Got a credit card? use our Credit Card & Finance Calculators

Thanks to gpadsa,Steffers0,lansdown,Wasron,jfgw, for Donating to support the site

Very High Yield Shares

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Very High Yield Shares

I have been taking a look at my highest yielding shares to see how they are doing. They are the following.

Legal & General

Imperial Brands

BAT

Phoenix Holdings

Chesnara

Their share prices have all fallen since the year end, except strangely enough, for Chesnara, but, more importantly, they all yield 8.0% or more except for Imperial Brands In fact, current yields (based on the trailing dividend at year end and the current price) are 8%, 7.9%, 8.1%. 8.9% and 8%

They have all increased their interim dividends so the current yield will be a little higher. That puts them all well into any danger zone, however you define it and all ought to be heading for a dividend cut and yet none show any signs of that. I can almost understand these yields for the tobacco shares as they are in a non growth business and are simply throwing off cash but the other three shares are all life insurers and major fund managers. Obviously the market thinks that the current environment is harming them. Maybe it is but there has not been much sign of that so far and their interim reports were all optimistic about new business prospects. Legal & General seems to me to be perfectly sound but I have never really liked Phoenix Holdings very much. I find their Accounts to be more than usually opaque and they are an amalgam of a very large number of rather second rate insurers except I guess for Standard Life.

Chesnara is by far the smallest company of the three insurers and they just seem to keep plugging away and are the only one to have more or less held their share price since year end. The biggest share price falls have been the two tobaccos where the fall has been 16.2% for Imperial and 18.6% for BAT. Dearly bought income as I keep saying.

I would be interested in any views. As I have said, I hold all five and apologies if I have got any of these numbers wrong.

Dod

Legal & General

Imperial Brands

BAT

Phoenix Holdings

Chesnara

Their share prices have all fallen since the year end, except strangely enough, for Chesnara, but, more importantly, they all yield 8.0% or more except for Imperial Brands In fact, current yields (based on the trailing dividend at year end and the current price) are 8%, 7.9%, 8.1%. 8.9% and 8%

They have all increased their interim dividends so the current yield will be a little higher. That puts them all well into any danger zone, however you define it and all ought to be heading for a dividend cut and yet none show any signs of that. I can almost understand these yields for the tobacco shares as they are in a non growth business and are simply throwing off cash but the other three shares are all life insurers and major fund managers. Obviously the market thinks that the current environment is harming them. Maybe it is but there has not been much sign of that so far and their interim reports were all optimistic about new business prospects. Legal & General seems to me to be perfectly sound but I have never really liked Phoenix Holdings very much. I find their Accounts to be more than usually opaque and they are an amalgam of a very large number of rather second rate insurers except I guess for Standard Life.

Chesnara is by far the smallest company of the three insurers and they just seem to keep plugging away and are the only one to have more or less held their share price since year end. The biggest share price falls have been the two tobaccos where the fall has been 16.2% for Imperial and 18.6% for BAT. Dearly bought income as I keep saying.

I would be interested in any views. As I have said, I hold all five and apologies if I have got any of these numbers wrong.

Dod

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10032 times

Re: Very High Yield Shares

Dod101 wrote:

Dearly bought income as I keep saying

Interesting timing Dod, because you may recall a related 'Too High?' thread from nearly a year ago now that was discussing a similar theme -

https://www.lemonfool.co.uk/viewtopic.php?f=15&t=34915

It was a lengthy and interesting discussion, with views across the spectrum as we'd expect, but anyone with a passing interest in some of the shares mentioned in the opening table on the above link will recognise that there's been some chunky capital losses since June of last year for holders of quite a few of those shares, and more than a couple of dividend cuts to go along with it.

I plan to post on the above thread with a 1-year anniversary update towards the end of June, with some further details which might help with this type of discussion.

In answer to your request for specific views, then I personally believe that for income-seekers, very-high 'abnormal' yields, well out of kilter with the broad market, introduce an element of high risk that is difficult to mitigate against for inexperienced investors, and where such investigation and mitigation is either not carried out, or carried out incorrectly, then generally, inexperienced income-seekers should fully expect to see a subsequent high level of volatility in both share price and underlying dividend income from those share that are bought at 'very high yields'...

