Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

Challenging the 4% Rule

-

MrFoolish

- Lemon Quarter

- Posts: 2340

- Joined: March 22nd, 2020, 7:27 pm

- Has thanked: 566 times

- Been thanked: 1145 times

Re: Challenging the 4% Rule

I understand Warren Buffett favours 90% US stocks and 10% bonds. And he isn't a fan of gold.

-

Hariseldon58

- Lemon Slice

- Posts: 835

- Joined: November 4th, 2016, 9:42 pm

- Has thanked: 124 times

- Been thanked: 513 times

Re: Challenging the 4% Rule

1nvest wrote:Will2pass wrote:I constantly read about the 4% rule or 3.5% in the UK but one key factor is having a contingency pot.

Having 'cash' that you can use during a downturn far outweighs the potential drag on returns during the good times in my opinion.

The tricky bit is getting the amount in that pot right. 3-5 years of essential spending and then attempting to rebalance during the good times.

Anyone who blindly withdraws a set amount regardless of annual return is asking for trouble.

Unfortunately one can't then title something with the snazzy strap line 'X % Rule'.

Half in 2x leveraged stock, half in bonds, yearly rebalanced, will pretty much track 100% 1x.

PV

Say you have £100K inside ISA, £100K outside of ISA, all invested in 1x stock, and stocks are down when you want to make a £20K cash withdrawal, then sell £20K of 1x stock inside ISA and buy £20K of 2x with the proceeds, and sell £20K of 1x outside of ISA, and deposit that in bonds ... and overall you've still the (near-as) exact same portfolio. But where you might now borrow those bonds (or rather not have bought bonds, but spent the £20K instead).

2x leveraged ETFs tend to be more volatile than many people might suspect, its not a simple product.

-

MrFoolish

- Lemon Quarter

- Posts: 2340

- Joined: March 22nd, 2020, 7:27 pm

- Has thanked: 566 times

- Been thanked: 1145 times

Re: Challenging the 4% Rule

I think most people are too cautious about this. In the event of that unlikely worst case scenario, you could take out equity release on your homes. Let your heirs carry some of the risk. Assuming they are working, they can then mop up some cheap shares during that downturn.

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Challenging the 4% Rule

Will2pass wrote:I constantly read about the 4% rule or 3.5% in the UK but one key factor is having a contingency pot.

Having 'cash' that you can use during a downturn far outweighs the potential drag on returns during the good times in my opinion.

The tricky bit is getting the amount in that pot right. 3-5 years of essential spending and then attempting to rebalance during the good times.

Anyone who blindly withdraws a set amount regardless of annual return is asking for trouble.

Unfortunately one can't then title something with the snazzy strap line 'X % Rule'.

Cash buffer ultimately doesn't help.

ERE deals with this fallacy that you can just hold a large cash buffer to ride out the downturns:

https://earlyretirementnow.com/2017/03/ ... h-cushion/

Look... if you are going to retire over 30+ years or more then you are going to have to face at least one or two major bear markets where you are withdrawing from your portfolio as it goes down. Better get used to that certainty, and set an asset allocation that you can live with.

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Challenging the 4% Rule

MrFoolish wrote:I understand Warren Buffett favours 90% US stocks and 10% bonds. And he isn't a fan of gold.

Yes, for building wealth. Not so much for living off your wealth, I daresay.

-

Will2pass

- Posts: 25

- Joined: September 16th, 2021, 5:42 pm

- Has thanked: 7 times

- Been thanked: 8 times

Re: Challenging the 4% Rule

vand wrote:Will2pass wrote:I constantly read about the 4% rule or 3.5% in the UK but one key factor is having a contingency pot.

Having 'cash' that you can use during a downturn far outweighs the potential drag on returns during the good times in my opinion.

The tricky bit is getting the amount in that pot right. 3-5 years of essential spending and then attempting to rebalance during the good times.

Anyone who blindly withdraws a set amount regardless of annual return is asking for trouble.

Unfortunately one can't then title something with the snazzy strap line 'X % Rule'.

Cash buffer ultimately doesn't help.

ERE deals with this fallacy that you can just hold a large cash buffer to ride out the downturns:

https://earlyretirementnow.com/2017/03/ ... h-cushion/

Look... if you are going to retire over 30+ years or more then you are going to have to face at least one or two major bear markets where you are withdrawing from your portfolio as it goes down. Better get used to that certainty, and set an asset allocation that you can live with.

