Got a credit card? use our Credit Card & Finance Calculators

Thanks to Anonymous,bruncher,niord,gvonge,Shelford, for Donating to support the site

Gilts vs Savings Accounts

-

GeoffF100

- Lemon Quarter

- Posts: 4835

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 182 times

- Been thanked: 1397 times

Gilts vs Savings Accounts

Until recently gilts paid less than savings term accounts with the same maturity, and index linked gilts had big negative real redemption yields. Conventional gilts are now paying more than savings accounts with the same maturity, and some are under par with tax free capital gains. Some of the index linked gilts are now above par and have positive real redemption yields.

-

GeoffF100

- Lemon Quarter

- Posts: 4835

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 182 times

- Been thanked: 1397 times

Re: Gilts vs Savings Accounts

Here is the context:

https://news.sky.com/story/pound-slumps ... eblog-body

What is the probability that the UK government will default on its debts?

https://news.sky.com/story/pound-slumps ... eblog-body

What is the probability that the UK government will default on its debts?

-

Alaric

- Lemon Half

- Posts: 6145

- Joined: November 5th, 2016, 9:05 am

- Has thanked: 21 times

- Been thanked: 1429 times

Re: Gilts vs Savings Accounts

GeoffF100 wrote:What is the probability that the UK government will default on its debts?

It's regarded as very low given the track record of almost never having defaulted. There was the forced conversion of maturing War Loan in 1931 to a lower coupon instead of repayment and apparantly some other American loan in the 1930s.

https://bondvigilantes.com/blog/2010/02 ... defaulted/

-

GeoffF100

- Lemon Quarter

- Posts: 4835

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 182 times

- Been thanked: 1397 times

Re: Gilts vs Savings Accounts

Alaric wrote:GeoffF100 wrote:What is the probability that the UK government will default on its debts?

It's regarded as very low given the track record of almost never having defaulted. There was the forced conversion of maturing War Loan in 1931 to a lower coupon instead of repayment and apparantly some other American loan in the 1930s.

https://bondvigilantes.com/blog/2010/02 ... defaulted/

That link says:

Today, in what looks like a different view, his Shadow Chancellor George Osborne has committed his party to maintain the UK’s AAA credit rating: “Judge us in the first few months of a Conservative government on whether we’re able to protect our credit rating”.

Our AAA credit rating is gone, and Cameron was not nearly as balmy as Truss. The markets are demanding high interest rates to hold our debt, so a further cut in our credit rating would not be surprising. There are tax advantages in holding gilts, but that could come at a high price.

-

hiriskpaul

- Lemon Quarter

- Posts: 3971

- Joined: November 4th, 2016, 1:04 pm

- Has thanked: 733 times

- Been thanked: 1587 times

Re: Gilts vs Savings Accounts

I would say the risk of default is extremely low. Yields have risen mainly because of factors other than credit risk. Comparable returns on non-sterling government bonds, inflation risk, the government needing to borrow more, the BoE putting QE into reverse, etc.

I agree there are some decent yields out there compared with cash deposits and the very low coupon on some gilts make for largely tax free returns. eg Treasury 0.125% 31/01/2024, Treasury 0.25% 31/01/2025, Treasury 0.125% 30/01/2026 gives a 3 year ladder yielding 4.27%, 4.62% and 4.44%. Better than fixed term deposits and almost tax free. I suspect it will not be long before deposit rates start climbing though.

The other advantage of gilts of course is that it is possible to exit at any time, unlike most fixed rate deposits.

I agree there are some decent yields out there compared with cash deposits and the very low coupon on some gilts make for largely tax free returns. eg Treasury 0.125% 31/01/2024, Treasury 0.25% 31/01/2025, Treasury 0.125% 30/01/2026 gives a 3 year ladder yielding 4.27%, 4.62% and 4.44%. Better than fixed term deposits and almost tax free. I suspect it will not be long before deposit rates start climbing though.

The other advantage of gilts of course is that it is possible to exit at any time, unlike most fixed rate deposits.

