Lootman wrote:1nvest wrote:Aren't US Treasuries also open to US withholding taxes?

Not for Treasuries, with a W-8BEN:

"Interest (including OID) received by

U.S. nonresidents on obligations of

the U.S. government (e.g., Treasury

bills, notes and bonds) which were

issued after July 18, 1984 (“portfolio

interest” obligations) is generally

exempt from U.S. withholding tax,

as long as a Form W-8BEN has been

provided to the payer."

Thanks.

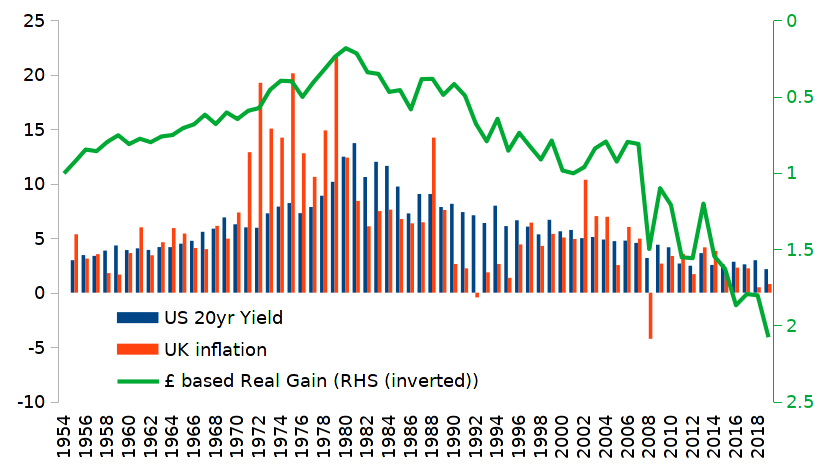

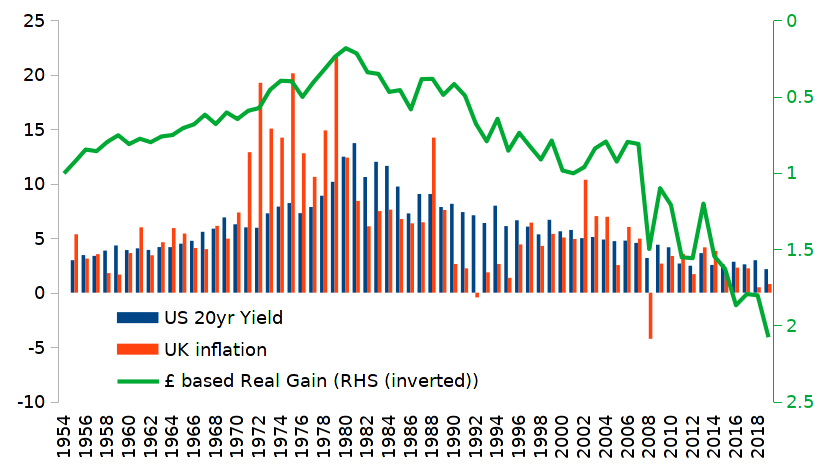

US 20 year constant maturity yields since 1954, calculate the yearly total return, adjust that to £'s and discount UK inflation ...

The accumulation real gain (green line) right hand scale is inverted, so as 1950's yields rose up to 1970's high the green line total real value dived considerable, £1 became 18p at the end of 1980 in real terms for total accumulation return, around a -6.6% annualised loss over 25 odd years. But as yields have subsequently declined, so the accumulation gains are massive, rising from that 18p in real terms up to £2.07 at the end of 2019, a whopping 11.5 times real gain over 40 odd years (6.3% annualised real).

The Pound has more than halved over that mid 1950's to recent data range, down from 2.80 dollars per £ to recent 1.3 $ per £ levels, the £/$ was around 2.20 in 1980 so that £ slide has more benefited (occurred since) the post 1980 rise rather than diluting down the 1950's to 1980 decline.

Stocks weren't particularly good across the 1960/1970's decades, at least not in real terms (better in nominal terms but that's not what really counts), near as flat when all of dividends were being reinvested. Short dated bonds would more have reflected/paced inflation, at least in gross terms (less after taxes). Precious metals, silver 1955 to 1971, gold since 1972 after the US broke the $ from gold and the price of gold free-floated, saw that PM achieve a 3.4% annualised real over mid 1950's to the start of 1980.

A Permanent Portfolio that had 25% in each of PM, 20 year US Treasuries, cash (short dated gilts) and stocks, over the mid 1950's to 1980 period would have had stocks flat, bonds down around 6% annualised, gold up around 3% annualised, cash level ... in real terms. So overall marginally negative annualised real. For a pure UK Permanent Portfolio, UK stocks, UK 20 year Gilts, cash and gold ... that annualised 2.3% real over the mid 1950 to 1980 years.

Harry Browne did suggest that for his Permanent Portfolio one should hold domestic stocks and bonds (treasuries/Gilts) and it looks like that was a appropriate/good call.

Across the 1980's/1990's, when the price of gold repeatedly declined, the PP accumulated multiple times more ounces of gold over those years from rebalancing. It looks like that across the mid 1950's to 1980 it would have been accumulating more long dated gilts. In both cases such expansion of ounce of gold being held, and increased number of long dated gilt certificates being held, subsequently paid off - in a big way. Harry did indicate that one of the PP assets will be doing bad at any one time, whilst another will be doing well, and where generally the good asset(s) gains offset the bad asset(s) losses, and more.

I guess you could try and time things, strive to not hold the anticipated 'bad' asset, however that is notoriously difficult to actually do in practice. You're often surprised (and likely to make the wrong choice, making things worse not better).

As a proxy for a Inflation Bond, the

Permanent Portfolio could be a reasonable choice.

http://www.harrybrowne.org/articles/InvestmentRules.htmRule #11: Create a bulletproof portfolio for protection.

For the money you need to take care of you for the rest of your life, set up a simple, balanced, diversified portfolio. I call this a "Permanent Portfolio" because once you set it up, you never need to rearrange the investment mix— even if your outlook for the future changes.

The portfolio should assure that your wealth will survive any event — including an event that would be devastating to any individual element within the portfolio. In other words, this portfolio should protect you no matter what the future brings.

It isn't difficult or complicated to have such a portfolio this safe. You can achieve a great deal of diversification with a surprisingly simple portfolio.

Just seems to spit out 2.5% to 5% real (moderately) consistently, come what may. Relatively passive, buy a 25 year gilt, and stick with that for 5 years until is 20 years away from maturity at which time roll that into another 25 year gilt series. For the 25% 'cash' cash deposit accounts are a reasonable choice. A low cost FT all share fund/ETF (but personally I prefer the FT250 such as Vanguards VMID), and some gold (join thesilverforum.com and get yourself established with the crew that vacate that board, and you'll likely get spreads down to pretty low levels once you've been seen to trade (buy/sell) honestly a number of times). Review and maybe rebalance once/year, but only if modest drift is apparent, 20% lower, 30% upper are common choices of weightings before triggering actual rebalance trade(s).

More here

viewtopic.php?f=56&t=23992 and here

viewtopic.php?f=8&t=12360