As you may recall from an earlier topic of mine (https://www.lemonfool.co.uk/viewtopic.php?f=54&t=20594) my family and I in general are invested in combinations of two Investment Trusts - one an International General and the other an International (High Yield) Bond.

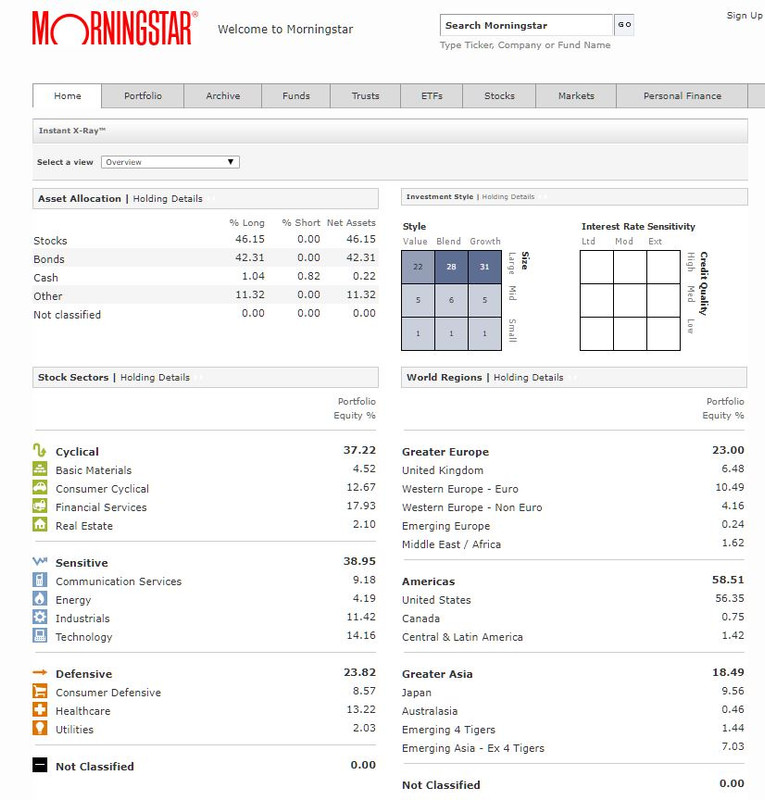

I was looking at each of these using the X-Ray tool provided by II, which is I think a re-badged Morningstar tool. When I did so, I noticed two things

- There is no "Fixed Income Style" analysis - the 3*3 table is there but is not populated, for any of the three combinations - whereas the adjacent "Stock Style" is, and

The combinations with FCIT and CMHY (kids Junior ISA's) are only 32.31% analysed - unlike the WTAN/HDIV (ISA) and ATST/IPE (SIPP) combinations - which are 100% analysed

Any ideas why?

Regards, Newroad

PS Compliments of the season to all!