https://www.investegate.co.uk/henderson ... 34265799J/

CHAIRMAN'S STATEMENT

Performance

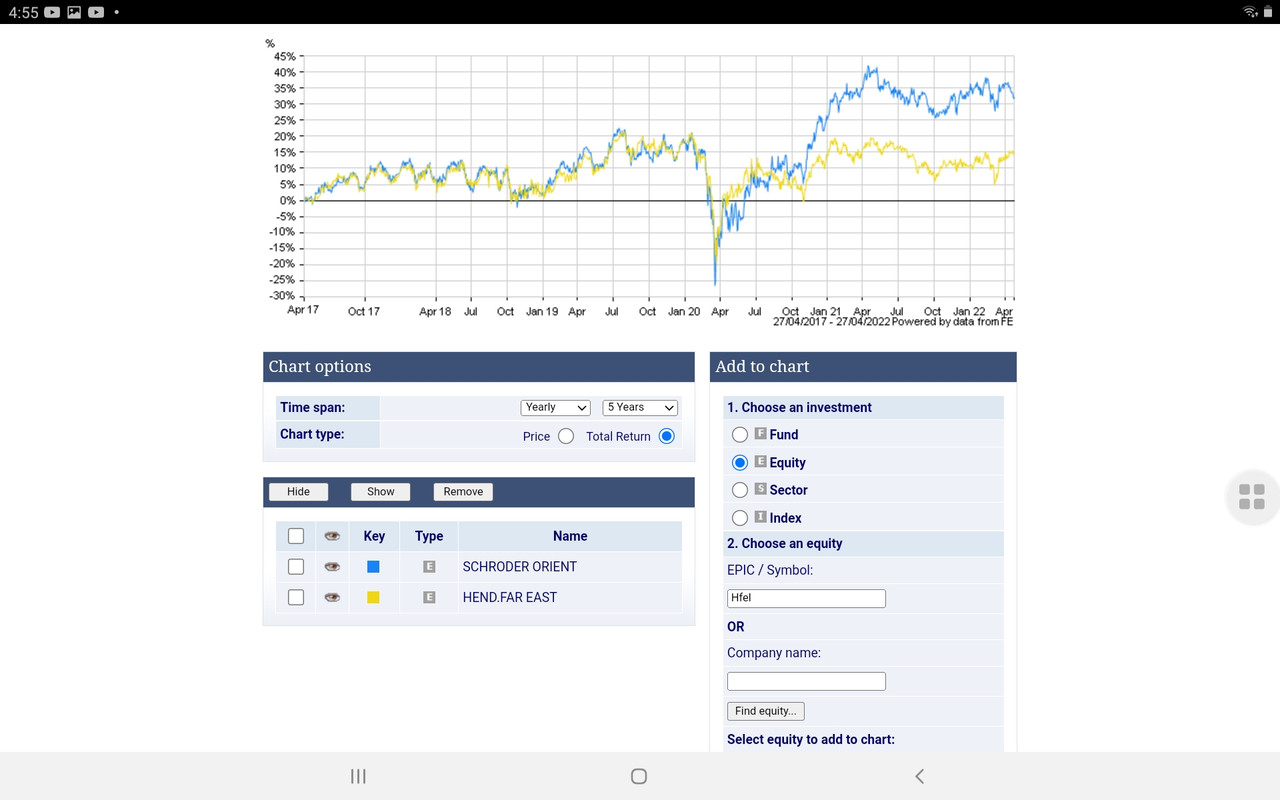

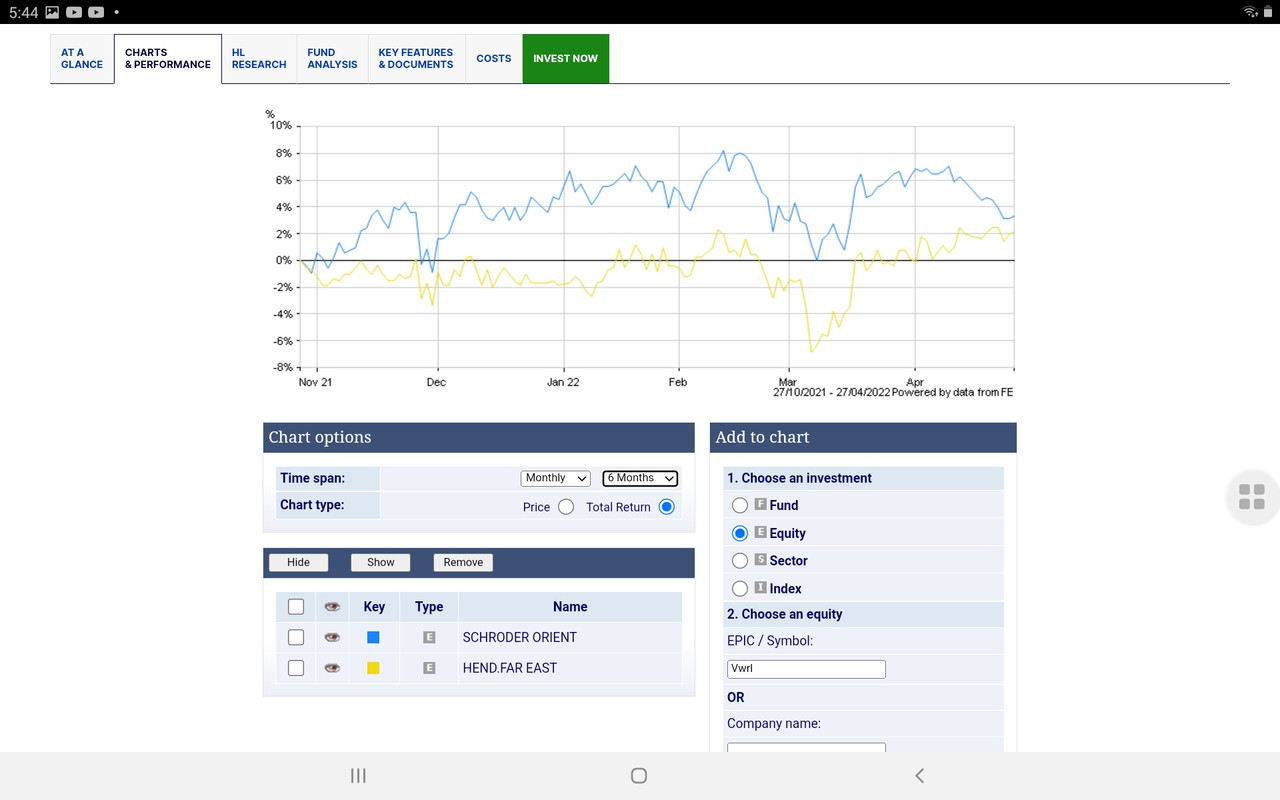

Performance for the six months to 28 February 2022 was mixed, with NAV total return performance negative 0.1%, which was markedly better than the FTSE World Asia Pacific ex Japan Index of negative 6.3%, but behind the MSCI AC Asia Pacific ex Japan High Dividend Yield Index of 3.1%. This reflected the rotation from growth to value, alongside the portfolio's increased allocation to the financials, materials and energy sectors. The underperformance against the high yield index was predominantly down to the oversized weighting of BHP following the consolidation of the UK stock line into the Australian listing.

Dividends

The first and second interim dividends for the current financial year have been declared in the amount of 5.90p per ordinary share each. This represents a 1.7% increase on the dividends paid or payable for the same period last year. The period saw the Company's dividend yield finish at 8.2%.

Outlook

Investors always face challenges, but it is even more difficult to remain focused when in the midst of a humanitarian crisis. Volatility is high and likely to remain so. The consequences of the war in Ukraine are largely unknowable. These shocking events tend to draw attention away from personal considerations in sympathy for those in severe distress.

We cannot ignore, however, the risks and opportunities we are now exposed to. This crisis coming so close to the pandemic is a further serious blow to global growth. The OECD recently noted 'The moves in commodity prices and financial markets seen since the outbreak of the war could, if sustained, reduce global GDP growth by over 1 percentage point in the first year, with a deep recession in Russia, and push up global consumer price inflation by approximately 2.5 percentage points'*.

The impact of these developments will be felt unevenly throughout the world. Weak global growth is a negative for exporting countries, significantly higher commodity prices a negative for importers, and lower disposable incomes and uncertainties negative for consumption levels and tourism. Rising rates of inflation will be a problem for everybody.

We are investors in the Asia Pacific region and what does it mean for us? The role of Russia and Ukraine in the global economy is small accounting for only about 2% of global GDP. However, they are major suppliers of commodities to the world and supply disruption will cause some severe problems. Russia and Ukraine together account for about 30% of global exports of wheat, 20% for corn, mineral fertilisers and natural gas and 11% for oil. Indonesia and the Philippines are dependent on wheat imports and Vietnam is dependent on corn. The impact on the Middle East will be severe as well. Farmers everywhere will be impacted by much higher fertilizer prices and supply disruption.

