Only one UK equity investment trust has made a sector-topping return while taking on more risk than the market, the latest Trustnet study finds.

Dunedin Income Growth is the only top-rated trust to beat its rivals over three years, according to Trustnet data.

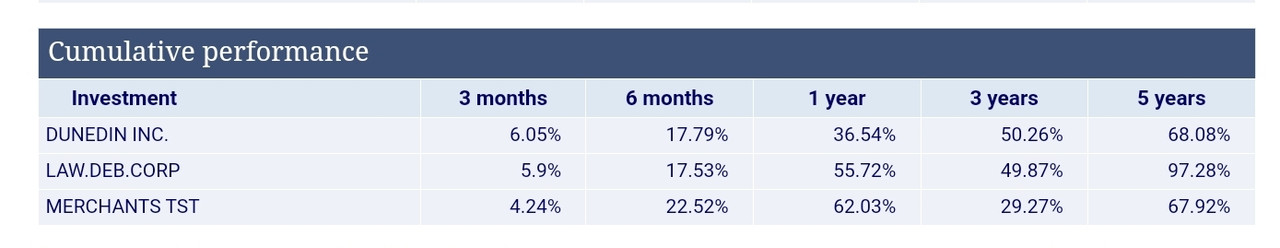

In our latest series, we compared investment trusts run by FE fundinfo Alpha Managers that had made top-quartile returns over the past three years and had a FE fundinfo Crown rating of four or five. Having previously looked at the global sectors, this week we cast our eye over the three UK sectors – IT UK All Companies, IT UK Equity Income and IT UK Smaller Companies.

We then used the FE fundinfo Risk Score – which measures a company’s volatility against the FTSE 100 over three years – to find the most risky trusts. Those with a score of more than 100 (the index’s score) were included.

Only Dunedin Income Growth made the grade. Managed by Alpha Manager Ben Ritchie and Georgina Cooper, the £487.5m trust has been under a recent transformation after shareholders voted to incorporate environmental, social and governance (ESG) principles into its objective.

This follows an evolution in recent years towards a greater focus on dividend growth at the expense of initial yield.

https://www.trustnet.com/news/13271844/ ... er-returns

https://www.hl.co.uk/shares/shares-sear ... st-ord-25p

I hold DIG amongst my UK G&I trusts.