Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

IT purchase views please

-

Wizard

- Lemon Quarter

- Posts: 2829

- Joined: November 7th, 2016, 8:22 am

- Has thanked: 68 times

- Been thanked: 1029 times

IT purchase views please

I am looking to get some international exposure for my investments with an objective of Total Return over the next 5 to 10 years. I currently only hold Lindsell Train in the IT space. I am thinking about the following ITs as a start:

Henderson Eurotrust (HNE)

JPMorgan American (JAM)

Schroder Asia Pacific (SDP)

The selection is based predominantly from the AIC performance tables and a quick look at the largest holdings of these and a couple of other alternatives. Any thoughts or recent changes that might invalidate the historic track record?

Henderson Eurotrust (HNE)

JPMorgan American (JAM)

Schroder Asia Pacific (SDP)

The selection is based predominantly from the AIC performance tables and a quick look at the largest holdings of these and a couple of other alternatives. Any thoughts or recent changes that might invalidate the historic track record?

-

richfool

- Lemon Quarter

- Posts: 3530

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1208 times

- Been thanked: 1294 times

Re: IT purchase views please

Wizard wrote:I am looking to get some international exposure for my investments with an objective of Total Return over the next 5 to 10 years. I currently only hold Lindsell Train in the IT space. I am thinking about the following ITs as a start:

Henderson Eurotrust (HNE)

JPMorgan American (JAM)

Schroder Asia Pacific (SDP)

The selection is based predominantly from the AIC performance tables and a quick look at the largest holdings of these and a couple of other alternatives. Any thoughts or recent changes that might invalidate the historic track record?

My suggestion would be: JGGI (JP Morgan Global Growth & Income trust).

I could suggest some more if I was knew whether your "Total Return" had any bias towards income or growth.

-

Wizard

- Lemon Quarter

- Posts: 2829

- Joined: November 7th, 2016, 8:22 am

- Has thanked: 68 times

- Been thanked: 1029 times

Re: IT purchase views please

richfool wrote:Wizard wrote:I am looking to get some international exposure for my investments with an objective of Total Return over the next 5 to 10 years. I currently only hold Lindsell Train in the IT space. I am thinking about the following ITs as a start:

Henderson Eurotrust (HNE)

JPMorgan American (JAM)

Schroder Asia Pacific (SDP)

The selection is based predominantly from the AIC performance tables and a quick look at the largest holdings of these and a couple of other alternatives. Any thoughts or recent changes that might invalidate the historic track record?

My suggestion would be: JGGI (JP Morgan Global Growth & Income trust).

I could suggest some more if I was knew whether your "Total Return" had any bias towards income or growth.

Thank you for the input.

I have no need for the income now, so my preference is for the best overall return either through capital growth and / or reinvestment of any income. Would you suggest JGGI as a replacement for all of the above? Why do you prefer JGGI?

-

baldchap

- Lemon Slice

- Posts: 257

- Joined: February 5th, 2017, 11:06 am

- Has thanked: 501 times

- Been thanked: 132 times

Re: IT purchase views please

+1 for JGGI. of all the global ITs, except maybe FCIT, it most resembles the MSCI ACWI index.

I would add some Asian & N.American to this (as you are suggesting, although I prefer SOI, SDP is 45% China/HK) and avoid Europe. JGGI is giving you enough European exposure.

EDIT - just saw the comment re total return. In that case MNKS or any of the global ITs does the job, or VWRL if you are that way inclined.

I would add some Asian & N.American to this (as you are suggesting, although I prefer SOI, SDP is 45% China/HK) and avoid Europe. JGGI is giving you enough European exposure.

EDIT - just saw the comment re total return. In that case MNKS or any of the global ITs does the job, or VWRL if you are that way inclined.

-

monabri

- Lemon Half

- Posts: 8427

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: IT purchase views please

For JAM...why not consider VUSA?

Ditto HNE and VERX.

