Got a credit card? use our Credit Card & Finance Calculators

Thanks to eyeball08,Wondergirly,bofh,johnstevens77,Bhoddhisatva, for Donating to support the site

Why buy UK?

-

seekingbalance

- 2 Lemon pips

- Posts: 163

- Joined: November 7th, 2016, 11:14 am

- Has thanked: 16 times

- Been thanked: 66 times

Why buy UK?

Ignoring dividends, which I appreciate make a big difference over time, I was somewhat shocked today, when explaining to my parents why investing in the USA is almost always best, to note the following:

Since 2009 the FTSE 100 has gone from about 3800 to just below 6000 today - an (rounding generously) increase of 60%. Over 11 years!

Since 2009 the Nasdaq 1000 has gone from 1000 to 11,000 - an increase of 1100% - or over 18x the return on the FTSE

Since 2009 the S&P500, perhaps closer to the FTSE100 in type, has gone from 750 to 3350 - a 450% increase, or 7.5 x the FTSE.

(And even the currency has moved in our favour over that time, adding even more to GBP returns)

Boy, oh boy, what a difference! I am thankful I always held some US shares (Apple, Amazon, Microsoft, Berkshire - but no Netflix, Tesla, Gilead!), and more recently some EQQQ and VUSA which have done very well - such that about 10% of my holdings now represent over 30% of my portfolio, 50% when counting VWRL and some US focused ITs such as Scottish American.

Of course, I am in no way mindful that if I had bought only US index funds in the last 11 years my holdings would now be north of an absolute shitload more than my pretty decent portfolio valuation (!), but it does beg the question, why bother with the UK market at all?

Go back to 2000 and the FTSE was actually higher than it is now - though again I do appreciate that dividend reinvestment would have still made for decent returns.

Still, it is certainly food for thought, and as I divest some of my non dividend paying U.K. shares in the coming months I think I will be deploying the cash into US focused trackers, albeit perhaps diversifying into smaller cap value to prevent me just buying more and more of the same top end tech.

Since 2009 the FTSE 100 has gone from about 3800 to just below 6000 today - an (rounding generously) increase of 60%. Over 11 years!

Since 2009 the Nasdaq 1000 has gone from 1000 to 11,000 - an increase of 1100% - or over 18x the return on the FTSE

Since 2009 the S&P500, perhaps closer to the FTSE100 in type, has gone from 750 to 3350 - a 450% increase, or 7.5 x the FTSE.

(And even the currency has moved in our favour over that time, adding even more to GBP returns)

Boy, oh boy, what a difference! I am thankful I always held some US shares (Apple, Amazon, Microsoft, Berkshire - but no Netflix, Tesla, Gilead!), and more recently some EQQQ and VUSA which have done very well - such that about 10% of my holdings now represent over 30% of my portfolio, 50% when counting VWRL and some US focused ITs such as Scottish American.

Of course, I am in no way mindful that if I had bought only US index funds in the last 11 years my holdings would now be north of an absolute shitload more than my pretty decent portfolio valuation (!), but it does beg the question, why bother with the UK market at all?

Go back to 2000 and the FTSE was actually higher than it is now - though again I do appreciate that dividend reinvestment would have still made for decent returns.

Still, it is certainly food for thought, and as I divest some of my non dividend paying U.K. shares in the coming months I think I will be deploying the cash into US focused trackers, albeit perhaps diversifying into smaller cap value to prevent me just buying more and more of the same top end tech.

-

dealtn

- Lemon Half

- Posts: 6090

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 442 times

- Been thanked: 2336 times

Re: Why buy UK?

seekingbalance wrote:Ignoring dividends, which I appreciate make a big difference over time...

So why do it then?

-

SalvorHardin

- Lemon Quarter

- Posts: 2062

- Joined: November 4th, 2016, 10:32 am

- Has thanked: 5357 times

- Been thanked: 2485 times

Re: Why buy UK?

seekingbalance wrote:Of course, I am in no way mindful that if I had bought only US index funds in the last 11 years my holdings would now be north of an absolute shitload more than my pretty decent portfolio valuation (!), but it does beg the question, why bother with the UK market at all?

Go back to 2000 and the FTSE was actually higher than it is now - though again I do appreciate that dividend reinvestment would have still made for decent returns.

Still, it is certainly food for thought, and as I divest some of my non dividend paying U.K. shares in the coming months I think I will be deploying the cash into US focused trackers, albeit perhaps diversifying into smaller cap value to prevent me just buying more and more of the same top end tech.

