The comparisons I see ...

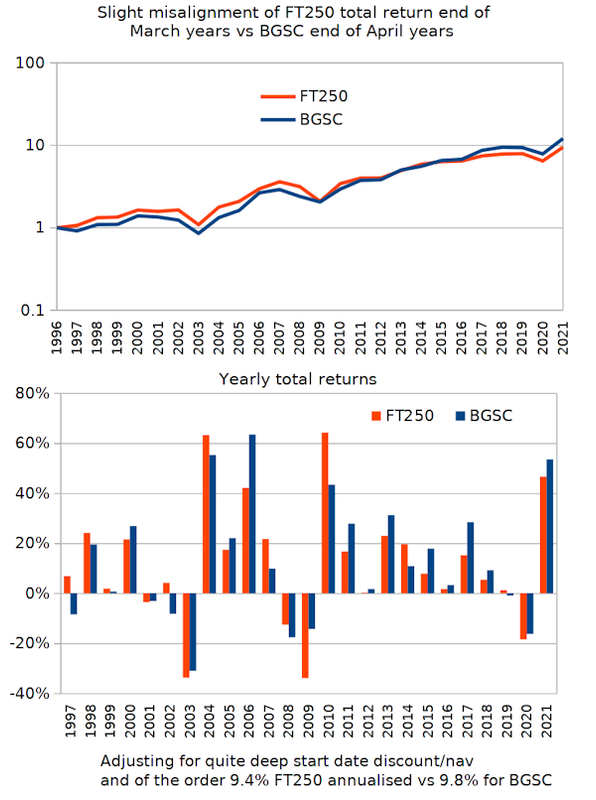

Broadly pretty similar IMO.

Elsewhere I've noted that FT250 has broadly compared to HYP1 and TJH HYP, which in underweighting the largest cap might also be considered as smaller cap value tilted.

Each have their pros/cons. IT's can use gearing/etc. active management, but where broadly the rewards that might bring are eaten by costs. BGSC also seems to hold other IT's so multi-layers of costs involved. A nice aspect however is that BMO provide savings plans such as for FCIT and you might even have the holdings converted into certificated form and avoid brokerage/platform fees altogether. Being able to at times buy at a discount to NAV (sell/rotate at a premium to NAV) could also enhance rewards.