Got a credit card? use our Credit Card & Finance Calculators

Thanks to Rhyd6,eyeball08,Wondergirly,bofh,johnstevens77, for Donating to support the site

Suggested Portfolio Rebalancing guidelines?

-

TUK020

- Lemon Quarter

- Posts: 2044

- Joined: November 5th, 2016, 7:41 am

- Has thanked: 762 times

- Been thanked: 1179 times

Suggested Portfolio Rebalancing guidelines?

I didn't wish to divert the HYP1 is 20 thread, so have pulled it out as a separate one.

What would people suggest as a set of guidelines to manage a portfolio from which a retirement income is being drawn, in order to mitigate risk of over concentration of capital or income?

I am very aware that TJH has a well tuned and finely evolved system, but I think he is an atypical investor in retirement for a number of reasons:

- he obviously takes a very keen interest in his portfolio, and spends a considerable amount of time and effort on the decisions, record keeping, and patiently answering questions.

- he has a large portfolio in terms of number of holdings, so already has wide diversification

- given his track record and length of time at it, He almost certainly has a large portfolio in capital terms - I only mention this is that he can draw relatively tight % differences from median, without resulting transaction costs becoming significant.

- he is still building his pot.

- his top slicing/rebalancing seems to be part of his secret sauce to capture gains from volatility

So for someone who wants to retire now, and has a fair % of their portfolio in a hyp, and would like to:

- take income with appropriate derisking

- spend minimal time monitoring the portfolio

- provide rebalancing commensurate with risk reduction

- minimise trading costs:

How often does the portfolio need to be reviewed?

What are the "need to do something trigger points"

How do these scale with number of holdings?

Can one assume that you can recycle the proceeds into the same portfolio? Or dos one need a new investment selection activity* to run permanently?

It would be very interesting to hear folks thoughts on this.

tuk020

* one possibility I am mulling over to recycle top-slicing gains into a sub-portfolio of ITs to keep minimum attention required

What would people suggest as a set of guidelines to manage a portfolio from which a retirement income is being drawn, in order to mitigate risk of over concentration of capital or income?

I am very aware that TJH has a well tuned and finely evolved system, but I think he is an atypical investor in retirement for a number of reasons:

- he obviously takes a very keen interest in his portfolio, and spends a considerable amount of time and effort on the decisions, record keeping, and patiently answering questions.

- he has a large portfolio in terms of number of holdings, so already has wide diversification

- given his track record and length of time at it, He almost certainly has a large portfolio in capital terms - I only mention this is that he can draw relatively tight % differences from median, without resulting transaction costs becoming significant.

- he is still building his pot.

- his top slicing/rebalancing seems to be part of his secret sauce to capture gains from volatility

So for someone who wants to retire now, and has a fair % of their portfolio in a hyp, and would like to:

- take income with appropriate derisking

- spend minimal time monitoring the portfolio

- provide rebalancing commensurate with risk reduction

- minimise trading costs:

How often does the portfolio need to be reviewed?

What are the "need to do something trigger points"

How do these scale with number of holdings?

Can one assume that you can recycle the proceeds into the same portfolio? Or dos one need a new investment selection activity* to run permanently?

It would be very interesting to hear folks thoughts on this.

tuk020

* one possibility I am mulling over to recycle top-slicing gains into a sub-portfolio of ITs to keep minimum attention required

-

tjh290633

- Lemon Half

- Posts: 8285

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 919 times

- Been thanked: 4137 times

Re: Suggested Portfolio Rebalancing guidelines?

TUK020 wrote:I didn't wish to divert the HYP1 is 20 thread, so have pulled it out as a separate one.

What would people suggest as a set of guidelines to manage a portfolio from which a retirement income is being drawn, in order to mitigate risk of over concentration of capital or income?

So for someone who wants to retire now, and has a fair % of their portfolio in a hyp, and would like to:

- take income with appropriate derisking

- spend minimal time monitoring the portfolio

- provide rebalancing commensurate with risk reduction

- minimise trading costs:

How often does the portfolio need to be reviewed?

What are the "need to do something trigger points"

How do these scale with number of holdings?

