Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

Will I be able to retire in 12 years?

Re: Will I be able to retire in 12 years?

Newguy,

It is worth noting that the neuro-typical are almost incapable of saying that at approximately aged 60 a British citizen stands a good chance of coming into some property wealth. It is hard to put on a spreadsheet, much like portfolio risk, but it is real. Both my parents did. Dad has now gone, it has rolled over to mom. She is now in care and the amount is reducing. I am including it in my calculations on an annual basis.

It is NOT our business but consider it.

W (not neuro-typical).

It is worth noting that the neuro-typical are almost incapable of saying that at approximately aged 60 a British citizen stands a good chance of coming into some property wealth. It is hard to put on a spreadsheet, much like portfolio risk, but it is real. Both my parents did. Dad has now gone, it has rolled over to mom. She is now in care and the amount is reducing. I am including it in my calculations on an annual basis.

It is NOT our business but consider it.

W (not neuro-typical).

-

Boots

- 2 Lemon pips

- Posts: 183

- Joined: August 1st, 2021, 2:51 pm

- Has thanked: 154 times

- Been thanked: 119 times

Re: Will I be able to retire in 12 years?

newguy wrote:

Please can I ask does my table look right?

It looks about right to me. Personally I would work out the growth on the opening balance, then add the contribution. Strictly speaking, I think you could work out growth on half of the contributions as well, but life is too short.

I really wouldn't try to assess if my prediction was correct based on a single year, there are far too many variables. I keep a little graph and just look for the trend over 5 to 10 years.

-

AsleepInYorkshire

- Lemon Half

- Posts: 7383

- Joined: February 7th, 2017, 9:36 pm

- Has thanked: 10514 times

- Been thanked: 4659 times

Re: Will I be able to retire in 12 years?

newguy wrote:Hi guys

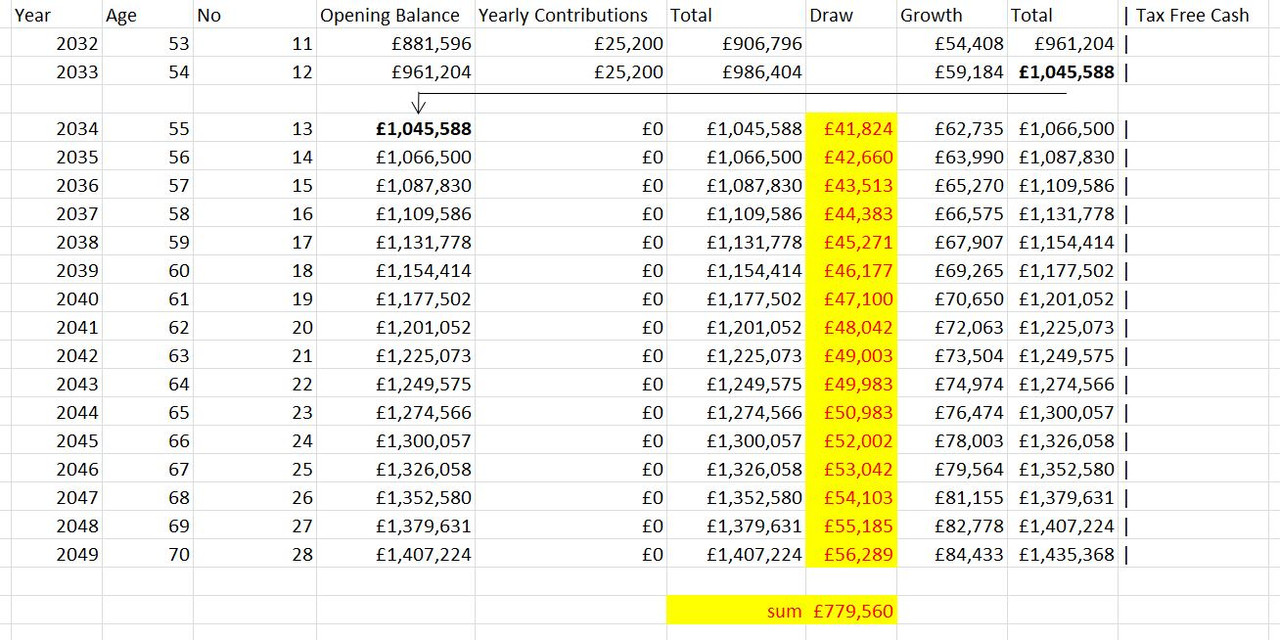

I don't think AiY table was quite right and to be honest I am not sure if mine is right either but using AiY as a basis here is what i have come up with.