If you exclude dividends you're excluding most of the FTSE100's performance. That's an omission on par with looking at England's performance in a five test match series against Australia and ignoring all runs scored by Steve Smith. By ignoring dividends you've left the best bit out.

If you exclude the S&P500 technology sector in the last few years, then the S&P500's performance isn't all that special. Better than the UK, not that that's all that difficult given that the FTSE100 is stuffed with price-taking oils and miners, plus badly run banks and many other businesses who've seen much better days.

Why invest in the UK? For many people the lure of home market bias is too hard to beat. Then there's those dividends. The massive amount of traffic on the High Yield Portfolio boards compared to the rest of TLF tells us a lot about the attraction of FTSE100 dividends.

I'd rather keep my cash on deposit than invest in a FTSE100 tracker. But I'm perfectly happy to stockpick the UK market (apologies for mentioning the S-word on the passive board).

Unilever is a good example; up by more than 370% since early 2000 (excluding dividends), whereas the FTSE100 has barely moved over the last twenty years. Unilever's yield tends to be about 1% lower than the FTSE100 (e.g. 3.2% when the FTSE100 yields 4.2%), so you could probably add back something like 25% to the FTSE100 return compared to Unilever over this period.

-

Adamski

- Lemon Quarter

- Posts: 1098

- Joined: July 13th, 2020, 1:39 pm

- Has thanked: 1482 times

- Been thanked: 566 times

Re: Why buy UK?

US stocks have had an amazing 10 year bull market, and with Covid bounce back, plus a Tech boom, so look good now. However hasn't always been the case. US stocks prior to this had a lost decade of 2000s when made a negative return. Looking long term I agree US stocks do better, but they look overvalued now, esp tech giants, and wouldn't be surprised if underperform versus the rest of the world UK included for the next few months.

-

MrFoolish

- Lemon Quarter

- Posts: 2339

- Joined: March 22nd, 2020, 7:27 pm

- Has thanked: 566 times

- Been thanked: 1145 times

Re: Why buy UK?

I think the UK is possibly ok as a speculative medium term punt, given the bombed out values.

Longer term? Very doubtful. Too many old economy stocks.

Longer term? Very doubtful. Too many old economy stocks.

-

seekingbalance

- 2 Lemon pips

- Posts: 163

- Joined: November 7th, 2016, 11:14 am

- Has thanked: 16 times

- Been thanked: 66 times

Re: Why buy UK?

Thanks to some of you for actually answering seriously.

But even you are wrong.

Taking the total return index for the FTSE 100, and again rounding a little, the index has gone from 8000 to 24000 since the lows of 2009 (so I am being generous as for the other indexes I took an approximate average for 2009, not just the low)

So the FTSE100 including reinvested dividends went up by 3 times - versus 11 times for the Nasdaq index alone - and the Nasdaq also has dividends, albeit lower than the FTSE, so would easily be 12 times increase over the period with dividends reinvested, probably more. And the S&P500 has better dividends than the Nasdaq, so would again be higher than the more than double it has done than the FTSE, at least 3 times v 7 times.

So even with dividends the FTSE is less than half the gains of the S&P and a quarter the Nasdaq.

And this works out for almost every other 10 or so year time period I looked at, so it is not just a one off.

By dismissing the US people are missing a much more consistently good market - and remember I am talking the whole index here, not just cherry picking one or two good stocks. Netflix, anyone?

But even you are wrong.

Taking the total return index for the FTSE 100, and again rounding a little, the index has gone from 8000 to 24000 since the lows of 2009 (so I am being generous as for the other indexes I took an approximate average for 2009, not just the low)

So the FTSE100 including reinvested dividends went up by 3 times - versus 11 times for the Nasdaq index alone - and the Nasdaq also has dividends, albeit lower than the FTSE, so would easily be 12 times increase over the period with dividends reinvested, probably more. And the S&P500 has better dividends than the Nasdaq, so would again be higher than the more than double it has done than the FTSE, at least 3 times v 7 times.

So even with dividends the FTSE is less than half the gains of the S&P and a quarter the Nasdaq.

And this works out for almost every other 10 or so year time period I looked at, so it is not just a one off.

By dismissing the US people are missing a much more consistently good market - and remember I am talking the whole index here, not just cherry picking one or two good stocks. Netflix, anyone?

-

Hariseldon58

- Lemon Slice

- Posts: 835

- Joined: November 4th, 2016, 9:42 pm

- Has thanked: 124 times

- Been thanked: 513 times

Re: Why buy UK?

