Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

Fundsmith

-

BullDog

- Lemon Quarter

- Posts: 2476

- Joined: November 18th, 2021, 11:57 am

- Has thanked: 1996 times

- Been thanked: 1209 times

-

scotia

- Lemon Quarter

- Posts: 3566

- Joined: November 4th, 2016, 8:43 pm

- Has thanked: 2376 times

- Been thanked: 1946 times

Re: Fundsmith

BullDog wrote:And the second part of the interview -

https://masterinvestor.co.uk/podcast-ma ... es-part-2/

Thanks for the link.

My thoughts - I would have liked to have asked Terry why, over the past 3 years his Fundsmith fund has closely followed a developed world tracker, until January when it fell significantly further than the tracker. So over the three years its growth was approximately 10% lower than the tracker (27% versus 37%). I heard reasons why there have been falls in the market - but I didn't discover why they have particularly affected his choices, and whether or not he had reasons to believe that his choices may over-perform in the coming months or years.

I'm starting to fear a reversion to the norm - which seems to affect investment managers who stick to a successful policy, after it has run its course, and which isn't adapted to changed circumstances. I'm thinking back to Woodford at Invesco Perpetual with the Income and High Income funds - which I believe amounted to around £24Billion (similar to Fundsmith), and was managed by him for around 25 years. Over a significant part of this period, his performance was outstanding, but towards the end it barely matched a tracker. When he founded his own Woodford Management business and tried to develop a different investment policy - disaster. I'm not suggesting that Terry will do this - but I fear that his current investment policy has seen better days, and currently I'm placing new money into a tracker - rather than Fundsmith.

-

BullDog

- Lemon Quarter

- Posts: 2476

- Joined: November 18th, 2021, 11:57 am

- Has thanked: 1996 times

- Been thanked: 1209 times

Re: Fundsmith

scotia wrote:BullDog wrote:And the second part of the interview -

https://masterinvestor.co.uk/podcast-ma ... es-part-2/

Thanks for the link.

My thoughts - I would have liked to have asked Terry why, over the past 3 years his Fundsmith fund has closely followed a developed world tracker, until January when it fell significantly further than the tracker. So over the three years its growth was approximately 10% lower than the tracker (27% versus 37%). I heard reasons why there have been falls in the market - but I didn't discover why they have particularly affected his choices, and whether or not he had reasons to believe that his choices may over-perform in the coming months or years.

I'm starting to fear a reversion to the norm - which seems to affect investment managers who stick to a successful policy, after it has run its course, and which isn't adapted to changed circumstances. I'm thinking back to Woodford at Invesco Perpetual with the Income and High Income funds - which I believe amounted to around £24Billion (similar to Fundsmith), and was managed by him for around 25 years. Over a significant part of this period, his performance was outstanding, but towards the end it barely matched a tracker. When he founded his own Woodford Management business and tried to develop a different investment policy - disaster. I'm not suggesting that Terry will do this - but I fear that his current investment policy has seen better days, and currently I'm placing new money into a tracker - rather than Fundsmith.

Excellent questions. You have perhaps already thought about it, but you could ask Fundsmith? They do take questions for the annual shareholder meeting. Not saying you would get your questions asked but it might be worth trying. I think the next meeting is around March 2023? Could be wrong, that's from memory.

I have been in FS not quite from the start but for more than a decade. I recently sold 80% of my FS holding. The reason - I feel the need to increase my dividend generating portfolio at the expense of the growthy portfolio to help with increasing expenses. I suspect, but obviously it's just a guess, that the best days of the Smith investment model are behind us. I sold at 600p, just a bit more than 5x what the original investment was. So not a terrible result though it could have been better given the poor last year or so.

I do have the remaining 20% still in FS. I will sit and wait but no plans to sell down further at the moment.

-

richfool

- Lemon Quarter

- Posts: 3520

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1204 times

- Been thanked: 1288 times

Re: Fundsmith

Further proof that the big and famous aren't immune from falls:

(Maybe behind a paywall or require registration).

https://www.telegraph.co.uk/investing/n ... ship-fund/

(Maybe behind a paywall or require registration).

Investors pull £1bn from star manager Terry Smith’s flagship fund

Fundsmith has lost 8pc of its value since the start of the year

By Lauren Almeida 23 August 2022 • 7:00am

Investors have pulled more than £1bn from star investor Terry Smith’s flagship fund in just three months, as one of Britain’s best known managers has failed to keep up with the rest of the stock market.