Cheers,

Itsallaguess

-

MrFoolish

- Lemon Quarter

- Posts: 2376

- Joined: March 22nd, 2020, 7:27 pm

- Has thanked: 574 times

- Been thanked: 1160 times

Re: Very High Yield Shares

Most people look on price comparison sites these days for their insurance products. It must be increasingly difficult for insurance companies to sell overpriced products. Margins will keep falling I would have thought.

-

BullDog

- Lemon Quarter

- Posts: 2484

- Joined: November 18th, 2021, 11:57 am

- Has thanked: 2003 times

- Been thanked: 1213 times

Re: Very High Yield Shares

I only own LGEN from that list and I'm pretty relaxed about it.

The other very high yield stock I own is MNG. I bought when it was hit by covid so the yield on purchase price is in double figures. I have worried about the yield from day one. It seems I'm not alone in that thinking but I don't think there's any real evidence that the dividend is in line to be cut. It's one to add to Dod101's worry list.

The other very high yield stock I own is MNG. I bought when it was hit by covid so the yield on purchase price is in double figures. I have worried about the yield from day one. It seems I'm not alone in that thinking but I don't think there's any real evidence that the dividend is in line to be cut. It's one to add to Dod101's worry list.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Very High Yield Shares

MrFoolish wrote:Most people look on price comparison sites these days for their insurance products. It must be increasingly difficult for insurance companies to sell overpriced products. Margins will keep falling I would have thought.

The insurers I highlight are not in the commodity insurance business where insurers appear on price comparison sites. That is much more attuned to personal lines, such as motor insurance where the market leaders are Admiral, Direct Line and Aviva. None of the three I mentioned are in that business

Dod

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Very High Yield Shares

Itsallaguess wrote:Dod101 wrote:

Dearly bought income as I keep saying

Interesting timing Dod, because you may recall a related 'Too High?' thread from nearly a year ago now that was discussing a similar theme -

https://www.lemonfool.co.uk/viewtopic.php?f=15&t=34915

It was a lengthy and interesting discussion, with views across the spectrum as we'd expect, but anyone with a passing interest in some of the shares mentioned in the opening table on the above link will recognise that there's been some chunky capital losses since June of last year for holders of quite a few of those shares, and more than a couple of dividend cuts to go along with it.

I plan to post on the above thread with a 1-year anniversary update towards the end of June, with some further details which might help with this type of discussion.

In answer to your request for specific views, then I personally believe that for income-seekers, very-high 'abnormal' yields, well out of kilter with the broad market, introduce an element of high risk that is difficult to mitigate against for inexperienced investors, and where such investigation and mitigation is either not carried out, or carried out incorrectly, then generally, inexperienced income-seekers should fully expect to see a subsequent high level of volatility in both share price and underlying dividend income from those share that are bought at 'very high yields'...

Cheers,

Itsallaguess

Thanks IAAG. I have a bit of an aversion to very long and occasionally dated threads so I started a new one. However, some of the stats in the opening post of the thread you have highlighted are interesting for comparison. I do not really worry about the dividends for the shares quoted but at the same time, I am curious as to why the market ascribes such a low opinion to at least the three insurers. Maybe they do not understand their business - I am not sure any of us really do - and feel that there must be something fishy going on. I have held L & G continuously for what must be getting on for 30 years with no hitches; the other two for much shorter periods. For what it is worth, as I said, I feel that Phoenix Holdings is the weakest and accordingly, that is reflected in the actual worth of the holdings, although Phoenix is doing a good job of that with the 18.6% drop in its share price over the last five months. The next question is of course, do I bale out at just the wrong moment?

Dod

-

MrFoolish

- Lemon Quarter

- Posts: 2376

- Joined: March 22nd, 2020, 7:27 pm

- Has thanked: 574 times

- Been thanked: 1160 times

Re: Very High Yield Shares

Dod101 wrote:The insurers I highlight are not in the commodity insurance business where insurers appear on price comparison sites. That is much more attuned to personal lines, such as motor insurance where the market leaders are Admiral, Direct Line and Aviva. None of the three I mentioned are in that business

Dod

This is true. L&G are actually one of my biggest holdings. Like you, I look at the high yield and wonder if I'm missing some snag.

Re MNG, I kept seeing an ad for them on youtube. At least I assumed it was MNG because their logo was mostly obscured by the "Skip ads" button. One wonders why their management allowed this to happen. It doesn't inspire confidence.