Can one assume that you can recycle the proceeds into the same portfolio? Or dos one need a new investment selection activity* to run permanently?

It would be very interesting to hear folks thoughts on this.

tuk020

* one possibility I am mulling over to recycle top-slicing gains into a sub-portfolio of ITs to keep minimum attention required

I deleted the section about me, but assuming that the portfolio has been built, and is currently equally weighted, then I would set limits for deviation from that equal weighting, both upper and lower. Those limits will vary with the number of holdings. With 20 holdings, nominally 5% each, you could allow up to 10% if you wished. Maybe 2.5% for the lower limit. If the portfolio was fairly large, say with an average holding value of the order of £20,000, then those limits could be tightened if the owner wished. Probably 7.5% at the top end or 3% at the lower end. I would not advocate the use of absolute values, but use the median or average holding weight as your yardstick.

I changed to a fomula based on median holding value, as I found that easier to manage. As the portfolio grew, and it will for reasons outside the owner's control, I narrowed my limits to 150% of the median at the top end and 66% at the lower end. You can use the average holding value if it makes you happier, but the results may be considerably different. Currently the difference is about 4%, but it can be higher or lower. If you use twice the median, then adjustments are likely to be infrequent. With my own limits I trimmed back overweight holdings on 5 occasions in 2018, 3 in 2019 and 10 in 2020. Usually it is just the odd share that starts to head northwards, this year William Hill, which has been trimmed back twice in September as its price rose because of takeover talk. AstraZeneca was trimmed back in 2018 and again in 2020. With wider limits 2 or 3 shares a year might need trimming, or none at all. It's the simple fact that some shares rise and some fall at the same time.

The lower limit was originally used to select a share for topping up, but then I developed my method which is now found in the HYPTUSS spreadsheet, developed by Kilorian and available on one of the forum boards. You could use it to cull a share if it also had a low yield. I contemplate selling a holding if the yield falls below about half the yield on the FTSE100 index, or 2% if you prefer. It doesn't pay to be too hasty, as an increase in dividend can change things. Likewise a share can emulate the rocket, and then turn into the stick.

So yes, the proceeds of topping up can be reinvested in the same portfolio, either in a new share or into suitable existing holdings.

How often? I would suggest that it is not left too long between reviews. A cursory glance one a month is probably a good thing, once a quarter might be too long and annually is far too long in my view. You will end up with a wide range of weightings and possibly the odd one which is very heavy. I started trimming when I found that Lloyds TSB had got to over 16% of my portfolio in 1997, and AstraZeneca was also about 12%, so I decided that this was dangerous and trimmed both back below 10%, which I judged to be reasonable with a portfolio of just under 20 shares. Another example is Imperial Tobacco, which was rising rapidly in the noughties, and I sold rights twice and trimmed back 4 times between 2002 and 2008. IMT was spun out of Hanson in 1996 at about 515p, trimmed at prices between £10 and £26, and was trimmed again in 2016 at over £35.

If you don't want to be bothered, then go for a smaller portfolio of ITs, where the job is done for you.

TJH

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10032 times

Re: Suggested Portfolio Rebalancing guidelines?

TUK020 wrote:

What would people suggest as a set of guidelines to manage a portfolio from which a retirement income is being drawn, in order to mitigate risk of over concentration of capital or income?

It's a good question.

Would any process-related answers change that much between the building and the draw-down stages though?

I only ask because for my personal approach to those issues, I expect the mitigation strategies themselves to stay broadly the same during both periods, with the only major difference being the amount of capital from outside the existing portfolio available to process them during each stage..

By that I mean that currently, whilst I'm still working and building my income-portfolio, I'm able to use new capital from wages and also ongoing received-dividends to manage and build the income-portfolio in a way that generally maintains a balanced approach to income and capital across the portfolio.

When I'm in draw-down, the 'new capital from wages' option will disappear, and I expect to draw down around 80% of received dividends to supplement my retirement, leaving around 20% spare as part of my risk-mitigation approach to drawing dividends.

I then largely expect that spare 20% of dividend-income to then be available to use on the existing balancing strategies that I'm already using. Whether that amount of capital alone will be able to cope with any and all diversification-needs that might crop up from that point is yet to be seen, of course, but I just wanted to ask how you do things now, and how your current processes might stop being relevant just because you might soon go into draw-down?

