Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

State Pension - Starting Amount

-

BobbyD

- Lemon Half

- Posts: 7814

- Joined: January 22nd, 2017, 2:29 pm

- Has thanked: 665 times

- Been thanked: 1289 times

State Pension - Starting Amount

I keep coming across the fact that pre 2015/16 years will count as the higher of what I would have got under the old scheme or the amount I would get under the new scheme but, and I'm probably overlooking something incredibly obvious here, I can't find out how to calculate the value under the old scheme. Could somebody please point out the obvious?

As it is my predicted pension values existing pre-2016 years to the penny as if they were made after 2016, so I'm fairly sure I know the answer but I'd like to be adding years on the basis of more than a hunch.

Thanks.

As it is my predicted pension values existing pre-2016 years to the penny as if they were made after 2016, so I'm fairly sure I know the answer but I'd like to be adding years on the basis of more than a hunch.

Thanks.

-

mc2fool

- Lemon Half

- Posts: 7896

- Joined: November 4th, 2016, 11:24 am

- Has thanked: 7 times

- Been thanked: 3051 times

Re: State Pension - Starting Amount

BobbyD wrote:I keep coming across the fact that pre 2015/16 years will count as the higher of what I would have got under the old scheme or the amount I would get under the new scheme but, and I'm probably overlooking something incredibly obvious here, I can't find out how to calculate the value under the old scheme.

Very good chance you can't. What you'd have got under the old scheme as per 6-Apr-2016 will have been the basic state pension at that date pro rata your number of years to a max of 30 plus your additional state pension entitlement. The first part of that (BSP) is easy, the second part (ASP) all but impossible; you have to ask them.

BobbyD wrote:As it is my predicted pension values existing pre-2016 years to the penny as if they were made after 2016, so I'm fairly sure I know the answer but I'd like to be adding years on the basis of more than a hunch.

I don't understand what you mean by that, the sentence doesn't quite parse, but do you have any 2006-2015/6 gaps in your NI record and had less than 35 years on 6-Apr-2016? If so, despite your extreme tardiness, I can help you figure out if they are worth filing or not.

If not then it's just academic and as it's a bit of a faff I'm disinclined to do any more of these unless they have a potential real-world benefit for folks. If you are curious do an advanced search of this forum for posts by me containing "COPE". There are plenty of examples where I've worked it out for others.

-

BobbyD

- Lemon Half

- Posts: 7814

- Joined: January 22nd, 2017, 2:29 pm

- Has thanked: 665 times

- Been thanked: 1289 times

Re: State Pension - Starting Amount

mc2fool wrote:BobbyD wrote:I keep coming across the fact that pre 2015/16 years will count as the higher of what I would have got under the old scheme or the amount I would get under the new scheme but, and I'm probably overlooking something incredibly obvious here, I can't find out how to calculate the value under the old scheme.

Very good chance you can't. What you'd have got under the old scheme as per 6-Apr-2016 will have been the basic state pension at that date pro rata your number of years to a max of 30 plus your additional state pension entitlement. The first part of that (BSP) is easy, the second part (ASP) all but impossible; you have to ask them.BobbyD wrote:As it is my predicted pension values existing pre-2016 years to the penny as if they were made after 2016, so I'm fairly sure I know the answer but I'd like to be adding years on the basis of more than a hunch.

I don't understand what you mean by that, the sentence doesn't quite parse, but do you have any 2006-2015/6 gaps in your NI record and had less than 35 years on 6-Apr-2016? If so, despite your extreme tardiness, I can help you figure out if they are worth filing or not.

If not then it's just academic and as it's a bit of a faff I'm disinclined to do any more of these unless they have a potential real-world benefit for folks. If you are curious do an advanced search of this forum for posts by me containing "COPE". There are plenty of examples where I've worked it out for others.

Thanks. I was trying to uncover the information to validate my own answers. I doubt you'll come across an easier set up, but with a reasonable amount of cash at stake any untied ends make me a little uneasy and having your eye cast over the figures would certainly inspire more confidence.

2006-2015/6 is all gaps

7 years paid, all of which are pre 2001/02.

19 years left.

Never been opted out.

What I was trying to say is that my predicted pension (£137.54) appears to be based on each of my years, all of which are 'old years' contributing £5.29 a week to the estimate. From there I'm hypothesising that this holds for any old years I pay up now, but this I haven't been able to prove.

My theory is paying up the last 9 years, and then keeping up to date should give me 35 years and £185.15pw.

Thanks for taking the time, much appreciated.

-

mc2fool

- Lemon Half

- Posts: 7896

- Joined: November 4th, 2016, 11:24 am

- Has thanked: 7 times

- Been thanked: 3051 times

Re: State Pension - Starting Amount

BobbyD wrote:2006-2015/6 is all gaps

7 years paid, all of which are pre 2001/02.

