Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

FCIT discount

FCIT discount

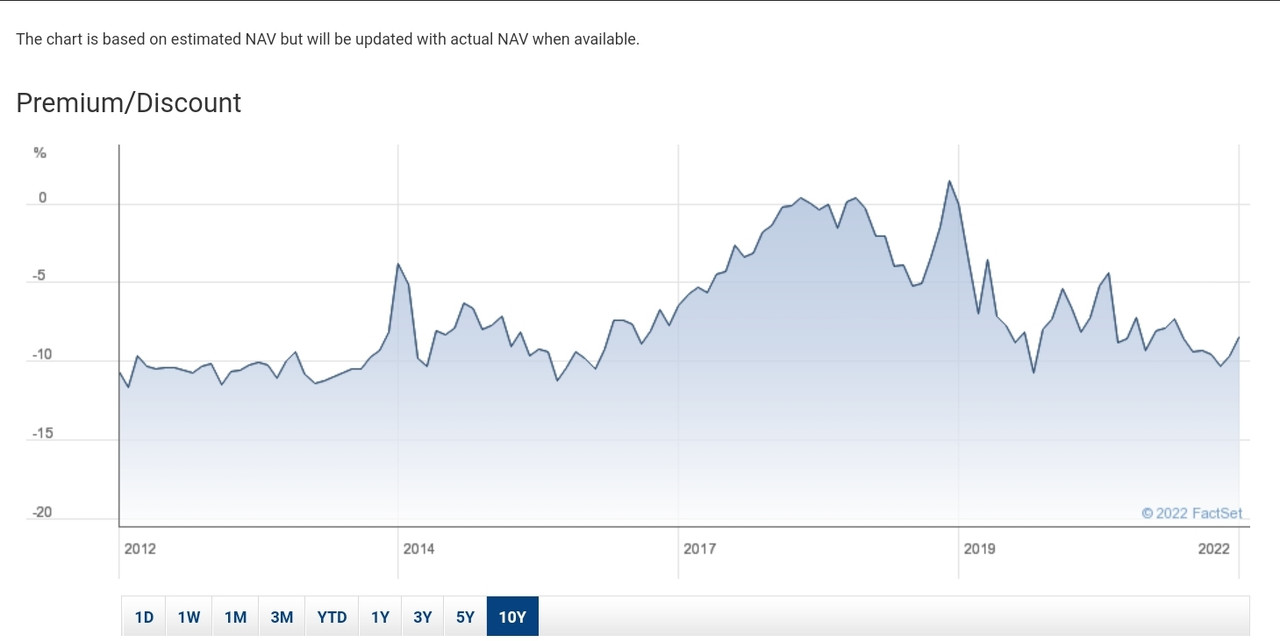

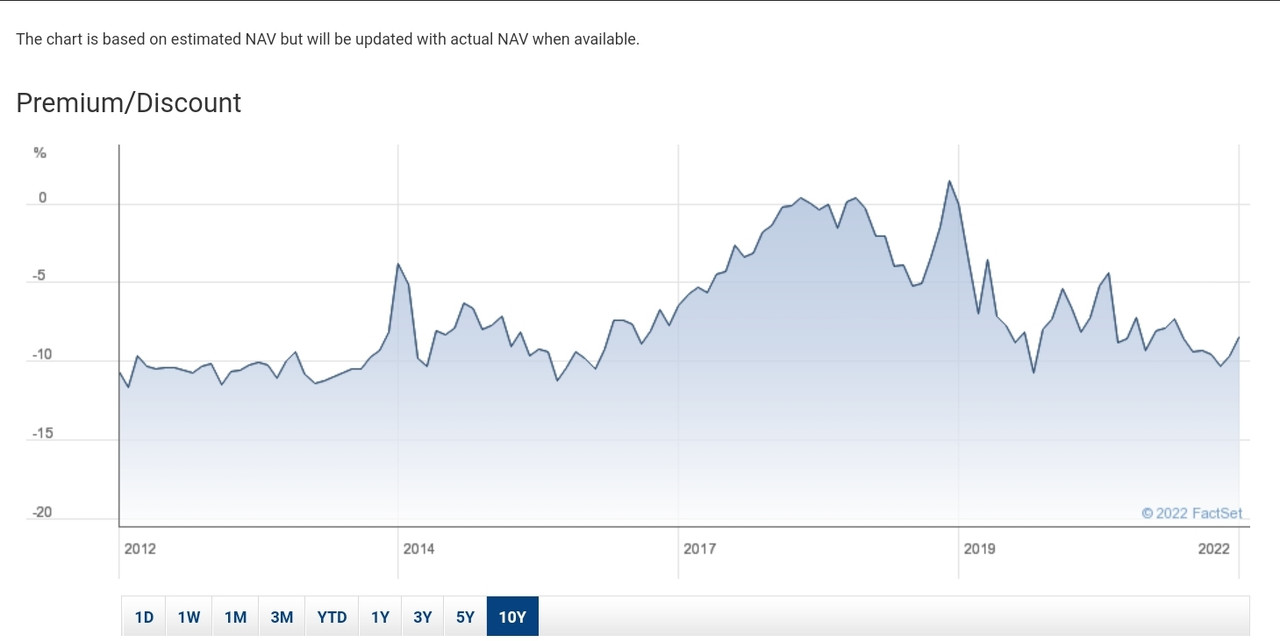

Investigating a new purchase, I note that the 10 year performance for FCIT has a first half matching VWRL pretty much move for move, albeit with a fairly static 10% discount.

For 3 or 4 years the discount then diminished as it outperformed VWRL but we find ourselves back in the 10% discount territory and, maybe, matching VWRL again?

My question to long term holders of FCIT, anything really behind it?

Something about buying similar for less appeals to me with the chance of a burst back to parity.

Thanks in advance,

W.

For 3 or 4 years the discount then diminished as it outperformed VWRL but we find ourselves back in the 10% discount territory and, maybe, matching VWRL again?

My question to long term holders of FCIT, anything really behind it?

Something about buying similar for less appeals to me with the chance of a burst back to parity.

Thanks in advance,

W.

-

SalvorHardin

- Lemon Quarter

- Posts: 2062

- Joined: November 4th, 2016, 10:32 am

- Has thanked: 5356 times

- Been thanked: 2484 times

Re: FCIT discount

Wuffle wrote:Investigating a new purchase, I note that the 10 year performance for FCIT has a first half matching VWRL pretty much move for move, albeit with a fairly static 10% discount.

For 3 or 4 years the discount then diminished as it outperformed VWRL but we find ourselves back in the 10% discount territory and, maybe, matching VWRL again?

My question to long term holders of FCIT, anything really behind it?

Something about buying similar for less appeals to me with the chance of a burst back to parity.

Nothing specific to FCIT, aka F&C aka Foreign & Colonial, as regards the discount. As a rule we can expect investment trust discounts to widen during "troubled times", then narrow during "good times". This volatility in the discount has been going on ever since F&C became the first investment trust in 1868.