-

AWOL

- Lemon Slice

- Posts: 564

- Joined: October 20th, 2020, 5:08 pm

- Has thanked: 366 times

- Been thanked: 277 times

Re: Gilts vs Savings Accounts

I read something today that put the risk of default at 0.21%. I have no idea how they came up with that figure but it gives you an idea. I think 0.5% is more like it given recent performance but that's just a finger in the air  It takes a lot for a country with a floating currency to default. Worst comes to the worst then you print money and tell your people that inflation is good for the economy. I do think that our credit rating will come under scrutiny if the Bank of England and Chancellor don't co-ordinate better in future.

It takes a lot for a country with a floating currency to default. Worst comes to the worst then you print money and tell your people that inflation is good for the economy. I do think that our credit rating will come under scrutiny if the Bank of England and Chancellor don't co-ordinate better in future.

-

Spet0789

- Lemon Quarter

- Posts: 1969

- Joined: June 21st, 2017, 12:02 am

- Has thanked: 264 times

- Been thanked: 975 times

Re: Gilts vs Savings Accounts

The U.K. is vanishingly unlikely to default. It funds in its own currency.

Yields have gone up because (i) the market thinks that there will be more supply of gilts and (ii) because the market expects the real value of GBP assets to be eroded over time by inflation and currency depreciation.

Yields have gone up because (i) the market thinks that there will be more supply of gilts and (ii) because the market expects the real value of GBP assets to be eroded over time by inflation and currency depreciation.

-

GeoffF100

- Lemon Quarter

- Posts: 4835

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 182 times

- Been thanked: 1397 times

Re: Gilts vs Savings Accounts

"Unfunded tax cuts threatening UK's credit rating, Moody's warns":

https://www.bbc.co.uk/news/live/uk-poli ... type=share

The BOE has just announced a massive "temporary" QE programme. The pound has fallen in response.

https://www.bbc.co.uk/news/live/uk-poli ... type=share

The BOE has just announced a massive "temporary" QE programme. The pound has fallen in response.

-

1nvest

- Lemon Quarter

- Posts: 4684

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 756 times

- Been thanked: 1521 times

Re: Gilts vs Savings Accounts

Generally Gilts are considered as risk-free, fully covered no matter how much is lent, as a Sovereign state can print money and/or raise taxes rather than defaulting - that leads to subsequent higher cost to borrow.

Whilst it would be nice to maintain a ladder/whatever where you held the better yield out of Gilt and Fixed term savings, in practice that only works if held outside of ISA, which incurs taxation drag.

If held inside a ISA and you roll each 10 year Gilt as it matures into another 10 year Gilt then a approximation of the running yield is the average of the current and past nine 10 year yields, which for the UK

On top of that there's the spread of buying each Gilt, typically 1%, and a trading fee (but where for the likes of ii you might get a free trade each month to make that zero cost). And when held to maturity there's no selling spread. So averages 0.1%/year type running expense.

When you hold each gilt to maturity you can ignore marked to market valuations and the yearly gains are known in advance. And for a 10 year ladder you have around 10% of the total value mature each year, with another 10% just a year or less away from maturity so likely also relatively close to the par price/value.