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10032 times

Re: Very High Yield Shares

Dod101 wrote:Itsallaguess wrote:

Interesting timing Dod, because you may recall a related 'Too High?' thread from nearly a year ago now that was discussing a similar theme -

https://www.lemonfool.co.uk/viewtopic.php?f=15&t=34915

It was a lengthy and interesting discussion, with views across the spectrum as we'd expect, but anyone with a passing interest in some of the shares mentioned in the opening table on the above link will recognise that there's been some chunky capital losses since June of last year for holders of quite a few of those shares, and more than a couple of dividend cuts to go along with it.

Thanks IAAG. I have a bit of an aversion to very long and occasionally dated threads so I started a new one.

At 9 pages long, it was a long one, but I think for me the whole thread was rather neatly wrapped up by the Brewin Dolphin document linked within it, that covered 35-years worth of dividend data, and said the following of their study, where I've bolded and underlined their most pertinent final conclusions related to risks not just to dividends themselves, but to potentially invested capital as well -

Earlier this year our Research Team carried out a study into the risk of dividend cuts and compiled an analysis of the safety, or otherwise, of UK dividends paid by a wide variety of companies.

We studied 35 years of monthly historic data to examine how many instances of dividend cuts had actually occurred during that time and how the probability of a cut changed depending on the level of the dividend yield.

Our analysts then estimated the probability of a dividend cut for each of the companies for which they provide recommendations.

The results are instructive.

As well as the intuitive result that large companies are less likely to cut their dividends than smaller companies, we also found that there is a slightly greater chance of a dividend cut for companies that offer a dividend yield of between 0% and 2% than for those who offer a dividend yield of between 2% and 4%.

For dividend yields above 6% the chances of a dividend cut rises rapidly, highlighting how a high yield can often reflect the market expectation that the dividend is not sustainable.

We are already using this research to influence how we invest for our clients, helping to reduce the risk of cuts to income which will also support total returns, given that a cut to the dividend is often accompanied by a fall in a company’s share price.

https://www.brewin.co.uk/insights/dividend-risk

I won't argue with any of that, although I would add in relation to your opening post that LGEN are one of my few remaining single-share holdings, and whilst I probably wouldn't add to them currently, at just 2% of invested capital and delivering around 3% of my overall investment-income, I also won't worry too much about them either, and one of the early points I made in the other linked thread was that I personally think it is important to view these potential risks in two ways, where already-held shares might be given a little more lee-way in these matters, and where harder decisions might be made against them if they are being considered as potential new investments, and so that's where LGEN currently sit for me personally where I'm happy to continue holding...

Cheers,

Itsallaguess

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Very High Yield Shares

MrFoolish wrote:Dod101 wrote:The insurers I highlight are not in the commodity insurance business where insurers appear on price comparison sites. That is much more attuned to personal lines, such as motor insurance where the market leaders are Admiral, Direct Line and Aviva. None of the three I mentioned are in that business

Dod

This is true. L&G are actually one of my biggest holdings. Like you, I look at the high yield and wonder if I'm missing some snag.

Re MNG, I kept seeing an ad for them on youtube. At least I assumed it was MNG because their logo was mostly obscured by the "Skip ads" button. One wonders why their management allowed this to happen. It doesn't inspire confidence.

M & G seem to be basically a fund manager. As such they join the others, abrdn and Schroders, in not doing all that well at the moment, partly at least, driven I think by the increased popularity of index funds, but also of course flat markets pretty much around the world. Of the three, I hold and prefer only Schroders. They have a better track record and that large family holding which I think brings stability. And the yield is not so high.

