I'll also have a 'modest' (near 6 digit start of payment of occupational pension) lump sum to drop into the market soon. Throwing a spanner into the PP works I do like a Talmud asset allocation of a third each UK home, US stock, gold. To me a 50/50 US stock/gold barbell is a form central currency unhedged global bond bullet. Two extremes/opposites that is somewhat like holding a barbell of 20 year and 1 year gilt barbell that broadly compares to a central 10 year bond bullet. Higher volatility, and in some years both stocks and gold can drop, but usually when that is the case the years either side of that tend to see one or the other do relatively well.

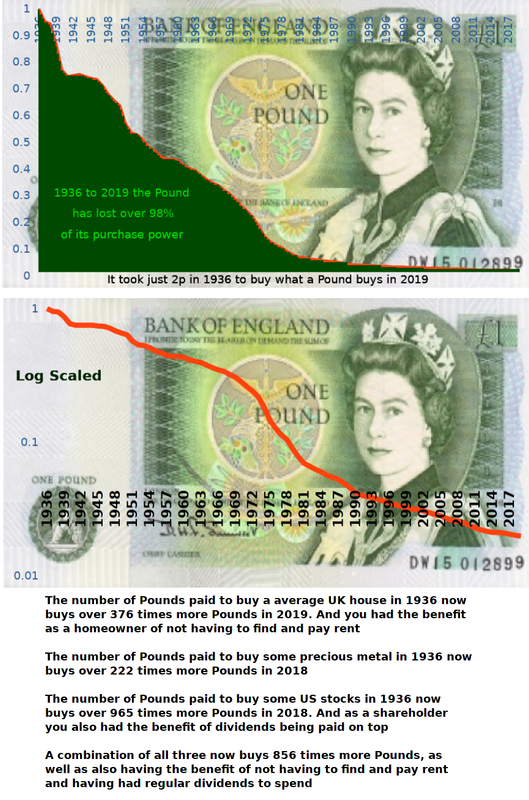

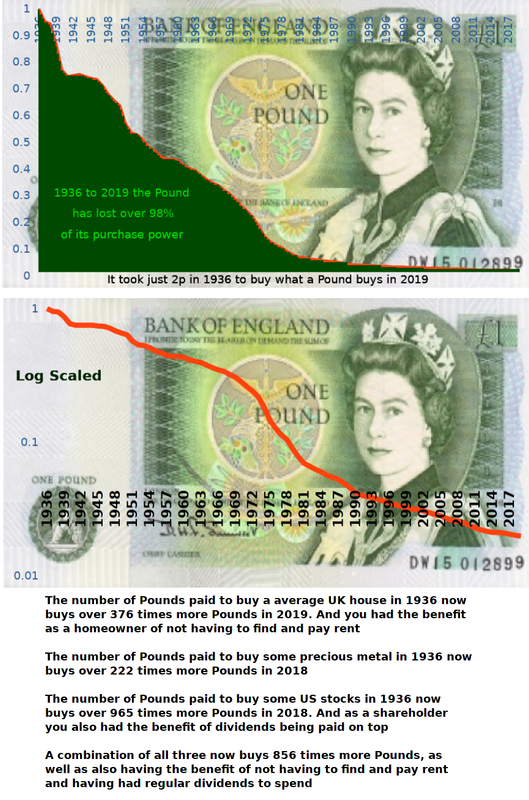

Here's a more for fun (messing around with LibreOffice Calc) image I created, but that is highly subjective

It's also somewhat more aligned with 'Old Money' - generational wealth mantra of a third, a third, a third (land, gold, art) but where art is instead replaced by stocks. Keynes art collection value was investigated by Dimson and others

https://academic.oup.com/raps/advance-a ... 01/5716334 and observed to have yielded around comparable longer term rewards.

Conceptually you might rebalance infrequently, and perhaps include some UK stocks as a proxy for UK home value - for liquidity purposes. What appeals to me is that in including some of home value as part of the portfolio, the higher capital value of the portfolio means a lower SWR figure can be applied, and a great way to substantially reduce risk is to reduce the SWR figure. £333K in each of home, US stocks, gold, £1M total with a 2.5% SWR (£25K/year income), excluding imputed rent, is considerably safer than a 3.75% SWR applied to a £666K amount (that provides the same £25K/year).

Domestic £ currency, primary reserve currency (US$) and global currency (gold) currencies diversification; Land, stock, commodity asset diversification.

Looking at something like

this is indicative of the higher volatility that endures. For some periods such as 1994 to 2004 in that link (and somewhat from 2012 onward also) the two can be quite similar in rewards, but at other times see that Talmud blend spike down, or up to a new higher/lower plateau.

It's a question of character/nature. Whether you see volatility as a risk, or just something that you ride through. Also many would hate having so much in gold, whilst others like having two thirds of 'in hand' assets (land and gold) just a third having counter party risk (stocks). Many in India look totally differently upon gold, as their domestic currency has at times been a lot less 'dependable' (lacks trust/faith).