Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

HFEL

-

seagles

- Lemon Slice

- Posts: 495

- Joined: August 19th, 2017, 8:37 am

- Has thanked: 153 times

- Been thanked: 240 times

Re: HFEL

I was interested by how my HFEL shares have performed. First brought 4/15 at £3.56, then another slice, 9/15 at £2.75, with a third in 8/18 at £3.59. Currently showing at circa £3. I show a capital "loss" (never a loss or gain until you sell, IMO) of 13.53%, average price seems to be £3.47. However, the income stream has been steady, which was my reason to buy them. They are the only IT of mine that actually shows a "loss". Strangely if I had only brought in 9/15 I would be feeling "positive" about their capital position. Will leave them alone and just keep taking the dividend.

-

mc2fool

- Lemon Half

- Posts: 7887

- Joined: November 4th, 2016, 11:24 am

- Has thanked: 7 times

- Been thanked: 3044 times

Re: HFEL

Well, I bought the income units of the OEIC equivalent, [Janus] Henderson Asian Dividend Income, back in January 2014, 'cos at the time the yield was higher than HFEL,which was on a premium.

I swapped that for HFEL, at a small discount, in April 18, having had an XIRR of 10.1%pa from the OEIC over the 4+ years (dividends withdrawn). Since then HFEL has given me an XIRR of 1.3%pa.

Nowt to do with the OEIC vs IT, the two track each other pretty well. https://www.hl.co.uk/funds/fund-discoun ... ive/charts

I swapped that for HFEL, at a small discount, in April 18, having had an XIRR of 10.1%pa from the OEIC over the 4+ years (dividends withdrawn). Since then HFEL has given me an XIRR of 1.3%pa.

Nowt to do with the OEIC vs IT, the two track each other pretty well. https://www.hl.co.uk/funds/fund-discoun ... ive/charts

-

richfool

- Lemon Quarter

- Posts: 3520

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1204 times

- Been thanked: 1288 times

Re: HFEL

I've stuck (stayed) with AAIF and JAGI, - for better capital appreciation, - though I reduced the latter and increased the former holdings back in June, - to reduce my exposure to China and Chinese tech.

AAIF - Aberdeen Asian Income

JAGI - JP Morgan Asian Growth & Income.

AAIF - Aberdeen Asian Income

JAGI - JP Morgan Asian Growth & Income.

-

funduffer

- Lemon Quarter

- Posts: 1338

- Joined: November 4th, 2016, 12:11 pm

- Has thanked: 123 times

- Been thanked: 845 times

Re: HFEL

My 2 Far East IT's are HFEL and Fidelity China Special Situations (FCSS).

I have held FCSS since 2010, when it was launched, although it went nowhere for 3 years, when I bought HFEL.

HFEL total return to date is 33% (with some dividend re-investment). Average share price paid £3.16, today at £3.01. Current yield 7.7%.

FCSS total return to date is 239% (with all dividends re-invested). Average share price paid £1.11, today at £3.56. Current yield 1.3%.

Quite a difference, although they are different beasts of course - one an income IT and the other a growth IT.

FD

I have held FCSS since 2010, when it was launched, although it went nowhere for 3 years, when I bought HFEL.

HFEL total return to date is 33% (with some dividend re-investment). Average share price paid £3.16, today at £3.01. Current yield 7.7%.

FCSS total return to date is 239% (with all dividends re-invested). Average share price paid £1.11, today at £3.56. Current yield 1.3%.

Quite a difference, although they are different beasts of course - one an income IT and the other a growth IT.

FD

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7535 times

Re: HFEL

funduffer wrote:My 2 Far East IT's are HFEL and Fidelity China Special Situations (FCSS).

I have held FCSS since 2010, when it was launched, although it went nowhere for 3 years, when I bought HFEL.

HFEL total return to date is 33% (with some dividend re-investment). Average share price paid £3.16, today at £3.01. Current yield 7.7%.

FCSS total return to date is 239% (with all dividends re-invested). Average share price paid £1.11, today at £3.56. Current yield 1.3%.

Quite a difference, although they are different beasts of course - one an income IT and the other a growth IT.

FD

Obviously the waters are muddied by the dividend reinvestment but the difference is so dramatic that it probably makes little difference. I am seeking a middle of the road IT, with a decent dividend plus capital growth. Whether my chosen vehicle is that, Schroder Oriental Income, only time will tell.