Dod

-

monabri

- Lemon Half

- Posts: 8437

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1551 times

- Been thanked: 3449 times

Re: Very High Yield Shares

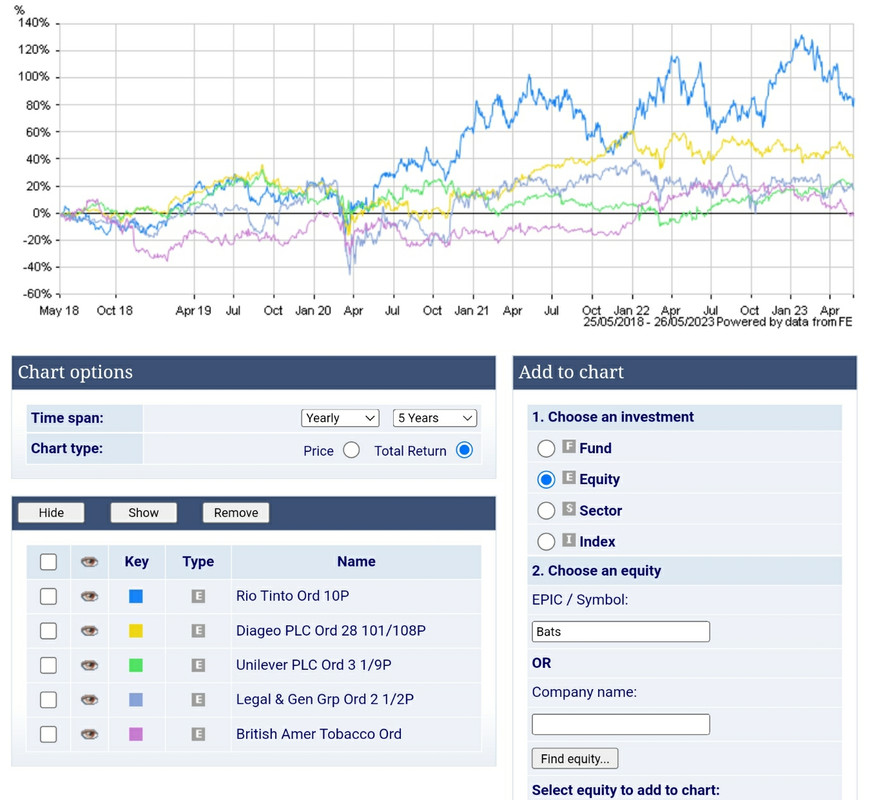

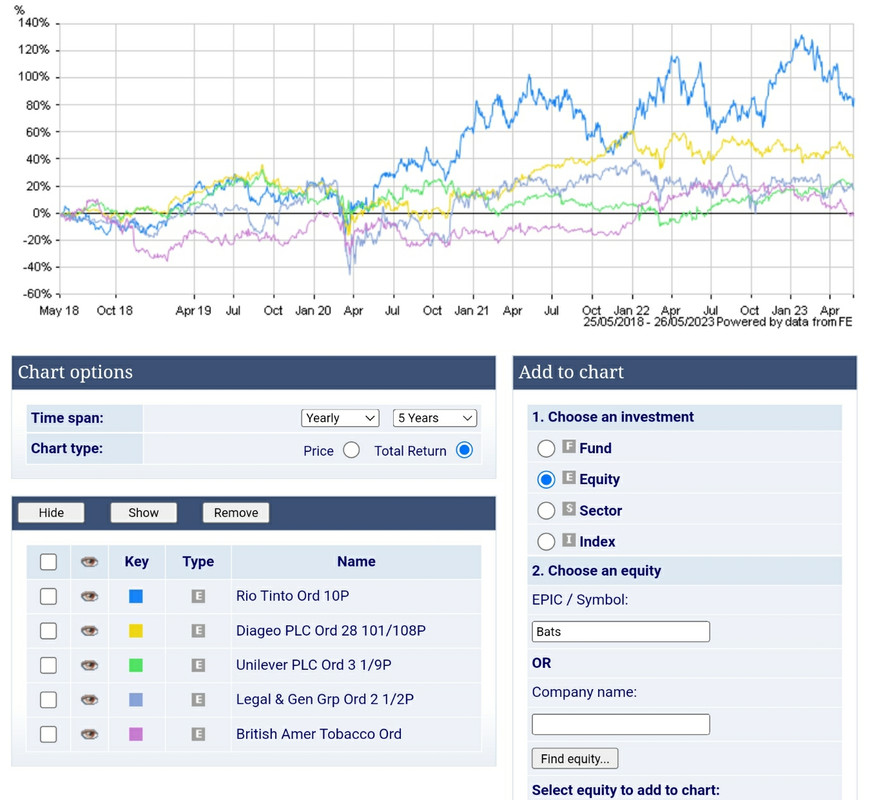

Rio...High yield (tick). 5 year total return > ULVR, DGE ( > LGEN, BAT).

(BHP TR 5 years = 107%...looked up after creating the graph)

Source HL https://www.hl.co.uk/funds/fund-discoun ... ion/charts

(BHP TR 5 years = 107%...looked up after creating the graph)

Source HL https://www.hl.co.uk/funds/fund-discoun ... ion/charts

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

-

Alaric

- Lemon Half

- Posts: 6069

- Joined: November 5th, 2016, 9:05 am

- Has thanked: 20 times

- Been thanked: 1419 times

Re: Very High Yield Shares

Dod101 wrote:M & G seem to be basically a fund manager.