19 years left.

Never been opted out.

Yes, that's pretty simple, and also unusual ... have you been outside of the UK most of your working life? And still are maybe?

So, sounds like you've got it right. Can you just confirm (I'm assuming you're looking at your online forecast) that:

a) the "Estimate based on your National Insurance record up to 5 April 2022" it shows (not the headline figure) is £37.03, and,

b) you have no COPE (if it's there it'll be at the bottom of the main page)

Assuming (a) is correct then that tells us that your starting amount was under the new system, meaning that any additional state pension entitlement under the old system wasn't enough to make the old system calculation higher, meaning that those few pre-2001/02 years weren't particularly highly paid.

-

BobbyD

- Lemon Half

- Posts: 7814

- Joined: January 22nd, 2017, 2:29 pm

- Has thanked: 665 times

- Been thanked: 1289 times

Re: State Pension - Starting Amount

mc2fool wrote:Yes, that's pretty simple, and also unusual ... have you been outside of the UK most of your working life? And still are maybe?

So, sounds like you've got it right. Can you just confirm (I'm assuming you're looking at your online forecast) that:

a) the "Estimate based on your National Insurance record up to 5 April 2022" it shows (not the headline figure) is £37.03, and,

b) you have no COPE (if it's there it'll be at the bottom of the main page)

Assuming (a) is correct then that tells us that your starting amount was under the new system, meaning that any additional state pension entitlement under the old system wasn't enough to make the old system calculation higher, meaning that those few pre-2001/02 years weren't particularly highly paid.

Thanks.

No, all years spent in the UK.

Yup looking at online forecast (....check-your-state-pension/account). Your state pension forecast is provided for your information only and the service does not offer financial advice...

Can't see anything but what I assume you are calling the headline figure (£137.54pw, £598.05pm, £7176.64pa), based on NI record up to 5 April 22 and assuming 19 more years contribution. I got my figures by dividing by 26.

Can't see any mention of COPE.

Searched the document for both £37.03 and COPE just to be certain. No hits.

Does this still sound right?

Many thanks again.

-

mc2fool

- Lemon Half

- Posts: 7896

- Joined: November 4th, 2016, 11:24 am

- Has thanked: 7 times

- Been thanked: 3051 times

Re: State Pension - Starting Amount

BobbyD wrote:mc2fool wrote:Yes, that's pretty simple, and also unusual ... have you been outside of the UK most of your working life? And still are maybe?

So, sounds like you've got it right. Can you just confirm (I'm assuming you're looking at your online forecast) that:

a) the "Estimate based on your National Insurance record up to 5 April 2022" it shows (not the headline figure) is £37.03, and,

b) you have no COPE (if it's there it'll be at the bottom of the main page)

Assuming (a) is correct then that tells us that your starting amount was under the new system, meaning that any additional state pension entitlement under the old system wasn't enough to make the old system calculation higher, meaning that those few pre-2001/02 years weren't particularly highly paid.

Thanks.

No, all years spent in the UK.

Yup looking at online forecast (....check-your-state-pension/account). Your state pension forecast is provided for your information only and the service does not offer financial advice...

Can't see anything but what I assume you are calling the headline figure (£137.54pw, £598.05pm, £7176.64pa), based on NI record up to 5 April 22 and assuming 19 more years contribution. I got my figures by dividing by 26.

Can't see any mention of COPE.

Searched the document for both £37.03 and COPE just to be certain. No hits.

Does this still sound right?

Many thanks again.

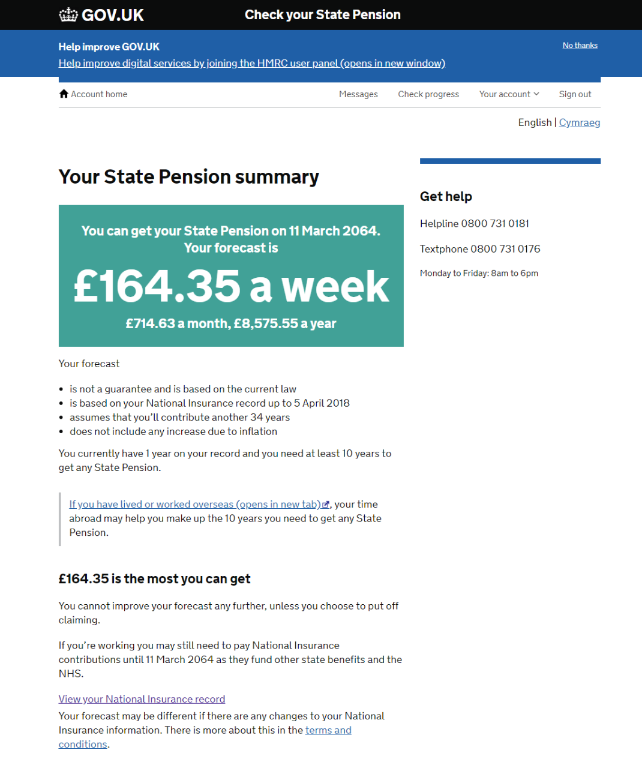

Unless they've totally changed it, you should see something like this:

https://www.litrg.org.uk/latest-news/news/210518-do-not-miss-out-your-state-pension-check-your-record

What does the line that says £154.55 per week in the above say for your case?