I have just written to the Chairman of HFEL as I still hold some HFEL in my SIPP and will be happy to report when I hear from him.

Dod

-

staffordian

- Lemon Quarter

- Posts: 2300

- Joined: November 4th, 2016, 4:20 pm

- Has thanked: 1895 times

- Been thanked: 870 times

Re: HFEL

Dod101 wrote:I have just written to the Chairman of HFEL as I still hold some HFEL in my SIPP and will be happy to report when I hear from him.

Dod

Presumably to ask why they are so cr@p?

I've held for several years and even allowing for the dividends my CAGR is only around 1.5%; significantly less than all my other holdings.

My natural instinct is not to tinker and assume that at some time it will have it's day in the sun, and in the meantime take the generous dividends and invest them elsewhere in the portfolio.

But at what point do I accept defeat and cut my losses?

Maybe the answer to your question will help me decide...

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7535 times

Re: HFEL

staffordian wrote:Dod101 wrote:I have just written to the Chairman of HFEL as I still hold some HFEL in my SIPP and will be happy to report when I hear from him.

Dod

Presumably to ask why they are so cr@p?

I've held for several years and even allowing for the dividends my CAGR is only around 1.5%; significantly less than all my other holdings.

My natural instinct is not to tinker and assume that at some time it will have it's day in the sun, and in the meantime take the generous dividends and invest them elsewhere in the portfolio.

But at what point do I accept defeat and cut my losses?

Maybe the answer to your question will help me decide...

Not in so many words but essentially yes. I have said that they have failed in one of their aims, shown on the website, of producing a good income 'as well as capital appreciation'.Interestingly, they have been issuing new shares quite regularly so there is clearly demand for the income. It is a bit like that old joke, 'Never mind the quality feel the width'. In fact the shares have been trading mostly at a modest premium for a long while and that makes the dividend yield all the more extraordinary. That will be reducing the yield on NAV. A great yield is not so great if it is all but wiped out by a capital loss.

I have suggested that I would like to see a discussion of this problem and what the Directors are doing about it in the forthcoming Annual Report (Their financial year ended 31 August) I have also reminded him that many IT Boards have in recent years exercised their independence by looking for alternative investment managers.

Dod

-

daveh

- Lemon Quarter

- Posts: 2202

- Joined: November 4th, 2016, 11:06 am

- Has thanked: 412 times

- Been thanked: 808 times

Re: HFEL

I started buying HFEL in my income portfolio in November 2019 as an alternative to IAPD (Ishares Asia Pacific dividend ETF). I decided to compare how I would have done if I'd continued to make investments in IAPD instead. If I'd invested in IAPD instead the income would have been slightly less. (HFEL =1.0 IAPD=0.59); the capital would have been significantly more (HFEL=1.0 IAPD=1.11); and overall IAPD would have been better (HFEL 1.0 IAPD 1.07).

I'll stick with HFEL at the moment with the hope that their performance will improve, but they won't be getting more money until it does.

I'll stick with HFEL at the moment with the hope that their performance will improve, but they won't be getting more money until it does.

-

staffordian

- Lemon Quarter

- Posts: 2300

- Joined: November 4th, 2016, 4:20 pm

- Has thanked: 1895 times

- Been thanked: 870 times

Re: HFEL

Interesting commentary from the chairman in todays final results addressing the lacklustre capital performance...

In recent years, however, while this policy has provided a high dividend yield, currently 7% plus, when combined with the capital performance has resulted in an overall outcome that has lagged our competitors whose yields are substantially lower. Our current process locks us into the value sector of the market that is not popular at present as most investors have preferred growth to income. The debate about value versus growth has been going on for a very long time. Sometimes value is preferred, sometimes growth. Rotation between these two styles will continue. When value returns to favour, our capital performance should improve. Our Fund Managers will do all they can to improve our capital performance, but the Board has directed them not to lose sight of our dividend growth preference.

So far, income investors have embraced this policy. Demand for new shares has been elevated. In the last two years we have issued 20.4m new shares and the share price has been consistently above our NAV. This outcome has given the Board confidence that the policy is meeting investor needs, but we will continue to monitor the situation as these do change over time and it is always the Board's intention to respond to our shareholder preferences.

