Got a credit card? use our Credit Card & Finance Calculators

Thanks to lansdown,Wasron,jfgw,Rhyd6,eyeball08, for Donating to support the site

VanEck

-

Peter1B1

- Lemon Pip

- Posts: 65

- Joined: November 17th, 2016, 5:12 pm

- Has thanked: 88 times

- Been thanked: 11 times

VanEck

I've not used VanEck before (vaneck.com) but found them while seeking an IT/ETF focussed on Defence. They appear to offer a range of relevant broad market and focussed vehicles, the latter including 'dividend leaders', gold variants, rare earths and others (see their Products drop down and other descriptives on the site).

I make no claim for them and do not presently hold any of their investments. The range, however, might usefully align with my current thoughts around 'concentration' as an adjunct to diversification, in the search for pf performance.

I will be interested in comments, please.

I make no claim for them and do not presently hold any of their investments. The range, however, might usefully align with my current thoughts around 'concentration' as an adjunct to diversification, in the search for pf performance.

I will be interested in comments, please.

-

Itsallaguess

- Lemon Half

- Posts: 9129

- Joined: November 4th, 2016, 1:16 pm

- Has thanked: 4140 times

- Been thanked: 10032 times

Re: VanEck

Peter1B1 wrote:

I've not used VanEck before (vaneck.com) but found them while seeking an IT/ETF focussed on Defence. They appear to offer a range of relevant broad market and focussed vehicles, the latter including 'dividend leaders', gold variants, rare earths and others (see their Products drop down and other descriptives on the site).

I make no claim for them and do not presently hold any of their investments. The range, however, might usefully align with my current thoughts around 'concentration' as an adjunct to diversification, in the search for pf performance.

I will be interested in comments, please.

It looks like they've had some fun thinking up their ETF tickers at the very least.

Space Innovators ETF (JEDI)

Cheers,

Itsallaguess

-

BullDog

- Lemon Quarter

- Posts: 2484

- Joined: November 18th, 2021, 11:57 am

- Has thanked: 2003 times

- Been thanked: 1212 times

Re: VanEck

Don't know a lot about Van Eck but I have held one or two of their ETFs in the past. Currently I don't.

-

Sobraon

- 2 Lemon pips

- Posts: 222

- Joined: November 4th, 2016, 3:00 pm

- Has thanked: 186 times

- Been thanked: 95 times

Re: VanEck

I bought some VanEck Vectors Global Equity Weight UCITS ETF stock and these were migrated by VanEck to VanEck Vectors Sustainable World Equal Weight UCITS ETF two years ago.

I will likely sell and move the holding into HSBC FTSE All-World Index Fund C at my next review.

I will likely sell and move the holding into HSBC FTSE All-World Index Fund C at my next review.

Re: VanEck

I've held VanEck Morningstar Developed Market Dividend Leaders for about a year. Good dividend but not exactly shooting the lights out performance wise. Currently up about 3% over the year plus a div of approx 4.5% so can't complain. March this year the holding was up over 7% but has come back in recent months.

-

BullDog

- Lemon Quarter

- Posts: 2484

- Joined: November 18th, 2021, 11:57 am

- Has thanked: 2003 times

- Been thanked: 1212 times

Re: VanEck

Dumbo wrote:I've held VanEck Morningstar Developed Market Dividend Leaders for about a year. Good dividend but not exactly shooting the lights out performance wise. Currently up about 3% over the year plus a div of approx 4.5% so can't complain. March this year the holding was up over 7% but has come back in recent months.

Sounds like a good result to me. I would be very happy with that this year.

-

monabri

- Lemon Half

- Posts: 8433

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3446 times

Re: VanEck

BullDog wrote:Dumbo wrote:I've held VanEck Morningstar Developed Market Dividend Leaders for about a year. Good dividend but not exactly shooting the lights out performance wise. Currently up about 3% over the year plus a div of approx 4.5% so can't complain. March this year the holding was up over 7% but has come back in recent months.

Sounds like a good result to me. I would be very happy with that this year.