Meh, a lot of waffle in there to fit the authors argument.

The cash reserves are in place mainly to guard against the sequence of return risk in the early years. Get through 1/3rd of your retirement years and you're laughing. The fact the author assumes you need 5 years of cash all the way through retirement makes little sense. I don't need nor want 5 years of cash after 30 years of retirement.

If my 3-5 years cash get me through 10-15 years of retirement then I'm laughing and have little need for a cash buffer after that.

The author also assumes you take a whole year's worth of cash but the reality is you may just 'top up ' in some years.

5 years cash to mitigate 15 years of retirement. I fancy my chances.

-

AsleepInYorkshire

- Lemon Half

- Posts: 7383

- Joined: February 7th, 2017, 9:36 pm

- Has thanked: 10514 times

- Been thanked: 4659 times

Re: Challenging the 4% Rule

vand wrote:

Cash buffer ultimately doesn't help.

ERE deals with this fallacy that you can just hold a large cash buffer to ride out the downturns:

https://earlyretirementnow.com/2017/03/ ... h-cushion/

Look... if you are going to retire over 30+ years or more then you are going to have to face at least one or two major bear markets where you are withdrawing from your portfolio as it goes down. Better get used to that certainty, and set an asset allocation that you can live with.

You comment piqued my interest and I popped over to your link to read the article. I didn't get to the end. Indeed I didn't get much further than the first two paragraphs. It seemed to be a very focused argument against cash instead of putting the case for and against.

I feel cash can be an important part of a defensive strategy. But not on it's own. I'd go one step further and suggest that no only can it be part of downside protection but it can also provide an opportunity to buy into a down-turn.

I hasten to add I don't see the 4% rule as a defence to protection at all. It's an arbitrary number lost in a sea of variables.

I'm by no stretch of the imagination a great investor. But I don't need to be. I'm happy with market returns of somewhere between 7-10%. I hasten to add I'd like more, but I am currently projecting my pension growth at 8.5%. I've worked with 12% previously and reduced that for my latest assessments.

I've never retired before. So I need to make sure I get it right first time. And that's more than daunting - it's downright scary.

So I've sat down and I've worked through a strategy that keeps me and my good lady financially secure in retirement.

1. We haven't set a date to retire. We have a known figure that we need to trigger retirement.

2. The pension pot size is going to be larger than it needs to be - approx double (but possibly slightly less)

3. On retirement we will reduce our equites to 75% and keep 25% in our pension envelopes (or remove the cash outside of this)

4. The cash will allow us to live for 4 years without drawing off the equities

5. The cash pot will be added to annually

6. We have a known required income at retirement and increase it annually by 3%.

7. The income requirement includes £1K/month extra to put in our daughters ISA.

8. It also includes for holidays and home maintenance etc.

9. The retirement income is set at twice what we need to pay the bills.

So

1. If the market drops by 50% we can buy in with cash. We don't need to worry about having 4 years cash at that point - we will either reduce it to 2 years cash or reduce our income needs or a combination of both.

I've tested the strategy. It works if the straight line nett growth of the equities falls to 6%.

There is one small part I've not quite got working yet. Keeping 25% in cash isn't quite achievable over thirty years. On a straight line analysis using [say] 4% drawdown it does shrink with time. However, the equity pot continues to grow. I'm just tinkering with my spreadsheet to check this. But the pot has doubled by the time the cash so I anticipate seeing the cash remaining increase, the equity decrease and probably a slightly higher annual tax bill.

AiY

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Challenging the 4% Rule

Will2pass wrote:vand wrote:Will2pass wrote:I constantly read about the 4% rule or 3.5% in the UK but one key factor is having a contingency pot.

Having 'cash' that you can use during a downturn far outweighs the potential drag on returns during the good times in my opinion.

The tricky bit is getting the amount in that pot right. 3-5 years of essential spending and then attempting to rebalance during the good times.

Anyone who blindly withdraws a set amount regardless of annual return is asking for trouble.

Unfortunately one can't then title something with the snazzy strap line 'X % Rule'.

Cash buffer ultimately doesn't help.

ERE deals with this fallacy that you can just hold a large cash buffer to ride out the downturns:

https://earlyretirementnow.com/2017/03/ ... h-cushion/

Look... if you are going to retire over 30+ years or more then you are going to have to face at least one or two major bear markets where you are withdrawing from your portfolio as it goes down. Better get used to that certainty, and set an asset allocation that you can live with.

