Scenario (conceptual rather than actual)

Occupational pension for a 60 year old £12,500 i.e. yearly tax allowance amount - so no income tax liability.

Assuming that is the only income can that count as 'earnings' i.e. that is allowed to be added to a SIPP each year?

Assuming it is, and £12,500 is added to the SIPP each year, along with 20% tax relief amount (£2500) being added then the SIPP expands by £15,000/year if left to accumulate (no withdrawals/drawdown).

Taking that a step further, if within the SIPP the assets held tend to naturally lose value, but where those losses are offset by counter assets/positions held within a ISA that gains by a similar amount to what the SIPP holdings lose, then in effect the SIPP value migrates over to being inside the ISA. Somewhat as though the SIPP had been drawn down and the proceeds deposited into the ISA, leaving the individual up £2500/year less costs/fees? Which relative to the £25,000 combined 'investment' amount (£12,500 into SIPP, £12,500 in ISA) = 10% gross gain - at least up to the £1M lifetime allowance amount having been added to the SIPP.

Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

SIPP does occupational pension income count towards SIPP contribution allowance

-

1nvest

- Lemon Quarter

- Posts: 4401

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1342 times

-

OLTB

- Lemon Quarter

- Posts: 1343

- Joined: November 4th, 2016, 9:55 am

- Has thanked: 1339 times

- Been thanked: 607 times

Re: SIPP does occupational pension income count towards SIPP contribution allowance

Hi 1nvest

The HMRC manual here https://www.gov.uk/hmrc-internal-manual ... qualifying suggests that DB income is not treated as 'earnings' and therefore won't attract tax relief (the relevant bit is a few sections down the page).

Cheers, OLTB.

The HMRC manual here https://www.gov.uk/hmrc-internal-manual ... qualifying suggests that DB income is not treated as 'earnings' and therefore won't attract tax relief (the relevant bit is a few sections down the page).

Cheers, OLTB.

-

1nvest

- Lemon Quarter

- Posts: 4401

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1342 times

Re: SIPP does occupational pension income count towards SIPP contribution allowance

Thanks OLTB

I suspected that would be the case. My mind tends to fog when trying to find/read such material. Occupational pension seems to count as earnings in some areas (tax), but not others (NI). I side with the £100M/year lost to the economy from people waiting for HMRC to answer the phone is a over-complicated British tax system disgrace camp. But I guess its also a job creation scheme that benefits millions.

That aside, the concept still holds for those maxing out £40K/year allowance assuming their income supports that, at least up to the 25 years before maxing out the £1M lifetime SIPP contribution limit.

I suspected that would be the case. My mind tends to fog when trying to find/read such material. Occupational pension seems to count as earnings in some areas (tax), but not others (NI). I side with the £100M/year lost to the economy from people waiting for HMRC to answer the phone is a over-complicated British tax system disgrace camp. But I guess its also a job creation scheme that benefits millions.

That aside, the concept still holds for those maxing out £40K/year allowance assuming their income supports that, at least up to the 25 years before maxing out the £1M lifetime SIPP contribution limit.

-

ursaminortaur

- Lemon Half

- Posts: 7035

- Joined: November 4th, 2016, 3:26 pm

- Has thanked: 455 times

- Been thanked: 1746 times

Re: SIPP does occupational pension income count towards SIPP contribution allowance

OLTB wrote:Hi 1nvest

The HMRC manual here https://www.gov.uk/hmrc-internal-manual ... qualifying suggests that DB income is not treated as 'earnings' and therefore won't attract tax relief (the relevant bit is a few sections down the page).

Cheers, OLTB.

All pension payments not just those received from a DB pension are ineligible for tax relief as they are not considered to be relevant earnings.

The maximum amount of contributions on which a member can have relief in any tax year is potentially the greater of:

the ‘basic amount’ - currently £3,600, or

the amount of the individual’s relevant UK earnings that are chargeable to income tax for the tax year.

.

.

.

For the avoidance of doubt a pension is not classed as earnings and cannot be included in the definition of relevant UK earnings.