In the case of F&C, given that its large number of holdings makes it somewhat of a global index tracker, its share price (but not the NAV) is all but guaranteed outperform and underperform Vanguard FTSE All-World as its discount narrows and widens. Back in January and February this year, F&C was trading at a small premium to NAV. Then the coronavirus combined with the lockdown triggered both a big fall in the net asset value and the widening of the discount, leading to the share price being hit by the proverbial "double whammy".

At a 10% discount today's buyers are getting roughly 10% more income for their money. IMHO this is a big advantage that investment trusts have over open-ended funds, as is being able to smooth out dividends by digging into reserves. Very nice if you rely on the income; as demonstrated this year with FTSE100 dividends collapsing yet investment trusts which predominately invest in the FTSE100 have generally maintained their dividends.

Also F&Cs annual management fee is between 0.3% and 0.35% which is lower than many trackers. And you can get a share certificate if you so please, which lets you eliminate those platform fees which eat into many low-cost trackers' returns (I hold mine through BMO's savings scheme, which is pretty cheap, and periodically add lump sums when the shares are trading at a decent discount to NAV).

-

jackdaww

- Lemon Quarter

- Posts: 2081

- Joined: November 4th, 2016, 11:53 am

- Has thanked: 3203 times

- Been thanked: 417 times

Re: FCIT discount

SalvorHardin wrote:Wuffle wrote:Investigating a new purchase, I note that the 10 year performance for FCIT has a first half matching VWRL pretty much move for move, albeit with a fairly static 10% discount.

For 3 or 4 years the discount then diminished as it outperformed VWRL but we find ourselves back in the 10% discount territory and, maybe, matching VWRL again?