I should add that whilst it's clear that there is likely to be a big difference between the capital currently 'available' for these portfolio-management tasks, and the 20% 'spare' income available during draw-down for the same processes, it's been clear to me over the years that the vast majority of my current 'fresh-capital' is not often used for 'actionable rebalancing processes', and is more often than not either used for a bit of 'try to float all boats over the years' topping up, or used to purchase a new holding completely, which has generally meant a new income-related Investment Trust for many recent years, so whilst it might seem that the same processes might have access to big differences in funding, depending on whether I'm still working or if I were to be in draw-down, I don't imagine the actual re-balancing processes to be affected all that much by the differences in funding levels - it'll just mean I won't be topping up as much (for general reasons - and not necessarily for 'actionable' reasons..) or buying new holdings as much, which will hopefully by then not be too much of a problem..

On the specific question about 'trigger points', I think it's very important to make them wide enough so that the normal ebb and flow of the markets aren't flashing red lights all the time, so setting them wide enough so that an eventual outlier really *is* an outlier is going to be important. I don't *just* look at price or yield levels, and do include a time-element in my processes to allow for what might be seen to be 'spikes', which may with hindsight not have necessarily required instant-action once a trigger might be met 'momentarily', so maybe that's worth considering as part of your plans if you don't already take time into account in your own processes, so ensuring that as well as any 'diversification window levels' having to be broken, they need to stay broken for an appropriate length of time before action might actually warrant being taken......I can't imagine being able to do that sort of thing without some sort of spreadsheet, so I'll assume that this is the way you're expecting to set and monitor these processes too?

As an aside, I plan on having around 3 years worth of required-income available as cash or near-cash when I do take the plunge of finishing work, so the above 20% spare 'income' would be a completely separate layer of income-safety again, to use first as and when required, with the 3-year-income capital held back as the final safety-net.

Cheers,

Itsallaguess

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Suggested Portfolio Rebalancing guidelines?

Just as an aside, IAAG tells us that he plans to spend only say 80% of his income from his portfolio and will reinvest the balance and that he plans to have three years expenditure in near cash as his safety buffer.

That is more or less what I have and have had since I retired 25 years ago. After the experience of the 2008 financial crisis and then this year which in many ways has been even more severe, I conclude that as a safety buffer that is quite excessive. I have never had cause to even think about touching the safety buffer of three years income and this year for instance, without even trying, my expenditure is only about 2/3rds of normal, less than that if I count long haul travel being cancelled as well.

That is not to say we should not have that much in cash or near cash but I think of it as asset allocation rather than a specific buffer or safety margin or whatever. Quite apart from the enforced saving this year, most budgets will allow for some voluntary trimming of expenses and that is what I would do if I had to.

As for rebalancing guidelines, I could not possibly knock the TJH method if you seek a mechanical method. This year has been different but I would normally look seriously at my portfolio once or twice a year only. My strategic thoughts are usually in January when I have done my reports for the calendar year just ended. My records are a 'numbers' statement drawn up along the lines which you see in many IT reports with columns showing value at the start of the year, sales or purchases, then changes in the market value and finally value at the year end. I also show somewhere the trailing yield for the year, and a commentary for myself. Doing that I find concentrates the mind and shows up weaknesses or otherwise.

I run two portfolios, an income one and a growth one and tend to harvest gains (if any!) from the growth one to add to the income one. I do not do much rebalancing as such but do tinker and am very happy to because I think any portfolio needs that from time to time.

Not really much help to anyone I am sorry to say.

Dod

That is more or less what I have and have had since I retired 25 years ago. After the experience of the 2008 financial crisis and then this year which in many ways has been even more severe, I conclude that as a safety buffer that is quite excessive. I have never had cause to even think about touching the safety buffer of three years income and this year for instance, without even trying, my expenditure is only about 2/3rds of normal, less than that if I count long haul travel being cancelled as well.

That is not to say we should not have that much in cash or near cash but I think of it as asset allocation rather than a specific buffer or safety margin or whatever. Quite apart from the enforced saving this year, most budgets will allow for some voluntary trimming of expenses and that is what I would do if I had to.

