Dod101 wrote:1nvest wrote:TUK020 wrote:A different question: If one followed the the 3 way split of HYP/BRK/FT250, what simple/mechanical/low cost way of determining how to pull income from this portfolio would you propose that would involve the minimum of attention or stress from the portfolio manager?

AJC5001 wrote:Given that the HYP you are using was the original HYP1 that Pyad started, and the dividends were assumed to be extracted from the portfolio as they arose, I would be grateful if you could explain what basis for reinvestment you are assuming in any of your comparisons.

BRK pays no dividends, a accumulation FTSE 250 fund can be held. When so then in drawdown even if HYP1 were paying 6% yield that's 2% or less of the whole portfolio value i.e. likely you'd also be selling some shares to service SWR income, typically from whatever is the relative highest valued.

The method I use is to draw SWR monthly, login a week or so before end of month and sell enough shares from the highest valued holding to cover that months 'wage' and then T+3 login again to transfer the sale proceeds to my spending/regular account. I'm with ii so that monthly sell trade is 'free'. None of my holdings pay dividends, if they did then I'd just revise the size of the sell market order to discount any dividends that had dropped into the account.

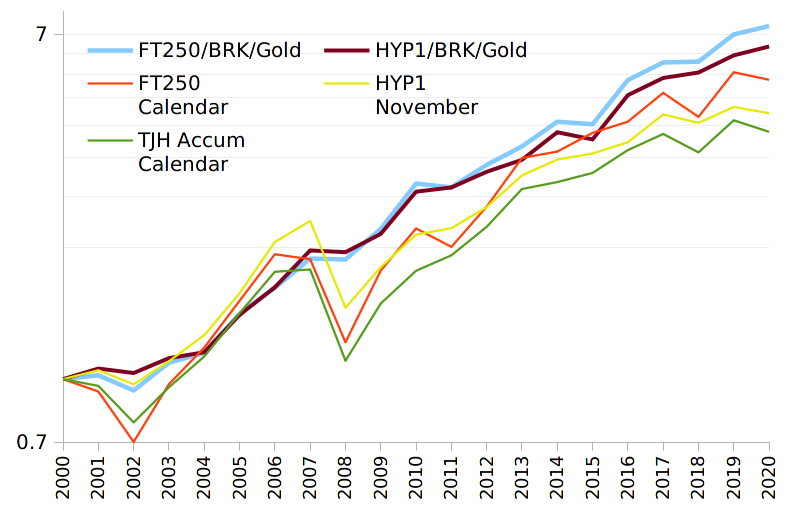

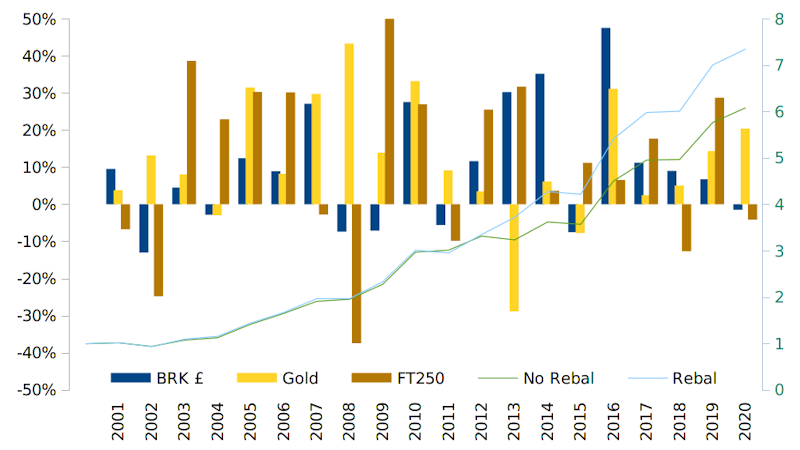

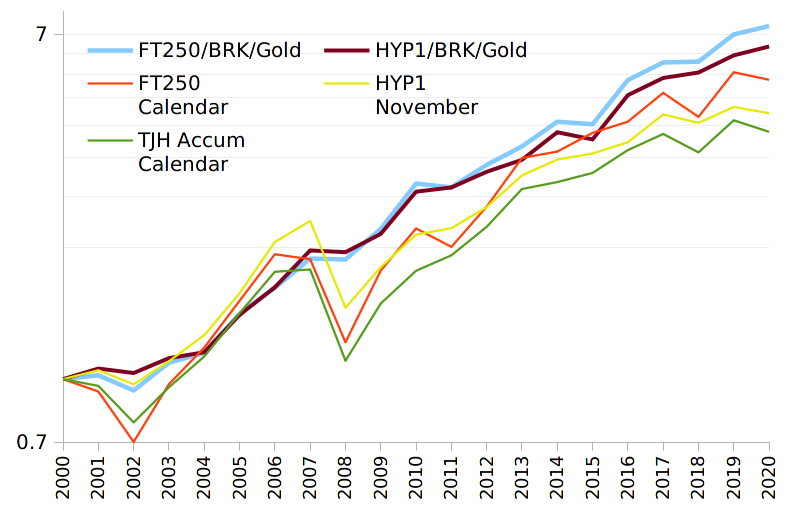

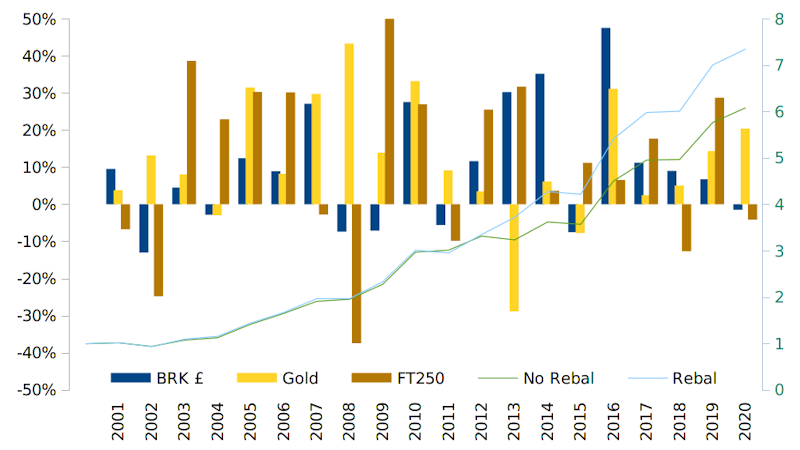

Non rebalanced BRK/FT250/HYP1 (capital only, spending dividends) had near the same total return as HYP1 alone with dividends accumulated. That would however have drifted to being around 42% in each of BRK and FT250, 16% in HYP1 if nothing were being drawn from either BRK or FT250, so in practice you might have opted to 'rebalance' at some points (or maybe not).

If you consider FT100 to be a form of global exc. US type holding, 50/50 with US (BRK) is a World type proxy. Adding in FT250 is small cap in US scale and is more domestic like (so somewhat 33/67 UK/World), but where much the fees/costs/withholding taxes are reduced. Something like

this comparison.

What you do may be fine whilst you are in good nick as far as the brain is concerned and you have the interest but I can assure you that it is a lot easier if all you need to do is transfer some naturally arising income (aka 'dividends') to your bank account or even better get the platform to do it for you. Then you do not have to risk selling into weakness now and again and you have no need to go through the selling and transfer exercise every month.

Fundamentally it all comes down to total return (obviously, the aggregate of dividends plus capital gain/loss) You appear to be at one end of the spectrum; I am more or less at the other. I suspect that I have less admin than you do.

Dod

I actually draw a relatively low 'wage' (ongoing SWR percentage amount is less than the suggested 4% rule-of-thumb SWR), and not always the same each month, more a amount in reflection of anticipated spending that month (or rather a amount that pays off the current months credit cards amounts plus some spending/cash for the month). If a unexpected higher cost occurs then cash is just T+3 days away. With dividends the cash flow would be problematic, not enough some months, too much in others, and possible dividend cuts ...etc. I guess OK if dividends were considerably more than enough, 5% when spending just 2% and the surplus cash accumulated was being left to be periodically reinvested, perhaps once yearly or whatever (0.5% stamp + trade cost involved to do so).