SDP outperformed passives VFEM / VAPX... ( no graph, but you can DIY).

Ditto HNE and VERX.

SDP outperformed passives VFEM / VAPX... ( no graph, but you can DIY).

Last edited by monabri on June 19th, 2020, 2:20 pm, edited 1 time in total.

-

monabri

- Lemon Half

- Posts: 8427

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: IT purchase views please

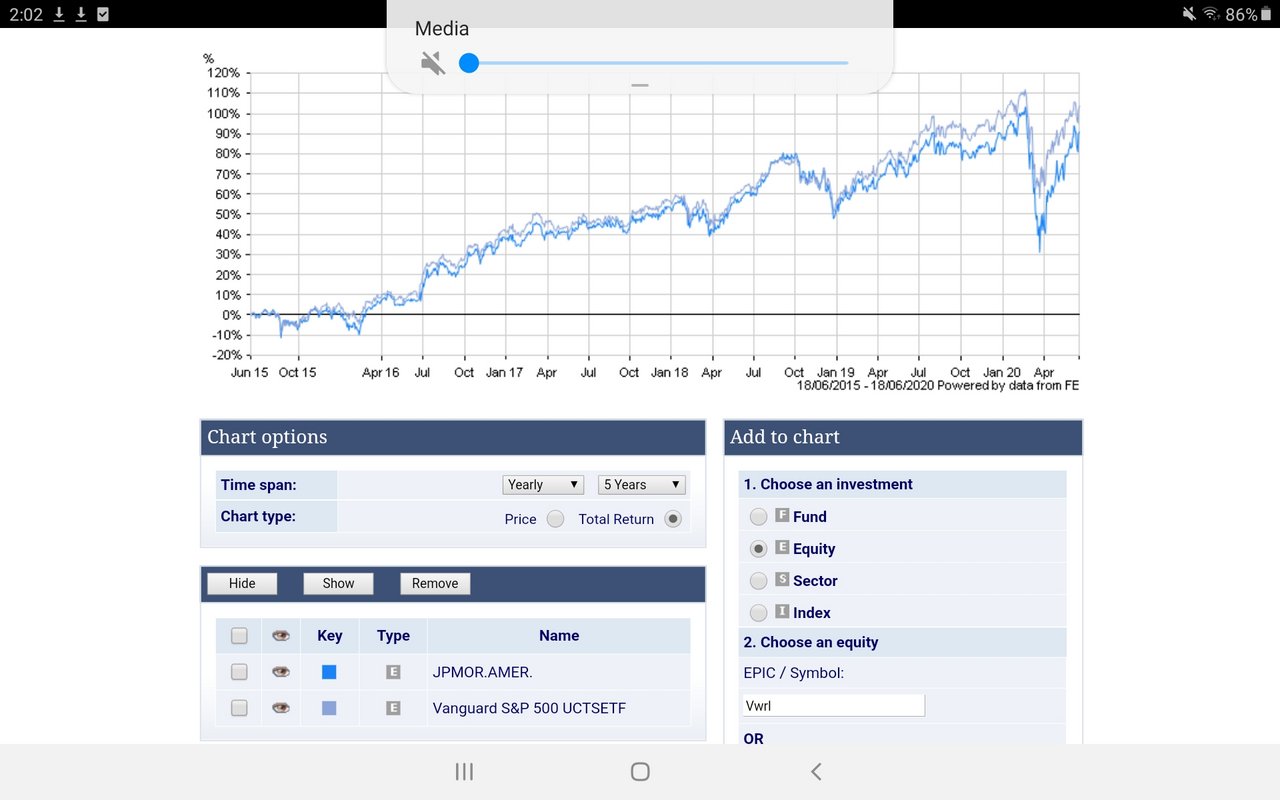

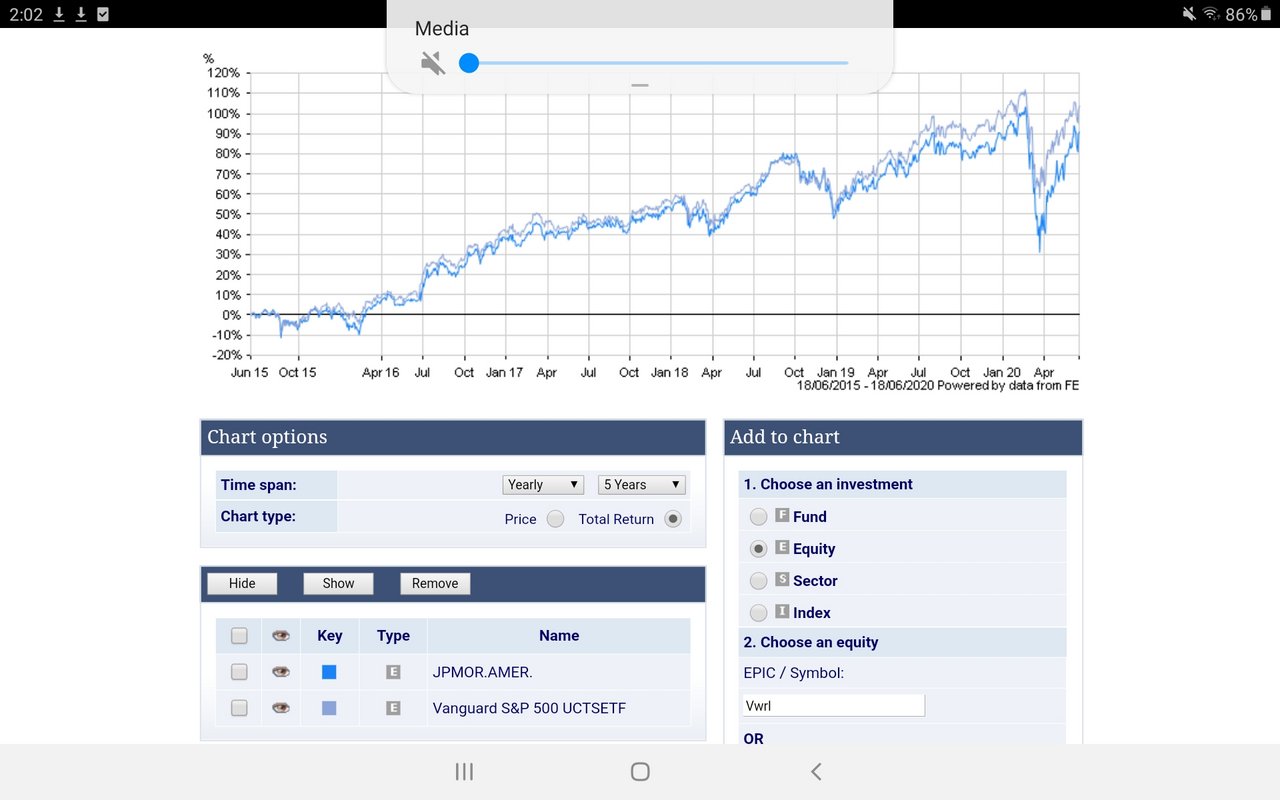

Here's the HL comparator tool and, being blunt about it, I'd compare the managed funds over the last 5 years and if they've not beaten a cheap passive then why pay for the brokers skiing holiday?

https://www.hl.co.uk/funds/fund-discoun ... ion/charts

Income ITs are one thing (reserves) but when it comes to growth collectives..don't indulge the broker unless they have demonstrated their value.

Of course, there are managers that are currently beating the trackers...currently.

https://www.hl.co.uk/funds/fund-discoun ... ion/charts

Income ITs are one thing (reserves) but when it comes to growth collectives..don't indulge the broker unless they have demonstrated their value.

Of course, there are managers that are currently beating the trackers...currently.

