Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

HICL/Infrastructure in general

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7535 times

HICL/Infrastructure in general

I recently bought 3i Infrastructure, my first venture in that area and it seems fine to me. I was looking at HICL. A good yield of over 5% but a premium that seems to be around 16% which more or less rules it out but setting that aside, I have been looking at it anyway.

I cannot understand the latest trading update which is full of jargon which always makes me suspicious and I do not like the PPP projects very much. I am also getting increasingly fed up of placings where the average private shareholder is being diluted and I see that they too have been indulging in that practice.

All in all therefore I think I can give it a miss as I am not that desperate for a good yield attractive though 5% is.

Has anyone got any recommendations for an attractive infrastructure business with a decent yield?

Dod

I cannot understand the latest trading update which is full of jargon which always makes me suspicious and I do not like the PPP projects very much. I am also getting increasingly fed up of placings where the average private shareholder is being diluted and I see that they too have been indulging in that practice.

All in all therefore I think I can give it a miss as I am not that desperate for a good yield attractive though 5% is.

Has anyone got any recommendations for an attractive infrastructure business with a decent yield?

Dod

-

monabri

- Lemon Half

- Posts: 8418

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1547 times

- Been thanked: 3439 times

Re: HICL/Infrastructure in general

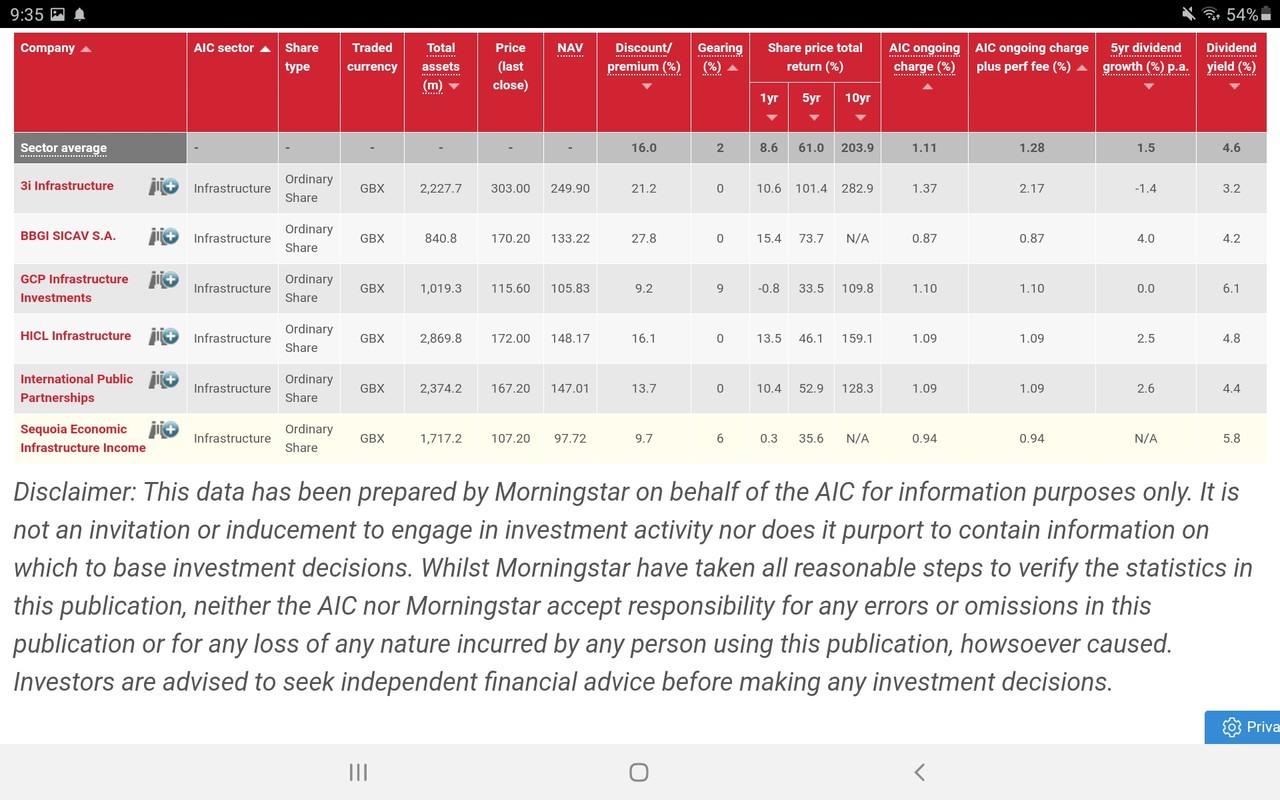

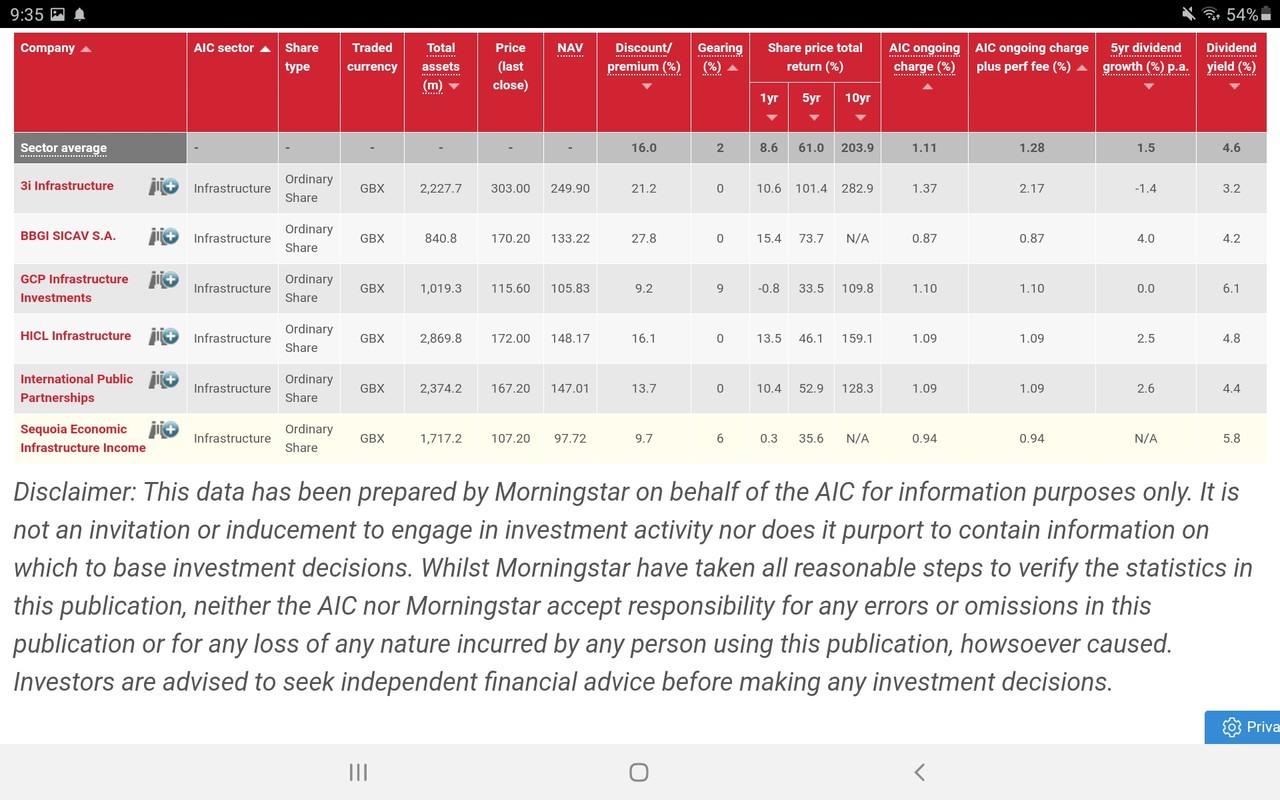

I had a quick look on the AIC website....there's not too much to chose from and all are reported as being at a premium to NAV.

https://www.theaic.co.uk/

A search for " Income and growth" with AIC Sector set to "Infrastructure " (selected as an option on the pull down menu) revealed a small choice.

Source of information....AIC website, link above

I have a v.small percentage held in SEQI ( note domicile of Guernsey for tax returns). Their 71 holdings are just over half in the US, 15% UK, a quarter in Europe and a few percent in Aus.