In practice I actually trade relatively little and otherwise would just log in once/month anyway to primarily check nothing odd had occurred with the account. The addition of a single sell trade action on top is minor. And that keeps more of capital working. No need for 10% of capital being in 'cash', or dividends having been declared/deducted but in transit to being paid after 30/whatever days (time between ex-div and pay dates).

Fundamentally it all comes down to total return

Total return wise my way is the better. Other people pay my 'dividends' via buying shares at perhaps 2 times book value whilst the firm sees no decline in its book value, rather than the firms paying the dividend and seeing their book value reduced by that amount. Where the 'dividend' matches my preferred timing and amount. And avoids having to keep a separate cash pot, 90/10 for instance will tend to lag 100/0. There's also none of the 30 day lag between ex-div and pay dates during which time that capital is in other peoples pockets.

That said, I am considering moving into a HYP, swapping out FT250 index ETF for a HYP1 buy and hold style due to possible forward time issues with ETF's

viewtopic.php?f=49&p=438370#p438370 As part of a third each BRK/HYP1/gold type asset allocation the third in HYP1 style would be too little dividends such that some share selling would still generally be required. The differences I see in historic total returns are just 'noise'

I used to have concerns with its non-tinkered approach, opining that led to concentration risk but more recently opine that isn't a issue, could be left for decades as-is other than enforced actions (takeovers/whatever). I see it more a case of 15 equal weighted diversity across different sectors transitions to being more like holding diversity of 4 across different sectors (best performers) along with a 5th set of a bunch of other sectors (collective laggards) after a 20 odd year transition period. That's still 'diverse enough'.

There's also some appeal in that when others are dumping the concept that's suggestive of potential 'value'.

I did look at Investment Trusts but came to the conclusion that any alpha add was generally retained by the managers. Me taking on additional risk for their benefit. Whether to hold IT's or not isn't a issue when holding a FT250 tracker as the FTSE 250 index includes around 20% of its components being IT's.

With regard to 'selling when down' well that's what diversification offsets. One down less than others, or even one up as others are down, and when selling some of the highest valued asset to provide income you're still reducing relatively high

In that image non rebalanced lagged rebalanced as it did become too tilted, gold rose strongly compared to the others and then endured a sizeable hit. So whilst non rebalancing within the HYP1 might be considered as OK across the broader portfolio some rebalancing at times appears to be appropriate when the weightings of the individual holdings drift too far (2011 and gold had risen to being 60% of the total portfolio weight).

I consider FT100 to be a proxy for world exc. US, so when US is around 50% of world 50/50 FT100/US stock is a proxy for World. £, $ and global currencies, 67/33 stock/commodity top level diversification historically has been 'diverse enough'.