-

BobbyD

- Lemon Half

- Posts: 7814

- Joined: January 22nd, 2017, 2:29 pm

- Has thanked: 665 times

- Been thanked: 1289 times

Re: State Pension - Starting Amount

mc2fool wrote:BobbyD wrote:

Thanks.

No, all years spent in the UK.

Yup looking at online forecast (....check-your-state-pension/account). Your state pension forecast is provided for your information only and the service does not offer financial advice...

Can't see anything but what I assume you are calling the headline figure (£137.54pw, £598.05pm, £7176.64pa), based on NI record up to 5 April 22 and assuming 19 more years contribution. I got my figures by dividing by 26.

Can't see any mention of COPE.

Searched the document for both £37.03 and COPE just to be certain. No hits.

Does this still sound right?

Many thanks again.

Unless they've totally changed it, you should see something like this:

https://www.litrg.org.uk/latest-news/news/210518-do-not-miss-out-your-state-pension-check-your-record

What does the line that says £154.55 per week in the above say for your case?

It doesn't, that line doesn't exist.

If I click on 'see your pension forecast' from the government gateway page I see something more like this:

- https://www.moneysavingexpert.com/news/ ... here-s-ho/

except:

- the figures are different

- and I don't have the line about the most I can get, presumably because unlike this page from mse I am not on schedule to get the most I can get.

-

mc2fool

- Lemon Half

- Posts: 7896

- Joined: November 4th, 2016, 11:24 am

- Has thanked: 7 times

- Been thanked: 3051 times

Re: State Pension - Starting Amount

BobbyD wrote:It doesn't, that line doesn't exist.

If I click on 'see your pension forecast' from the government gateway page I see something more like this:

:

- and I don't have the line about the most I can get, presumably because unlike this page from mse I am not on schedule to get the most I can get.

Well how strange! I've been doing these calculations for Lemons for many years and right up to a couple of weeks ago and that info is an absolutely standard one I've always asked for from their pension forecasts, and yours is the first one that doesn't show it -- and it's not like it's a new format as my example is from last year while the MSE one is from 2019. So, I don't know why it shows one format for some and another for others.

In any case, or rather, your case, so you've spent all your time in the UK, are in your late 40s and yet have only ever worked for four years?!? (The other 3 being your "starting credits" just for being 16, 17 & 18.) A member of the idle rich, I take it?

So, the £37.03 was just a cross check and going from the figures you have it is clear that your starting amount was under the new state pension calculation and that adding pre- or post-2016 years is worth the same to you (£5.29pw). In that respect it doesn't matter which 28 of your 16 fillable past years and 19 present and future years you fill, any 28 will do.

However, there are deadlines and costs to consider. Firstly, you only have (by extension) until 31 July to fill any years from 2006/7 to 2016/17 inclusive. Further, the cost for the other past years, except 2020/21 & 21/22, goes up after then to next year's price. Prices always stay at the original price for two years, and then rise to the current year's price . See this HMRC forum post for details (scroll down to the table).

However, going forward the optimal thing to do is to declare yourself self-employed at some "toy" job, which makes you eligible to pay voluntary class 2 NICs, which cost a mere £163.80 p.a. See https://www.gov.uk/guidance/tax-free-allowances-on-property-and-trading-income.

-

BobbyD

- Lemon Half

- Posts: 7814

- Joined: January 22nd, 2017, 2:29 pm

- Has thanked: 665 times

- Been thanked: 1289 times

Re: State Pension - Starting Amount

mc2fool wrote:Well how strange! I've been doing these calculations for Lemons for many years and right up to a couple of weeks ago and that info is an absolutely standard one I've always asked for from their pension forecasts, and yours is the first one that doesn't show it -- and it's not like it's a new format as my example is from last year while the MSE one is from 2019. So, I don't know why it shows one format for some and another for others.

What can I say I'm special! If I had to take a punt I'd guess the change occurred in 2016 but only for those x years from pension, but that is a totally uninformed guess and would require me to be the youngest person you've helped.

mc2fool wrote:

In any case, or rather, your case, so you've spent all your time in the UK, are in your late 40s and yet have only ever worked for four years?!? (The other 3 being your "starting credits" just for being 16, 17 & 18.) A member of the idle rich, I take it?Or maybe a kept man/woman?