They would like to be thought of that way. They still have the closed fund UK business of the Prudential, although they were looking to offload it. They may not succeed. There was a court case where the judge ruled that if you took out an annuity with the Pru, that was what you wanted. not some little known organisation. Hence the Court refused to allow the transfer.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Very High Yield Shares

Alaric wrote:Dod101 wrote:M & G seem to be basically a fund manager.

They would like to be thought of that way. They still have the closed fund UK business of the Prudential, although they were looking to offload it. They may not succeed. There was a court case where the judge ruled that if you took out an annuity with the Pru, that was what you wanted. not some little known organisation. Hence the Court refused to allow the transfer.

I see. That is presumably what they are referring to when they write about their Heritage business. Of course the annuity is no longer with the Pru anyway, which is now flogging life policies in the Far East, but I understand what you mean. There will no doubt be others which a Court might recognise as being a more secure proposition to which that business can be off loaded. Probably at less attractive terms for M & G of course.

Dod

-

BullDog

- Lemon Quarter

- Posts: 2484

- Joined: November 18th, 2021, 11:57 am

- Has thanked: 2003 times

- Been thanked: 1213 times

Re: Very High Yield Shares

monabri wrote:Rio...High yield (tick). 5 year total return > ULVR, DGE ( > LGEN, BAT).

(BHP TR 5 years = 107%...looked up after creating the graph)

Source HL https://www.hl.co.uk/funds/fund-discoun ... ion/charts

The most interesting thing for me in that chart is actually Diageo. A not especially high yielding share. And a share price not that much different than it was four years ago. Not exactly covering itself in glory for what's supposed to be a very high quality company?

-

dealtn

- Lemon Half

- Posts: 6101

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 443 times

- Been thanked: 2344 times

Re: Very High Yield Shares

BullDog wrote:The most interesting thing for me in that chart is actually Diageo. A not especially high yielding share. And a share price not that much different than it was four years ago. Not exactly covering itself in glory for what's supposed to be a very high quality company?

Indeed a Total Return of 40% exceeding 75% of the other alternatives on the chart. If that's not covering itself in glory why is it the one that stands out and not the other 3 (of which I hold 2)?

-

BullDog

- Lemon Quarter

- Posts: 2484

- Joined: November 18th, 2021, 11:57 am

- Has thanked: 2003 times

- Been thanked: 1213 times

Re: Very High Yield Shares

dealtn wrote:BullDog wrote:The most interesting thing for me in that chart is actually Diageo. A not especially high yielding share. And a share price not that much different than it was four years ago. Not exactly covering itself in glory for what's supposed to be a very high quality company?

Indeed a Total Return of 40% exceeding 75% of the other alternatives on the chart. If that's not covering itself in glory why is it the one that stands out and not the other 3 (of which I hold 2)?

I have just checked for MNG that I hold. I don't hold Diageo. According to HL total return of those two stocks is 105% for MNG and 30% for Diageo. If that's covering itself in glory, it's a very odd kind of glory indeed.

I just checked LGEN which I also hold and it's 3 year TR is 41%. Diageo isn't exactly selling itself to me.

-

monabri

- Lemon Half

- Posts: 8437

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1551 times

- Been thanked: 3449 times

Re: Very High Yield Shares

BullDog wrote:The most interesting thing for me in that chart is actually Diageo. A not especially high yielding share. And a share price not that much different than it was four years ago. Not exactly covering itself in glory for what's supposed to be a very high quality company?

I deliberately included both ULVR & DGE for that very reason - moderate yield quality companies. It's not just the HY companies that see their shareprice festering. The question is why they are not "performing"?

Main Market Listing

I wonder how they would perform if they were to have their main listing in say the US - would they trade at higher valuations? In the UK we have high interest rates that are seemingly not currently under control and a government perceived to be anti-business - if it moves, tax it. Interest rates have increased to (more normal) levels and this has had an effect on valuations and general outlook.

Media

Then there is the media....e.g. The Daily Terrograph! never let bad news go to waste, indeed, recycle it..it's green! Our economy must be slightly better than Argentina but not quite as good as Russia's.