Firstly, I am really not sure if it is a great idea adding the growth rate on the contributions. I think it maybe sensible to only do the growth rate on the opening balance. Does anybody have a view?

Now according to my table the growth rate should be around £19K this year. Well given that my assets only went up by about £17K last year that does seem like a bit of a stretch. However, looking at my pension contributions in the last year I didn't contribute as much as I am planning to do this year. Hopefully this will be the turning point.

Please can I ask does my table look right?

Thanks

Newguy

Yup. Sorry I added 2.1K incorrectly.

Newguy

Year Age No Op Bal Contr Total Draw Growth Total Tax Free Cash

1980 25.20 4.00% 6.00% 25.00%

2022 42 1 295.7 25.2 320.9 0 19.3 340.2 0.0

2023 43 2 340.2 25.2 365.4 0 21.9 387.3 0.0

2024 44 3 387.3 25.2 412.5 0 24.7 437.2 0.0

2025 45 4 437.2 25.2 462.4 0 27.7 490.2 0.0

2026 46 5 490.2 25.2 515.4 0 30.9 546.3 0.0

2027 47 6 546.3 25.2 571.5 0 34.3 605.8 0.0

2028 48 7 605.8 25.2 631.0 0 37.9 668.8 0.0

2029 49 8 668.8 25.2 694.0 0 41.6 735.7 0.0

2030 50 9 735.7 25.2 760.9 0 45.7 806.5 0.0

2031 51 10 806.5 25.2 831.7 0 49.9 881.6 0.0

2032 52 11 881.6 25.2 906.8 0 54.4 961.2 0.0

2033 53 12 961.2 25.2 986.4 0 59.2 1,045.6 0.0

2034 54 13 1,045.6 25.2 1,070.8 0 64.3 1,135.1 0.0

2035 55 14 1,135.1 25.2 1,160.3 0 69.6 1,229.9 0.0

2036 56 15 1,229.9 25.2 1,255.1 0 75.3 1,330.4 0.0

2037 57 16 1,330.4 25.2 1,355.6 (54.2) 78.1 1,379.5 344.9

2038 58 17 1,034.6 0.0 1,034.6 (41.4) 59.6 1,052.8 0.0

2039 59 18 1,052.8 0.0 1,052.8 (42.1) 60.6 1,071.3 0.0

2040 60 19 1,071.3 0.0 1,071.3 (42.9) 61.7 1,090.2 0.0

2041 61 20 1,090.2 0.0 1,090.2 (43.6) 62.8 1,109.4 0.0

2042 62 21 1,109.4 0.0 1,109.4 (44.4) 63.9 1,128.9 0.0

2043 63 22 1,128.9 0.0 1,128.9 (45.2) 65.0 1,148.8 0.0

2044 64 23 1,148.8 0.0 1,148.8 (46.0) 66.2 1,169.0 0.0

2045 65 24 1,169.0 0.0 1,169.0 (46.8) 67.3 1,189.6 0.0

2046 66 25 1,189.6 0.0 1,189.6 (47.6) 68.5 1,210.5 0.0

2047 67 26 1,210.5 0.0 1,210.5 (48.4) 69.7 1,231.8 0.0

2048 68 27 1,231.8 0.0 1,231.8 (49.3) 71.0 1,253.5 0.0

2049 69 28 1,253.5 0.0 1,253.5 (50.1) 72.2 1,275.6 0.0

403.2 1,253.5 (601.8) 1,523.4 1,275.6

Noting that this is a small part of my spreadsheet and I can model variables at the press of a button (that is assuming I put the right figures in first

Other areas model the impact of inflation, draw down, tax allowances and future expenses.