Sometimes idle, never rich! Just not prone to activities that HMRC deems taxable!

mc2fool wrote:

So, the £37.03 was just a cross check and going from the figures you have it is clear that your starting amount was under the new state pension calculation and that adding pre- or post-2016 years is worth the same to you (£5.29pw). In that respect it doesn't matter which 28 of your 16 fillable past years and 19 present and future years you fill, any 28 will do.

However, there are deadlines and costs to consider. Firstly, you only have (by extension) until 31 July to fill any years from 2006/7 to 2016/17 inclusive. Further, the cost for the other past years, except 2020/21 & 21/22, goes up after then to next year's price. Prices always stay at the original price for two years, and then rise to the current year's price . See this HMRC forum post for details (scroll down to the table).

Thanks for the confirmation.

Yup, I looked at the price for a year a few years back, it never crossed my mind it would go up! That's the real disappointment here. Now I'm sure how many years to pay up they'll all be going in the shopping cart tomorrow for a one off fix. All I've got to do is not die for about 25 years so I get my money back. I might even start to exercise...

mc2fool wrote:However, going forward the optimal thing to do is to declare yourself self-employed at some "toy" job, which makes you eligible to pay voluntary class 2 NICs, which cost a mere £163.80 p.a. See https://www.gov.uk/guidance/tax-free-allowances-on-property-and-trading-income.

Yup, already in hand. Been on the to do list for a few years. Delayed this year by an ill timed illness. Just enough to generate a couple of invoices, and truthfully declare my £6.34 annual profit. Not sure why but possibly the only lesson I picked up from my parents was don't lie to the taxman...

Thanks for all your help. one of those weird situations where the answer seemed obvious, but the working elusive. Congratulations on your pending retirement from this sort of thing!

-

BobbyD

- Lemon Half

- Posts: 7814

- Joined: January 22nd, 2017, 2:29 pm

- Has thanked: 665 times

- Been thanked: 1289 times

Re: State Pension - Starting Amount

mc2fool wrote:Well how strange! I've been doing these calculations for Lemons for many years and right up to a couple of weeks ago and that info is an absolutely standard one I've always asked for from their pension forecasts, and yours is the first one that doesn't show it -- and it's not like it's a new format as my example is from last year while the MSE one is from 2019.

New hypothesis. Format updates when you make your next NIC.

I now qualify for the 2 flash bars, which tell me that so far I've only been credited with 6 of the 9 years I purchased!

-

mc2fool

- Lemon Half

- Posts: 7896

- Joined: November 4th, 2016, 11:24 am

- Has thanked: 7 times

- Been thanked: 3051 times

Re: State Pension - Starting Amount

BobbyD wrote:mc2fool wrote:Well how strange! I've been doing these calculations for Lemons for many years and right up to a couple of weeks ago and that info is an absolutely standard one I've always asked for from their pension forecasts, and yours is the first one that doesn't show it -- and it's not like it's a new format as my example is from last year while the MSE one is from 2019.

New hypothesis. Format updates when you make your next NIC.

I now qualify for the 2 flash bars, which tell me that so far I've only been credited with 6 of the 9 years I purchased!

And that (format updates when you make your next NIC) is also strange ...

So, do the two bars say what you'd expect them to? (Other than 6 vs 9 extra years)

I was going to say, it takes them a while to get NICs onto the system, but I assume you purchased all 9 at the same time,, so further strangeness....

-

BobbyD

- Lemon Half

- Posts: 7814

- Joined: January 22nd, 2017, 2:29 pm

- Has thanked: 665 times

- Been thanked: 1289 times

Re: State Pension - Starting Amount

mc2fool wrote:BobbyD wrote:New hypothesis. Format updates when you make your next NIC.

I now qualify for the 2 flash bars, which tell me that so far I've only been credited with 6 of the 9 years I purchased!

And that (format updates when you make your next NIC) is also strange ...

So, do the two bars say what you'd expect them to? (Other than 6 vs 9 extra years)

I was going to say, it takes them a while to get NICs onto the system, but I assume you purchased all 9 at the same time,, so further strangeness....

Well they haven't misfiled my SA preventing me from filing a return for the year which they misfiled it as and then fined me £1000 for not filing, and then locked me out of my account for a year making it impossible to resolve for a while so I'll forgive them their formatting eccentricities.

If pro-rata'd up to 35 years both bars predict my maximum amount, so they look right to me.

It's weird since the max has had it's annual increase it feels like I've had a pay rise already!

They've added 16/17 on, still waiting for the previous three years. Not saying it's logical but I can see a pattern. Note in diary to recheck it closer to the new deadline. They've definitely got the money anyway...

Return to “Pensions - Practical Problems”

Who is online

Users browsing this forum: No registered users and 36 guests