My question to long term holders of FCIT, anything really behind it?

Something about buying similar for less appeals to me with the chance of a burst back to parity.

Also F&Cs annual management fee is between 0.3% and 0.35% which is lower than many trackers.

.

==================================

the AIC site shows charges of 0.54% .

which is still pretty good.

-

DavidM13

- Lemon Slice

- Posts: 425

- Joined: October 12th, 2018, 5:01 pm

- Has thanked: 46 times

- Been thanked: 406 times

Re: FCIT discount

Yes. The original poster was quoting the Management Fee which actually goes as low as 0.25%

"The Manager receives remuneration of 0.35% p.a. of the market cap of the Company up to GBP 3.0 bn, 0.30% between GBP 3.0 and GBP 4.0 bn, and 0.25% above GBP4.0bn"

The OCF of 0.54% will be this management fee but will include lots of other charges such as admin, legal, insurance, marketing, accountancy, directors, audit etc.

"The Manager receives remuneration of 0.35% p.a. of the market cap of the Company up to GBP 3.0 bn, 0.30% between GBP 3.0 and GBP 4.0 bn, and 0.25% above GBP4.0bn"

The OCF of 0.54% will be this management fee but will include lots of other charges such as admin, legal, insurance, marketing, accountancy, directors, audit etc.

-

LooseCannon101

- Lemon Slice

- Posts: 255

- Joined: November 5th, 2016, 2:12 pm

- Has thanked: 309 times

- Been thanked: 148 times

Re: FCIT discount

The UK stock market is depressed at the moment which tends to increase the discount on FCIT.

When a vaccine is available, I expect the discount to gradually decrease and FCIT's share price to rise substantially.

Recently, the trust has bought back its own shares, sometimes 100k shares one day and the next day none at all. Why is there such a wide variation when the discount is the same both days?

When a vaccine is available, I expect the discount to gradually decrease and FCIT's share price to rise substantially.

Recently, the trust has bought back its own shares, sometimes 100k shares one day and the next day none at all. Why is there such a wide variation when the discount is the same both days?

-

bluedonkey

- Lemon Quarter

- Posts: 1805

- Joined: November 13th, 2016, 3:41 pm

- Has thanked: 1413 times

- Been thanked: 652 times

Re: FCIT discount

LooseCannon101 wrote:Recently, the trust has bought back its own shares, sometimes 100k shares one day and the next day none at all. Why is there such a wide variation when the discount is the same both days?

Their cash position will vary daily, so that may be a factor.

-

richfool

- Lemon Quarter

- Posts: 3507

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1199 times

- Been thanked: 1283 times

Re: FCIT

I couldn't find a dedicated thread for FCIT (formerly F&C IT). So I've adopted this one.

I spotted this on the AIC website:

Full article here:

https://www.theaic.co.uk/aic/news/cityw ... s-after-10

I spotted this on the AIC website:

Opportunities ‘emerging’ as F&C drops small caps, pulls in global horns after 10% fall

26 July 2022

Private equity proved to be a rare bright spot in a half-year sea of red for F&C investment trust, which has sold out of global smaller companies and cut gearing as fund manager Paul Niven raises defences against a likely recession.

Private equity proved to be a rare bright spot in a half-year sea of red for F&C (FCIT ) investment trust, which has sold its global smaller-companies exposure and cut gearing as fund manager Paul Niven raises defences against a likely recession.

The £4.5bn flagship trust of what is now Colombia Threadneedle Investments, following the acquisition of BMO Global, slightly underperformed a falling market in the first half of the year.

Reporting interim results for the six months to 30 June, the UK’s oldest investment trust said its 400-stock portfolio fell 10.8%, below the 10.7% decline in the FTSE All-World index, as all areas of public investment slumped and underperformed their stock market benchmarks as surging inflation, rising interest rates and the war in Ukraine took their toll.

A defensive Niven, who took charge of the 154-year-old trust eight years ago, continued to cut holdings in expensive US large-cap growth stocks in the expectation they would suffer further falls as investors re-assessed their prospects.

‘In addition, we made the decision to divest entirely from our exposure to global small-cap stocks, having initially reduced our holdings last year,’ the manager said.

‘In our view, small-cap stocks are less likely to perform well in an environment of rising inflation and we decided to focus our exposure on the large-cap space. Small-cap holdings modestly underperformed over the first half,’ he said, justifying the move.