The Fundsmith Equity fund suffered withdrawals of £1.1bn in the three months to July 31, according to analysis by the data provider FE Fundinfo.

Fundsmith was the poorest performing of all the British funds that invest in global stocks, it said. The fund with the next biggest outflow was Quilter Investors Global Equity Index, which saw £507m withdrawn.

The outflows follow a difficult period for Mr Smith’s fund, which has lost 8pc of its value since the start of the year. Meanwhile, the MSCI World index – which tracks the largest global stocks and is Mr Smith’s preferred benchmark – was flat over the same period.

https://www.telegraph.co.uk/investing/n ... ship-fund/

-

simoan

- Lemon Quarter

- Posts: 2100

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1463 times

Re: Fundsmith

richfool wrote:Further proof that the big and famous aren't immune from falls:

(Maybe behind a paywall or require registration).

Investors pull £1bn from star manager Terry Smith’s flagship fund

Fundsmith has lost 8pc of its value since the start of the year

By Lauren Almeida 23 August 2022 • 7:00am

Investors have pulled more than £1bn from star investor Terry Smith’s flagship fund in just three months, as one of Britain’s best known managers has failed to keep up with the rest of the stock market.

The Fundsmith Equity fund suffered withdrawals of £1.1bn in the three months to July 31, according to analysis by the data provider FE Fundinfo.

Fundsmith was the poorest performing of all the British funds that invest in global stocks, it said. The fund with the next biggest outflow was Quilter Investors Global Equity Index, which saw £507m withdrawn.

The outflows follow a difficult period for Mr Smith’s fund, which has lost 8pc of its value since the start of the year. Meanwhile, the MSCI World index – which tracks the largest global stocks and is Mr Smith’s preferred benchmark – was flat over the same period.

https://www.telegraph.co.uk/investing/n ... ship-fund/

I have to say, this is poor financial journalism even by the abysmally low standards of the Telegraph. To quote absolute withdrawal numbers rather than the amount as a percentage of the fund size is so stupid it beggars belief, even though it creates the headline they wanted to. I should imagine many funds have seen withdrawals, and some will represent a higher percentage of the fund size. The good news is that the liquidity of the holdings allows such outflows without any problem. Other funds holding more illiquid investments will not be so lucky. I mean, if they really wanted to stick the boot in, a bit of simple maths would allow them to calculate the constant currency loss year-to-date which is much greater than 8% given how weak GBP has been relative to the USD (down 13% as I write).

-

forrado

- 2 Lemon pips

- Posts: 221

- Joined: May 16th, 2017, 7:41 pm

- Has thanked: 4 times

- Been thanked: 242 times

Re: Fundsmith

Having been at this fund investment game for 35 years I’ve reached the point where I’m now a spectator rather the player I used to be. Consequently, I find myself with a lot of time to think about what I’ve done right, and what I’ve done wrong on my investment journey thus far. If I can blow my own trumpet, the one skill I feel I've honed is the ability to keep my finances out of harm’s way. As a result, on the upside I haven’t always got it as right as I would have liked, while on the downside there hasn't been any downsides, other than the general market falls one would naturally encounter over a 35-year duration.

I’m convinced one of the reasons I’ve managed to navigate my way round potential pitfalls is a well-developed mistrust of star fund managers. No matter what type of profession someone chooses to follow, attach the adjective ‘star’ to a job description elevates that person to a position above that of his / her contemporaries. If one believes, like I happen to do, that form is temporary, while class is permanent. Then the number of fund managers I consider to be permanently class operators are extremely few and far between, and even they can find themselves out-of-form from time to time.

So, rather than set myself up to be disappointed I won’t even go there. A practice that has on occasions been to my advantage – think Neil Woodford, while on other occasions has caused me to miss out - think Scottish Mortgage in full flight. Which means, rightly or wrongly, I’ve tended to steer clear of the likes of Terry Smith and Nick Train during both the ascent and the descent.

I’m convinced one of the reasons I’ve managed to navigate my way round potential pitfalls is a well-developed mistrust of star fund managers. No matter what type of profession someone chooses to follow, attach the adjective ‘star’ to a job description elevates that person to a position above that of his / her contemporaries. If one believes, like I happen to do, that form is temporary, while class is permanent. Then the number of fund managers I consider to be permanently class operators are extremely few and far between, and even they can find themselves out-of-form from time to time.