It is trading on a significant (~10%) premium to underlying NAV.

I've only held for just over 2 years but there has been a small positive return over this period (as measured by an internal rate of return ( XIRR in Excel) of 4.2%). The divis in the first year were 1.50p per quarter, increasing to 1.56p in year two. However the first dividend of year 3 has remained static at 1.56p.

I bought in May 2018 at 107p I note the closing price of on Friday of ....107.2p . The price dropped to 76p mid March 2020 but has recovered.

https://www.theaic.co.uk/

A search for " Income and growth" with AIC Sector set to "Infrastructure " (selected as an option on the pull down menu) revealed a small choice.

Source of information....AIC website, link above

I have a v.small percentage held in SEQI ( note domicile of Guernsey for tax returns). Their 71 holdings are just over half in the US, 15% UK, a quarter in Europe and a few percent in Aus.

It is trading on a significant (~10%) premium to underlying NAV.

I've only held for just over 2 years but there has been a small positive return over this period (as measured by an internal rate of return ( XIRR in Excel) of 4.2%). The divis in the first year were 1.50p per quarter, increasing to 1.56p in year two. However the first dividend of year 3 has remained static at 1.56p.

I bought in May 2018 at 107p I note the closing price of on Friday of ....107.2p . The price dropped to 76p mid March 2020 but has recovered.

-

TahiPanasDua

- Lemon Slice

- Posts: 322

- Joined: June 4th, 2017, 6:51 pm

- Has thanked: 402 times

- Been thanked: 233 times

Re: HICL/Infrastructure in general

Dod101 wrote:I recently bought 3i Infrastructure, my first venture in that area and it seems fine to me. I was looking at HICL. A good yield of over 5% but a premium that seems to be around 16% which more or less rules it out but setting that aside, I have been looking at it anyway.

I cannot understand the latest trading update which is full of jargon which always makes me suspicious and I do not like the PPP projects very much. I am also getting increasingly fed up of placings where the average private shareholder is being diluted and I see that they too have been indulging in that practice.

All in all therefore I think I can give it a miss as I am not that desperate for a good yield attractive though 5% is.

Has anyone got any recommendations for an attractive infrastructure business with a decent yield?

Dod

Hi Dod,

I have an admittedly highly controversial view of infrastructure companies in general.

They seem to buy mostly wasting assets in the form of contracts that revert to zero value on expiry. They pay you back the purchase costs over the lifetime of the contract in the form of high dividends. In a sense, they just give you your money back as long as there is a steady inflow of new investors to finance new contracts. You could consider them to be totally honest and upfront Ponzi schemes that depend on new investors financing to continue the payment process. Heaven forfend the flow diminishes or worse disappears.

I made this outrageous suggestion some time ago and was surprised not to be inundated with indignant response. Maybe the suggestion is just dumb.

TP2.

-

monabri

- Lemon Half

- Posts: 8418

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1547 times

- Been thanked: 3439 times

Re: HICL/Infrastructure in general

Hindsight..a wonderful thing! Over the last 5 years, 3IN looks to have been the better choice.

(Graphs generated using free comparator tool at Hargreaves Lansdowne)

https://www.hl.co.uk/funds/fund-discoun ... ion/charts

(Graphs generated using free comparator tool at Hargreaves Lansdowne)

https://www.hl.co.uk/funds/fund-discoun ... ion/charts

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7535 times

Re: HICL/Infrastructure in general

TahiPanasDua wrote:Hi Dod,

I have an admittedly highly controversial view of infrastructure companies in general.

They seem to buy mostly wasting assets in the form of contracts that revert to zero value on expiry. They pay you back the purchase costs over the lifetime of the contract in the form of high dividends. In a sense, they just give you your money back as long as there is a steady inflow of new investors to finance new contracts. You could consider them to be totally honest and upfront Ponzi schemes that depend on new investors financing to continue the payment process. Heaven forfend the flow diminishes or worse disappears.

I made this outrageous suggestion some time ago and was surprised not to be inundated with indignant response. Maybe the suggestion is just dumb.

TP2.

You may well be right. I am slightly uncomfortable and yet ..........Maybe I will just hang on to 3i and let it run and leave it at that. It will let me see how it goes because I find holding a share makes me much more knowledgeable about it than all the dry research that I can do, not that I am much into that anyway.