As for rebalancing guidelines, I could not possibly knock the TJH method if you seek a mechanical method. This year has been different but I would normally look seriously at my portfolio once or twice a year only. My strategic thoughts are usually in January when I have done my reports for the calendar year just ended. My records are a 'numbers' statement drawn up along the lines which you see in many IT reports with columns showing value at the start of the year, sales or purchases, then changes in the market value and finally value at the year end. I also show somewhere the trailing yield for the year, and a commentary for myself. Doing that I find concentrates the mind and shows up weaknesses or otherwise.

I run two portfolios, an income one and a growth one and tend to harvest gains (if any!) from the growth one to add to the income one. I do not do much rebalancing as such but do tinker and am very happy to because I think any portfolio needs that from time to time.

Not really much help to anyone I am sorry to say.

Dod

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: Suggested Portfolio Rebalancing guidelines?

I'm following a system based on HYPTUSS and Terry's method.

To minimise trading, I have adopted an upper limit for any given share of 2x median. I've found this rarely triggers, notable examples being Diageo and Astrazeneca. Like IAAG I temper this further by adding a time dimension to avoid spikes, which recently came into play with Admiral. This went to 2.27x median and therefore triggered a "watching brief". I usually leave it a week to see if the burst is maintained, but this week ADM has dropped relative to other shares, now being at 1.85x median. I did not trim it, though it is now easily my biggest share in capital weight.

The other trigger point is for yield, which if it falls to 2% or half the market value, I would trim. This does not happen often and at the moment, this limit is dubious in view of the dividend question marks. The last share sold for this reason was BT which cancelled and flagged that resumption would be too far in the future for me, and at too a lower rate to be worth the wait.

I'm pulled in two ways with ADM as it's yield is currently very low: on the one hand, I could trim and immediately earn more elsewhere, on the other, ADM could well resume specials next year.

Additionally, I withdraw 80% of my dividends and re-invest the remainder. I also have around 9 months to a year of cash in reserve. This used to be two years, but I decided it would be better to invest more and keep a lower IR. So far, I haven't need to use it. My starting point was the probability that at some point we would have a 50% drop in dividend income and that it would take between 5 and 7 years to catch up.

Arb.

To minimise trading, I have adopted an upper limit for any given share of 2x median. I've found this rarely triggers, notable examples being Diageo and Astrazeneca. Like IAAG I temper this further by adding a time dimension to avoid spikes, which recently came into play with Admiral. This went to 2.27x median and therefore triggered a "watching brief". I usually leave it a week to see if the burst is maintained, but this week ADM has dropped relative to other shares, now being at 1.85x median. I did not trim it, though it is now easily my biggest share in capital weight.

The other trigger point is for yield, which if it falls to 2% or half the market value, I would trim. This does not happen often and at the moment, this limit is dubious in view of the dividend question marks. The last share sold for this reason was BT which cancelled and flagged that resumption would be too far in the future for me, and at too a lower rate to be worth the wait.

I'm pulled in two ways with ADM as it's yield is currently very low: on the one hand, I could trim and immediately earn more elsewhere, on the other, ADM could well resume specials next year.

Additionally, I withdraw 80% of my dividends and re-invest the remainder. I also have around 9 months to a year of cash in reserve. This used to be two years, but I decided it would be better to invest more and keep a lower IR. So far, I haven't need to use it. My starting point was the probability that at some point we would have a 50% drop in dividend income and that it would take between 5 and 7 years to catch up.

Arb.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Suggested Portfolio Rebalancing guidelines?

Arb's experience with the cash reserve is similar to mine. I may reduce my cash reserve but I'll think on it.

Re Admiral, they reinstated their special with their recent interim dividend surely? They seem to be one of the shares which is pretty much back to normal, or am I confused?

Dod

Re Admiral, they reinstated their special with their recent interim dividend surely? They seem to be one of the shares which is pretty much back to normal, or am I confused?

Dod

-

dealtn

- Lemon Half

- Posts: 6098

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 443 times

- Been thanked: 2343 times

Re: Suggested Portfolio Rebalancing guidelines?