So, rather than set myself up to be disappointed I won’t even go there. A practice that has on occasions been to my advantage – think Neil Woodford, while on other occasions has caused me to miss out - think Scottish Mortgage in full flight. Which means, rightly or wrongly, I’ve tended to steer clear of the likes of Terry Smith and Nick Train during both the ascent and the descent.

-

simoan

- Lemon Quarter

- Posts: 2100

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1463 times

Re: Fundsmith

forrado wrote:Having been at this fund investment game for 40 years I’ve reached the point where I’m now a spectator rather the player I used to be. Consequently, I find myself with a lot of time to think about what I’ve done right, and what I’ve done wrong on my investment journey thus far. If I can blow my own trumpet, the one skill I feel I've honed is the ability to keep my finances out of harm’s way. As a result, on the upside I haven’t always got it as right as I would have liked, while on the downside there hasn't been any downsides, other than the general market falls one would naturally encounter over a 40-year duration.

I’m convinced one of the reasons I’ve managed to navigate my way round potential pitfalls is a well-developed mistrust of star fund managers. No matter what type of profession someone chooses to follow, attach the adjective ‘star’ to a job description elevates that person to a position above that of his / her contemporaries. If one believes, like I happen to do, that form is temporary, while class is permanent. Then the number of fund managers I consider to be permanently class operators are extremely few and far between, and even they can find themselves out-of-form from time to time.

So, rather than set myself up to be disappointed I won’t even go there. A practice that has on occasions been to my advantage – think Neil Woodford, while on other occasions has caused me to miss out - think Scottish Mortgage in full flight. Which means, rightly or wrongly, I’ve tended to steer clear of the likes of Terry Smith and Nick Train during both the ascent and the descent.

But IMHO it's not about the manager at all. FWVLIW I hold Fundsmith but don't really like Terry Smith. At the same time, you shouldn't let your dislike of someone stop you from making money if you like the investment strategy. For me it's about the investment process of the fund and the types of companies it invests in, nothing else. The fact is that Woodfords investment process was deeply flawed and that was pretty evident to some of us. He made one good call 20 years ago and lived off it the next 20 years.

-

ADrunkenMarcus

- Lemon Quarter

- Posts: 1590

- Joined: November 5th, 2016, 11:16 am

- Has thanked: 675 times

- Been thanked: 481 times

Re: Fundsmith

simoan wrote:The fact is that Woodfords investment process was deeply flawed and that was pretty evident to some of us. He made one good call 20 years ago and lived off it the next 20 years.

Was that avoiding banks or buying tobacco? Or neither?

Best wishes

Mark

-

simoan

- Lemon Quarter

- Posts: 2100

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1463 times

Re: Fundsmith

ADrunkenMarcus wrote:simoan wrote:The fact is that Woodfords investment process was deeply flawed and that was pretty evident to some of us. He made one good call 20 years ago and lived off it the next 20 years.

Was that avoiding banks or buying tobacco? Or neither?

Best wishes

Mark

Both!

-

BullDog

- Lemon Quarter

- Posts: 2476

- Joined: November 18th, 2021, 11:57 am

- Has thanked: 1996 times

- Been thanked: 1209 times

Re: Fundsmith

Dumbo wrote:New textspeak - FWVLIW???

Wotsit mean please.

Dumbo

For What Very Little It's Worth.

-

nmdhqbc

- Lemon Slice

- Posts: 634

- Joined: March 22nd, 2017, 10:17 am

- Has thanked: 112 times

- Been thanked: 226 times

Re: Fundsmith

BullDog wrote:Dumbo wrote:New textspeak - FWVLIW???

Wotsit mean please.

Dumbo

For What Very Little It's Worth.

TYVMFT

-

westmoreland9

- Posts: 28

- Joined: February 17th, 2020, 6:32 pm

- Been thanked: 6 times

Re: Fundsmith

woodford got a huge amount of mileage out of avoiding the dotcom bubble, but this was by virtue of the sector he was in, ie running an equity income fund, so there was no way he could have been buying non yielding tech bubble shares. like a UK equity income investor proclaiming that they avoided losses from investing in say, Japan, when they couldn't invest there in the first place.

as for smith, on his own measure, when the fund was started, he was able to buy shares on a free cash flow yield of 6.5%. IIRC as of Jan 22, the fund was somewhere around 3%. so if it reverted to 6.5%, the total loss could be around 55% (albeit this would be mitigated by the dollar exposure). if it reverts to say 5%, that would be a 40% loss.

as for smith, on his own measure, when the fund was started, he was able to buy shares on a free cash flow yield of 6.5%. IIRC as of Jan 22, the fund was somewhere around 3%. so if it reverted to 6.5%, the total loss could be around 55% (albeit this would be mitigated by the dollar exposure). if it reverts to say 5%, that would be a 40% loss.

