My situation. Aged 48 with £350k held.

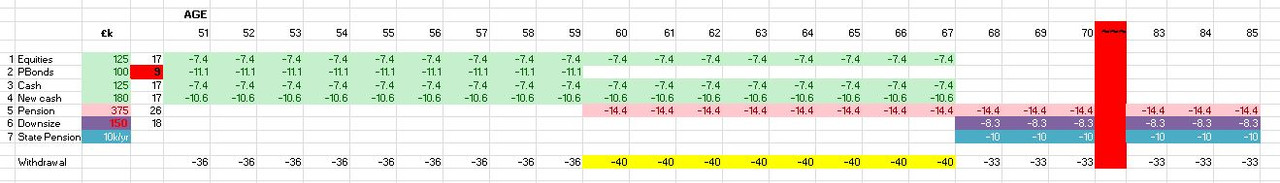

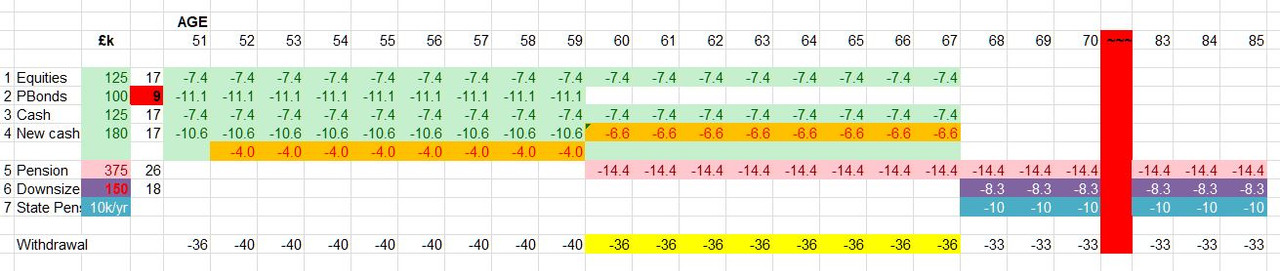

- £125k in equity ISAs (spread across Vanguard mainly but some Scottish Mortgage and Fundsmith in there too)

- £100k in premium bonds

- £125k cash

Pension currently worth £375k.

Property owned outright and worth circa £600k.

Shares due to vest periodically across next two years worth £180k after tax though could get worse/better depending on price.

Living costs circa £45k per year.

My maths tell me that at age 51 I could have about £450-500k plus the pension, state pension and the house. Property equity rarely gets mentioned on this board but if I downsize in a decade (as I plan to) and release £100-150k then that goes in the pot.

Even with modest, risk averse returns of less than 2%, I calculate that I could take about £40k per year out of the pot to live on (indexed to 2% annual inflation), reducing to £30k (in today's terms) from about 70.

I would run out of money in my early 80s. If that's sub optimal (and it probably is

I'm not saying I will stop working either entirely or at all at 51, but knowing I have the choice is immensely powerful!

Does my plan stack up or is it a pipe dream full of holes?