Meh, a lot of waffle in there to fit the authors argument.

The cash reserves are in place mainly to guard against the sequence of return risk in the early years. Get through 1/3rd of your retirement years and you're laughing. The fact the author assumes you need 5 years of cash all the way through retirement makes little sense. I don't need nor want 5 years of cash after 30 years of retirement.

If my 3-5 years cash get me through 10-15 years of retirement then I'm laughing and have little need for a cash buffer after that.

The author also assumes you take a whole year's worth of cash but the reality is you may just 'top up ' in some years.

5 years cash to mitigate 15 years of retirement. I fancy my chances.

But that wasn’t clear from your original post. ultimately all you are doing is adding further insurance that probably won’t be needed, and in nearly all cases you would simply be better off with that cash invested. If it helps you sleep better then that’s one thing button the opportunity cost of that cash is huge.

-

AsleepInYorkshire

- Lemon Half

- Posts: 7383

- Joined: February 7th, 2017, 9:36 pm

- Has thanked: 10514 times

- Been thanked: 4659 times

Re: Challenging the 4% Rule

vand wrote:

But that wasn’t clear from your original post. ultimately all you are doing is adding further insurance that probably won’t be needed, and in nearly all cases you would simply be better off with that cash invested. If it helps you sleep better then that’s one thing button the opportunity cost of that cash is huge.

I have worked in the construction industry for 42 years. A large part of my role is commercial risk assessment and downside protection. Often I will be happy to see a reduced margin if the risk of downside begins to rise. It's a balancing act. But sooner walk away with some margin than no margin or even worse a loss. When various positions upstream from me review the commercial position of individual projects they are keen to know what risks are threatening the project and what can be done to mitigate them "if" they transpire.

I know you have recently joined TLF and I've enjoyed reading your posts. I've reviewed my spreadsheet again last night. I don't find myself disagreeing with your comments. I do, however, find, I simply have an alternative view. The defensive strategies that we all adopt need to be personalised to meet our individual circumstances. There's no set rules for this. We will all perceive risk differently.

I digress. Last nights review indicated that my "cash" strategy works for me. I'm not concerned about potential loss of growth on the cash I hold. That's the fulcrum of balance for me. I've worked on a market drop of 50%. I would imagine some may have worked on more. Some less. "If" the market falls by 50% when I have retired I can use some of my 50% cash to buy the lows. I'm not bothered about strict timing. I can also maintain 4 years income in cash at that time.

In other words I can't lose. And that works for me. I don't want to maximise growth when I've retired if it comes with risk - any risk. I want protection first. "If" my projections transpire I will start retirement with £200K in cash. "If" the market grows by approximately 8.25% per annum I can maintain that cash balance with ease. As the cash balance shrinks I can increase my withdrawal rates well above a notional 4%. I can also adjust my living costs to. "If" I was retired tomorrow my "essential" living costs would be about £1,600 per month. Therefore, my £200K would without any increase keep me for roughly 125 months, let's say 10 years. Noting inflation would shorten this by say 20% And there's a huge amount I can do in the meantime too. I can stack shelves for £10/hr. I can downsize my home. I can find similar work to that I currently do at say £350/day. I could even accept that I need to take some small amounts out of my equities.

I should clarify that the term "essential" living costs refers to a "bunkered" spend. If I maintained my "lifestyle" spend the cash would last for 54 months without a need to draw on equities.

Holding cash as part of a risk management strategy works for me. But holding cash is part of my defensive strategy. It's not the only tool in my box. It won't be everyone's approach though.

AiY

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Challenging the 4% Rule

AsleepInYorkshire wrote:vand wrote:

Cash buffer ultimately doesn't help.

ERE deals with this fallacy that you can just hold a large cash buffer to ride out the downturns:

https://earlyretirementnow.com/2017/03/ ... h-cushion/

Look... if you are going to retire over 30+ years or more then you are going to have to face at least one or two major bear markets where you are withdrawing from your portfolio as it goes down. Better get used to that certainty, and set an asset allocation that you can live with.

You comment piqued my interest and I popped over to your link to read the article. I didn't get to the end. Indeed I didn't get much further than the first two paragraphs. It seemed to be a very focused argument against cash instead of putting the case for and against.

I feel cash can be an important part of a defensive strategy. But not on it's own. I'd go one step further and suggest that no only can it be part of downside protection but it can also provide an opportunity to buy into a down-turn.