In recent years, however, while this policy has provided a high dividend yield, currently 7% plus, when combined with the capital performance has resulted in an overall outcome that has lagged our competitors whose yields are substantially lower. Our current process locks us into the value sector of the market that is not popular at present as most investors have preferred growth to income. The debate about value versus growth has been going on for a very long time. Sometimes value is preferred, sometimes growth. Rotation between these two styles will continue. When value returns to favour, our capital performance should improve. Our Fund Managers will do all they can to improve our capital performance, but the Board has directed them not to lose sight of our dividend growth preference.

So far, income investors have embraced this policy. Demand for new shares has been elevated. In the last two years we have issued 20.4m new shares and the share price has been consistently above our NAV. This outcome has given the Board confidence that the policy is meeting investor needs, but we will continue to monitor the situation as these do change over time and it is always the Board's intention to respond to our shareholder preferences.

-

dundas666

- 2 Lemon pips

- Posts: 177

- Joined: December 27th, 2019, 2:53 pm

- Has thanked: 165 times

- Been thanked: 100 times

Re: HFEL

I must admit HFEL's yield of 7.8% is very tempting, particularly if you think there will be a shift from growth to value. This could be a great opportunity to bag a tasty yield.

Btw I checked and their huge dividend is completely covered by income (eps = 23.71p, div per share = 23p), so they're not paying the dividend by selling capital like JAGI and others.

Btw I checked and their huge dividend is completely covered by income (eps = 23.71p, div per share = 23p), so they're not paying the dividend by selling capital like JAGI and others.

-

staffordian

- Lemon Quarter

- Posts: 2300

- Joined: November 4th, 2016, 4:20 pm

- Has thanked: 1895 times

- Been thanked: 870 times

Re: HFEL

I'm in two minds over HFEL. It scrapes along the bottom of the total return table for my eleven trust portfolio but it does keep some income rolling in.

As I don't currently need this income, it seems expensively bought, but my non tinkering instinct stops me from selling.

My current plan is to keep it, in the expectation that in time it might get it's moment in the sun, though it will not benefit from the top-ups the other ten members will enjoy.

As I don't currently need this income, it seems expensively bought, but my non tinkering instinct stops me from selling.

My current plan is to keep it, in the expectation that in time it might get it's moment in the sun, though it will not benefit from the top-ups the other ten members will enjoy.

-

Lootman

- The full Lemon

- Posts: 18888

- Joined: November 4th, 2016, 3:58 pm

- Has thanked: 636 times

- Been thanked: 6656 times

Re: HFEL

dundas666 wrote:I must admit HFEL's yield of 7.8% is very tempting, particularly if you think there will be a shift from growth to value. This could be a great opportunity to bag a tasty yield.

Btw I checked and their huge dividend is completely covered by income (eps = 23.71p, div per share = 23p), so they're not paying the dividend by selling capital like JAGI and others.

A fund like HFEL can be like a bond (or worse, an annuity) not just by distributing capital as income, but also by buying the kind of companies that do that as a business model. A 7.8% yield requires that most otherwise eligible shares have to be ignored, which in turn pushes you into market sectors that have effectively gone ex-growth and/or are in decline.

Also check and see if HFEL is selling options. That can easily boost the yield to that kind of level, but only at the expense of crimping growth (short calls) or exposing the fund to loss (short puts).

And of course a fund manager can always play games around ex-dividend dates. But none of these tactics give you a free lunch, and they all come at the expense of capital one way or the other.

But it is not the fund manager's fault. If investors crave yield and are seduced by it, then the managers give the punters what they want. It is easy to juice the yield if you feel the fund holders are on your side.

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: HFEL

For those needing income, HFEL is a satisfactory core, whether or not the income is boosted by losing some capital gain. If it tends towards eating capital slowly, it isn't ideal but not fatal - at least not in comparison with an annuity.

I have a substantial slug of HFEL and find it useful as a big beast of my income portfolio: one of four top payers. My attitude to the capital side is that I have other funds which counterbalance and will eventually come through with their higher dividend and capital growth rates. It will take them a long time to catch up, even so.

Mix it up folks, is my approach.

Arb.