I thought I'd have a quick shufty at VanEck Morningstar Developed Market Dividend Leaders..not a common ETF mentioned "round here".

The next link I found to be quite useful (not just for the dividend history!)

Dividend History:

https://www.vaneck.com/uk/en/investment ... portfolio/

12-Month Yield 4.99% "The 12-Month Yield is the yield an investor would have received if they had held the fund over the last 12 months assuming the most recent NAV. The 12-month yield is calculated by summing any income distributions over the past 12 months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past 12 months. The dividend paid may differ from the dividend yield of the index by increasing or decreasing the fund. A part of the dividend can be reinvested whereby this is processed in the price and not paid out."

The TER looks a little high (0.38%) for an ETF..but it is a smallish fund. I note it is Dutch domiciled so that might lead to a need to declare dividends if held in a taxable account ("Foreign" Section).

Top 10 Holdings (September 2023 -latest factsheet available on HL website)

Performance :

source : https://www.hl.co.uk/funds/fund-discoun ... ion/charts

Comparison versus funds more often referenced "round here"....

The factsheet quotes an inception date of 2016 so I don't know why there's no 5 year comparison from the Hargreaves website.

I also did a quick comparison versus some other ITs/ETFS...

It does offer exposure to mostly "Not UK" ....

United States 22.46%

France 13.76%

Germany 10.89%

Canada 9.72%

Japan 7.50%

Italy 5.83%

Australia 4.63%

Switzerland 4.53%

Other/Cash 20.69%

Overall Thoughts

A bit different, market exposure wise and thus a diversification for me ....maybe when funds are available it might be a new addition.

edit: I wanted to compare it with another fund but I couldn;t remember the fund name/ticker. Something like "Global Quality Dividend"

-

BullDog

- Lemon Quarter

- Posts: 2484

- Joined: November 18th, 2021, 11:57 am

- Has thanked: 2003 times

- Been thanked: 1212 times

Re: VanEck

Thanks go to monabri for looking that up.

Certainly something rather different to the usual suspects. I'm pleased my attention has been drawn to it's existence. One thing, if it's Dutch domiciled, is it subject to Netherlands with holding tax on dividends?

Certainly something rather different to the usual suspects. I'm pleased my attention has been drawn to it's existence. One thing, if it's Dutch domiciled, is it subject to Netherlands with holding tax on dividends?

-

kempiejon

- Lemon Quarter

- Posts: 3589

- Joined: November 5th, 2016, 10:30 am

- Has thanked: 1 time

- Been thanked: 1198 times

Re: VanEck

monabri wrote:It does offer exposure to mostly "Not UK" ..

I compared it to the vanguard global etf VWRP there's not a lot in it to my eye from HL 5 year charts.

It is quite interesting to look at global offerings sometimes but when it's a lot like a global index may as well park my money there. I have similar thoughts about my Murray international MYI and Henderson HINT that I gave up on neither kept up with the index. JGGI is the hindsight winner.

Re: VanEck

Monabri,

Did you mean Fidelity Global Quality Income - FGQD? or Wisdomtree Global Quality Dividend Growth - GGRP?

I've got small holdings in both of those as well. Both have shown smaller increases over the last 12 months. Again nothing to shout about but nice dividend payments.

Eddie

"edit: I wanted to compare it with another fund but I couldn;t remember the fund name/ticker. Something like "Global Quality Dividend"(old age, senility is a creeping in...I'm sure I wrote it down somewhere...

)."

Did you mean Fidelity Global Quality Income - FGQD? or Wisdomtree Global Quality Dividend Growth - GGRP?

I've got small holdings in both of those as well. Both have shown smaller increases over the last 12 months. Again nothing to shout about but nice dividend payments.

