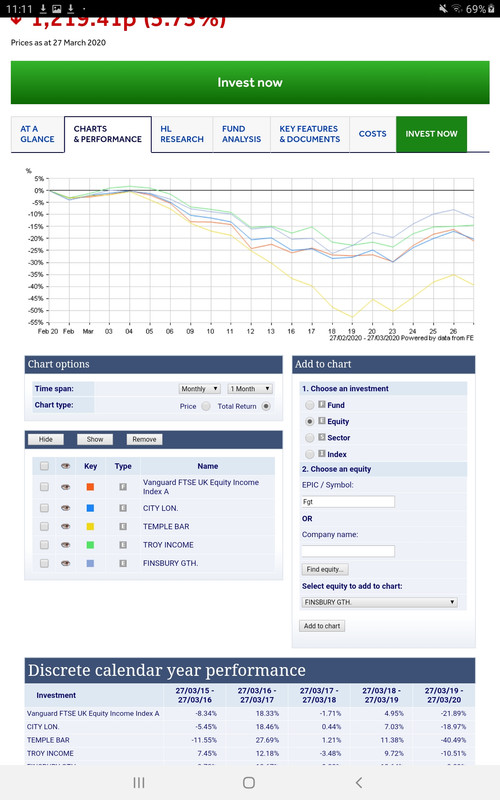

FGT held up better in the UK sector, as did CTY and TIGT. TMPL as we know fared worst.

Corona Crash: Train’s Finsbury Growth holds up better in horror month for UK trusts

https://citywire.co.uk/investment-trust ... st-insider

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

Corona Crash: Train’s Finsbury Growth holds up better in horror month for UK trusts

richfool wrote:...

FGT held up better in the UK sector, as did CTY and TIGT. TMPL as we know fared worst.

...

Julian wrote:richfool wrote:...

FGT held up better in the UK sector, as did CTY and TIGT. TMPL as we know fared worst.

...

Thanks. That article is a really convenient one-stop-shop to assess the recent carnage.

If you're setting the "held up better" bar at the CTY level (31.3% drop in the last month) then I note that Murray Income (MUT) dropped 31.7% so pretty much identical to CTY but the 5 year total NAV return is -12.4% for CTY vs +0.2%(*) for MUT. I also note that on NAV for the last month CTY is at -33.5% vs MUT at -30.8%. All things considered I think MUT deserves a place alongside CTY in the "held up better" club.

I'm not a MUT shareholder at the moment by the way. My core UK income IT holding is in CTY but I am one of those people who doesn't like to have all his eggs in one basket so, although there is the counter argument expressed by some that there is no real point diversifying too much amongst the UK income ITs because most have broadly the same underlying big holdings, I like to have exposure to different manager behaviours and the tails of the holding tend to be quite different. In that light I'd actually been looking at adding MUT as a diversification partner to sit alongside CTY for quite a while but before this crisis hit the yield on MUT was just a bit below what I was aiming for. With the recent share price collapses and hence significantly higher yields (assuming dividends are maintained which for ITs with a long unbroken record to preserve I don't think is an unreasonable assumption) the current 5.17% yield on MUT is well over my threshold. As and when I start putting some cash I have sitting on the sidelines back into the market MUT might well be joining my portfolio to sit alongside my CTY holding.

- Julian

(*) I thought I'd better put in an explit "+" sign since in these times it would be all to easy to assume I had a erratic "-" key and the lack of a "-" was a typo!

Return to “Investment Trusts and Unit Trusts”

Users browsing this forum: No registered users and 26 guests