veeCodger1 wrote:it is very difficult to pick managed funds that will continue to deliver. Hence, most people are probably better off, like the OP, with a global tracker.

So those that market/provide such products would prefer you believed.

Since 1980 pretty much everything has provided a decent reward. The failings during the 1970's wiped out much of values and saw high inflation and interest rates. Some complain how recently real (after inflation) yields are marginally negative, but back then at times real yields were massively negative. Even when yields/interest rates were up at 15% levels, when inflation was running at 25% you were losing 10% of purchase power ... type situation.

In effect investors have been subsequently compensated for that failing, and as such bonds, stocks ...etc have rewarded above long term averages. Progressively declining yields down from double digits to very low levels has the effect of driving bonds and stocks to provide above average rewards. From present low interest rate levels that isn't a trend that can continue.

A concern with global funds as I see it are all the hidden extra costs. Countries take different slices out of dividends/interest according to whatever their policy of 'withholding tax' rates. France for instance has imposed 70% withholding taxes to some. Index providers, that calculate the mathematical indexes may opt to discount such costs, and provide a net total return figure for the index, that a fund might then 'benchmark' to. And the fund of course applies its own costs to cover its costs and provide profits out of provision of their 'product' (fund).

Market makers used to really exploit investors, often setting bid/ask spreads of +10% or more.

As I see it, global funds with their broad diversity into many different markets and political (taxation) regimes is a form of multi-layered costs, before you finally receive (hopefully) a positive reward, which HMRC will then look to take a slice.

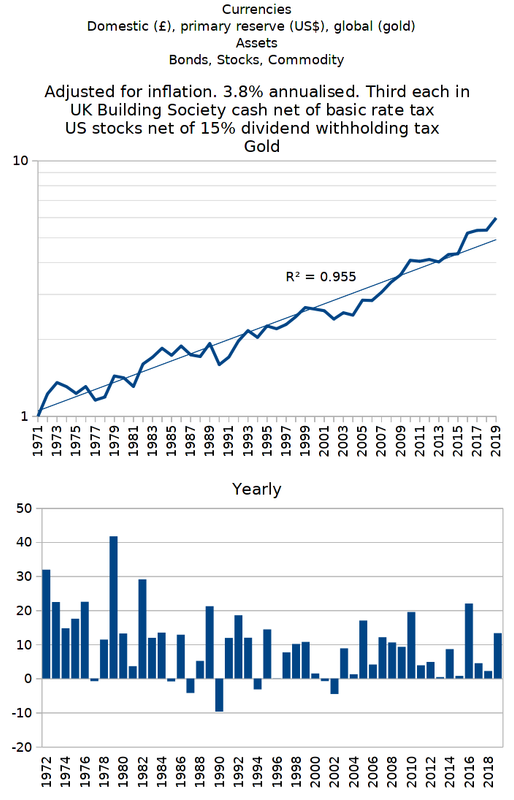

Many invest to offset inflation, and hopefully achieve a positive return on top of that, after costs and taxes. Governments induce inflation in order to force you to invest or otherwise risk seeing the value decayed by inflation. If you stuffed £ notes under a bed in 1972 then to recent that money would have annualised a 5.7% decay of its purchase power (RPI). If however instead of just £'s stuffed under the bed you stored equal amounts of £'s, US $ and gold, adjusting that each year back to around equal capital values, then that 'money' would have lost -1.5% annualised (decay in purchase power). If you'd invested the third held as $'s into US stocks instead of holding $'s under the bed, then you'd have negated inflation altogether. If you'd also deposited the £'s into earning interest (cash deposit account) then the collective value of that portfolio would have grown at over 4% annualised.

Holding a third each in domestic currency (£'s), primary reserve currency (US$) and global currency (gold), whilst being asset diversified across 'bonds' (cash deposits), stocks (US) and commodity (gold), potentially can be achieved with lower costs/taxes than going with a global stock (and/or bond) fund(s).

When it comes to spending some, just avoid spending whichever currency (£, $ or gold) that is down at the time. Better to spend the currency that is relatively up at the time. As more often the ones that are down this year, maybe the best in another year, whilst the ones that are presently best may later be the worst.

Again this chart is total returns, before costs/taxes, but there is considerable transparency in those costs and taxes and there are means to keep cost/taxes reasonably low.

And once you're familiar with that asset allocation, it can be very Zen like. When others are running around shouting that the Pound, or Dollar, or Gold is down (or up), or that stocks (or gold) is crashing due to x, y or z, you can just turn your head to the other side of the comfee chair and continue dozing in the knowledge that such transitions periodically come along and when you next review you'll just be adding more of x, reducing y and that no other action is required - as after all, where else could you move money to without becoming more predictive/preemptive (a.k.a speculative).

2000 dot com bubble bursting and the worst year was (nominal) a -3.8% decline (2002). 2000 and 2001 when others were seeing sizeable stock price declines and the above pretty much broke even in both of those years. 2008/9 financial crisis years and it was up over +11% in both years. Current Covid-19 year and at the start of 2020 the £/$ was around 1.32, more recently its 1.28, whilst US stock prices (excluding dividends) are pretty much back up to where they started the year, so the third in $'s has primarily been just currency gains year to date of around +3%. UK cash third, as good as 0%. Gold however in £ terms is up around +30%. So across the Covid panic period the portfolio is up around +10% year to date. If I were to speculate I'd guess forward time might see gold down, stocks up, perhaps also £ up after Brexit uncertainties fade and maybe $ down as investors who flighted into the US $ for safety move that money elsewhere looking for higher rewards. But each/any/all of those predictions could be completely wrong. Best not to speculate.

For a US investor whose domestic currency was also the primary reserve currency I guess they'd be more inclined to hold

this For them 2008 would have been a relatively bad year, -10% down, but that followed a year with a +13% gain (2007) and was further compensated by a reasonable +17% gain in the next year (2009)