It's constantly evolving and is a work-in-progress.

I can fill in my anticipated expenses now and project them forward. The spreadsheet works for up to two people as my good lady has both a private pension and a DB pension.

AIY(D)

Sorry forgot to mention the growth rate for each year works on the money going in up front not monthly. I am self employed so I tend not to buy monthly. I think the constant to use for monthly input would be 0.541.

Last edited by AsleepInYorkshire on January 23rd, 2022, 11:15 am, edited 1 time in total.

-

JohnB

- Lemon Quarter

- Posts: 2505

- Joined: January 15th, 2017, 9:20 am

- Has thanked: 690 times

- Been thanked: 1005 times

Re: Will I be able to retire in 12 years?

The OP should develop a spreadsheet that runs forward their investments, with a range of assumptions on growth rates, market setbacks, and taxes. That will give a range of outcomes, retirement date could move by 2-3 years. I moved on from a spreadsheet to a webpage, http://www.johnbray.org.uk/retire/retire.html, its complicated because life is.

-

newguy

- Lemon Pip

- Posts: 84

- Joined: June 16th, 2019, 8:32 am

- Has thanked: 126 times

- Been thanked: 28 times

Re: Will I be able to retire in 12 years?

Wuffle wrote:Newguy,

It is worth noting that the neuro-typical are almost incapable of saying that at approximately aged 60 a British citizen stands a good chance of coming into some property wealth. It is hard to put on a spreadsheet, much like portfolio risk, but it is real. Both my parents did. Dad has now gone, it has rolled over to mom. She is now in care and the amount is reducing. I am including it in my calculations on an annual basis.

It is NOT our business but consider it.

W (not neuro-typical).

Thanks Wuffle. In my case I've got three other brothers and my parents are not well. I am not expecting there to be any inheritance left.

Newguy

-

newguy

- Lemon Pip

- Posts: 84

- Joined: June 16th, 2019, 8:32 am

- Has thanked: 126 times

- Been thanked: 28 times

Re: Will I be able to retire in 12 years?

Thank you everybody you have given me a lot to think about.

Newguy

Newguy

-

monabri

- Lemon Half

- Posts: 8420

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3441 times

Re: Will I be able to retire in 12 years?

"TAX" was mentioned but I can't see where it is being applied.

( and hopefully income will be supplemented with state pension).

( and hopefully income will be supplemented with state pension).

-

newguy

- Lemon Pip

- Posts: 84

- Joined: June 16th, 2019, 8:32 am

- Has thanked: 126 times

- Been thanked: 28 times

Re: Will I be able to retire in 12 years?

monabri wrote:"TAX" was mentioned but I can't see where it is being applied.

( and hopefully income will be supplemented with state pension).

Hi. In my case it’s done through work at payroll and I think the scheme is called a salary exchange. I don’t need to take any action.

-

monabri

- Lemon Half

- Posts: 8420

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3441 times

Re: Will I be able to retire in 12 years?

newguy wrote:monabri wrote:"TAX" was mentioned but I can't see where it is being applied.

( and hopefully income will be supplemented with state pension).

Hi. In my case it’s done through work at payroll and I think the scheme is called a salary exchange. I don’t need to take any action.

I was referring to year 2034 when you start to drawdown your pension. You'd be able to drawdown 25% tax free but the drawdown sum totals to ~£780k

Bear in mind you will be getting state pension as well (eventually) and you are in to paying high rate tax.

-

Hariseldon58

- Lemon Slice

- Posts: 835

- Joined: November 4th, 2016, 9:42 pm

- Has thanked: 124 times

- Been thanked: 513 times

Re: Will I be able to retire in 12 years?

For the OP he has made a great start, he’s going to add about £25k a year for 12 years.

