Abrdn Asian Income Fund (AAIF) - 4th interim dividend -

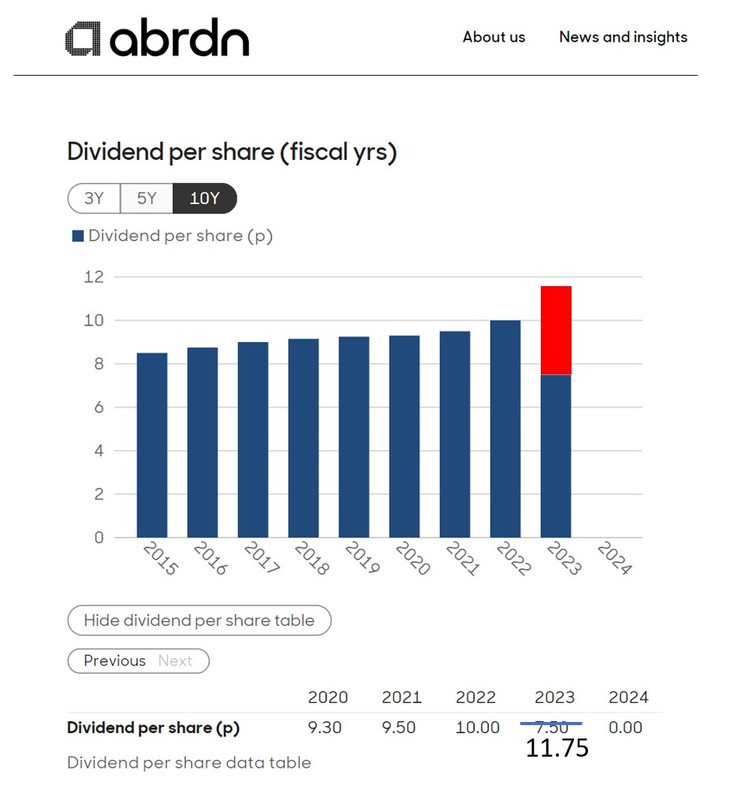

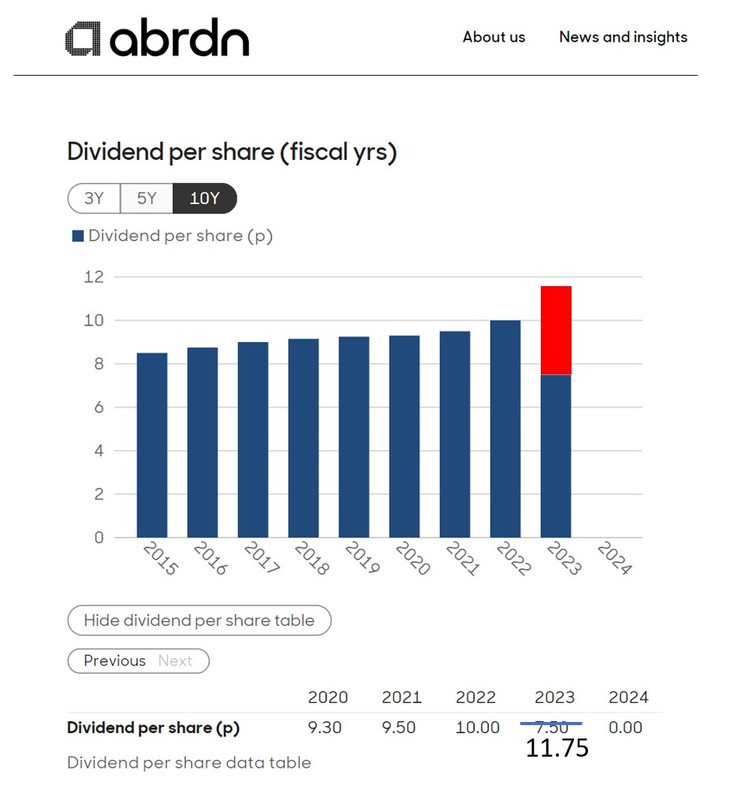

The Directors of the Company have today declared an increased fourth interim dividend in respect of the year ending 31 December 2023 of 4.25p per share (fourth interim for 2022: 3.10p).

The dividend will be payable on 23 February 2024 to Ordinary shareholders on the register on 26 January 2024, ex-dividend date 25 January 2024.

The total dividend for 2023 amounts to 11.75p, representing an increase of 17.5% compared to the previous year (2022: 10.00p), and the Board is pleased to note that this represents the fifteenth consecutive year of annual dividend increases and means that the Company continues to be a "next generation dividend hero" as recognised by the Association of Investment Companies.

The dividend for the year equates to a dividend yield of 5.8% based on the closing share price of 201p on 12 January 2024 and is expected to be fully covered by earnings for the year ended 31 December 2023.

In the absence of unforeseen circumstances, it is the Board's intention to continue to increase the level of dividend in future years.

"In line with what I said in my statement as at 31 December 2022, our investment manager has continued its focus through 2023 on high-yielding companies throughout the Asia region with strong fundamentals and as a result we have seen growth in dividend receipts flowing into the portfolio. The Board is very aware of the importance of dividends to shareholders, as well as providing an above-average yield and ensuring that those dividends grow over time. We are therefore pleased to be announcing an above-inflationary increase in dividend with an above-average yield today"

https://www.londonstockexchange.com/news-article/AAIF/fourth-interim-dividend-declaration/16289117

Cheers,

Itsallaguess

Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

Abrdn Asian Income Fund (AAIF) - 4th interim dividend

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10032 times

-

ReformedCharacter

- Lemon Quarter

- Posts: 3141

- Joined: November 4th, 2016, 11:12 am

- Has thanked: 3649 times

- Been thanked: 1522 times

Re: Abrdn Asian Income Fund (AAIF) - 4th interim dividend

Itsallaguess wrote:

...