Not sure telling respondents that they are wrong is going to foster a good debate....

I think starting with the World market and then deciding if we wish to overweight/underweight a region is a sound policy.

The US market has done well over the years, particularly the last decade , worth remembering the performance of Japan in the 80’s...

I think starting with the World market and then deciding if we wish to overweight/underweight a region is a sound policy.

The US market has done well over the years, particularly the last decade , worth remembering the performance of Japan in the 80’s...

-

SalvorHardin

- Lemon Quarter

- Posts: 2062

- Joined: November 4th, 2016, 10:32 am

- Has thanked: 5357 times

- Been thanked: 2485 times

Re: Why buy UK?

Hariseldon58 wrote:Not sure telling respondents that they are wrong is going to foster a good debate....

I think starting with the World market and then deciding if we wish to overweight/underweight a region is a sound policy.

The US market has done well over the years, particularly the last decade , worth remembering the performance of Japan in the 80’s...

Indeed. The start of the OP's most recent post is quite informative - I've copied it below in italics and bold:

"Thanks to some of you for actually answering seriously. But even you are wrong."

I did have a reply about possible comparisons between S&P technology sector and the "Nifty Fifty" of the 1960s and early 1970s, amongst other things, plus the underperformance of the S&P500 in the first decade of the 21st century. But since the OP has already decided that everyone who replied is wrong, I couldn't be bothered.

-

seekingbalance

- 2 Lemon pips

- Posts: 163

- Joined: November 7th, 2016, 11:14 am

- Has thanked: 16 times

- Been thanked: 66 times

Re: Why buy UK?

Wow..

So, “debate” does not include one party disagreeing that some of the other viewpoints are wrong?

Okay, got it.

So, “debate” does not include one party disagreeing that some of the other viewpoints are wrong?

Okay, got it.

-

SalvorHardin

- Lemon Quarter

- Posts: 2062

- Joined: November 4th, 2016, 10:32 am

- Has thanked: 5357 times

- Been thanked: 2485 times

Re: Why buy UK?

seekingbalance wrote:Wow..

So, “debate” does not include one party disagreeing that some of the other viewpoints are wrong?

Okay, got it.

But you did not say that.

You said that we were ALL wrong. Not some. ALL.

That's 100% wrong. Everyone who replied was completely wrong. Had made provable false statements, etc.

So, for example, you claim that I am wrong in stating that home bias does exist (it does, it is well documented).

So if you ask a question "Why buy UK" and people put forward a few reasons as to why people do this (and which are correct answers), then don't be surprised if after you then say that they are all wrong that they decide that you're not worth bothering with.

I've seen enough people over the years online claiming to know all the answers about investment, to know that no-one does. Except you, apparently.

(I won't be seeing any more of your posts)

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7535 times

Re: Why buy UK?

The one thing I know about investing is that we all know very little except that fundamentally we are all plugging in to the basis of the advancement of mankind. In the end all stock markets will provide a benefit, at least they have so far. Some may or may not be better than others at achieving that end and I must say that the UK market has not done very well over the last 20/25 years or so or maybe longer, but who knows for the future? It is down to the imagination and foresight of some to get a winner and then a series of winners.

To be as black and white about it as our OP seems to be, you need to be very sure of your ground and be able to demonstrate it. Horses for courses and all that.

Dod

To be as black and white about it as our OP seems to be, you need to be very sure of your ground and be able to demonstrate it. Horses for courses and all that.

Dod

-

spasmodicus

- Lemon Slice

- Posts: 261

- Joined: November 6th, 2016, 9:35 am

- Has thanked: 65 times

- Been thanked: 117 times

Re: Why buy UK?

Dod101 wrote:The one thing I know about investing is that we all know very little except that fundamentally we are all plugging in to the basis of the advancement of mankind. In the end all stock markets will provide a benefit, at least they have so far. Some may or may not be better than others at achieving that end and I must say that the UK market has not done very well over the last 20/25 years or so or maybe longer, but who knows for the future? It is down to the imagination and foresight of some to get a winner and then a series of winners.

To be as black and white about it as our OP seems to be, you need to be very sure of your ground and be able to demonstrate it. Horses for courses and all that.