I have a substantial slug of HFEL and find it useful as a big beast of my income portfolio: one of four top payers. My attitude to the capital side is that I have other funds which counterbalance and will eventually come through with their higher dividend and capital growth rates. It will take them a long time to catch up, even so.

Mix it up folks, is my approach.

Arb.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7535 times

Re: HFEL

Lootman wrote:dundas666 wrote:I must admit HFEL's yield of 7.8% is very tempting, particularly if you think there will be a shift from growth to value. This could be a great opportunity to bag a tasty yield.

Btw I checked and their huge dividend is completely covered by income (eps = 23.71p, div per share = 23p), so they're not paying the dividend by selling capital like JAGI and others.

A fund like HFEL can be like a bond (or worse, an annuity) not just by distributing capital as income, but also by buying the kind of companies that do that as a business model. A 7.8% yield requires that most otherwise eligible shares have to be ignored, which in turn pushes you into market sectors that have effectively gone ex-growth and/or are in decline.

Also check and see if HFEL is selling options. That can easily boost the yield to that kind of level, but only at the expense of crimping growth (short calls) or exposing the fund to loss (short puts).

And of course a fund manager can always play games around ex-dividend dates. But none of these tactics give you a free lunch, and they all come at the expense of capital one way or the other.

But it is not the fund manager's fault. If investors crave yield and are seduced by it, then the managers give the punters what they want. It is easy to juice the yield if you feel the fund holders are on your side.

They do write options to boost the income. What I object to is that whilst we have a great yield, it comes at the expense of not just losing capital growth but actually often a negative growth, that is a loss of capital. That to me is not acceptable.

Dod

-

Arborbridge

- The full Lemon

- Posts: 10439

- Joined: November 4th, 2016, 9:33 am

- Has thanked: 3644 times

- Been thanked: 5272 times

Re: HFEL

Dod101 wrote:

They do write options to boost the income. What I object to is that whilst we have a great yield, it comes at the expense of not just losing capital growth but actually often a negative growth, that is a loss of capital. That to me is not acceptable.

Dod

Writing options is not unusual for income funds, but as you say at times it means a decrease in the spending power of the capital. That's not good, and not what a HYPer or income dependent person wants ideally. However, if one had checked the chart at other times, one could have claimed the capital was "more or less" keeping up with the real value of the investment. Its horses for courses, and I confess there have been times when I have thought of ditching this fund and MRCH. However, on balance, I'm quite happy for this part of my pension scheme to take the income knowing that the capital growth will be sluggish at best, even negative at times as I do not intend to use the capital for any other purpose, and I have other funds which increase my capital. I'll just have to make sure I die when it's positive

