Page 4 of 9

Re: Fundsmith

Posted: June 2nd, 2022, 8:35 am

by BullDog

crazypanda wrote:monabri wrote:BullDog wrote:For those who follow Fundsmith, the May report says they have sold out of their holding in Starbucks. No new holdings are reported this month.

Reviewing the previous factsheets there appears to me to be a fair amount of selling for a fund with a mantra of " do nothing " after finding good companies and not overpaying.

https://www.fundsmith.co.uk/factsheet/

I’m surprised with this sale at what are close to lows, despite some of the headwinds they are seeing

Actually, I just checked and I suspect that when Smith bought the shares back in March 2020 it was in the $60's and he's sold recently in the $70's. Admittedly, he could have sold a while back for more. But that's 100% hindsight that not even Smith has.

Kind of interesting-ish is that when he bought Starbucks, Smith also bought Nike. While Nike is also well below recent highs, it's still maybe close to 2x what Smith bought the stock for in March 2020.

Re: Fundsmith

Posted: July 8th, 2022, 4:39 pm

by BullDog

Those with an interest might care to read Terry Smith's half yearly letter to Fundsmith share holders.

https://www.fundsmith.co.uk/media/jhnc4 ... letter.pdf

Re: Fundsmith

Posted: July 9th, 2022, 9:10 pm

by monabri

"The Financial Conduct Authority (FCA) is not requiring Fundsmith to take any further action following an independent review of manager Terry Smith’s funds business."

"The FCA issues such notices

[section 166], also known as a skilled person review, to examine a firm’s system controls and determine if there is any risk of failure. They are carried out by independent bodies nominated by the watchdog, usually one of the ‘big four’ consultants or a top law firm."

"The report contains various recommendations, but the firm has not been instructed to take any further action."

and

"Smith himself is based in Mauritius and the firm has paid increasing amounts in investment fees to a separate Mauritian arm in recent years, Fundsmith Investment Services, which does not have to make its account public"

https://citywire.com/investment-trust-i ... e/a2391992

Re: Fundsmith

Posted: August 1st, 2022, 6:30 pm

by BullDog

Update for the last month -

"Portfolio Comment for July 2022 - We began buying a new position for the fund, the name of which will be revealed when we have accumulated our desired weighting."

Place your bets. I say Apple.

Re: Fundsmith

Posted: August 1st, 2022, 6:40 pm

by nmdhqbc

BullDog wrote:Place your bets. I say Apple.

it says the undisclosed holding was a top 5 detractor and it seems apple did pretty well in july.

Re: Fundsmith

Posted: August 1st, 2022, 6:54 pm

by BullDog

nmdhqbc wrote:BullDog wrote:Place your bets. I say Apple.

it says the undisclosed holding was a top 5 detractor and it seems apple did pretty well in july.

Not Apple then!

Re: Fundsmith

Posted: August 6th, 2022, 3:05 pm

by BullDog

Well, just when you think you have heard everything Terry Smith has to say already - He releases probably the best interview I have ever heard from him. Well worth listening if you have any interest in what Smith has to say -

https://masterinvestor.co.uk/podcast-ma ... es-part-1/

Re: Fundsmith

Posted: August 6th, 2022, 6:21 pm

by absolutezero

BullDog wrote:Well, just when you think you have heard everything Terry Smith has to say already - He releases probably the best interview I have ever heard from him. Well worth listening if you have any interest in what Smith has to say -

https://masterinvestor.co.uk/podcast-ma ... es-part-1/

Always good.

Thanks for posting.

Re: Fundsmith

Posted: August 6th, 2022, 8:05 pm

by BullDog

absolutezero wrote:BullDog wrote:Well, just when you think you have heard everything Terry Smith has to say already - He releases probably the best interview I have ever heard from him. Well worth listening if you have any interest in what Smith has to say -

https://masterinvestor.co.uk/podcast-ma ... es-part-1/

Always good.

Thanks for posting.

I was mildly surprised what a good mood Terry seemed to be in. Listening to him, he sounded like he was enjoying the interview, where often he seems to be barely tolerating the questions asked. That on it's own I found interesting.

Re: Fundsmith

Posted: August 7th, 2022, 8:06 am

by Itsallaguess

Thanks Bulldog - a very interesting 28 minutes, covering a wide range of currently relevant global topics.

Having listened to it, I'm currently undecided whether Terry had the chirpiness of someone who didn't think things were going to be quite as bad as they're currently being portrayed, or he's simply decided to align his approach to the current issues with that of Edmund at the end of Blackadder Goes Forth...

