clunk wrote:

My own SIPP is primarily low cost index funds with no new money and literally zero cash. Any incidental dividends cover platform fees and the rest gets re-invested into cheap tracker OEICs.

My S&S ISA is where all new money goes as I intend to continue maxing the allowance for the coming years. I am 61 years old.

I'm one of those investors who looks at the ISA as a growing annuity where control over the capital is maintained. Dividend income being the primary focus, far less so that of overall capital growth and/or total return. I want to create a tax free income which I can ultimately live off.

I suspect many 'older' investors, if they haven't already, begin to consider tax-free dividend income as pension age approaches.

Hi clunk,

Welcome to The Lemon Fool.

I think your multi-pronged approach is a very sensible one, with a SIPP automatically running on a long-term TR-basis whilst your ISA helps to provide you with a live 'income-investment' study whilst you're in a period where you're not yet needing to consume it, but where you'll obviously gain some much-needed confidence from seeing how it behaves over the years before you ultimately make the switch-over into using it for it's intended purpose.

I've been income-investing for many years now, during a long period where I've still been working, but I know myself well enough to understand that I wouldn't have been happy or confident to carry out what many might see as a TR-to-Income switch much closer to the period where that income-stream is required.

I always knew that I would need to see the structure and income-delivery working and building for quite a few years, re-investing non-required dividends back into the strategy during a period where they don't need to be consumed, but at the same time being able to provide long-term generated-dividend data for me in terms of how my own income-portfolio was performing even when I didn't 'need' it, so that when the day comes where I do flick that switch from dividend-reinvestment to dividend-consumption, I would have those years of confidence behind me to help sleep a little better at night...

The bulk of my income-portfolio is held in a broad number of geographically-diverse income-related IT's (

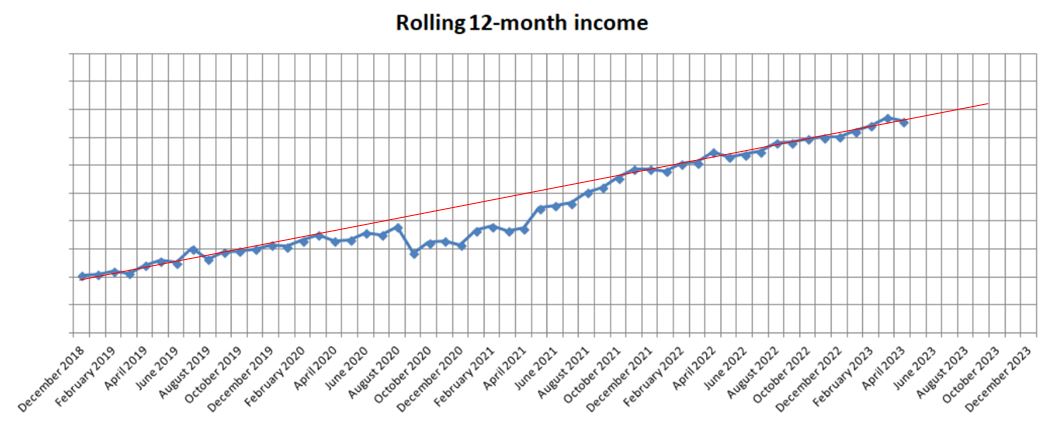

https://tinyurl.com/2f9lns4e), and over the past few years as I approach a time where I might look to make some work-related decisions, I've tracked my rolling 12-month income to help get a sense of income-stability and long-term growth, which has helped me enormously in terms of provided fact-based evidence on which to help base my medium-term plans -

Source - my own income-tracking spreadsheet

Source - my own income-tracking spreadsheetWhilst I've removed the left-hand income-axis figures, I hope it's clear to see how useful it is to monitor these types of long-term income-trends, and I honestly can't see how I'd have had any personal confidence in making any proposed work-related plans, without having visibility of this type of medium-term legacy income-data from my own live portfolio, and with 93% of the above income being delivered from holdings that are held within ISA accounts, I completely agree that this is a very important aspect of the whole approach...

Cheers,

Itsallaguess