-

1nvest

- Lemon Quarter

- Posts: 4401

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1342 times

Re: SIPP does occupational pension income count towards SIPP contribution allowance

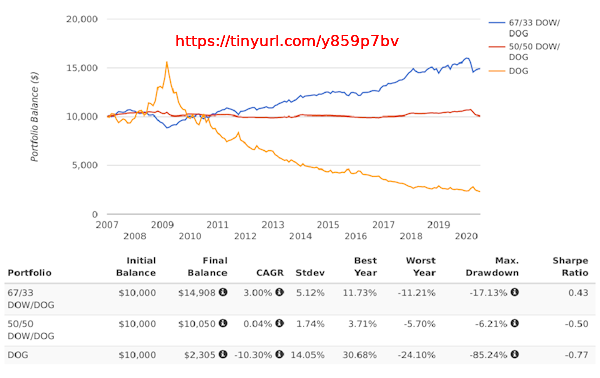

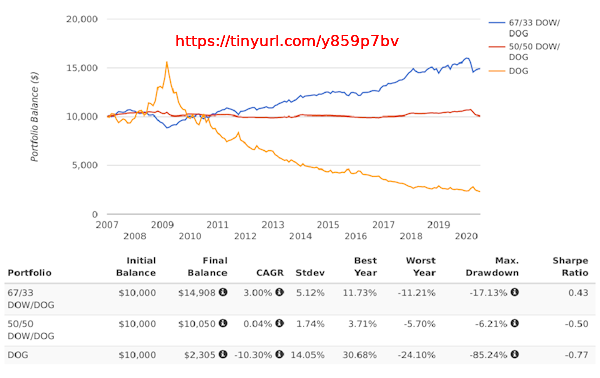

Rather than 50/50 long/short, where the short inside SIPP tends to lose value, long inside ISA tends to gain, as though some funds were progressively (generally) transferred from the SIPP to the ISA, biasing the long side modestly will tend to provide a modest reward

(US data/service for ease of access/availability i.e. PortfolioVisualizer.com)

I set the portfolio rebalance interval to yearly for that.

If self and other half both load £2,880 into a SIPP (that even those without any income can load into a SIPP each year), that is increased to £3600 by the addition of £720 tax relief allowance, £7200 combined, and that is invested in a short stock position, and within ISA £14,400 is invested in long stock, then that's a £21,600 overall 67/33 long/short position, where £1440 was sourced by tax credits, and where the tendency will be to see the SIPP value decline, ISA value expand. If as per that example above the 67/33 long/short produces a 3% CAGR from in effect being a overall 33% long stock holding, then the £1440 tax credit amount relative to £21,600 portfolio value = 6.7% effective 'gain' on top. Close to 10% overall benefit in a relatively low risk manner (33% long stock exposure).

At least that's the conceptual thought-train.

(US data/service for ease of access/availability i.e. PortfolioVisualizer.com)

I set the portfolio rebalance interval to yearly for that.

If self and other half both load £2,880 into a SIPP (that even those without any income can load into a SIPP each year), that is increased to £3600 by the addition of £720 tax relief allowance, £7200 combined, and that is invested in a short stock position, and within ISA £14,400 is invested in long stock, then that's a £21,600 overall 67/33 long/short position, where £1440 was sourced by tax credits, and where the tendency will be to see the SIPP value decline, ISA value expand. If as per that example above the 67/33 long/short produces a 3% CAGR from in effect being a overall 33% long stock holding, then the £1440 tax credit amount relative to £21,600 portfolio value = 6.7% effective 'gain' on top. Close to 10% overall benefit in a relatively low risk manner (33% long stock exposure).

At least that's the conceptual thought-train.

-

CaitrionasDad

- Posts: 7

- Joined: October 1st, 2019, 11:04 am

Re: SIPP does occupational pension income count towards SIPP contribution allowance

1nvest wrote:That aside, the concept still holds for those maxing out £40K/year allowance assuming their income supports that, at least up to the 25 years before maxing out the £1M lifetime SIPP contribution limit.

I imagine that this thread is more about the ways to match long & short positions in different investment vehicles, however note that the Lifetime Allowance isn't a contribution allowance but an allowance/limit on how much benefit you can drawdown tax free.