Cheers,

Itsallaguess

Re: Fundsmith

Posted: August 7th, 2022, 8:16 am

by scrumpyjack

It may be the chirpiness of someone who has made a massive pile and can take detached view from the magnificent tropical mansion he lives in in Mauritius

Re: Fundsmith

Posted: August 7th, 2022, 9:04 am

by BullDog

Itsallaguess wrote:Thanks Bulldog - a very interesting 28 minutes, covering a wide range of currently relevant global topics.

Having listened to it, I'm currently undecided whether Terry had the chirpiness of someone who didn't think things were going to be quite as bad as they're currently being portrayed, or he's simply decided to align his approach to the current issues with that of Edmund at the end of Blackadder Goes Forth...

Cheers,

Itsallaguess

Agreed, undecided here too. There's apparently a part two of that interview that's for release shortly.

Re: Fundsmith

Posted: August 7th, 2022, 3:00 pm

by monabri

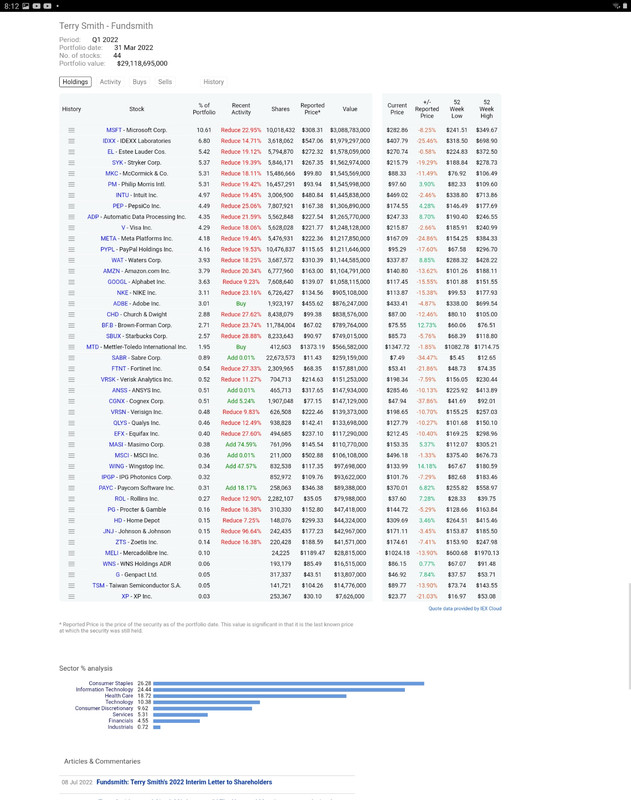

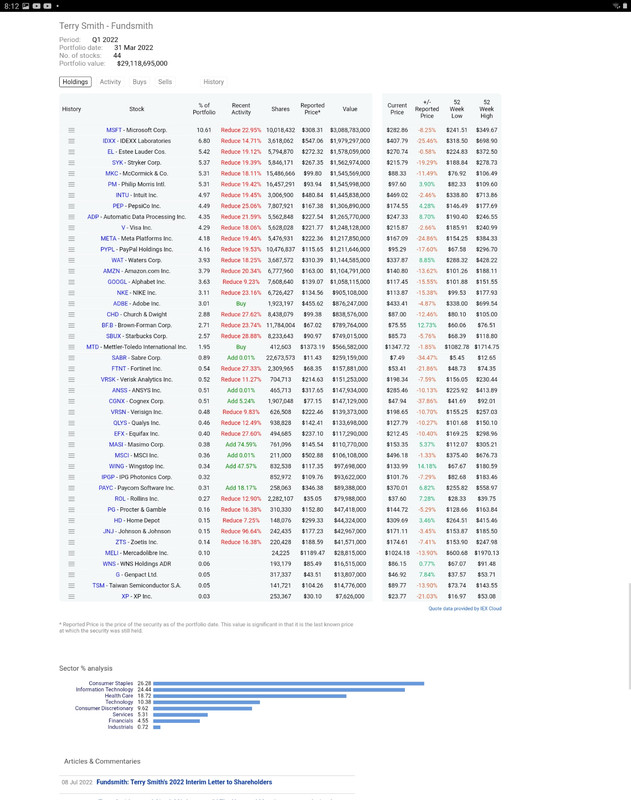

Fundsmith portfolio (I came across this site today- DATAROMA)

https://www.dataroma.com/m/holdings.php?m=FSQuite a lot of info on buy/sell and top 2O historical holdings.

Re: Fundsmith

Posted: August 7th, 2022, 4:33 pm

by simoan

Only includes US listed shares though (so no LVMH, L’Oreal, Kone, Novo Nordisk et al.) and includes holdings of FEET and SSON investment trusts. Nice find though.