Eddie

-

monabri

- Lemon Half

- Posts: 8433

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3446 times

Re: VanEck

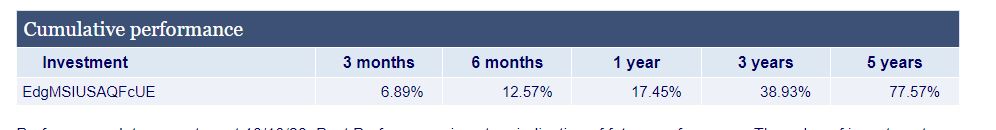

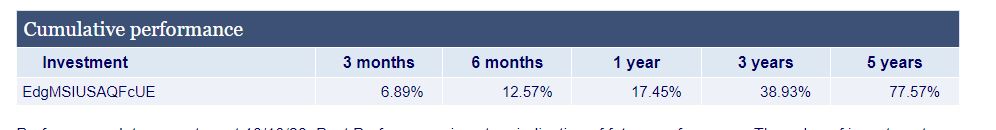

I had to look it up.... IUQF

ISHARES IV PLC EDGE MSCI USA QUALITY FACTOR UCITS ETF (IUQF)

It's not one for dividends though (accumulation fund)!

https://www.fundslibrary.co.uk/FundsLib ... fvgxu6&r=1

TOP HOLDINGS (%)

NVIDIA CORP 6.11

VISA INC CLASS A 4.56

META PLATFORMS INC CLASS A 4.48

MICROSOFT CORP 4.35

APPLE INC 4.29

MASTERCARD INC CLASS A 4.06

ELI LILLY 3.09

CONOCOPHILLIPS 3.08

NIKE INC CLASS B 2.63

BROADCOM INC 2.62

TER of 0.20%

Domicile = Ireland so also "foreign"

https://www.hl.co.uk/funds/fund-discoun ... ion/charts

upload and share pictures

upload and share pictures

ISHARES IV PLC EDGE MSCI USA QUALITY FACTOR UCITS ETF (IUQF)

It's not one for dividends though (accumulation fund)!

https://www.fundslibrary.co.uk/FundsLib ... fvgxu6&r=1

TOP HOLDINGS (%)

NVIDIA CORP 6.11

VISA INC CLASS A 4.56

META PLATFORMS INC CLASS A 4.48

MICROSOFT CORP 4.35

APPLE INC 4.29

MASTERCARD INC CLASS A 4.06

ELI LILLY 3.09

CONOCOPHILLIPS 3.08

NIKE INC CLASS B 2.63

BROADCOM INC 2.62

TER of 0.20%

Domicile = Ireland so also "foreign"

https://www.hl.co.uk/funds/fund-discoun ... ion/charts

upload and share pictures

upload and share pictures-

Peter1B1

- Lemon Pip

- Posts: 65

- Joined: November 17th, 2016, 5:12 pm

- Has thanked: 88 times

- Been thanked: 11 times

Re: VanEck

My thanks to all for their responses, especially mon abri for the generous research.

My thoughts are focussing around ‘old’ and ‘new’ economy investing: the old for income, stability; the ‘new’ for growth. VanEck Dividend Leaders would fit the former, perhaps for an ISA. A new economy thematic for a SIPP, depending if there is a lengthy time until drawdown.

I may try to tabulaires this in a new post.

My thoughts are focussing around ‘old’ and ‘new’ economy investing: the old for income, stability; the ‘new’ for growth. VanEck Dividend Leaders would fit the former, perhaps for an ISA. A new economy thematic for a SIPP, depending if there is a lengthy time until drawdown.

I may try to tabulaires this in a new post.

-

Wasron

- 2 Lemon pips

- Posts: 218

- Joined: November 4th, 2016, 5:03 pm

- Has thanked: 172 times

- Been thanked: 119 times

Re: VanEck

I use VanEck for targeted access to the semi-conductor industry, a commodity for the 21st century.

VanEck Semi Conductors (SMGB)

Initially bought in Feb 2022 and gradually added.

Up around 25% in just over 18 months

Wasron

VanEck Semi Conductors (SMGB)

Initially bought in Feb 2022 and gradually added.

Up around 25% in just over 18 months

Wasron

Return to “Investment Trusts and Unit Trusts”

Who is online

Users browsing this forum: No registered users and 12 guests