‘With a relatively high holding cash and diversified exposure across a range of different equity strategies we believe that the company is appropriately positioned for the difficult market conditions that we expect,’ Niven added.

Analysts generally agreed. Although there was some disappointment at the underperformance of the listed equity strategies, F&C’s broad exposure, lowish costs of 0.5%, its strong revenue reserves, determination to deliver long-term dividend increases over inflation and buy back shares to narrow the 8% discount impressed.

Christopher Brown of JP Morgan Cazenove reiterated an ‘overweight’ rating and said F&C ‘remains one of our preferred picks’.

Full article here:

https://www.theaic.co.uk/aic/news/cityw ... s-after-10

-

scrumpyjack

- Lemon Quarter

- Posts: 4845

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 613 times

- Been thanked: 2698 times

Re: FCIT discount

I see that over 5 years the NAV has slightly outperformed the FT All World total return index, which is good as that index won't include any charges whilst the FCIT NAV will be after all charges.

Also it has the advantage of being able to buy private unquoted shares, which it does, and to have modest gearing by borrowing.

So overall slightly preferable, IMO, to simply buying a tracker.

Also it has the advantage of being able to buy private unquoted shares, which it does, and to have modest gearing by borrowing.

So overall slightly preferable, IMO, to simply buying a tracker.

-

scrumpyjack

- Lemon Quarter

- Posts: 4845

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 613 times

- Been thanked: 2698 times

Re: FCIT discount

bluedonkey wrote:LooseCannon101 wrote:Recently, the trust has bought back its own shares, sometimes 100k shares one day and the next day none at all. Why is there such a wide variation when the discount is the same both days?

Their cash position will vary daily, so that may be a factor.

More likely to be down to what shares are on offer in the market that day and not wanting to distort the SP by buying more than a certain percentage of that day's trading.

Also, I have been increasing my holding recently, so maybe that has helped narrow the discount

-

DavidM13

- Lemon Slice

- Posts: 425

- Joined: October 12th, 2018, 5:01 pm

- Has thanked: 46 times

- Been thanked: 406 times

Re: FCIT discount

scrumpyjack wrote:I see that over 5 years the NAV has slightly outperformed the FT All World total return index, which is good as that index won't include any charges whilst the FCIT NAV will be after all charges.

I am glad you said that. I have lost count of the number of people who don't understand, or factor in, this nuance.

-

monabri

- Lemon Half

- Posts: 8414

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1544 times

- Been thanked: 3439 times

Re: FCIT discount

8% discount to ( estimated) NAV for FCIT - 10 year view.