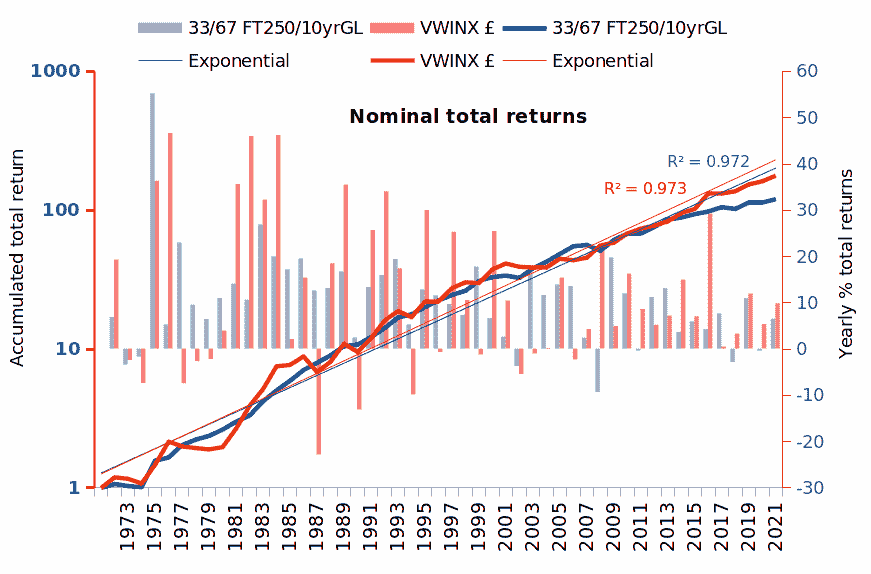

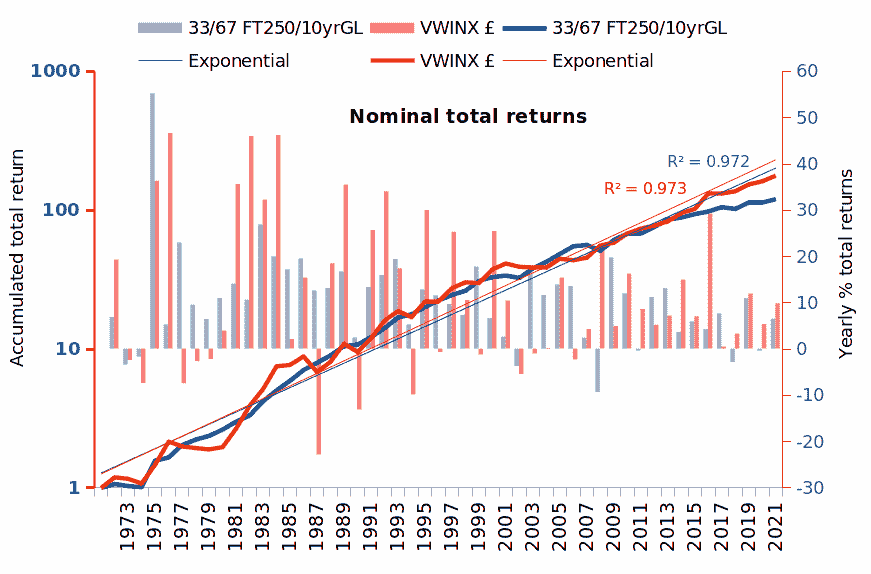

With that base you might in practice actually trade, or swap out rungs for fixed savings alternatives. Maybe a 5 year fixed savings ISA choice for tax efficiencies, but then what do you do with that at maturity? Lose the ISA space/amount as you perhaps roll a maturing bond back into a Gilt? It's all very subjective, but with the capacity to potentially excel the base/standard ladder. That aside, for a US Wellesley defensive type asset allocation PV a UK version of that might be 33/67 FT250/10 year Gilt Ladder. With the ladder having a 0.1% yearly expense, the same as VMID (Vanguard FT250 tracker fund/ETF), and assuming 'free-trades' then the yearly net of costs (but not taxes) ...

8.6% annualised nominal, 5.15% annualised real since 1986, with the worst year up to end of 2021 being less than a -10% nominal decline (2008 -9.5%). With year to date FT250 being down -27%, weighted a third = -9%, and with 2022 set to earn just a 1.46% x 0.66 weighted Gilt return (+0.97%), so far its a -8% type year for that (close to being as bad as 2008).

Whilst it would be nice to maintain a ladder/whatever where you held the better yield out of Gilt and Fixed term savings, in practice that only works if held outside of ISA, which incurs taxation drag.

If held inside a ISA and you roll each 10 year Gilt as it matures into another 10 year Gilt then a approximation of the running yield is the average of the current and past nine 10 year yields, which for the UK

On top of that there's the spread of buying each Gilt, typically 1%, and a trading fee (but where for the likes of ii you might get a free trade each month to make that zero cost). And when held to maturity there's no selling spread. So averages 0.1%/year type running expense.

When you hold each gilt to maturity you can ignore marked to market valuations and the yearly gains are known in advance. And for a 10 year ladder you have around 10% of the total value mature each year, with another 10% just a year or less away from maturity so likely also relatively close to the par price/value.