TUK020 wrote:So for someone who wants to retire now, and has a fair % of their portfolio in a hyp, and would like to:

- take income with appropriate derisking

- spend minimal time monitoring the portfolio

- provide rebalancing commensurate with risk reduction

- minimise trading costs:

Sounds like someone with those objectives should outsource all the decisions and pay a small cost to relieve them of all those processes. A single set of sell and buy decisions, transferring the current portfolio to a small number of "tracker" type funds would do the job.

-

monabri

- Lemon Half

- Posts: 8426

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3443 times

Re: Suggested Portfolio Rebalancing guidelines?

Dod101 wrote:Arb's experience with the cash reserve is similar to mine. I may reduce my cash reserve but I'll think on it.

Re Admiral, they reinstated their special with their recent interim dividend surely? They seem to be one of the shares which is pretty much back to normal, or am I confused?

Dod

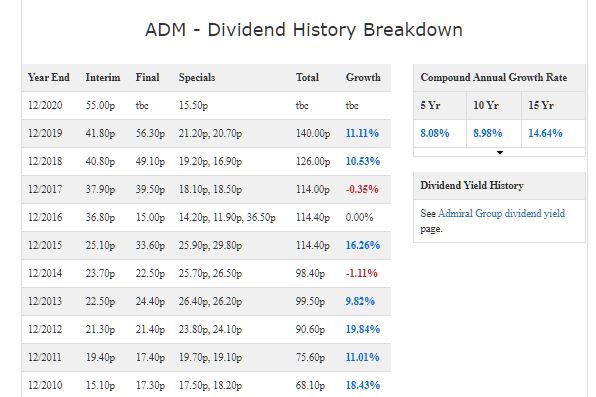

Admiral paid both an interim and a special dividend on 2nd October 2020. The interim dividend was significantly increased over the previous year with a reduction in the special (see table "Dividend History Breakdown)). The final dividend is yet to be announced but the fact that they paid the interim plus a special augurs well.

source: https://www.dividenddata.co.uk/dividend ... y?epic=ADM

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Suggested Portfolio Rebalancing guidelines?

Thanks monabri. I did not have time to look this morning but at the interim stage (results to 30 June), they paid an interim dividend of 55p plus a special of 15p and in addition paid the deferred special from the Final results earlier in the year of 20.7p. As per my recollection that is bringing them back to normal so Arb is not correct. If he includes the specials (and I see no reason not to because they have been paid with every declaration now for many years), the yield is over 5%.

Dod

Dod

-

daveh

- Lemon Quarter

- Posts: 2204

- Joined: November 4th, 2016, 11:06 am

- Has thanked: 413 times

- Been thanked: 809 times

Re: Suggested Portfolio Rebalancing guidelines?

What do I do:

I use HYPTUSS to help with top ups - so I don't end up adding too much to anyone holding. I also have a look at a shares % of cost as well as the % of portfolio value. This is so I don't add too much to a share that keeps falling in value.

I keep an eye on shares that go over 2x median value with a view to trimming them. So far that has only been SEGRO which has been trimmed twice and it is again back well over the median value and has been joined by LGEN, AZN, PSN, SSE and VWRL ( but the latter gets more lee way as a collective). At present I've not done any more trimming as I said (to myself) I'd wait until the covid situation settled down, as yields and values were very uncertain.

I use HYPTUSS to help with top ups - so I don't end up adding too much to anyone holding. I also have a look at a shares % of cost as well as the % of portfolio value. This is so I don't add too much to a share that keeps falling in value.

I keep an eye on shares that go over 2x median value with a view to trimming them. So far that has only been SEGRO which has been trimmed twice and it is again back well over the median value and has been joined by LGEN, AZN, PSN, SSE and VWRL ( but the latter gets more lee way as a collective). At present I've not done any more trimming as I said (to myself) I'd wait until the covid situation settled down, as yields and values were very uncertain.

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10032 times

Re: Suggested Portfolio Rebalancing guidelines?

Dod101 wrote:

[Having three years expenditure in cash or near cash] is more or less what I have and have had since I retired 25 years ago.