-

KnightOfSpring

- Lemon Pip

- Posts: 50

- Joined: January 20th, 2020, 9:26 pm

- Has thanked: 24 times

- Been thanked: 39 times

Re: Fundsmith

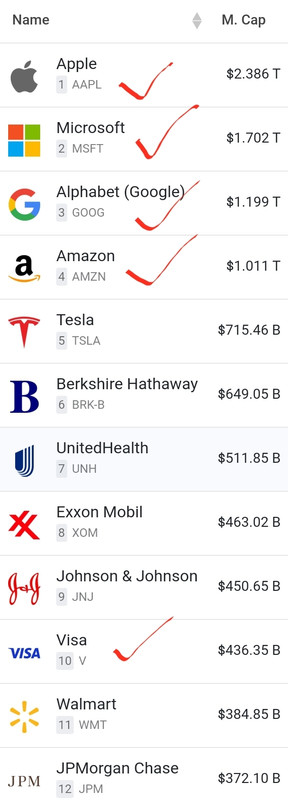

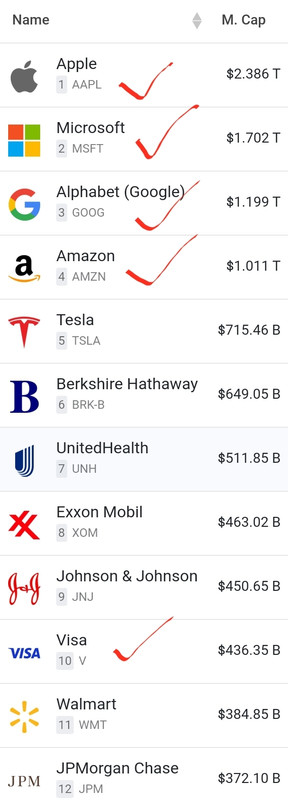

Can't accuse Terry of keeping his head down and trying to play it safe. Has taken a medium sized pasting in tech stocks this year (probably more so than the tech sector as a whole).His very high profile Meta investment has had a very bad share fall very recently also. What's he just done? Just gone and opened up a new holding in Apple, a stock he has previously expressed a dislike for. From memory I think he said Apple was too dependent on being fashionable and that the next big thing will inevitably come along and displace it. Hasn't had anything like the fall in it's share price that other US tech stocks have had either. Joins Amazon in his previously disliked tech stock list!

-

monabri

- Lemon Half

- Posts: 8419

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3441 times

Re: Fundsmith

"Portfolio Comment for October 2022

We purchased a stake in Otis to replace our stake in Kone and began a currently small holding in Apple. The top 5 contributors in the month were Visa, Stryker, Adobe, IDEXX and Novo Nordisk. The top 5 detractors were Meta Platforms, Estée Lauder, Microsoft, Amazon and L'Oréal."

I read these portfolio comments and think "space filler". What does a single months movement mean? It just pads out a "news sheet".

Apple...a surprise.

Tesla next?

https://companiesmarketcap.com/usa/larg ... arket-cap/

We purchased a stake in Otis to replace our stake in Kone and began a currently small holding in Apple. The top 5 contributors in the month were Visa, Stryker, Adobe, IDEXX and Novo Nordisk. The top 5 detractors were Meta Platforms, Estée Lauder, Microsoft, Amazon and L'Oréal."

I read these portfolio comments and think "space filler". What does a single months movement mean? It just pads out a "news sheet".

Apple...a surprise.

Tesla next?

https://companiesmarketcap.com/usa/larg ... arket-cap/

-

monabri

- Lemon Half

- Posts: 8419

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3441 times

Re: Fundsmith

I wonder if Smith is thinking "What happens if China invades Taiwan ? On the face of it, a worry..

"TSMC is Apple's sole chip supplier and is responsible for fabricating all of the company's custom silicon chips.."

Along with;

"The plans to build a new multi-billion dollar factory in Singapore are still under consideration."

(Although the new Singapore factory would not be able to manufacture the 5nm chips, only the older slower ones).

However;

"Beyond the plans for a new plant in Singapore, TSMC is also building a $12 billion factory in Arizona to manufacture five-nanometer chips. TSMC's main factories are located in Taiwan, but it already operates a factory in Camas, Washington, as well as design centers in Austin, Texas and San Jose, California, meaning that the Arizona facility will be its second manufacturing site in the United States.

