Last 12 months SPY (US S&P500) + 9.5% in $ % terms, £/$ benefit from holding US$ for a UK investor +4%, so combined benefit/gain for a UK investor = +14%.

Expect that to continue? Well with the Fed now having the authority to buy up to 70% of each/any Corporate Bond issue such QE could inject $8T of newly printed money into such bonds, which has investment funds reducing higher priced/valued bonds to buy stocks, so stocks are up. The fear of CV-19 has also seen the flight to safety (US$). That could sustain, could flip around. Best is to diversify, perhaps 50/50 SPY and UK FT All Share.

All stock or stock and bonds? Some like 50/50 stock/bond, a variant of that is 25% each US stock and gold, UK stock and UK T-Bills, so around 50/50 £ and foreign currency diversification (US$ is the worlds primary reserve currency, gold is a form of global currency (as well as being a commodity)).

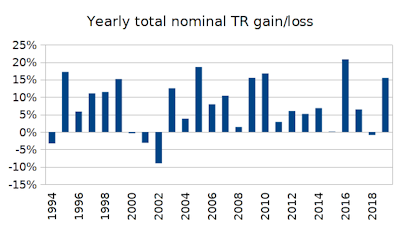

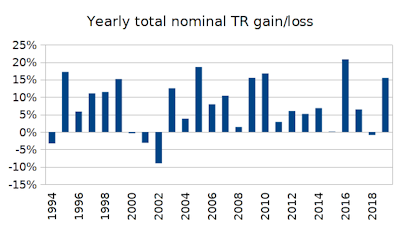

Since the start of 1994 that yearly rebalanced asset allocation has provided around 5% annualised real (after inflation) total return. Where the dot com bubble decline, -3% in 2001, -9% in 2002, followed by +12.5% in 2003 rebound, was the greatest impact since the start of 1994. 2008/9 financial crisis was a non-event for the portfolio, as has CV-19 been ... so far.

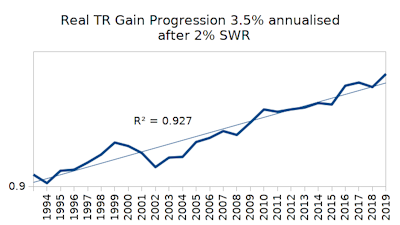

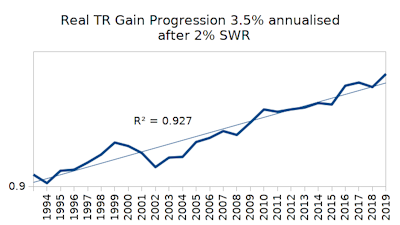

After withdrawal of a 2% SWR (2% of portfolio drawn at the start, then uplift that by inflation each year as the amount drawn in subsequent years, so a regular inflation adjusted 'dividend'), the remainder of the inflation adjusted portfolio value has grown ...

at a 3.5% annualised real rate, so opportunities to top-slice additional income ('dividends') to supplement the SWR.

The above are all calendar year figures, better for a UK investor to review/rebalance once/year around the end/start of the fiscal year (5th April) as that way you can opt to rebalance in the old, new or a combination of both according to whichever might be the more tax efficient. Between times, as xxd09 said, forget about it. If another dot com type event occurs any dips will tend to be recouped in a later year (or have been preceded with a above average gain year), or events such as the financial crisis/CV-19 might come and go without hardly being recorded/indicated in your portfolios value. Such are the effects/benefits of diversification.

Want higher returns, then go more with stock-heavy/all-stock and 'enjoy' the Rollercoaster ride along the way. No guarantees that will make more though. Depends upon what timeframe you look at. Being more volatile it will sometimes zig up more, sometimes zag down again

https://tinyurl.com/y8qwx8tp