TMF and TLF about it?

Whereas holding a single index fund, whether UK or global, really is trivially simple. I would contend that even the most ardent HYP fan owes it to himself or herself to occasionally compare their outcomes with the alternative of, say, a global index fund. With drawdown of an equivalent yield if appropriate. And in fact Pyad does compare his returns to the FTSE-100, although whether he would if HYP1 had under-performed it is another matter.

I've already answered the point in your first paragraph - I deliberately exclude the comparison with asset harvesting for the reason given: lack of simplicity.

However, I am interested in your main proposition. Can you suggest an index fund which would be a substitute for HYP? That is, it must pay out regular dividends on a "high and rising" basis. Yes, I know that HYP income has not risen in the financial crises, but I allow some slack on that on the basis that most people in practice use Alt-HYP with both a safety margin and income reserve so it is of no consequence.

So, could you put forward some index funds which would provide the same. I'm interested for my own reasons - I have in addition to HYP other "fall back" investments such as ITs, so the more the merrier.

Incidentally, the yield must be of the order of 4-5% to compete with my HYP and reach my income requirement. Or rather less if I do not need to keep a safety mrgin.

Arb

Moderator Message:

A reminder of this board's guidelines:

"For the avoidance of doubt, the practicalities of taking a HYP approach DO NOT include making decisions about whether to use such an approach, nor decisions about whether to stop using one, the effectiveness and performance of HYP strategies versus other strategies, the desirability or otherwise of investment trusts as an alternative to HYP shares, nor discussions of other types of approaches."

So any answers to Arb's question will be removed as off-topic. Or, I can move this post and the next to HYS-S? Let me know which course of action is preferred. --MDW1954

A reminder of this board's guidelines:

"For the avoidance of doubt, the practicalities of taking a HYP approach DO NOT include making decisions about whether to use such an approach, nor decisions about whether to stop using one, the effectiveness and performance of HYP strategies versus other strategies, the desirability or otherwise of investment trusts as an alternative to HYP shares, nor discussions of other types of approaches."

So any answers to Arb's question will be removed as off-topic. Or, I can move this post and the next to HYS-S? Let me know which course of action is preferred. --MDW1954

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: HYP1 is 21

Lootman wrote:Whereas holding a single index fund, whether UK or global, really is trivially simple. I would contend that even the most ardent HYP fan owes it to himself or herself to occasionally compare their outcomes with the alternative of, say, a global index fund. With drawdown of an equivalent yield if appropriate. And in fact Pyad does compare his returns to the FTSE-100, although whether he would if HYP1 had under-performed it is another matter.

I've just noticed the weasel in this paragraph: "With drawdown...". That is moving the goal posts! The idea is to fund retirement with a simple dividend scheme which lets John Doe off the hook when it comes to deciding when to sell.

Pyad compares with FTSE100 for the same reason I do: the bulk of HYP shares as originally conceived were FTSE100 stocks. And although the FTSE isn't "Everest, or even Ben Nevis" it is what I also use, and what the scheme was devised around. I can say, my HYP acc-units have also comfortably beaten the FTSE TR, so exceeding the target in my mind.

PS; being just a small step above John Doe (I flatter myself!) I do have ITs which cover the international dimension, though that is not relevant here.

Arb.

Return to “HYP Practical (See Group Guidelines)”

Who is online

Users browsing this forum: idpickering and 36 guests