After the experience of the 2008 financial crisis and then this year which in many ways has been even more severe, I conclude that as a safety buffer that is quite excessive.

I have never had cause to even think about touching the safety buffer of three years income and this year for instance, without even trying, my expenditure is only about 2/3rds of normal, less than that if I count long haul travel being cancelled as well.

That is not to say we should not have that much in cash or near cash but I think of it as asset allocation rather than a specific buffer or safety margin or whatever. Quite apart from the enforced saving this year, most budgets will allow for some voluntary trimming of expenses and that is what I would do if I had to.

Arborbridge wrote:

I also have around 9 months to a year of cash in reserve.

This used to be two years, but I decided it would be better to invest more and keep a lower IR.

So far, I haven't need to use it.

Thanks both - and it's interesting, especially coming from two income-investors who've been through both the financial crisis and into the virus episode that we're currently moving through, to hear that you both started out with a larger emergency cash buffer, and have then both separately come to the same conclusion that it doesn't have to be as large as you'd originally planned for...

I do absolutely take Dod's very important point, which is one that I've experienced myself during this pandemic period, which is that actually, *during* the periods where we might have planned to have to access such funds, such as right now, perhaps, there is often good scope, and some opportunity (which may even be a tendency, given how our human natures work...) to considerably cut back anyway, almost like a 'reflex financial-action' perhaps, and so catering for long periods of 'normal activity' to be paid out of such emergency funds might often be over-egging the situation anyway, because there would *be* no 'normal situation' to be coping with, and there may well be cost-cutting that happens by default that then means any emergency funds would be likely to last longer than normal anyway...

I'm still unsure if I would need to go through the potential process of over-egging that emergency fund myself though, before also cutting back if I discovered exactly the same benefits as you both have - I think it might be one of those lessons that we each have to have 'proved' ourselves, and given how risk-averse I am in that area, I will probably still tend towards over-egging initially, and then hopefully gain some of your confidence over time, but hearing both of your experiences in this area at least gives me some level of confidence that such an 'overegging period' might now be a short one..

Cheers,

Itsallaguess

-

Darka

- Lemon Slice

- Posts: 773

- Joined: November 4th, 2016, 2:18 pm

- Has thanked: 1819 times

- Been thanked: 705 times

Re: Suggested Portfolio Rebalancing guidelines?

Itsallaguess wrote:Thanks both - and it's interesting, especially coming from two income-investors who've been through both the financial crisis and into the virus episode that we're currently moving through, to hear that you both started out with a larger emergency cash buffer, and have then both separately come to the same conclusion that it doesn't have to be as large as you'd originally planned for...

I've gone back and forth over how much reserve to have between lots and not so much.

My plan is to have 1 year of income as a float by the end of 2022 (when I aim to retire), divide that by 12 and that's our monthly income for 2023.

During 2023, all dividends, pensions, etc refill the float - repeat every year, which gives me a rolling 1 years income in the float.

I will then have an additional 1 year spending as a reserve, everything else will get reinvested to grow my safety margin.

The reserve would almost (most likely) be inclusive of an emergency fund, so that I don't have another separate pot of cash sitting there.

Sorry for hijacking the thread.

regards,

Darka

-

vrdiver

- Lemon Quarter

- Posts: 2574

- Joined: November 5th, 2016, 2:22 am

- Has thanked: 552 times

- Been thanked: 1212 times

Re: Suggested Portfolio Rebalancing guidelines?

We keep 3 years of cash (or near cash) reserve, and aim to draw 75% of dividend income from the HYP (£3 for me, £1 to reinvest).

This year, with Covid, the cash outflow has been reduced (as per Dod's point about reduced travel etc.) BUT, we have a monthly budget that accrues the received income into various pots, so our cash pot for e.g. travel now includes most of 2020's allocated, but as yet unspent, budget. Next year (or the year after, if it takes the best part of next year to return to normal) we will continue to accrue travel funds, but be able to spend a backlog of 2020's unused budget.

In the meantime, assuming dividends recover, we will replenish our IR from excess dividends before resuming investments. The point I am making is that with the 3x IR AND a safety margin on HYP income (or whichever income replacement you plan on having in retirement) it is possible to be more flexible than with a reduced IR that needs to be both protected and rebuilt asap in the event of a GFC or pandemic.