Dod

Yes, there would be no point in investing if one did not believe in advancement. Nowadays we seem to be seeing signs of limits on the Earth's capacity to support perpetual population and growth in physical living standards, predicted by the likes of Malthus at the end of the 18th century. However, people have been pointing this out pretty regularly in the intervening 200 years, indeed I remember a spate of doom laden predictions in the 1970s, c.f. River of Tears, Silent Spring and "Plant a Tree in '73!". But here we still are and I conclude that the main effect of limits to growth may be a tendency towards a global economic zero sum game, in which some economies do well at the expense of others. In the UK, what with simultaneous Brexit and Covid hysteria, we are currently demonstrating our very best British spirit of mismanagement and incompetence with a peculiar mixture of self doubt, pessimism and even some jingoism thrown in. It's hardly surprising that our economy is doing badly. At the moment I cannot visualise the FTSE 100 index moving skywards into the sunny uplands of promised post-Brexit nirvana, but I have been proved wrong enough times in the past to know that I should keep at least some UK eggs in my international basket.

S

-

SalvorHardin

- Lemon Quarter

- Posts: 2062

- Joined: November 4th, 2016, 10:32 am

- Has thanked: 5357 times

- Been thanked: 2485 times

Re: Why buy UK?

spasmodicus wrote:Nowadays we seem to be seeing signs of limits on the Earth's capacity to support perpetual population and growth in physical living standards, predicted by the likes of Malthus at the end of the 18th century. However, people have been pointing this out pretty regularly in the intervening 200 years, indeed I remember a spate of doom laden predictions in the 1970s, c.f. River of Tears, Silent Spring and "Plant a Tree in '73!". But here we still are and I conclude that the main effect of limits to growth may be a tendency towards a global economic zero sum game, in which some economies do well at the expense of others. In the UK, what with simultaneous Brexit and Covid hysteria, we are currently demonstrating our very best British spirit of mismanagement and incompetence with a peculiar mixture of self doubt, pessimism and even some jingoism thrown in. It's hardly surprising that our economy is doing badly. At the moment I cannot visualise the FTSE 100 index moving skywards into the sunny uplands of promised post-Brexit nirvana, but I have been proved wrong enough times in the past to know that I should keep at least some UK eggs in my international basket.

IMHO the doom laden forecasts generally fail because they fail to take account of human ingenuity. But they get loads of publicity because bad news sells. The media trope "if it bleeds, it leads", continues to dominate news reporting - just look at the headlines of any TV news bulletin for confirmation of this.

Malthus is a classic example of gloomy forecasting that's been shown to be complete nonsense. Malthus assumed famine because the tendency of the population to grow at a geometric rate would outpace any growth in the food supply. What he failed to account for is innovation in agriculture and that rising food prices would attract more supply. Nowadays there are tremendous developments going on in agriculture and aquaculture, yet because these don't produce bodies in the streets they're mostly ignored by the media.

The Limits of Growth, published in 1972, also turned out to be complete nonsense. Innovation produced much more efficent use of existing resources whilst prices signalled producers and consumers to make changes as to how their operate. Unfortunately it remains a major influence upon policymakers, even though its central tenets have been shown to be a joke. I suspect that climate change will be fixed by technological developments and allowing the price mechanism to work, though this won't be too popular amongst many constituencies because this reduces the opportunities for graft and virtue signalling, as well as to impose puritanical policies upon the population.

Economics is not a zero sum game. If it was there would be no global GDP growth beyond that resulting from population growth (and innovation would never occur). Unfortunately many politicians and voters believe this nonsense as if it is and act accordingly (there are a lot of votes and kickbacks in acting as if one person becoming wealthier must make other people poorer). Here's an excellent article about how bad GDP is at measuring the economy:

https://mises.org/library/how-gdp-metrics-distort-our-view-economy

The amount of oil required per unit of GDP has been in steady decline since the 1970s oil crisis. GDP growth continues to be come far less dependent upon resources thanks to technological innovation. IMHO GDP has been woefully understated for decades, due in large part to the spectacular distortions caused by what counts towards GDP and what is ignored (and the bizarre way in which GDP treats international trade, as explained in the Mises article).

The FTSE100 is a poor measure for the performance of the British economy, given that it is dominated by multinationals who do most of their business outside the UK. As to the FTSE100 and Brexit, bear in mind that the consensus forecasts of Britain's economists have been spectacularly wrong about major changes in our relationship with the EEC/EU. Three examples are leaving the exchange rate mechanism, not joining the Euro and voting to leave the European Union. They forecast a deep recession in each case and instead the economy grew, with a boom resulting from our leaving the ERM. But we're now supposed to assume that they are going to get it right when forecasting the effects of Brexit?

Finally, here are a couple of podcasts from EconTalk about innovation and GDP growth. Being EconTalk, the discussions are strongly rooted in free markets, with a healthy dose of Austrian economics.