Source https://www.hl.co.uk/shares/shares-sear ... st-ord-25p

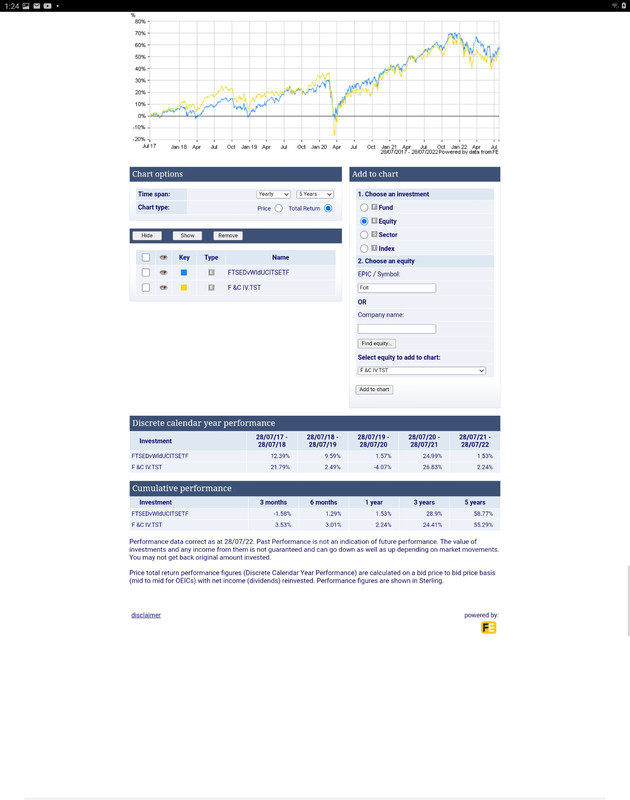

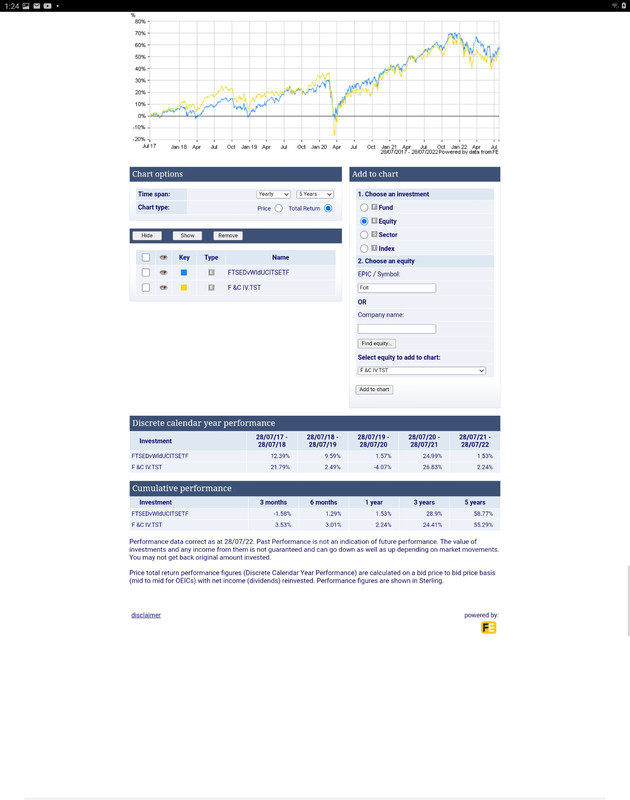

Over the last 5 years, there's no real demonstrated ability of the managed fund to outrun Vanguard's Developed World ETF ( " VEVE")....VEVE being slightly ahead. VEVE's ongoing charge of 0.12% versus 0.54%.

Source https://www.hl.co.uk/shares/shares-sear ... st-ord-25p

Over the last 5 years, there's no real demonstrated ability of the managed fund to outrun Vanguard's Developed World ETF ( " VEVE")....VEVE being slightly ahead. VEVE's ongoing charge of 0.12% versus 0.54%.

-

scrumpyjack

- Lemon Quarter

- Posts: 4845

- Joined: November 4th, 2016, 10:15 am

- Has thanked: 613 times

- Been thanked: 2698 times

Re: FCIT discount

Their benchmark is the All World Total Return, not the developed world. Anyway I'm happy to have FCIT and also a good holding of VWRL (plus VMID plus several other ETF trackers!). If income matters then I also agree with the earlier point about greater certainty of income that an IT gives.

-

monabri

- Lemon Half

- Posts: 8414

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1544 times

- Been thanked: 3439 times

Re: FCIT discount

scrumpyjack wrote:Their benchmark is the All World Total Return, not the developed world. Anyway I'm happy to have FCIT and also a good holding of VWRL (plus VMID plus several other ETF trackers!). If income matters then I also agree with the earlier point about greater certainty of income that an IT gives.

Over the last 5 years there is very little difference between FCIT and VWRL in terms of total return ( 55.3% v 54.5%).

-

richfool

- Lemon Quarter

- Posts: 3507

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1199 times

- Been thanked: 1283 times

Re: FCIT discount

monabri wrote:scrumpyjack wrote:Their benchmark is the All World Total Return, not the developed world. Anyway I'm happy to have FCIT and also a good holding of VWRL (plus VMID plus several other ETF trackers!). If income matters then I also agree with the earlier point about greater certainty of income that an IT gives.

Over the last 5 years there is very little difference between FCIT and VWRL in terms of total return ( 55.3% v 54.5%).

FCIT the better performer over 2 years and VWRL/VEVE better performers over 3 years. The latter have slightly higher dividend yields.

FCIT holds some private equity and c 6% in cash/liquidity.

-

forrado

- 2 Lemon pips

- Posts: 221

- Joined: May 16th, 2017, 7:41 pm

- Has thanked: 4 times

- Been thanked: 242 times

Re: FCIT discount

According to yesterday's Citywire release ...

F&C looks to race back into FTSE on back of summer rally

Which should it come to pass, will be reassuring news on the discount front as demand from index providers for F&C shares increases.