I hasten to add I don't see the 4% rule as a defence to protection at all. It's an arbitrary number lost in a sea of variables.

I'm by no stretch of the imagination a great investor. But I don't need to be. I'm happy with market returns of somewhere between 7-10%. I hasten to add I'd like more, but I am currently projecting my pension growth at 8.5%. I've worked with 12% previously and reduced that for my latest assessments.

I've never retired before. So I need to make sure I get it right first time. And that's more than daunting - it's downright scary.

So I've sat down and I've worked through a strategy that keeps me and my good lady financially secure in retirement.

1. We haven't set a date to retire. We have a known figure that we need to trigger retirement.

2. The pension pot size is going to be larger than it needs to be - approx double (but possibly slightly less)

3. On retirement we will reduce our equites to 75% and keep 25% in our pension envelopes (or remove the cash outside of this)

4. The cash will allow us to live for 4 years without drawing off the equities

5. The cash pot will be added to annually

6. We have a known required income at retirement and increase it annually by 3%.

7. The income requirement includes £1K/month extra to put in our daughters ISA.

8. It also includes for holidays and home maintenance etc.

9. The retirement income is set at twice what we need to pay the bills.

So

1. If the market drops by 50% we can buy in with cash. We don't need to worry about having 4 years cash at that point - we will either reduce it to 2 years cash or reduce our income needs or a combination of both.

I've tested the strategy. It works if the straight line nett growth of the equities falls to 6%.

There is one small part I've not quite got working yet. Keeping 25% in cash isn't quite achievable over thirty years. On a straight line analysis using [say] 4% drawdown it does shrink with time. However, the equity pot continues to grow. I'm just tinkering with my spreadsheet to check this. But the pot has doubled by the time the cash so I anticipate seeing the cash remaining increase, the equity decrease and probably a slightly higher annual tax bill.

AiY

Again, all of this "I can have my cake and eat it" is based around a refusal to accept that your portfolio will go down and you will be forced to sell from it while it is doing so. That is unavoidable.

Having a plan that allows you to actually switch from being a seller and then buying when the market is down by your suggested 50% also necessitates having a large amount on the sidelines for most of the time.

In distribution you have moved from being a net buyer to being a net seller. Just get used to that!

Just like in accumulation it is silly to stop buying just because the market is going up, in distribution it is silly to stop selling just because the market is going down. If you have no confidence that your portfolio can sustain the income you need then you don't have enough saved and/or you have the wrong asset allocation.

-

1nvest

- Lemon Quarter

- Posts: 4411

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 691 times

- Been thanked: 1343 times

Re: Challenging the 4% Rule

MrFoolish wrote:I understand Warren Buffett favours 90% US stocks and 10% bonds. And he isn't a fan of gold.

Frustration perhaps.

Berkshire Hathaway Chairman letter 1979 ...

One friendly but sharp-eyed commentator on Berkshire has pointed out that our book value at the end of 1964 would have bought about one-half ounce of gold and, fifteen years later, after we have plowed back all earnings along with much blood, sweat and tears, the book value produced will buy about the same half ounce. A similar comparison could be drawn with Middle Eastern oil. The rub has been that government has been exceptionally able in printing money and creating promises, but is unable to print gold or create oil.

Adding to that ...

BRK share price at the end of 1999 would have bought a similar amount of gold as the BRK share price would have bought twenty-one years later at the end of 2020, after having ploughed back all earnings along with much blood, sweat and tears. The rub has been that government has been exceptionally able in printing money and creating promises, but is unable to print gold

Must be frustrating that for a combined 36 years out of 56 years of blood/sweat/tears (toil) BRK was no better than gold.

1972 to 2021 inclusive 50/50 US stock/gold versus all-stock has yielded the same (near-as) reward, and done so more consistently (higher Sharpe Ratio).

Unlike the 1965 to 1979 years where the Dow/Gold ratio transitioned from high (stocks expensive/gold cheap) to low (stocks cheap/gold expensive) levels, such that 1980 was a bad time to be buying gold, for 2000 to 2021 the Dow/Gold ratio is still relatively high, up at around 20 levels

-

1nvest

- Lemon Quarter

- Posts: 4411

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 691 times

- Been thanked: 1343 times

Re: Challenging the 4% Rule

vand wrote:Again, all of this "I can have my cake and eat it" is based around a refusal to accept that your portfolio will go down and you will be forced to sell from it while it is doing so. That is unavoidable.

