monabri wrote:

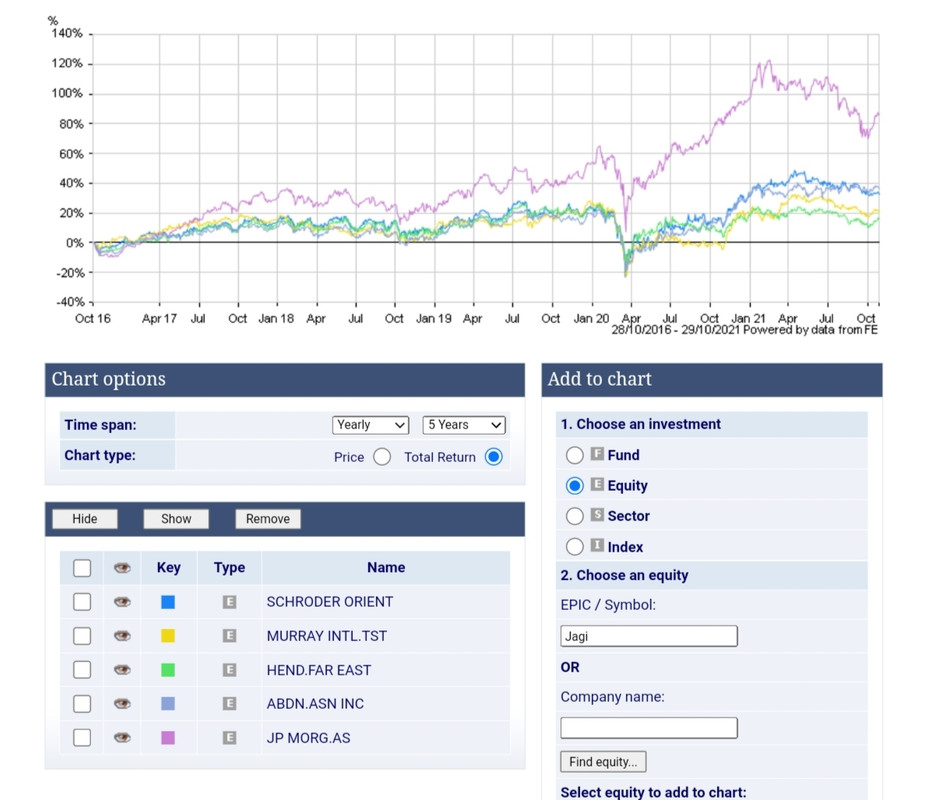

I feel that we need to compare SOI, MYI & HFEL on a total return (TR) basis. Certainly, the order of TR in the last 5 yrs currently still puts SOI in top position in this comparison, but when dividends are factored in, the " gap" closes.

I find it interesting that for 4 years ( 2016-20) there was not a marked difference between the three and we only start to see divergence in early 2020. It would seem that HFEL is holding shares that are still suffering from the mark down from Covid-19.

Source https://www.hl.co.uk/funds/fund-discoun ... ion/charts

TR is fine as a useful final arbitor, but the reason I used share price without investment was to look at the point Dod raised - that is to say, the concern about what's left of your capital after taking out dividends - which therefore could not be re-invested.

Arb.