If, of course, your travel plans etc. are not restricted by available cash, so there is no "catching up" required after things get back to normal, then the issue of whether to have the extra buffer to dip into or not becomes moot!

To the OP's question on rebalancing - I think IAAG answered pretty much as I plan on doing. We are a little ahead, already being in drawdown, and excess income does tend to go to ITs rather than individual shares, whilst rebalancing of existing shares is a relaxed affair (unlike TJH's more rigorous approach) where a 2x mean of the top 20 holdings is used as a threshold for maximum value, but subject to review as to why a share has surged (and whether I think it has a story that suggests further momentum upwards).

VRD

This year, with Covid, the cash outflow has been reduced (as per Dod's point about reduced travel etc.) BUT, we have a monthly budget that accrues the received income into various pots, so our cash pot for e.g. travel now includes most of 2020's allocated, but as yet unspent, budget. Next year (or the year after, if it takes the best part of next year to return to normal) we will continue to accrue travel funds, but be able to spend a backlog of 2020's unused budget.

In the meantime, assuming dividends recover, we will replenish our IR from excess dividends before resuming investments. The point I am making is that with the 3x IR AND a safety margin on HYP income (or whichever income replacement you plan on having in retirement) it is possible to be more flexible than with a reduced IR that needs to be both protected and rebuilt asap in the event of a GFC or pandemic.

If, of course, your travel plans etc. are not restricted by available cash, so there is no "catching up" required after things get back to normal, then the issue of whether to have the extra buffer to dip into or not becomes moot!

To the OP's question on rebalancing - I think IAAG answered pretty much as I plan on doing. We are a little ahead, already being in drawdown, and excess income does tend to go to ITs rather than individual shares, whilst rebalancing of existing shares is a relaxed affair (unlike TJH's more rigorous approach) where a 2x mean of the top 20 holdings is used as a threshold for maximum value, but subject to review as to why a share has surged (and whether I think it has a story that suggests further momentum upwards).

VRD

-

kempiejon

- Lemon Quarter

- Posts: 3574

- Joined: November 5th, 2016, 10:30 am

- Has thanked: 1 time

- Been thanked: 1190 times

Re: Suggested Portfolio Rebalancing guidelines?

I rebalance annually when I sell unsheltered and move into the ISA, I did focus on those holding producing the most dividends to minimise dividend income tax though I did have bill last couple of tax years. I top up the best looking income producers in my ISA that wouldn't upset my concentration limits; a handful of shares historically. I'm adding new money unsheltered and mopping up dividends within and without the ISA. When I start drawdown I hope the natural yield will be sufficient and leave a small surplus; I'll start with that 3 years cash buffer too so some minor adjustment couldbe done with the surplus.

Once in drawdown - some time within the next 3 years - I expect there might still be a few years of unsheltered holdings to shuffle across where I can again look at balance. I currently do not have a plan for ongoing maintenance other than takeover or other corporate action, market trading or surplus dividends/cash buffer ploughed back in; perhaps over the years if the portfolio does come right out of kilter I might be forced to look again but my HYP is over 30 shares and nothing even remotely looks heavy to me so it'd take a pretty dramatic increase in a couple with nothing from the balance to get worryingly wonky.

I'm not sure it'll bother me even if I did get unbalanced, these things do have a way of righting themselves in my portfolio - BT used to be my largest holding. I do contemplate selling lower yields to improve income, that might guide me.

Once in drawdown - some time within the next 3 years - I expect there might still be a few years of unsheltered holdings to shuffle across where I can again look at balance. I currently do not have a plan for ongoing maintenance other than takeover or other corporate action, market trading or surplus dividends/cash buffer ploughed back in; perhaps over the years if the portfolio does come right out of kilter I might be forced to look again but my HYP is over 30 shares and nothing even remotely looks heavy to me so it'd take a pretty dramatic increase in a couple with nothing from the balance to get worryingly wonky.

I'm not sure it'll bother me even if I did get unbalanced, these things do have a way of righting themselves in my portfolio - BT used to be my largest holding. I do contemplate selling lower yields to improve income, that might guide me.