And thanks monabri for your ever helpful charts.

Dod

-

mc2fool

- Lemon Half

- Posts: 7883

- Joined: November 4th, 2016, 11:24 am

- Has thanked: 7 times

- Been thanked: 3042 times

Re: HICL/Infrastructure in general

TahiPanasDua wrote:I have an admittedly highly controversial view of infrastructure companies in general.

They seem to buy mostly wasting assets in the form of contracts that revert to zero value on expiry. They pay you back the purchase costs over the lifetime of the contract in the form of high dividends.

While the first part is partly true I don't think that's all totally so. Firstly, while it's true that public-private-partnership contracts are usually fixed term concessions, these aren't the only kind of assets the infrastructure companies invest in, they do also have some perpetual businesses.

Secondly, it's not right to say they (just) pay you back the purchase costs, there is the goal of making a profit! Indeed, that's one of the common complaints about PPP, isn't it?, that companies/investors are making a profit from public services.

HICL's annual report has lots on the different types of assets they have (they categorise them into PPP, Regulated, Demand-based and Corporate) and their different characteristics, as well as on future cashflows, risk ,etc, etc, for those that want to read up (I haven't in detail).

Like Dod, before even getting into any of that, I've always been put off by the premium ... a bit unfortunate as it's done ok regardless, although a bit more volatile than I would have expected. HICL vs FTSE chart.

There is, however, something else that's always made me a bit wary, which is that the valuation of the assets -- and hence the NAV -- is determined by a discounted cash flow analysis of the forecast revenues, and so the NAV will change with changes in the discount rate, inflation, interest rates, and a few other "macro" factors. The annual report does go into all this, and gives some sensitivities. E.g. a 0.5% increase in the discount rate will knock 7.5p off the NAV, whereas a 0.5% increase in inflation will add 7.6p to it. See page 63 (as numbered).

-

richfool

- Lemon Quarter

- Posts: 3515

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1201 times

- Been thanked: 1287 times

Re: HICL/Infrastructure in general

I hold INPP, SEQI and EGL in that sector.

I don't recall INPP, (which has a slightly lower yield than the others), having raised further funds. I previously held GCP, but switched to SEQI.

International Public Partnerships Ltd

Sequoia Economic Infrastructure Fund*

Ecofin Global Utilities & Infrastructure Income Fund

GCP Infrastructure Investments*

* Hold debt rather than equity.

https://www.hl.co.uk/shares/shares-sear ... ps-ltd-ord

https://www.hl.co.uk/shares/shares-sear ... income-npv

https://www.hl.co.uk/shares/shares-sear ... ructure-1p

https://www.hl.co.uk/shares/shares-sear ... ltd-1p-shs

I don't recall INPP, (which has a slightly lower yield than the others), having raised further funds. I previously held GCP, but switched to SEQI.

International Public Partnerships Ltd

Sequoia Economic Infrastructure Fund*

Ecofin Global Utilities & Infrastructure Income Fund

GCP Infrastructure Investments*

* Hold debt rather than equity.

https://www.hl.co.uk/shares/shares-sear ... ps-ltd-ord

https://www.hl.co.uk/shares/shares-sear ... income-npv

https://www.hl.co.uk/shares/shares-sear ... ructure-1p

https://www.hl.co.uk/shares/shares-sear ... ltd-1p-shs

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7535 times

Re: HICL/Infrastructure in general

mc2fool wrote:[There is, however, something else that's always made me a bit wary, which is that the valuation of the assets -- and hence the NAV -- is determined by a discounted cash flow analysis of the forecast revenues, and so the NAV will change with changes in the discount rate, inflation, interest rates, and a few other "macro" factors. The annual report does go into all this, and gives some sensitivities. E.g. a 0.5% increase in the discount rate will knock 7.5p off the NAV, whereas a 0.5% increase in inflation will add 7.6p to it. See page 63 (as numbered).

All very interesting but of course the discount rate very much affects insurance reserving as well, the Ogden rate mentioned for example by Admiral, and it directly affects profits in the case of insurers but not I think Infrastructure companies. The variation in NAV from that source would be of much less concern to me than some of the other factors such as a contract with a limited lifespan and then the assets need to be handed back, presumably in the case of many if not all PPP contracts.