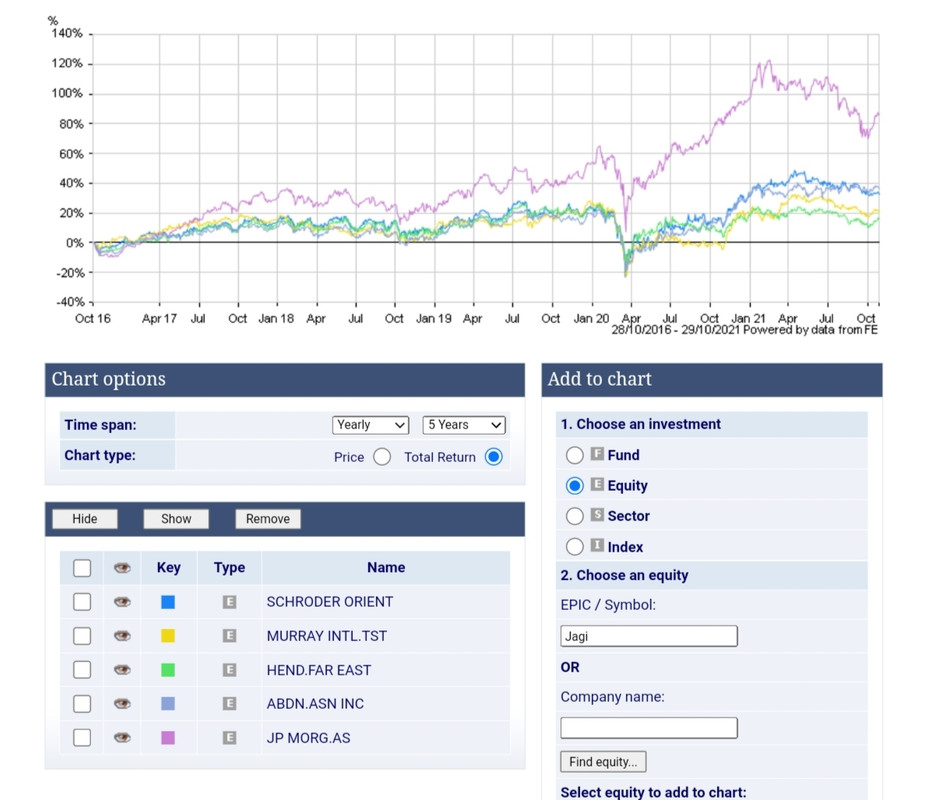

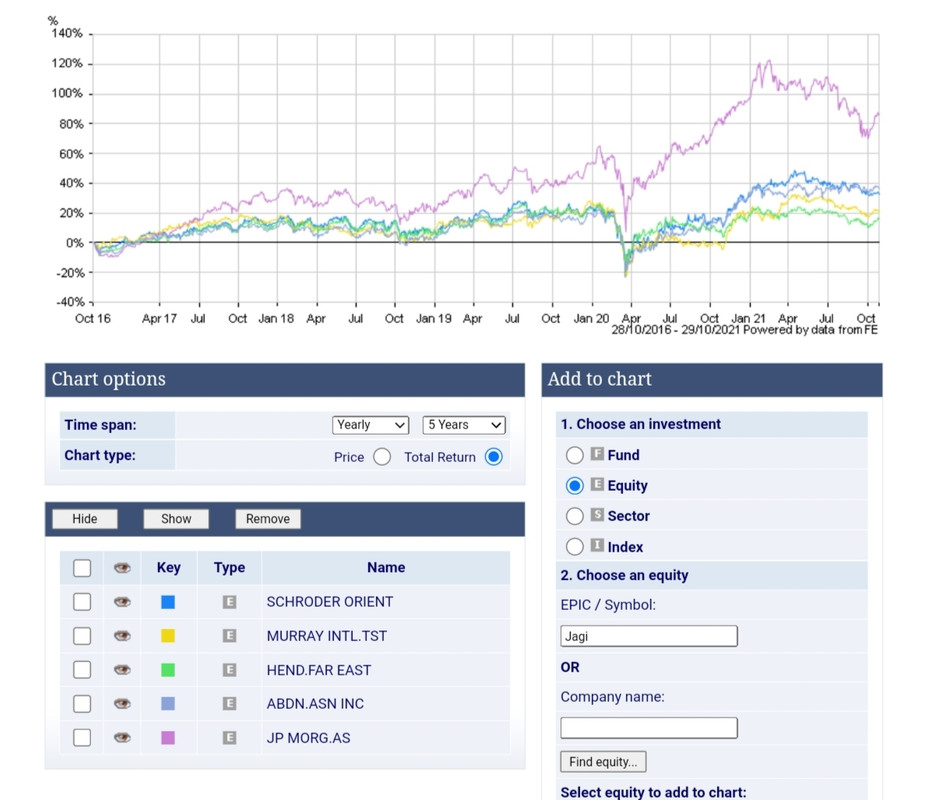

On the brighter side, I have similar amount invested in SOI which has fared better - but I couldn't live on the yield from it. Here, I show SOI, HFEL and MYI without income reinvested over ten years.

In my view, the question with HFEL should be: what will the capital growth be from now on, and has there been a permanent change in the manager's performance. One could argue that capital growth was quite reasonable until the end of 2019 (keeping pace with inflation, which is HYP-competitive) - is this recent decline terminal and increasing, or just a passing phase due to Covid?

Source https://www2.trustnet.com/Tools/Chartin ... I,T_FITMYI

Arb.