"TSMC is also building a new factory in Japan with help from the Japanese government and investment by Sony."

Manufacturing 5nm chips in Japan....it's abit earthquakey around there I would have thought? ( too much vibration interfering with chip yields).

So, Chip manufacture supply must remain a risk surely and then will folk still willingly flash out £1000/£1200 for a phone if we have a recession ( not just the UK)?

"TSMC is Apple's sole chip supplier and is responsible for fabricating all of the company's custom silicon chips.."

Along with;

"The plans to build a new multi-billion dollar factory in Singapore are still under consideration."

(Although the new Singapore factory would not be able to manufacture the 5nm chips, only the older slower ones).

However;

"Beyond the plans for a new plant in Singapore, TSMC is also building a $12 billion factory in Arizona to manufacture five-nanometer chips. TSMC's main factories are located in Taiwan, but it already operates a factory in Camas, Washington, as well as design centers in Austin, Texas and San Jose, California, meaning that the Arizona facility will be its second manufacturing site in the United States.

"TSMC is also building a new factory in Japan with help from the Japanese government and investment by Sony."

Manufacturing 5nm chips in Japan....it's abit earthquakey around there I would have thought? ( too much vibration interfering with chip yields).

So, Chip manufacture supply must remain a risk surely and then will folk still willingly flash out £1000/£1200 for a phone if we have a recession ( not just the UK)?

-

simoan

- Lemon Quarter

- Posts: 2100

- Joined: November 5th, 2016, 9:37 am

- Has thanked: 469 times

- Been thanked: 1463 times

Re: Fundsmith

monabri wrote:I wonder if Smith is thinking "What happens if China invades Taiwan ? On the face of it, a worry..

"TSMC is Apple's sole chip supplier and is responsible for fabricating all of the company's custom silicon chips.."

Not really the forum for this discussion but if that were to happen, I do not believe the US Government would stop Apple from buying into Intel and expanding US based chip production. Intel should have a 5nm process in the next 6 months.

Besides, it wouldn't just be Apple that would be effected if China invades Taiwan. To think the whole global market would not tank is very naive. On that basis, why worry about one company in a portfolio having such exposure? It makes no sense to consider this risk standalone with respect to one company, and is definitely no bar to holding Apple or Fundsmith. I mean, just look at what would happen to Berkshire Hathaway by comparison...

Anyway, we're veering off-topic now. I don't see a small holding in Apple as being a problem. Not sure who said "when the facts change, I change my mind" but that's fine by me and shows honesty, openness and a lack of stubbornness. I think far too much is made of Mr. Smiths decision making. All investors get some things right and some things wrong. As long as the former outnumber the latter, you will make positive returns.

All the best, Si

-

ADrunkenMarcus

- Lemon Quarter

- Posts: 1590

- Joined: November 5th, 2016, 11:16 am

- Has thanked: 675 times

- Been thanked: 481 times

Re: Fundsmith

I've held Kone since April 2017 and I continue to hold on a 'coffee can' basis. I noticed the share price is up about 6 percent today. Fundsmith do like the sector and I note they've replaced it with Otis.

Best wishes

Mark.

Best wishes

Mark.

-

monabri

- Lemon Half

- Posts: 8419

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3441 times

Re: Fundsmith

ADrunkenMarcus wrote:I've held Kone since April 2017 and I continue to hold on a 'coffee can' basis. I noticed the share price is up about 6 percent today. Fundsmith do like the sector and I note they've replaced it with Otis.

Best wishes

Mark.

Drat! Kone was on my top up list!

-

Steveam

- Lemon Slice

- Posts: 979

- Joined: March 18th, 2017, 10:22 pm

- Has thanked: 1772 times

- Been thanked: 537 times

Re: Fundsmith

ASUI the winding-up (assuming it is approved) leads to the shareholders receiving tranches of cash ... a first payment being the bulk and then a further tranche as the liquidators are able to realize the assets. I hold these in an unprotected account so i need to look at the CGT implications. I'm not sure how this works. When have I "sold" all my FEET shares and when will I know the realized value. This could be burdensome if it spans tax years.

There is a section in the documents from Fundsmith but it doesn't clarify this.

Best wishes,

Steve

There is a section in the documents from Fundsmith but it doesn't clarify this.

Best wishes,

Steve

Return to “Investment Trusts and Unit Trusts”

Who is online

Users browsing this forum: No registered users and 33 guests