F&C looks to race back into FTSE on back of summer rally

F&C (FCIT ), the UK’s oldest investment trust, is poised for a possible return to the FTSE 100 after an absence of 13 years as compilers of the blue-chip index look to replace cybersecurity firm Avast following its $8.6bn (£7.3bn) takeover by NortonLifeLok Inc.

Which should it come to pass, will be reassuring news on the discount front as demand from index providers for F&C shares increases.

-

1nvest

- Lemon Quarter

- Posts: 4397

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1339 times

Re: FCIT discount

Wuffle wrote:Investigating a new purchase, I note that the 10 year performance for FCIT has a first half matching VWRL pretty much move for move, albeit with a fairly static 10% discount.

For 3 or 4 years the discount then diminished as it outperformed VWRL but we find ourselves back in the 10% discount territory and, maybe, matching VWRL again?

The Company has appointed F&C as manager. F&C receives a fee equal to 0.365% of the market capitalisation of the Company. The North America large and mid-cap equity portfolios are managed by Barrow Hanley and T Rowe Price by way of delegation from F&C. The private equity funds of funds are managed by Pantheon ventures and HarbourVest Partners.

The fund has an unlimited life. The authority of the Company to buy back up to 14.99% of the share capital was renewed at the last AGM. Directors were also authorised to allot up to 5%. The Board has the objective of maintaining a less volatile discount with a ceiling of 10% (with debt at market value), as well as enhancing net asset value per share for continuing shareholders.

-

richfool

- Lemon Quarter

- Posts: 3507

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1199 times

- Been thanked: 1283 times

Re: F&C Investment Trust (FCIT)

An update on FCIT's portfolio, as at 30th September 2022:

https://www.investegate.co.uk/f--38-c-i ... 05298015C/

https://www.investegate.co.uk/f--38-c-i ... 05298015C/

Re: FCIT discount

Joining the FTSE100 has shrunk the discount when the average IT discount has moved out, which is notable.

My buying pattern here was a lump, initiation of a monthly buy, then a strategic lump when it went cheap.

I am tempted to ease out of the expensive monthly buys from a year ago and redeploy somewhere else with discount.

Trivial, but tempting.

W.

My buying pattern here was a lump, initiation of a monthly buy, then a strategic lump when it went cheap.

I am tempted to ease out of the expensive monthly buys from a year ago and redeploy somewhere else with discount.

Trivial, but tempting.

W.

-

LooseCannon101

- Lemon Slice

- Posts: 255

- Joined: November 5th, 2016, 2:12 pm

- Has thanked: 309 times

- Been thanked: 148 times

Re: FCIT discount

Wuffle wrote:Joining the FTSE100 has shrunk the discount when the average IT discount has moved out, which is notable.

My buying pattern here was a lump, initiation of a monthly buy, then a strategic lump when it went cheap.

I am tempted to ease out of the expensive monthly buys from a year ago and redeploy somewhere else with discount.

Trivial, but tempting.

W.

I don't understand why you would reduce your monthly payment.

F&C Investment Trust (FCIT) is a great long-term investment, and who knows if today's 'high' prices might look cheap with hindsight.

I have so much confidence in FCIT that it is 98% of my life savings.

-

Steveam

- Lemon Slice

- Posts: 978

- Joined: March 18th, 2017, 10:22 pm

- Has thanked: 1767 times

- Been thanked: 536 times

Re: FCIT discount

LooseCannon101 wrote:Wuffle wrote:Joining the FTSE100 has shrunk the discount when the average IT discount has moved out, which is notable.

My buying pattern here was a lump, initiation of a monthly buy, then a strategic lump when it went cheap.

I am tempted to ease out of the expensive monthly buys from a year ago and redeploy somewhere else with discount.

Trivial, but tempting.

W.

I don't understand why you would reduce your monthly payment.

F&C Investment Trust (FCIT) is a great long-term investment, and who knows if today's 'high' prices might look cheap with hindsight.

I have so much confidence in FCIT that it is 98% of my life savings.

98% in anything seems excessive. If nothing else I’d be concerned about (massive) fraud. I have something like 10% in each of FCIT, VWRL and iShares World ETF plus another 25% in a number of themed ITs or ETFs.

Best wishes,

Steve

Return to “Investment Trusts and Unit Trusts”

Who is online

Users browsing this forum: No registered users and 60 guests