Retail Investors - Looking for safer income havens

I would also imagine that there is a flight of retail money from shares into fixed rate bonds - having been scarred by what happened during Covid. The UK market is close to an all time high (well it was until recently) and retail investors who saw their incomes curtailed and share prices fall dramatically might be thinking - time to bail out into the safer income of a fixed rate bond now that shareprices have recovered.

Interest rates hikes - in short timescales

I can understand the valuations of REITs coming under pressure as a result of re-evaluations of the assets (PHP/LAND/BLND etc) but when you see companies such as LGEN post pretty good results (and Aviva for that matter) and the market says "so what", then you have to ask is it worth it? What does the market want? Conversely, fail to meet expectations by even a small margin and the sp gets crucified. Dare to cut a dividend and you get a 30% fall in shareprice (Direct Line).

Prudency or ?

Poor increases in dividends or a held dividend might send a mesage that a company is struggling - quite a few companies have posted only small dividend increases. Are the companies being prudent or are they signalling trouble ahead? If dividends aren't rising, I might be better locked into a Fixed Rate bond..see above.

Government

The current goverment ...say no more! It is probable they will be replaced by the other Labour party. How very dare you have assets and have provided for your retirement!

I'm coming to the view that it might not be the companies that are "bad", just the environment they are in.

-

Charlottesquare

- Lemon Quarter

- Posts: 1796

- Joined: November 4th, 2016, 3:22 pm

- Has thanked: 106 times

- Been thanked: 568 times

Re: Very High Yield Shares

monabri wrote:I can understand the valuations of REITs coming under pressure as a result of re-evaluations of the assets (PHP/LAND/BLND etc) but when you see companies such as LGEN post pretty good results (and Aviva for that matter) and the market says "so what", then you have to ask is it worth it? What does the market want? .

With LGEN there are to me two conclusions- the markets know something but it is taking a very long time to gestate OR they are seriously mispricing the business. I am running to a degree with the latter and carry a small holding, I really struggle to smell any rotten odour and prefer to trust my nose over the market's sell by date but not enough to own an average size holding in my portfolio.

-

dealtn

- Lemon Half

- Posts: 6101

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 443 times

- Been thanked: 2344 times

Re: Very High Yield Shares

BullDog wrote:dealtn wrote:

Indeed a Total Return of 40% exceeding 75% of the other alternatives on the chart. If that's not covering itself in glory why is it the one that stands out and not the other 3 (of which I hold 2)?

I have just checked for MNG that I hold. I don't hold Diageo. According to HL total return of those two stocks is 105% for MNG and 30% for Diageo. If that's covering itself in glory, it's a very odd kind of glory indeed.

I just checked LGEN which I also hold and it's 3 year TR is 41%. Diageo isn't exactly selling itself to me.

The claim that was made was "most interesting thing (for me) in that chart".

I am making no claim that others not in the chart have had a higher Total Return. Just strikes me as an odd thing to say that the "most" interesting was a negative view about the 2nd best performer!

-

moorfield

- Lemon Quarter

- Posts: 3559

- Joined: November 7th, 2016, 1:56 pm

- Has thanked: 1589 times

- Been thanked: 1418 times

Re: Very High Yield Shares

As you know my benchmark of very high yield or too high yield is twice that of CTY (City of London), so 9.8% currently, and with regards to dividend cuts that has not let me down yet in recent years.

MNG (10.1%) has been running comfortably above that multiple for the last 6 months. It's next interim results in September will bring the portended dividend cut / kitchen sink from the newish CEO now that he's got the last final results out of the way.

And VOD (9.7%) has been steadily heading towards its second cut in recent years for some time now. Again, with a newish CEO installed, that will come with November's half year results.

Bookmark this post, because you read it here first, and then you can tell me I was right.

The baccys IMB and BATS yields are high, but not too high. They will continue to payout steadily for the forseeable, fill yer boots.

MNG (10.1%) has been running comfortably above that multiple for the last 6 months. It's next interim results in September will bring the portended dividend cut / kitchen sink from the newish CEO now that he's got the last final results out of the way.

And VOD (9.7%) has been steadily heading towards its second cut in recent years for some time now. Again, with a newish CEO installed, that will come with November's half year results.

Bookmark this post, because you read it here first, and then you can tell me I was right.

The baccys IMB and BATS yields are high, but not too high. They will continue to payout steadily for the forseeable, fill yer boots.

Return to “High Yield Shares & Strategies - General”

Who is online

Users browsing this forum: No registered users and 14 guests