The total dividend for 2023 amounts to 11.75p, representing an increase of 17.5% compared to the previous year (2022: 10.00p), and the Board is pleased to note that this represents the fifteenth consecutive year of annual dividend increases and means that the Company continues to be a "next generation dividend hero" as recognised by the Association of Investment Companies.

...

Itsallaguess

Thanks Itsallaguess, that's a welcome dividend increase, I've held AAIF since 2017 and the performance has been on the disappointing side so far.

RC

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10032 times

Re: Abrdn Asian Income Fund (AAIF) - 4th interim dividend

ReformedCharacter wrote:

That's a welcome dividend increase, I've held AAIF since 2017 and the performance has been on the disappointing side so far.

Yes, it's tended to behave as an annuity for the past few years now, and whilst it's certainly been able to maintain the dividends well, as this recent welcome hike demonstrates, it's total-return performance has been lacklustre to say the least.

It's certainly the case that there's worse income-investment options to pursue, but as an income-investor who welcomes a semblance of underlying TR-based return as well as regular dividend income, I hope it can start to show some NAV-based returns soon as well.

Cheers,

Itsallaguess

-

monabri

- Lemon Half

- Posts: 8428

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: Abrdn Asian Income Fund (AAIF) - 4th interim dividend

Source : https://www.asian-income.co.uk/en-gb/pr ... erformance (with edit by monabri to reflect the increased Q4 dividend)

Re: Abrdn Asian Income Fund (AAIF) - 4th interim dividend

In the current economic climate, that type of steady income growth is valuation. And pushing the payout above inflation levels indicates the portfolio is still capturing dividends from quality high-yield companies in Asia.At a 5.8% trailing yield based on the increased total 2023 distribution, AAIF remains an attractive income option relative to typical UK equity funds.Good note too on the managers emphasizing dividend-paying fundamentals across selections in the region. That focus pays off for investors prioritizing payouts.The fact that earnings are on track to fully cover the distributions is also reassuring from a sustainability standpoint.Overall, great to see AAIF staying consistent with providing both above-average yield and dependable dividend growth for shareholders. Here's to continued success compounding our income in 2024 and beyond!

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Abrdn Asian Income Fund (AAIF) - 4th interim dividend

alexm3941 wrote:In the current economic climate, that type of steady income growth is valuation. And pushing the payout above inflation levels indicates the portfolio is still capturing dividends from quality high-yield companies in Asia.At a 5.8% trailing yield based on the increased total 2023 distribution, AAIF remains an attractive income option relative to typical UK equity funds.Good note too on the managers emphasizing dividend-paying fundamentals across selections in the region. That focus pays off for investors prioritizing payouts.The fact that earnings are on track to fully cover the distributions is also reassuring from a sustainability standpoint.Overall, great to see AAIF staying consistent with providing both above-average yield and dependable dividend growth for shareholders. Here's to continued success compounding our income in 2024 and beyond!

That sounds a bit OTT to judge by the comments earlier from Itsallaguess. It is all very well concentrating on income but it is not much use if there is no capital growth, or worse.

I do not hold.

Dod

-

Charlottesquare

- Lemon Quarter

- Posts: 1794

- Joined: November 4th, 2016, 3:22 pm

- Has thanked: 105 times

- Been thanked: 567 times

Re: Abrdn Asian Income Fund (AAIF) - 4th interim dividend

Itsallaguess wrote:ReformedCharacter wrote:

That's a welcome dividend increase, I've held AAIF since 2017 and the performance has been on the disappointing side so far.

Yes, it's tended to behave as an annuity for the past few years now, and whilst it's certainly been able to maintain the dividends well, as this recent welcome hike demonstrates, it's total-return performance has been lacklustre to say the least.

It's certainly the case that there's worse income-investment options to pursue, but as an income-investor who welcomes a semblance of underlying TR-based return as well as regular dividend income, I hope it can start to show some NAV-based returns soon as well.

Cheers,

Itsallaguess

Yet again, tends to depend when you bought.

I bought 23/3/20 3000 @144.74, 31/3/20 1500@158.31, 1/4/20 1,000@153.09 and 1/3/22 1500@225.6, I appreciate Covid gains re first three but also note my poor timing on 4th, overall currently up 17.98% re share price plus current yield 5.98%, so, like comedy, timing is everything.

Re: Abrdn Asian Income Fund (AAIF) - 4th interim dividend

Dod101 wrote:alexm3941 wrote:In the current economic climate, that type of steady income growth is valuation. And pushing the payout above inflation levels indicates the portfolio is still capturing dividends from quality high-yield companies in Asia.At a 5.8% trailing yield based on the increased total 2023 distribution, AAIF remains an attractive income option relative to typical UK equity funds.Good note too on the managers emphasizing dividend-paying fundamentals across selections in the region. That focus pays off for investors prioritizing payouts.The fact that earnings are on track to fully cover the distributions is also reassuring from a sustainability standpoint.Overall, great to see AAIF staying consistent with providing both above-average yield and dependable dividend growth for shareholders. Here's to continued success compounding our income in 2024 and beyond!

That sounds a bit OTT to judge by the comments earlier from Itsallaguess. It is all very well concentrating on income but it is not much use if there is no capital growth, or worse.

I do not hold.

Dod

I respect your opinion.

Return to “High Yield Shares & Strategies - General”

Who is online

Users browsing this forum: No registered users and 42 guests