Having a plan that allows you to actually switch from being a seller and then buying when the market is down by your suggested 50% also necessitates having a large amount on the sidelines for most of the time.

In distribution you have moved from being a net buyer to being a net seller. Just get used to that!

Just like in accumulation it is silly to stop buying just because the market is going up, in distribution it is silly to stop selling just because the market is going down. If you have no confidence that your portfolio can sustain the income you need then you don't have enough saved and/or you have the wrong asset allocation.

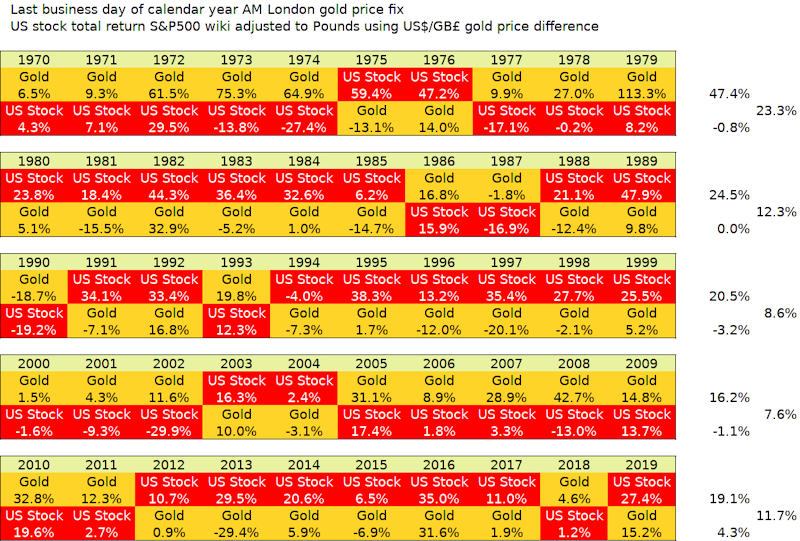

It's nice to more often have one asset that is up most years that you can top slice to service income/withdrawals.

May not happen in all years, so some additional top-slicing needs to be managed to build up additional cash reserves out of good/great years that are set aside for years when nothing might be up.

Figures to the right of the above image are the averages for each decades best/worst rows, and the rightmost figure is the average of those two values.

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Challenging the 4% Rule

AsleepInYorkshire wrote:vand wrote:

But that wasn’t clear from your original post. ultimately all you are doing is adding further insurance that probably won’t be needed, and in nearly all cases you would simply be better off with that cash invested. If it helps you sleep better then that’s one thing button the opportunity cost of that cash is huge.

I have worked in the construction industry for 42 years. A large part of my role is commercial risk assessment and downside protection. Often I will be happy to see a reduced margin if the risk of downside begins to rise. It's a balancing act. But sooner walk away with some margin than no margin or even worse a loss. When various positions upstream from me review the commercial position of individual projects they are keen to know what risks are threatening the project and what can be done to mitigate them "if" they transpire.

I know you have recently joined TLF and I've enjoyed reading your posts. I've reviewed my spreadsheet again last night. I don't find myself disagreeing with your comments. I do, however, find, I simply have an alternative view. The defensive strategies that we all adopt need to be personalised to meet our individual circumstances. There's no set rules for this. We will all perceive risk differently.

I digress. Last nights review indicated that my "cash" strategy works for me. I'm not concerned about potential loss of growth on the cash I hold. That's the fulcrum of balance for me. I've worked on a market drop of 50%. I would imagine some may have worked on more. Some less. "If" the market falls by 50% when I have retired I can use some of my 50% cash to buy the lows. I'm not bothered about strict timing. I can also maintain 4 years income in cash at that time.

In other words I can't lose. And that works for me. I don't want to maximise growth when I've retired if it comes with risk - any risk. I want protection first. "If" my projections transpire I will start retirement with £200K in cash. "If" the market grows by approximately 8.25% per annum I can maintain that cash balance with ease. As the cash balance shrinks I can increase my withdrawal rates well above a notional 4%. I can also adjust my living costs to. "If" I was retired tomorrow my "essential" living costs would be about £1,600 per month. Therefore, my £200K would without any increase keep me for roughly 125 months, let's say 10 years. Noting inflation would shorten this by say 20% And there's a huge amount I can do in the meantime too. I can stack shelves for £10/hr. I can downsize my home. I can find similar work to that I currently do at say £350/day. I could even accept that I need to take some small amounts out of my equities.