With that base you might in practice actually trade, or swap out rungs for fixed savings alternatives. Maybe a 5 year fixed savings ISA choice for tax efficiencies, but then what do you do with that at maturity? Lose the ISA space/amount as you perhaps roll a maturing bond back into a Gilt? It's all very subjective, but with the capacity to potentially excel the base/standard ladder. That aside, for a US Wellesley defensive type asset allocation PV a UK version of that might be 33/67 FT250/10 year Gilt Ladder. With the ladder having a 0.1% yearly expense, the same as VMID (Vanguard FT250 tracker fund/ETF), and assuming 'free-trades' then the yearly net of costs (but not taxes) ...

8.6% annualised nominal, 5.15% annualised real since 1986, with the worst year up to end of 2021 being less than a -10% nominal decline (2008 -9.5%). With year to date FT250 being down -27%, weighted a third = -9%, and with 2022 set to earn just a 1.46% x 0.66 weighted Gilt return (+0.97%), so far its a -8% type year for that (close to being as bad as 2008).

-

1nvest

- Lemon Quarter

- Posts: 4684

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 756 times

- Been thanked: 1521 times

Re: Gilts vs Savings Accounts

Not marking a 10 year gilt ladder to market (just the rolling 10 x 10 year yields) and for a defensive Wellesley type asset allocation ....

-

1nvest

- Lemon Quarter

- Posts: 4684

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 756 times

- Been thanked: 1521 times

Re: Gilts vs Savings Accounts

With a baseline/foundation, such as I've outlined earlier, consider how you might alpha-add. On the stock side, FT250, with just 33% weighting, you'd need a +3% alpha to add just 1% to the overall total portfolio, so focusing upon the bond side and its 67% weighing has more potential, where each 1.5% additional yield/gain adds 1% to the total portfolio gain. But that shouldn't totally exclude looking at the stock side, for instance MRC investment trust is recently priced to a -15% discount to NAV, such that rotating some into that instead of a FT250 ETF has the capacity to see some 'alpha' added as/when that discount to NAV narrows.

On the bond side, rolling down the yield curve, swapping out some Gilts for Corporate Bonds ...etc. type strategies might be used to enhance rewards. Somewhat like taking on more stock risk, but where the risk/rewards might suggest reasonable additional rewards for relatively low additional risk.

You might also scale stock exposure up/down in reflection of perceived risk/rewards. Similar to how many Investment Trusts scale up/down leverage. As might rotations from one stock index to another potentially add-alpha.

Many investors spend much more time looking at stocks than bonds, however the bond market is larger than the stock market, IIRC from when I last looked 5+ years ago, for the US around a relative difference of $40T bond market versus £25Tn stock market.

The fixedincomeinvestor web site used to be great as it had the likes of charts where Corporate bonds were plotted (time axis/yield axis) and when you hovered the mouse over one of those dots it popped up drill-down type details/information, so it was relatively easy to identify potential alternative candidates to otherwise Gilt holdings. Miss it viewtopic.php?f=52&t=36289

viewtopic.php?f=52&t=36289

On the bond side, rolling down the yield curve, swapping out some Gilts for Corporate Bonds ...etc. type strategies might be used to enhance rewards. Somewhat like taking on more stock risk, but where the risk/rewards might suggest reasonable additional rewards for relatively low additional risk.

You might also scale stock exposure up/down in reflection of perceived risk/rewards. Similar to how many Investment Trusts scale up/down leverage. As might rotations from one stock index to another potentially add-alpha.

Many investors spend much more time looking at stocks than bonds, however the bond market is larger than the stock market, IIRC from when I last looked 5+ years ago, for the US around a relative difference of $40T bond market versus £25Tn stock market.

The fixedincomeinvestor web site used to be great as it had the likes of charts where Corporate bonds were plotted (time axis/yield axis) and when you hovered the mouse over one of those dots it popped up drill-down type details/information, so it was relatively easy to identify potential alternative candidates to otherwise Gilt holdings. Miss it

Who is online

Users browsing this forum: No registered users and 11 guests