I need to study this in more detail and am grateful for the pointers.

Dod

-

Alaric

- Lemon Half

- Posts: 6059

- Joined: November 5th, 2016, 9:05 am

- Has thanked: 20 times

- Been thanked: 1413 times

Re: HICL/Infrastructure in general

Dod101 wrote:All very interesting but of course the discount rate very much affects insurance reserving as well, the Ogden rate mentioned for example by Admiral, and it directly affects profits in the case of insurers but not I think Infrastructure companies.

Off topic for infrastructure, but the Ogden rate is specifically for personal injury claims. The idea is that when the Court assesses payments as injury compensation as £ X per week, the Ogden tables convert that into a lump sum. Whether in practice someone receiving a lump sum compensation would invest it in index linked Gilts at a negative real rate of return isn't so obvious, but that's the assumption which underpins the awards and which the likes of Admiral have to allow for in their claim reserving.

To some extent perhaps Infrastructure companies have the same relative relationship and return to Indexed Linked Gilts as Corporate Bonds have to conventional Gilts. Defined Benefit pension schemes and insurers like Legal & General with major annuity portfolios will have a natural demand for investments where the payout is both reasonably secure and linked to inflation measures.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7535 times

Re: HICL/Infrastructure in general

Yes Alaric I appreciate that but they are both variations on the discount rate that mc2fool mentioned, at least I have always taken that to be the case.

Dod

Dod

-

UncleEbenezer

- The full Lemon

- Posts: 10783

- Joined: November 4th, 2016, 8:17 pm

- Has thanked: 1470 times

- Been thanked: 2993 times

Re: HICL/Infrastructure in general

TahiPanasDua wrote:They seem to buy mostly wasting assets in the form of contracts that revert to zero value on expiry.

And as for leasehold property

p.s. to the OP, I hold First State global listed infrastructure. Unlike the ITs in the sector, I didn't have to pay a premium to buy it. Last time I looked I was happy with that choice based on track record.

-

88V8

- Lemon Half

- Posts: 5817

- Joined: November 4th, 2016, 11:22 am

- Has thanked: 4169 times

- Been thanked: 2592 times

Re: HICL/Infrastructure in general

Sequioa are reported to be the largest creditor of Bulb, the latest failed energy supplier, as reported by richfool here https://www.lemonfool.co.uk/viewtopic.php?f=8&t=21718&start=20

In addition to their exposure to Bulb - 2.9% of NAV - they already have c2% exposed to Talen Energy Corp https://news.bloomberglaw.com/bankruptcy-law/talen-energy-bonds-drop-on-earnings-outlook-debt-concerns

I sold a third of my Sequioa holding this morning and may unload the rest. Istm that there are better sources of income available, they keep calling for new capital, the SP has gone nowhere, and I don't feel that I have to be in this sector.

V8

In addition to their exposure to Bulb - 2.9% of NAV - they already have c2% exposed to Talen Energy Corp https://news.bloomberglaw.com/bankruptcy-law/talen-energy-bonds-drop-on-earnings-outlook-debt-concerns

I sold a third of my Sequioa holding this morning and may unload the rest. Istm that there are better sources of income available, they keep calling for new capital, the SP has gone nowhere, and I don't feel that I have to be in this sector.

V8

-

monabri

- Lemon Half

- Posts: 8418

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1547 times

- Been thanked: 3439 times

Re: HICL/Infrastructure in general

88V8 wrote:Sequioa are reported to be the largest creditor of Bulb, the latest failed energy supplier, as reported by richfool here https://www.lemonfool.co.uk/viewtopic.php?f=8&t=21718&start=20

In addition to their exposure to Bulb - 2.9% of NAV - they already have c2% exposed to Talen Energy Corp https://news.bloomberglaw.com/bankruptcy-law/talen-energy-bonds-drop-on-earnings-outlook-debt-concerns

I sold a third of my Sequioa holding this morning and may unload the rest. Istm that there are better sources of income available, they keep calling for new capital, the SP has gone nowhere, and I don't feel that I have to be in this sector.

V8

I bought shares in SEQI in May 2018. The price was 107p per share with a dividend of 6p per share (hence a yield of 5.6%).