I should clarify that the term "essential" living costs refers to a "bunkered" spend. If I maintained my "lifestyle" spend the cash would last for 54 months without a need to draw on equities.

Holding cash as part of a risk management strategy works for me. But holding cash is part of my defensive strategy. It's not the only tool in my box. It won't be everyone's approach though.

AiY

Thanks, I think we are not completely opposed in our view.

I am just reminding us that that investing is about balancing risk and reward. However when it comes to retirement investment planning and investment people seem to automatically strip out all the nuance and view things simply in black and whitel. All the focus is on avoiding the worst outcome, ie all based around risk, and reward is treated ubiquitously as a single criteria of "not running out of money".

Unfortunately there seems to be an irrational albeit understandable fear of the worst case scenario unfolding, and you end up with people being overly cautious instead of just accepting it as risk that goes with investing.

The cash on the sides thing is all well in theory, but in practice do you think that anyone who retired in 2019 with best intentions put all their cash into the market in March 2020? I'll wager they sat on the sidelines crapping themselves despite what their carefully crafted investment policy statement said.. to misquote Mike Tyson, everyone has a plan until they get punched in the face.

-

Will2pass

- Posts: 25

- Joined: September 16th, 2021, 5:42 pm

- Has thanked: 7 times

- Been thanked: 8 times

Re: Challenging the 4% Rule

vand wrote:AsleepInYorkshire wrote:vand wrote:

AiY

The cash on the sides thing is all well in theory, but in practice do you think that anyone who retired in 2019 with best intentions put all their cash into the market in March 2020? I'll wager they sat on the sidelines crapping themselves despite what their carefully crafted investment policy statement said.. to misquote Mike Tyson, everyone has a plan until they get punched in the face.

I would have expected them not to have sold stock after a cradh to fund their annual spending. Instead they would have used 1 years cash reserves.

This year they can sell off and live off the proceeds and begin to replenish the cash pot.

Personally, I wouldn't hold cash to time the market just to use as spending money rather than be forced to sell a depressed investment.

That's how I would have done it anyway.

For clarity, I'm 40 this year and I'm planning on FIRE in the next 12 months (although will side hustle for luxury spends). At 40, 3 years of cash is important to me ,(no dB pension). If I was 65 then I probably wouldn't have cash reserves.

Re: Challenging the 4% Rule

Good thread (75 yrs -18 yrs retd)

Seen some ups and downs myself

The trouble with retirement is that you cannot afford to fail

Then it is down to the individual to decide how to avoid that disastrous scenario

Very personal-my route was to amass a big pot then go to 30/70 portfolio during retirement

Worked for me

Relying on a large equity allocation just before and during retirement is a difficult one for most investors unless you have a massive savings pot(Warren Buffets wife-he recommended 90% S&P 500 and 20% Treasury Bonds for her-she had no interest in investing!)

It would probably mor usually mean that the investor has not saved enough or has a too high SWR or is too optimistic about how the market will perform going forward-5% might be realistic

As I say very personal how risk is handled but the dangers out there are common to all scenarios

xxd09

Seen some ups and downs myself

The trouble with retirement is that you cannot afford to fail

Then it is down to the individual to decide how to avoid that disastrous scenario

Very personal-my route was to amass a big pot then go to 30/70 portfolio during retirement

Worked for me

Relying on a large equity allocation just before and during retirement is a difficult one for most investors unless you have a massive savings pot(Warren Buffets wife-he recommended 90% S&P 500 and 20% Treasury Bonds for her-she had no interest in investing!)

It would probably mor usually mean that the investor has not saved enough or has a too high SWR or is too optimistic about how the market will perform going forward-5% might be realistic

As I say very personal how risk is handled but the dangers out there are common to all scenarios

xxd09

-

scrumpyjack

- Lemon Quarter

- Posts: 4850

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 614 times

- Been thanked: 2702 times

Re: Challenging the 4% Rule

xxd09 wrote:Good thread (75 yrs -18 yrs retd)

Warren Buffets wife-he recommended 90% S&P 500 and 20% Treasury Bonds for her-she had no interest in investing!)

xxd09

I thought Warren B would be better at maths than that

-

vand

- Lemon Slice

- Posts: 758

- Joined: January 5th, 2022, 9:00 am

- Has thanked: 174 times

- Been thanked: 350 times

Re: Challenging the 4% Rule

Will2pass wrote:vand wrote:AsleepInYorkshire wrote:vand wrote:

AiY

The cash on the sides thing is all well in theory, but in practice do you think that anyone who retired in 2019 with best intentions put all their cash into the market in March 2020? I'll wager they sat on the sidelines crapping themselves despite what their carefully crafted investment policy statement said.. to misquote Mike Tyson, everyone has a plan until they get punched in the face.