A bleak picture indeed. However, there are some bright spots. China adopted more restrictive monetary and fiscal policies in late 2020 but is now easing policies and while credit growth has been falling it now appears to be bottoming out. This will support growth in China and should have a cushioning effect on the region and on the rest of the world. China provided significant support to the global economy during the 2008 financial crisis and played an important part in helping to avoid a global depression. It seems it could play a similar role today, although the recent lockdowns following Covid-19 outbreaks may delay this.

The outlook for us is quite encouraging. We have a large number of companies in a diverse geographical setting to choose from. To achieve our dividend objective, we invest largely in value shares paying significant levels of dividend; this has been something of a negative for our NAV total return performance in the past two years as investor preferences largely concentrated on growth shares with low dividend payouts. In a rising inflation environment value and income become much more to the fore in meeting investor needs. Our concentration on value is now working in our favour. Since the beginning of the 2022 calendar year, the NAV total return has risen to 4.9% and the dividend income generated by the portfolio has risen 14.7% compared to the same period last year.

As noted by the Fund Managers, we have significant holdings in industrial metals and energy. Prices of copper, aluminum, nickel, steel and others have risen sharply on the back of strong demand and constrained supply. Demand levels reflect increased global fiscal stimulus via infrastructure spending and long-term structural growth from the transition to a low carbon world. An example of this was demonstrated by a recent report from Blackrock World Mining. The report compared the resources to build a 100MW natural gas fired turbine with a wind farm equivalent. Twenty wind turbines would need to be installed requiring 100 times more iron ore, 25 times more concrete and 10 times more specialty metals including copper. This is a measure of the challenge confronting the world and the strength of demand for industrial metals.

The supply of industrial metals has been constrained by significant underinvestment in recent years. Short supply and high demand will support rising prices for some time and mining companies are experiencing high levels of free cash flow which they are paying back to shareholders in the form of higher dividends and/or share buy backs. This is welcome news to us.

In summary, we are in an environment that supports our investment strategy of producing attractive levels of income for our shareholders with an enhanced prospect of sound capital performance. The recent shift towards more value oriented investments should be a positive factor in portfolio returns as we look ahead to the balance of our financial year.