Share price today is just over 106p - so, it has not gone anywhere (but, so far, it hasn't gone pop)! The dividend has increased to 6.25p per share.

I think I will just leave it alone.

-

richfool

- Lemon Quarter

- Posts: 3515

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1201 times

- Been thanked: 1287 times

Re: HICL/Infrastructure in general

monabri wrote:88V8 wrote:Sequioa are reported to be the largest creditor of Bulb, the latest failed energy supplier, as reported by richfool here https://www.lemonfool.co.uk/viewtopic.php?f=8&t=21718&start=20

In addition to their exposure to Bulb - 2.9% of NAV - they already have c2% exposed to Talen Energy Corp https://news.bloomberglaw.com/bankruptcy-law/talen-energy-bonds-drop-on-earnings-outlook-debt-concerns

I sold a third of my Sequioa holding this morning and may unload the rest. Istm that there are better sources of income available, they keep calling for new capital, the SP has gone nowhere, and I don't feel that I have to be in this sector.

V8

I bought shares in SEQI in May 2018. The price was 107p per share with a dividend of 6p per share (hence a yield of 5.6%).

Share price today is just over 106p - so, it has not gone anywhere (but, so far, it hasn't gone pop)! The dividend has increased to 6.25p per share.

I think I will just leave it alone.

I did previously hold SEQI as an alternative asset class and for the dividend yield, but then sold out back in early 2020 as the capital appreciation was going nowhere and I became concerned over debtor risk.

-

richfool

- Lemon Quarter

- Posts: 3515

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1201 times

- Been thanked: 1287 times

Re: HICL

A recent article about HICL, from the AIC website:

Infrastructure: Busy HICL adds more power and trains to its core portfolio

9 September 2022

HICL Infrastructure has extended this year's spate of acquistions with three additions to its £3.4bn, inflation-linked portfolio in the past month.

https://www.theaic.co.uk/aic/news/cityw ... -portfolio

Infrastructure: Busy HICL adds more power and trains to its core portfolio

9 September 2022

HICL Infrastructure has extended this year's spate of acquistions with three additions to its £3.4bn, inflation-linked portfolio in the past month.

HICL Infrastructure (HICL ) has extended a spate of acquistions this year with three additions to its £3.4bn, inflation-linked portfolio in the past month.

With cash and a borrowing facility expanded to £730m in July, this week the the steady income fund announced two investments, spending £236.4m on a 45.8% stake in Texas Nevada Transmission (TNT), and £118m on a bid to run the offshore transmission link (OFTO) connecting the Hornsea II wind farm in the North Sea off Yorkshire with the mainland.

This follows the investment company’s acquisition last month of a minority position in Cross London Trains from Equitix Investment Management, its third investment in the rail sector.

The core infrastructure fund started diversifying its UK-centric portfolio earlier in the year, buying a 40% stake in Aotearoa Towers, New Zealand’s dominant masts business, after a £160m fundraise.

Analysts say the 2022 acquisitions have also changed the revenue mix of the portfolio, adding more regulated, private sector and non-UK cashflows.

TNT, HICL’s fifth investment in North America, will account for around 6% of the closed-end fund. It brings equity interests in two electric transmission entities: Cross Texas Transmission (CTT), a regulated electric utility in Texas, and Great Basin Transmission South (GBTS).

The latter owns a 75% interest in the 231-mile One Nevada Transmission Line which has a long-term contract with NV Energy, a subsidiary of Warren Buffett’s Berkshire Hathaway.

HICL’s partner in the venture is clean energy infrastructure provider LS Power.

The investment in TNT was led by the Americas team of HICL’s fund manager InfraRed. This is headed by Jack Paris who joined last year from Citi bank. Its asset management team in the US was also strengthened last year by the hiring of Jay Crawford who has over 20 years experience in the sector at Cogentrix Energy, Calpine, and Nextera Energy Resources.

‘This acquisition fits firmly within HICL’s vision to support sustainable modern economies and is another example of InfraRed’s international footprint and network enabling HICL to execute its strategic priorities,’ said Edward Hunt, head of the InfraRed’s core income funds team.

The Hornsea II OFTO, where HICL joined the Diamond Transmission consortium alongside Mitsubishi, will account for 3% of the portfolio if, as expected, the deal completes next year. HICL will have a 75% stake of the project which will earn revenues under a 24-year contract for operating the link and making it available.