I would have expected them not to have sold stock after a cradh to fund their annual spending. Instead they would have used 1 years cash reserves.

This year they can sell off and live off the proceeds and begin to replenish the cash pot.

Personally, I wouldn't hold cash to time the market just to use as spending money rather than be forced to sell a depressed investment.

That's how I would have done it anyway.

For clarity, I'm 40 this year and I'm planning on FIRE in the next 12 months (although will side hustle for luxury spends). At 40, 3 years of cash is important to me ,(no dB pension). If I was 65 then I probably wouldn't have cash reserves.

I was replying to AiY's idea that he would be retired with cash on the sides but would "buy in if the market crashed 50%" as a totally unrealistic proposition - which it is. When someone plans such things they imagine the stock market at a 50% discount with nothing else having changed in the world. However it doesn't work like that... the only times when stocks are on sale by that sort of discount is when something so scary is going on that that you think that this time next year it could be down another 50%. A virus that could change the fabric of society as we know it, a major war, a nuclear missile crisis, the end of the financial system as we know it, etc.

The market dropped the most it has in a generation on March 2020. Did any retirees living off their portfolio plough their cash into the market at that time? If not, what makes you think you can do it next time? Even Buffett missed his window of opportunity and is remains stuck with over $100bn on the sidelines.

-

1nvest

- Lemon Quarter

- Posts: 4411

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 691 times

- Been thanked: 1343 times

Re: Challenging the 4% Rule

xxd09 wrote:amass a big pot then go to 30/70 portfolio during retirement

Some don't rebalance that, simply initially load into 30/70 upon retiring and spend bonds first, maybe 3%/year SWR style, where the 70% in 0% real inflation bonds/index linked gilts alone covers more than 23 years, enough to see a 65 year old through to age 88 (relatively high probability of outliving them), whilst the initial 30 in stocks is left to accumulate for those years (that if accumulation occurs at a little over 5% real rate sees the final stock value equal to the start/retirement date inflation adjusted portfolio amount). 30/70 initial, 100/0 final averages 65/35 which for many is 'aggressive enough' and has the tendency to leave a more stock heavy portfolio for younger heirs whilst also totally avoiding earlier years bad sequence of returns risk. Pretty good on the sleep-well-at-night front also (less inclined to have you passing earlier due to financial fears/shock).

That was nicer in periods when inflation bonds could be bought with positive real yields. Less rewarded more, nowadays that's swung the other way around and you need more to buy less. 70 might formerly have bought you 25 years, nowadays maybe just 20 years.

Trivia :

Since 1930's a UK investor into midcaps for 25 years in the worst case (calendar year granularity) saw that increase 275% (3.75 real gain factor) such that 27% initial allocation to that grew to 100% of the original inflation adjusted amount. In the average case over 1100%, median case 750%. So if you spent all of the 73% over 25 years that's a little under 3%/year and in historic cases ended with at least the same, or considerably more (in inflation adjusted terms) at the end of 25 years than what you started with.

Last edited by 1nvest on January 16th, 2022, 4:26 pm, edited 1 time in total.

Re: Challenging the 4% Rule

One practical problem is that the cheap platforms that every amateur investor currently uses gets swamped in a downturn and become effectively inoperable

In fact it is unwise to trade in these conditions as orders may be seriously delayed -not what you want in volatile stockmarket conditions

If you want to practice this type of buying at the bottom a stockbroker is required-expensive

Really a game for the professionals

Amateur investors are better to have a Plan in place and sit out the storm-market corrections usually occur relatively quickly

xxd09

In fact it is unwise to trade in these conditions as orders may be seriously delayed -not what you want in volatile stockmarket conditions

If you want to practice this type of buying at the bottom a stockbroker is required-expensive

Really a game for the professionals

Amateur investors are better to have a Plan in place and sit out the storm-market corrections usually occur relatively quickly

xxd09

Return to “Retirement Investing (inc FIRE)”

Who is online

Users browsing this forum: No registered users and 24 guests