wanderer wrote:I've sold out of Fundsmith today after holding it since not long after it started. It has been a great performer for a long time, but not so much recently. The recent interview with Terry linked to on here set a lot of alarm bells ringing because he didn't seem to have an answer for the charge that the fund was now so big that it couldn't take stakes in companies like Dominos these days - he just said that they still held Dominos from the old days, which isn't really very persuasive when you're thinking about future sources of outperformance.

I'm sorry but this is incorrect. Fundsmith Equity no longer owns Dominos Pizza. They sold out of the UK listed entity years ago. I believe the Smithson IT holds Dominos Pizza, the US listed company, last I looked. I hope you find a decent investment to replace your holding. That's easier said than done! In an economic scenario where inflation is high and interest rates stay comparatively low I'd expect Fundsmith to do OK. If interest rate rises go too far and a recession results, it's the kind of thing I'd want to be holding. Whilst I'm not happy with the switch towards US technology companies I was surprised by the relatively low rating of Google (Fwd PER = 24) when I looked the other day.

wanderer wrote:Then we have had the recent purchases of companies that he has rubbished in the past (Google, Amazon, Facebook to some extent) but where he has now bought in after having seen them soar to many multiples of their past value. There is little point in having a concentrated, high conviction portfolio if that just means buying the biggest companies in the market; it just becomes an index tracker. Especially when Microsoft is another one of your holdings.

It all depends how they are weighted within the fund. It is perfectly possible to outperform the index whilst holding these huge companies if their weighting is very different to that of the S&P500.

wanderer wrote:He appears to himself believe that Unilever is a bit of a stinker and he made the wrong call on P&G. And Pay Pal today is another disappointing outcome. I have made far worse stockpicks in the past, of course, but it's clear that Terry is making some mistakes too. And he's charging big fees for doing it.

All investors make mistakes, even the most high profile like Munger & Buffett, and Terry Smith. That doesn't mean they can't outperform in the long run. It just gets more difficult as the fund size increases due to liquidity. As an example, he recently sold out of London listed Sage and Intertek. Although he gave fundamental reasons for the sales, the lack of liquidity must have also have been a major concern because to get them even to equal rating in the fund he'd have to owned around £1bn of stock, and the current market caps are only £7.5B and £9B, respectively. I suspect he didn't want to end up with > 10% of either. This is why they launched the Smithson IT to give access to lower market cap companies which do not provide sufficient liquidity for the Equity Fund.

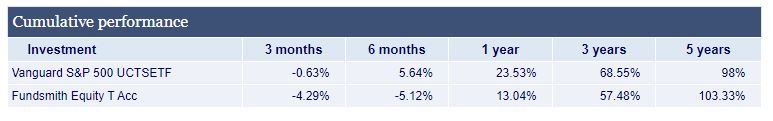

wanderer wrote:So, having been a big fan of his for many years, and having benefited hugely from his stockpicking in the past, I've regretfully come to the conclusion that if it is going to be a portfolio which increasingly consists of the big US tech stocks then there are cheaper managed funds out there offering much the same thing. I am also trying to act on my own convictions on a timely basis and not do what I did with Woodford, where I got out before things went completely belly up but long after I had started having doubts.

I'm no fan of Terry Smith (a pro-Brexit tax exile) but to compare him with Woodford is completely out of order. Woodford got it all wrong exactly because he didn't consider liquidity within his fund, the exact same thing that is leading Fundsmith to have to hold larger and larger companies as the fund size increases.

All the best, Si