Personally I consider adding to the ISA alongside/instead of the SIPP at some point, tax relief is great but there is a lack of flexibility, you may want t access money at some point. It mitigates the risk of further changes in the rules and need to be aware of the lifetime allowance….

With a large ISA pot I have a lot of potential tax free income, its swings and roundabouts for a basic rate taxpayer. I have enough SIPP to use the basic rate allowance fully and thus pay no income tax. A thought.

The OP is doing what’s required, just needs to keep doing it ! Year in and year out, minimise expenses and churning the portfolio.

With respect to the actual investments, the pension contains three broad market trackers, in truth is that those three, in an appropriate mix, is all that is needed. The rest are adding complexity and costs in the hope to do better, in truth not necessary and not likely to make a significant improvement.

WHy not keep the picking your own trusts/funds to the much smaller ISA, if after five years you can demonstrate that you have done better and are confident that will continue then may be extend it to the SIPP.

At some point as you get closer to retirement adding some safe bonds for a reserve makes sense.

Personally I consider adding to the ISA alongside/instead of the SIPP at some point, tax relief is great but there is a lack of flexibility, you may want t access money at some point. It mitigates the risk of further changes in the rules and need to be aware of the lifetime allowance….

With a large ISA pot I have a lot of potential tax free income, its swings and roundabouts for a basic rate taxpayer. I have enough SIPP to use the basic rate allowance fully and thus pay no income tax. A thought.

The OP is doing what’s required, just needs to keep doing it ! Year in and year out, minimise expenses and churning the portfolio.

With respect to the actual investments, the pension contains three broad market trackers, in truth is that those three, in an appropriate mix, is all that is needed. The rest are adding complexity and costs in the hope to do better, in truth not necessary and not likely to make a significant improvement.

WHy not keep the picking your own trusts/funds to the much smaller ISA, if after five years you can demonstrate that you have done better and are confident that will continue then may be extend it to the SIPP.

At some point as you get closer to retirement adding some safe bonds for a reserve makes sense.

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Will I be able to retire in 12 years?

Also, one of the financial levers you can pull is to go with an interest-only mortgage, which will dramatically lower your monthly payment, and allow you to invest more of your income. The drawback, of course, is that you are not paying down the principal, just paying interest, so you'll need to account for that in your pot size.

Nonetheless, if you think investments are going to grow at the rates you have pencilled (6% real?) in then it will undouted speed up your time to reach your goals and something to consider.

Your current mortgage rate seems very high compared to the current best deals available at the LTVs you are currently at, so there is opportunity there to free up more cash regardless if you want to go interest only or standard repayment.

Nonetheless, if you think investments are going to grow at the rates you have pencilled (6% real?) in then it will undouted speed up your time to reach your goals and something to consider.

Your current mortgage rate seems very high compared to the current best deals available at the LTVs you are currently at, so there is opportunity there to free up more cash regardless if you want to go interest only or standard repayment.

-

newguy

- Lemon Pip

- Posts: 84

- Joined: June 16th, 2019, 8:32 am

- Has thanked: 126 times

- Been thanked: 28 times

Re: Will I be able to retire in 12 years?

Hariseldon58 wrote:For the OP he has made a great start, he’s going to add about £25k a year for 12 years.

Personally I consider adding to the ISA alongside/instead of the SIPP at some point, tax relief is great but there is a lack of flexibility, you may want t access money at some point. It mitigates the risk of further changes in the rules and need to be aware of the lifetime allowance….

With a large ISA pot I have a lot of potential tax free income, its swings and roundabouts for a basic rate taxpayer. I have enough SIPP to use the basic rate allowance fully and thus pay no income tax. A thought.

The OP is doing what’s required, just needs to keep doing it ! Year in and year out, minimise expenses and churning the portfolio.

With respect to the actual investments, the pension contains three broad market trackers, in truth is that those three, in an appropriate mix, is all that is needed. The rest are adding complexity and costs in the hope to do better, in truth not necessary and not likely to make a significant improvement.

WHy not keep the picking your own trusts/funds to the much smaller ISA, if after five years you can demonstrate that you have done better and are confident that will continue then may be extend it to the SIPP.