-

richfool

- Lemon Quarter

- Posts: 3530

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1208 times

- Been thanked: 1294 times

Re: IT purchase views please

Wizard wrote:richfool wrote:Wizard wrote:I am looking to get some international exposure for my investments with an objective of Total Return over the next 5 to 10 years. I currently only hold Lindsell Train in the IT space. I am thinking about the following ITs as a start:

Henderson Eurotrust (HNE)

JPMorgan American (JAM)

Schroder Asia Pacific (SDP)

The selection is based predominantly from the AIC performance tables and a quick look at the largest holdings of these and a couple of other alternatives. Any thoughts or recent changes that might invalidate the historic track record?

My suggestion would be: JGGI (JP Morgan Global Growth & Income trust).

I could suggest some more if I was knew whether your "Total Return" had any bias towards income or growth.

Thank you for the input.

I have no need for the income now, so my preference is for the best overall return either through capital growth and / or reinvestment of any income. Would you suggest JGGI as a replacement for all of the above? Why do you prefer JGGI?

I prefer JGGI because it is in the global growth and income sector, and as such targets a dividend income yield of 4.00%, but it focuses on global growth stocks and therefore gives exposure to technology stocks and the likes of Amazon. The other trusts in that sector tend to concentrate on income stocks. Being in the growth & income sector it gives income to reinvest and holds up better in market falls. JGGI is usually first or second in the performance tables in that sector.

If you want to avoid income completely, then Monks in the global growth sector, USA (Baillie Gifford US Growth) in the USA, and PHI (Baillie Gifford Asia Growth trust) in Asia Pacific. The latter would be more volatile, along with SMT (Scottish Mortgage) as an alternative in the global growth sector.

https://citywire.co.uk/wealth_manager/i ... ePeriod=12

https://citywire.co.uk/wealth_manager/i ... ePeriod=12

https://citywire.co.uk/wealth_manager/i ... ePeriod=12

https://citywire.co.uk/wealth_manager/i ... ePeriod=12

-

richfool

- Lemon Quarter

- Posts: 3530

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1208 times

- Been thanked: 1294 times

-

77ss

- Lemon Quarter

- Posts: 1276

- Joined: November 4th, 2016, 10:42 am

- Has thanked: 233 times

- Been thanked: 416 times

Re: IT purchase views please

Wizard wrote:I am looking to get some international exposure for my investments with an objective of Total Return over the next 5 to 10 years. I currently only hold Lindsell Train in the IT space. I am thinking about the following ITs as a start:

Henderson Eurotrust (HNE)

JPMorgan American (JAM)

Schroder Asia Pacific (SDP)

The selection is based predominantly from the AIC performance tables and a quick look at the largest holdings of these and a couple of other alternatives. Any thoughts or recent changes that might invalidate the historic track record?

There are more ways of getting international exposure than going specifically for country/region focused ITs, and in general I have avoided this path.

Some ITs with a different focus have, by their very nature, huge international exposure - and better 5 year TRs than the trio you mention.

Allianz Technology Trust, Worldwide Healthcare, Edinburgh Worldwide International and, as mentioned by another poster, Monks.

I hold all the above 4. My forays into geographically based ITs have met with mixed success. JESC is down about 10% this year (better than the FT100 though) but JCGI is up 23% - somewhat counterintuitively.

Cast your net widely when thinking about what to buy. Looking for TR, I would screen for ITs with a 5 year TR of over (say) 90% - pick your number - a simple process, using the excellent AIC website.

-

Wizard

- Lemon Quarter

- Posts: 2829

- Joined: November 7th, 2016, 8:22 am

- Has thanked: 68 times

- Been thanked: 1029 times

Re: IT purchase views please

77ss wrote:Wizard wrote:I am looking to get some international exposure for my investments with an objective of Total Return over the next 5 to 10 years. I currently only hold Lindsell Train in the IT space. I am thinking about the following ITs as a start:

Henderson Eurotrust (HNE)

JPMorgan American (JAM)

Schroder Asia Pacific (SDP)

The selection is based predominantly from the AIC performance tables and a quick look at the largest holdings of these and a couple of other alternatives. Any thoughts or recent changes that might invalidate the historic track record?