-

monabri

- Lemon Half

- Posts: 8419

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3441 times

Re: HFEL

Arborbridge wrote:Dod101 wrote:

They do write options to boost the income. What I object to is that whilst we have a great yield, it comes at the expense of not just losing capital growth but actually often a negative growth, that is a loss of capital. That to me is not acceptable. Until

Dod

Writing options is not unusual for income funds, but as you say at times it means a decrease in the spending power of the capital. That's not good, and not what a HYPer or income dependent person wants ideally. However, if one had checked the chart at other times, one could have claimed the capital was "more or less" keeping up with the real value of the investment. Its horses for courses, and I confess there have been times when I have thought of ditching this fund and MRCH. However, on balance, I'm quite happy for this part of my pension scheme to take the income knowing that the capital growth will be sluggish at best, even negative at times as I do not intend to use the capital for any other purpose, and I have other funds which increase my capital. I'll just have to make sure I die when it's positive

On the brighter side, I have similar amount invested in SOI which has fared better - but I couldn't live on the yield from it. Here, I show SOI, HFEL and MYI without income reinvested over ten years.

In my view, the question with HFEL should be: what will the capital growth be from now on, and has there been a permanent change in the manager's performance. One could argue that capital growth was quite reasonable until the end of 2019 (keeping pace with inflation, which is HYP-competitive) - is this recent decline terminal and increasing, or just a passing phase due to Covid?

Arb.

(Arb, I took the liberty of removing your graph from this response).

I feel that we need to compare SOI, MYI & HFEL on a total return (TR) basis. Certainly, the order of TR in the last 5 yrs currently still puts SOI in top position in this comparison, but when dividends are factored in, the " gap" closes.

I find it interesting that for 4 years ( 2016-20) there was not a marked difference between the three and we only start to see divergence in early 2020. It would seem that HFEL is holding shares that are still suffering from the mark down from Covid-19.

Source https://www.hl.co.uk/funds/fund-discoun ... ion/charts

-

richfool

- Lemon Quarter

- Posts: 3520

- Joined: November 19th, 2016, 2:02 pm

- Has thanked: 1204 times

- Been thanked: 1288 times

Re: HFEL

If people are looking at, or comparing, Asian Pacific income trusts, then surely AAIF should also be included in the comparison. It usually has a better dividend yield than SOI, but historically slightly lower capital appreciation, though AAIF's capital appreciation has improved over the last year or so.

I don't hold HFEL specifically because of its poor capital performance.

I used to hold: AAIF, SOI and JAGI.

I currently hold AAIF (increased holding) and JAGI (reduced holding), with an eye on income and not too much exposure to China or property, hence the adjustments.

I don't hold HFEL specifically because of its poor capital performance.

I used to hold: AAIF, SOI and JAGI.

I currently hold AAIF (increased holding) and JAGI (reduced holding), with an eye on income and not too much exposure to China or property, hence the adjustments.

-

monabri

- Lemon Half

- Posts: 8419

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3441 times

Re: HFEL

Aberdeen Asian Income Fund ( AAIF) and JP Morgan Asia Income and Growth (JAGI). I wonder why JAGI is doing so well, comparatively?

Source: https://www.hl.co.uk/funds/fund-discoun ... ion/charts

Source: https://www.hl.co.uk/funds/fund-discoun ... ion/charts

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7535 times

Re: HFEL

richfool wrote:If people are looking at, or comparing, Asian Pacific income trusts, then surely AAIF should also be included in the comparison. It usually has a better dividend yield than SOI, but historically slightly lower capital appreciation, though AAIF's capital appreciation has improved over the last year or so.

I don't hold HFEL specifically because of its poor capital performance.

I used to hold: AAIF, SOI and JAGI.

I currently hold AAIF (increased holding) and JAGI (reduced holding), with an eye on income and not too much exposure to China or property, hence the adjustments.

In the 6 months to 31 March 2021, JAGI had one way or another reduced its China exposure from 54% to 47% anyway and it will be interesting to see what it looks like at its FYE to 30 September.

Dod

-

monabri

- Lemon Half

- Posts: 8419

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1548 times

- Been thanked: 3441 times

Re: HFEL

Sorry Mods

All graphs posted by myself were produced using free comparator tool at Hargreaves Lansdown.

https://www.hl.co.uk/funds/fund-discoun ... ion/charts

Edit..Thank you, Mod!

All graphs posted by myself were produced using free comparator tool at Hargreaves Lansdown.

https://www.hl.co.uk/funds/fund-discoun ... ion/charts

Edit..Thank you, Mod!

Return to “Investment Trusts and Unit Trusts”

Who is online

Users browsing this forum: 88V8 and 29 guests