If you have a £500k pension pot at 50 that grows with modest returns could exceed the LTA when the final assessment is made at 75.

Tax benefits for pension contributions encourage folks to prefer SIPP style vehicles over ISAs.

Similarly we fear running out of money in retirement.

Result is we save too much (?) into a SIPP and will suffer tax clawback later.

That is taxed at 55%

Other alternative would have been to draw down above the Basic Rate tax and incur the 40% charge.

This (matching Short and Long investments) could be an interesting way of effectively transferring value out of your SIPP to avoid the 'excess value' charge that will be applied at 75.

-

1nvest

- Lemon Quarter

- Posts: 4401

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1342 times

Re: SIPP does occupational pension income count towards SIPP contribution allowance

Instead of 1x long and short, you might use 2x or even 3x long and short. Or the VIX tends to be negatively correlated and is more like a 5x.

Depending on the scale and the short side can lose massive amount rapidly (fast migration of SIPP to ISA), but can spike the other way. Blending various choices ...

https://tinyurl.com/y6vn2qnh

https://tinyurl.com/y7mefm4c

If you click the 'Assets' tab in that, you'll see just how large the VIX side can spike.

Also with higher volatility holdings you need to rebalance more frequently. For 1x and 2x once/year can suffice. 3x you're looking at bi yearly or even quarterly, For something like VIX 5x you're looking at monthly. With 10x Options type choices, perhaps weekly or even more frequent. Otherwise the weightings can soon drift to being more long or short than desired.

I suspect that generally its perhaps better to do small/slow progressive migration over time rather than a largescale short term position, as single positions could deviate either way, could lose some, could gain some, whilst averaging multiple smaller plays would be more inclined towards being more neutral overall. For smaller/longer term/multiple positions you might even want to bias the long side a little, so a positive reward expectancy rather than being neutral expectancy.

It's also of course subject to having sufficient sums within ISA. If for instance ISA value was relatively low compared to SIPP value then you might have to hold something like a 25% in 3x or higher long in ISA, 75% in 1x short within the SIPP. And perhaps dilute that down such as something like https://tinyurl.com/yd4vzvq5 More often shorting volatility is better than being long volatility, so SVXY within ISA with small amount of capital and weighted 5%, rest in SIPP (15% in 1x short stock DIA and 80% in short term treasury (Gilt like) holdings).

Thanks for that, I don't have a SIPP, but evidently I should and I intent to rectify that

Depending on the scale and the short side can lose massive amount rapidly (fast migration of SIPP to ISA), but can spike the other way. Blending various choices ...

https://tinyurl.com/y6vn2qnh

https://tinyurl.com/y7mefm4c

If you click the 'Assets' tab in that, you'll see just how large the VIX side can spike.

Also with higher volatility holdings you need to rebalance more frequently. For 1x and 2x once/year can suffice. 3x you're looking at bi yearly or even quarterly, For something like VIX 5x you're looking at monthly. With 10x Options type choices, perhaps weekly or even more frequent. Otherwise the weightings can soon drift to being more long or short than desired.

I suspect that generally its perhaps better to do small/slow progressive migration over time rather than a largescale short term position, as single positions could deviate either way, could lose some, could gain some, whilst averaging multiple smaller plays would be more inclined towards being more neutral overall. For smaller/longer term/multiple positions you might even want to bias the long side a little, so a positive reward expectancy rather than being neutral expectancy.

It's also of course subject to having sufficient sums within ISA. If for instance ISA value was relatively low compared to SIPP value then you might have to hold something like a 25% in 3x or higher long in ISA, 75% in 1x short within the SIPP. And perhaps dilute that down such as something like https://tinyurl.com/yd4vzvq5 More often shorting volatility is better than being long volatility, so SVXY within ISA with small amount of capital and weighted 5%, rest in SIPP (15% in 1x short stock DIA and 80% in short term treasury (Gilt like) holdings).

however note that the Lifetime Allowance isn't a contribution allowance but an allowance/limit on how much benefit you can drawdown tax free.

Thanks for that, I don't have a SIPP, but evidently I should and I intent to rectify that

Return to “Retirement Investing (inc FIRE)”

Who is online

Users browsing this forum: No registered users and 25 guests