There are more ways of getting international exposure than going specifically for country/region focused ITs, and in general I have avoided this path.

Some ITs with a different focus have, by their very nature, huge international exposure - and better 5 year TRs than the trio you mention.

Allianz Technology Trust, Worldwide Healthcare, Edinburgh Worldwide International and, as mentioned by another poster, Monks.

I hold all the above 4. My forays into geographically based ITs have met with mixed success. JESC is down about 10% this year (better than the FT100 though) but JCGI is up 23% - somewhat counterintuitively.

Cast your net widely when thinking about what to buy. Looking for TR, I would screen for ITs with a 5 year TR of over (say) 90% - pick your number - a simple process, using the excellent AIC website.

Thanks for the suggestions. I picked the ones I noted at the top using the AIC website, however, I staryed by ordering on 10 year return. Is there a particular reason you would suggest using 5 years instead of 10?

As it happens my plan is to purchase 8 or 9 trusts in total, these were just the starting point. Maybe I need to think about the whole basket. I am a bit wary of technology focussed funds, just because they are currently riding so high.

-

BrummieDave

- Lemon Slice

- Posts: 818

- Joined: November 6th, 2016, 7:29 pm

- Has thanked: 200 times

- Been thanked: 378 times

Re: IT purchase views please

Wizard wrote: I am a bit wary of technology focussed funds, just because they are currently riding so high.

Good point, who would back a winner...?

-

77ss

- Lemon Quarter

- Posts: 1276

- Joined: November 4th, 2016, 10:42 am

- Has thanked: 233 times

- Been thanked: 416 times

Re: IT purchase views please

Wizard wrote:.....

Thanks for the suggestions. I picked the ones I noted at the top using the AIC website, however, I staryed by ordering on 10 year return. Is there a particular reason you would suggest using 5 years instead of 10?

As it happens my plan is to purchase 8 or 9 trusts in total, these were just the starting point. Maybe I need to think about the whole basket. I am a bit wary of technology focussed funds, just because they are currently riding so high.

I would look at both 5 and 10 yrs actually. I just just used 5 for my post as I like the way HL displays the data.

IT riding high - well I understand your being wary, but in my opinion the sector is still worth a decent slice of one's dosh. No crystal ball though.

-

OllyDrod

- 2 Lemon pips

- Posts: 103

- Joined: February 5th, 2020, 3:58 pm

- Has thanked: 91 times

- Been thanked: 85 times

Re: IT purchase views please

BrummieDave wrote:Wizard wrote: I am a bit wary of technology focussed funds, just because they are currently riding so high.

Good point, who would back a winner...?

Agreed - but up to a point. Growth, yes. Growth at a Reasonable Price, infinitely better!

-

richfool

- Lemon Quarter

- Posts: 3530

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1208 times

- Been thanked: 1294 times

Re: IT purchase views please

Wizard wrote:As it happens my plan is to purchase 8 or 9 trusts in total, these were just the starting point. Maybe I need to think about the whole basket. I am a bit wary of technology focussed funds, just because they are currently riding so high.

Wizard, Most growth trusts/funds include technology stocks but not exclusively so. You would need to check what percentage each one holds in technology and decide what percentage you are comfortable with.

For example, SMT, according to Citywire, holds 17.3% in "Communication Services" and 9.30% in "technology" stocks. Monks according to its factsheet has 18% in technology and 18% in Consumer Services (I'm not sure what the latter are). Mid Wynd, according to its factsheet holds 23% in "Information Technology" and 9% in "Communication Services". JGGI (per fact sheet) has 18% in technology - semi & hardware, 7.8% in technology - software.

Return to “Investment Trusts and Unit Trusts”

Who is online

Users browsing this forum: terminal7 and 34 guests