At some point as you get closer to retirement adding some safe bonds for a reserve makes sense.

Thanks Hariseldon58

I think my plan is to try and use the tax relief that is available. If/When the chancellor reduces the tax relief available then paying into the ISA is a better option.

The keep doing it bit will be difficult but trying to get as much money into my pension funds at present makes a lot of sense and is very much required.

I am still very much unsure of my own stock picking skills. I see the pension as being the professional plan whereas my isa i see as a small gamble. In time hopefully i will see the returns increasing in the ISA and i will be happier with my own stock picking.

The two fidelity special situations fund make up about 30% of total funds currently.

Newguy

-

newguy

- Lemon Pip

- Posts: 84

- Joined: June 16th, 2019, 8:32 am

- Has thanked: 126 times

- Been thanked: 28 times

Re: Will I be able to retire in 12 years?

vand wrote:Also, one of the financial levers you can pull is to go with an interest-only mortgage, which will dramatically lower your monthly payment, and allow you to invest more of your income. The drawback, of course, is that you are not paying down the principal, just paying interest, so you'll need to account for that in your pot size.

Nonetheless, if you think investments are going to grow at the rates you have pencilled (6% real?) in then it will undouted speed up your time to reach your goals and something to consider.

Your current mortgage rate seems very high compared to the current best deals available at the LTVs you are currently at, so there is opportunity there to free up more cash regardless if you want to go interest only or standard repayment.

Hi Vand. I will look into the mortgage thing in March as the charges substantially reduce in June.

Going interest only seems very risky as especially as I am not entirely sure whether I will be able to get growth of 6%.

If i did go down this route, where would the money go. Would it be better to pay into the pension plan to get the tax relief and then draw down at somepoint to pay off the capital sum.

If you are going interest only it might be sensible to get an even longer term. Well when i retire I suppose my investments would become less risky so returns may not be as high.

-

Hariseldon58

- Lemon Slice

- Posts: 835

- Joined: November 4th, 2016, 9:42 pm

- Has thanked: 124 times

- Been thanked: 513 times

Re: Will I be able to retire in 12 years?

newguy wrote:Hariseldon58 wrote:For the OP he has made a great start, he’s going to add about £25k a year for 12 years.

Personally I consider adding to the ISA alongside/instead of the SIPP at some point, tax relief is great but there is a lack of flexibility, you may want t access money at some point. It mitigates the risk of further changes in the rules and need to be aware of the lifetime allowance….

With a large ISA pot I have a lot of potential tax free income, its swings and roundabouts for a basic rate taxpayer. I have enough SIPP to use the basic rate allowance fully and thus pay no income tax. A thought.

The OP is doing what’s required, just needs to keep doing it ! Year in and year out, minimise expenses and churning the portfolio.

With respect to the actual investments, the pension contains three broad market trackers, in truth is that those three, in an appropriate mix, is all that is needed. The rest are adding complexity and costs in the hope to do better, in truth not necessary and not likely to make a significant improvement.

WHy not keep the picking your own trusts/funds to the much smaller ISA, if after five years you can demonstrate that you have done better and are confident that will continue then may be extend it to the SIPP.

At some point as you get closer to retirement adding some safe bonds for a reserve makes sense.

Thanks Hariseldon58

I think my plan is to try and use the tax relief that is available. If/When the chancellor reduces the tax relief available then paying into the ISA is a better option.

The keep doing it bit will be difficult but trying to get as much money into my pension funds at present makes a lot of sense and is very much required.

I am still very much unsure of my own stock picking skills. I see the pension as being the professional plan whereas my isa i see as a small gamble. In time hopefully i will see the returns increasing in the ISA and i will be happier with my own stock picking.

The two fidelity special situations fund make up about 30% of total funds currently.

Newguy

With regard to stock picking skills, you will likely discover that your faith in your ability will diminish with experience !!!!

It does for most people, including me…

Return to “Retirement Investing (inc FIRE)”

Who is online

Users browsing this forum: No registered users and 30 guests