HYP1 is/was a more aggressive SWR style, perhaps might be considered as a 5% SWR targeted choice. A risk there is that of increased risk of failure, as historically 4% SWR is the accepted safer choice.

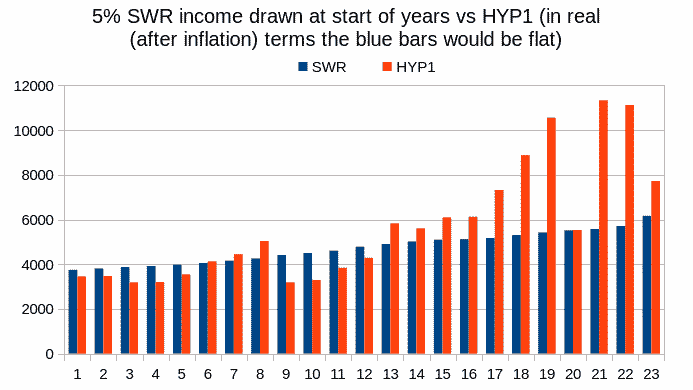

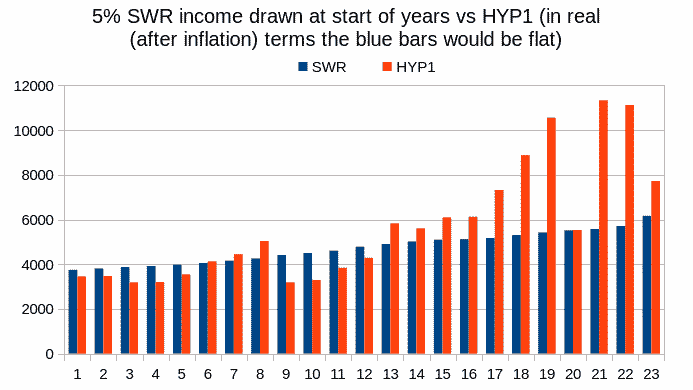

As a suggested alternative to a annuity the other risk is that of more dynamic/variable income, and of income distribution across each year. With the 5% SWR you take the entire years inflation adjusted income at the start of each year.

Comparing my prior posts income data

and the blue bars reflect inflation adjusted income (5% SWR) that if those were adjusted for inflation would be a constant flat line. In comparison th HYP1 income was more variable around that. What for instance would you do if you were solely reliant upon the HYP1 income in years like 3, 4, 5 and/or 9, 10, 11, 12 when the HYP1 income was relatively down in real terms? Presumably sell shares, likely at relatively lower prices - far from the better times to have been selling shares. Furthermore with dividends distributed across the year (HYP1) compared to having a lump sum dropped into your bank account at the start of the year (SWR) there could be cash-flow issues with the HYP1.

The residual/remaining portfolios for those broadly compare, whether that was holding the HYP1 shares or the FT250 stock index. Such that the indications are that the HYP1 had greater risk, where income might have been too little when most needed, and the risk of concentration, where too much exposure into single stocks could backfire ... and where that risk wasn't compensated - ended up with similar overall residual portfolio value remaining assuming no shares were sold, but where in practice some may have had to be sold in order to pay bills - typically at a bad time to be selling shares.

More suited to old-days, when due to high costs it was more appropriate to buy a diverse bunch of individual stocks and hold those long term. Less appropriate in a era when index funds/ETF's are common and relatively inexpensive to hold/trade.

If you are headed for a shop on a street corner on the other side of a three lane carriageway you might take your chances crossing between the traffic flow (HYP) or walk down to the traffic lights and more safely cross there (SWR). Either way there's no advantage, you still get to the shop at around the same time, but with one choice you took uncompensated risk in order to get there.