All the best, Si

Re: Fundsmith

Posted: August 7th, 2022, 6:09 pm

by scotia

scrumpyjack wrote:It may be the chirpiness of someone who has made a massive pile and can take detached view from the magnificent tropical mansion he lives in in Mauritius

Yes - I was disappointed by hearing nothing of the specifics of his current investment philosophy , and whether or not it was ideal in the current changing circumstances. Over the past 18 months he has fallen behind a developed world tracker (VEVE). Are we seeing a reversion to the norm ?

Re: Fundsmith

Posted: August 7th, 2022, 8:19 pm

by monabri

One of Fundsmith's "Promises" is no trading. I'm surprised by the level of buying and selling...and the data below is for a single quarter of 2022.Maybe "trading" only applies if the fund completely disposes of an interest?

Why would you reduce J&J by 96.xx%...why not go the full hog? There's quite a lot of 20%+ modifications.

https://www.fundsmith.co.uk/From the link I posted above : post #520514

( it reminded me of the other Terry (TJH) who trades shares in his HYP to ratchet up yield...selling 20% of the shares which had increased in price beyond set limits).

Re: Fundsmith

Posted: August 7th, 2022, 8:43 pm

by ADrunkenMarcus

monabri wrote:One of Fundsmith's "Promises" is no trading. I'm surprised by the level of buying and selling...and the data below is for a single quarter of 2022.Maybe "trading" only applies if the fund completely disposes of an interest?

I imagine so. As an open-ended fund, they must have to do all sorts of transactions daily to manage redemptions and subscriptions. I only hold Smithson (SSON). If Fundsmith had been a closed-ended fund, I'd probably have bought it.

Best wishes

Mark.

Re: Fundsmith

Posted: August 7th, 2022, 11:06 pm

by simoan

ADrunkenMarcus wrote:monabri wrote:One of Fundsmith's "Promises" is no trading. I'm surprised by the level of buying and selling...and the data below is for a single quarter of 2022.Maybe "trading" only applies if the fund completely disposes of an interest?

I imagine so. As an open-ended fund, they must have to do all sorts of transactions daily to manage redemptions and subscriptions. I only hold Smithson (SSON). If Fundsmith had been a closed-ended fund, I'd probably have bought it.

Best wishes

Mark.

This isn’t just transactions for a single fund though and so not really that helpful in that regard. This seems like information inferred from Fundsmith SEC filings in the US for the two OEICs and two ITs. Of mild interest only and the portfolios weightings are total nonsense.

Re: Fundsmith

Posted: August 8th, 2022, 10:03 am

by simoan

scrumpyjack wrote:It may be the chirpiness of someone who has made a massive pile and can take detached view from the magnificent tropical mansion he lives in in Mauritius

To be honest, he didn't sound any different to how he normally does at Fundsmith AGMs. He has a cynical but light hearted approach generally and is always ready with a joke and some old saying. I think people can read too much into his demeanour when he's talking to someone he's clearly known for many years - just two old mates having a chat. He knows he doesn't know any more about future than anyone else and that in itself is a very powerful thing. He also knows the companies he holds will continue generating profits, paying dividends, investing in their businesses, and come out the other side maybe in an even better position as many have seen off far worse times.

Re: Fundsmith

Posted: August 8th, 2022, 11:57 am

by Tigger

I think the apparent large reduction in many of the holdings for Q1 2022 could be more of a technicality than the wholesale selling of positions. It looks like a lot of holdings in Fundsmith LLP (which is what the dataroma site seems to list) could have been transferred to another entity called Fundsmith Investment Services Limited. FIS Ltd publishes a separate 13-F that you can find on sites like Whale Wisdom.

Given the numbers involved, the most likely suspect is the Fundsmith SICAV fund which has assets of about €9bn. I think Fundsmith SICAV is for EU-based investors and has the same holdings as the main fund although the percentages in each stock seem to differ somewhat. I think the main fund did see some net outflow in Q1 2022 but not enough for most position sizes to be cut by 20%, so a transfer out would be seem to be the most likely explanation.

As for selling nearly all of J&J, I think that is because the main Fundsmith Equity fund sold out of this position in February 2022 but it's still held in the much smaller Fundsmith Sustainable fund which only has around £700m of assets.

The 13-Fs for Q2 2022 are due to be published in the next week so they should give a more up-to-date view of what Fundsmith has been buying and selling. The monthly factsheets have said three new companies have been added to the main fund (Adobe, Mettler-Toledo, and TBC) and two have been sold outright (J&J and Starbucks). So trading has been a little more active that you would expect -- on average about 3 companies have been bought and sold each year out of a portfolio of around 25-30 companies.