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: Suggested Portfolio Rebalancing guidelines?

Dod101 wrote:Arb's experience with the cash reserve is similar to mine. I may reduce my cash reserve but I'll think on it.

Re Admiral, they reinstated their special with their recent interim dividend surely? They seem to be one of the shares which is pretty much back to normal, or am I confused?

Dod

Yes, quite right. When I wrote that, I had lost some of my marbles!

There have been so many changes this year.

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: Suggested Portfolio Rebalancing guidelines?

Arborbridge wrote:Dod101 wrote:Arb's experience with the cash reserve is similar to mine. I may reduce my cash reserve but I'll think on it.

Re Admiral, they reinstated their special with their recent interim dividend surely? They seem to be one of the shares which is pretty much back to normal, or am I confused?

Dod

Yes, quite right. When I wrote that, I had lost some of my marbles!

There have been so many changes this year.

I notice in HYPTUSS I took the cautious route of using 70p, since that was "in the bag". If we assume the next div is 56p or more, the situation will be far better - a yield of over 4% seems likely for the next year.

However, that won't take Admiral far from the bottom of my topup table, so whatever the yield is, in that respect is not critical for me. Of course, if I trim the share, it will rise up the table!

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10032 times

Re: Suggested Portfolio Rebalancing guidelines?

TUK020 wrote:

How often does the portfolio need to be reviewed?

This is a question close to my heart...

We're all different, of course, but I suspect that many of us that frequent this site regularly have such a keen interest in investing that there's barely a 7 day period in any given year where either on-line accounts aren't accessed or a spreadsheet isn't opened and updated to enable a quick 'status update' to be carried out...

That's a habit - not a 'review'...

It's a habit - not 'portfolio management'...

I ask myself all the time what the ratio might be between instances of monitoring and instances of 'required-action'...

Like many here, I'd probably be too embarrassed to actually say how high that ratio actually is...

I'll try to answer your question -

Every three months it'll need reviewing, and even that'll be too frequent, and twice a year will no doubt do.

I know that, and I should do that, but will I ever get there? No.

Will I try? Yes.

And I'll fail, like most of us here....

Cheers,

Itsallaguess

-

tjh290633

- Lemon Half

- Posts: 8285

- Joined: November 4th, 2016, 11:20 am

- Has thanked: 919 times

- Been thanked: 4137 times

Re: Suggested Portfolio Rebalancing guidelines?

Itsallaguess wrote:I ask myself all the time what the ratio might be between instances of monitoring and instances of 'required-action'...

I put the number of "required actions" on another thread somewhere. So far this year I have had 10 such, which is unusually high, more normal would be 2, 3 or 4. In 2019 there were only 3.

Of the 10, 3 actually took place simultaneously, so there were 7 occasions. I normally look at my portfolio each night when the exchanges are open. Things can move quickly, although often there is little relative movement of shares. The current week is an exception, with very substantial changes, but nothing going out of bounds.

Going away for a 4 week cruise can give you big surprises when you get back home.

TJH

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10032 times

Re: Suggested Portfolio Rebalancing guidelines?

tjh290633 wrote:

Going away for a 4 week cruise can give you big surprises when you get back home...

They might be large plates, but you can still put small portions on you know...

:O)

Cheers,

Itsallaguess

-

Wizard

- Lemon Quarter

- Posts: 2829

- Joined: November 7th, 2016, 8:22 am

- Has thanked: 68 times

- Been thanked: 1029 times

Re: Suggested Portfolio Rebalancing guidelines?

Itsallaguess wrote:tjh290633 wrote:

Going away for a 4 week cruise can give you big surprises when you get back home...

They might be large plates, but you can still put small portions on you know...

:O)

Cheers,

Itsallaguess

Heading off topic a bit, but in addition to 'income shocks' if one is lucky enough to have a long drawdown phase there is likely to be a need for 'lumpy capital spend' such as changing cars, new kitchens, major maintenance such as repainting, etc.

Return to “High Yield Shares & Strategies - General”

Who is online

Users browsing this forum: No registered users and 25 guests