This involves no exposure to construction risk, electricity production risk or power price risk, Hunt said.

Last month’s acquisition of a minority stake in Cross London Trains (XLT), which owns a fleet of 115 trains operating on the Thameslink route, will represent 3% of HICL’s portfolio and marks its third investment in the rail sector after High Speed I and the Dutch High Speed Rail Link.

Numis estimates UK cashflows represent 65% of the portfolio, down from 73% in March, the US increases into double-digit territory from 9% and New Zealand will represent 5.5% of the portfolio.

The broker calculates that corporate cashflows will represent 9.6% (assuming a roughly even split between regulated and corporate cashflows within TNT) and regulated cashflows increases to 18% from 12%.

The acquisitions come off the back of a strong set of annual results in May and an interim update last month in which the 4.7%-yielder said it was on track to deliver full-year dividends of 8.25p per share.

It also expected that inflation raging over 10% would add between 3p to 3.6p to its net asset value at the end of September. The half-yearly updated NAV last stood at 159p at 31 March.

HICL has previously said its portfolio is 0.8% correlated with inflation, meaning it provides protection against four-fifths of rises in the cost of living. This is because the revenues it earns on many of its facility management contracts are linked to inflation.

The shares currently stand close to a premium of 6% over Numis estimate of NAV per share of 167p. They have gained 3.5% this year and delivered a total return of 23.4% over three years.

https://www.theaic.co.uk/aic/news/cityw ... -portfolio

-

TUK020

- Lemon Quarter

- Posts: 2042

- Joined: November 5th, 2016, 7:41 am

- Has thanked: 762 times

- Been thanked: 1178 times

Re: HICL/Infrastructure in general

Since about Feb, the discount has gone from ~0 to ~20%.

All long term assets. Not aware any under danger, although political risk on one of their top ten would be a water company.

0 net gearing.

Reputedly good correlation with inflation.

What am I missing? or is this just market sentiment (aka buying opportunity)?

All long term assets. Not aware any under danger, although political risk on one of their top ten would be a water company.

0 net gearing.

Reputedly good correlation with inflation.

What am I missing? or is this just market sentiment (aka buying opportunity)?

-

moorfield

- Lemon Quarter

- Posts: 3549

- Joined: November 7th, 2016, 1:56 pm

- Has thanked: 1581 times

- Been thanked: 1414 times

Re: HICL/Infrastructure in general

Also a holder of INPP here.

A "dividend hero" on a 6.1% yield and 19% discount currently.

A "dividend hero" on a 6.1% yield and 19% discount currently.

-

monabri

- Lemon Half

- Posts: 8418

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1547 times

- Been thanked: 3439 times

Re: HICL/Infrastructure in general

Snippet from Investors Chron :

"HICL Infrastructure (HICL) is notable for having guided to no dividend increases through to financial year 2025"

"The great income reset - What the bond yield bonanza means for portfolios" (Dave Baxter).

11-17th August 2023.

"HICL Infrastructure (HICL) is notable for having guided to no dividend increases through to financial year 2025"

"The great income reset - What the bond yield bonanza means for portfolios" (Dave Baxter).

11-17th August 2023.

-

TUK020

- Lemon Quarter

- Posts: 2042

- Joined: November 5th, 2016, 7:41 am

- Has thanked: 762 times

- Been thanked: 1178 times

Re: HICL/Infrastructure in general

monabri wrote:Snippet from Investors Chron :

"HICL Infrastructure (HICL) is notable for having guided to no dividend increases through to financial year 2025"

"The great income reset - What the bond yield bonanza means for portfolios" (Dave Baxter).

11-17th August 2023.

That would do it - not such a great inflation correlation then

-

TUK020

- Lemon Quarter

- Posts: 2042

- Joined: November 5th, 2016, 7:41 am

- Has thanked: 762 times

- Been thanked: 1178 times

Re: HICL/Infrastructure in general

Discount has gone from 0 to -27% this year.

Is it the NAV assessment that is wildly adrift?

Is it the NAV assessment that is wildly adrift?

Return to “Investment Trusts and Unit Trusts”

Who is online

Users browsing this forum: No registered users and 22 guests