Matt Ridley on Innovation and its effect on the economy (from August 2020)

https://www.econtalk.org/matt-ridley-on-how-innovation-works/

Robin Hanson on The Technological Singularity (from January 2011). This is really "out there", as Hanson goes into how technological developments (particularly in artificial intelligence) could produce truly awesome levels of economic growth in the future.

https://www.econtalk.org/hanson-on-the-technological-singularity/

-

UnclePhilip

- 2 Lemon pips

- Posts: 212

- Joined: November 4th, 2016, 7:30 pm

- Has thanked: 22 times

- Been thanked: 33 times

Re: Why buy UK?

Putting aside the OP's silly response, the issue of regional/global investing is, I believe, of fundamental importance.

A personal anecdote, if I may.... About 3.5 years ago I decided to move away from individual stocks to funds. This was for health reasons; not wanting to saddle a widow with a relatively complex portfolio. At that time, due to concerns about the UK, I decided to go global. So, about 50% went into a managed global fund, and more recently the rest went into a couple of Vanguard global index trackers.

I am SO glad that I did. When I look at performance compared to FTSE indexes, the difference is staggering. And looking at 2020 to date, even more so.

I believe that (i) I was lucky more than clever, (ii) this outperformance is likely to continue, and (iii) a total return pursuit involving a cash cushion and 'selling a few' as and when needed is most likely to look after my financial needs.

A personal anecdote, if I may.... About 3.5 years ago I decided to move away from individual stocks to funds. This was for health reasons; not wanting to saddle a widow with a relatively complex portfolio. At that time, due to concerns about the UK, I decided to go global. So, about 50% went into a managed global fund, and more recently the rest went into a couple of Vanguard global index trackers.

I am SO glad that I did. When I look at performance compared to FTSE indexes, the difference is staggering. And looking at 2020 to date, even more so.

I believe that (i) I was lucky more than clever, (ii) this outperformance is likely to continue, and (iii) a total return pursuit involving a cash cushion and 'selling a few' as and when needed is most likely to look after my financial needs.

-

spasmodicus

- Lemon Slice

- Posts: 261

- Joined: November 6th, 2016, 9:35 am

- Has thanked: 65 times

- Been thanked: 117 times

Re: Why buy UK?

SalvorHardin wrote:

Economics is not a zero sum game. If it was there would be no global GDP growth beyond that resulting from population growth (and innovation would never occur). Unfortunately many politicians and voters believe this nonsense as if it is and act accordingly (there are a lot of votes and kickbacks in acting as if one person becoming wealthier must make other people poorer). Here's an excellent article about how bad GDP is at measuring the economy:

Although, as you rightly point out, economics is not a zero sum game, in relative terms it sometimes seems like it. The strategy of a 33/33/33 equities/gold/bonds portfolio, rebalanced regularly, suggest that gold will gain when equities lose and vice versa, although over time both may increase. So the rebalancing could be seen as a FOMO mitigation.

The FTSE100 is a poor measure for the performance of the British economy, given that it is dominated by multinationals who do most of their business outside the UK. As to the FTSE100 and Brexit, bear in mind that the consensus forecasts of Britain's economists have been spectacularly wrong about major changes in our relationship with the EEC/EU. Three examples are leaving the exchange rate mechanism, not joining the Euro and voting to leave the European Union. They forecast a deep recession in each case and instead the economy grew, with a boom resulting from our leaving the ERM. But we're now supposed to assume that they are going to get it right when forecasting the effects of Brexit?

In the case of the FTSE100, the approx 5 year performance of the ISF tracker from 2015 to present with dividends reinvested at the end of each calendar year (not in 2020) is about +10% gain (excludes transaction costs). Without dividends, it is currently recording a -12% loss.

For those like me who thought that dividends might save them, UKDV (FTSE dividend aristocrats) and IUKD (FTSE high dividend) have both done worse than the straight ISF index tracker at +4% and -19% respectively (dividends reinvested at year end, as for ISF). As others have pointed out, despite being international, the FTSE100 did a lot worse than say VWRL at +74% with divis reinvested. Admittedly, VWRL is quite heavily weighted towards the USA market. OK, post Brexit we could go either way but first we get to see whether the USA embroils itself in a post election political stalemate where Donald will not concede defeat.

S

(holds ISF, UKDV and IUKD and looking to ditch the latter)

-

1nvest

- Lemon Quarter

- Posts: 4401

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1342 times

Re: Why buy UK?

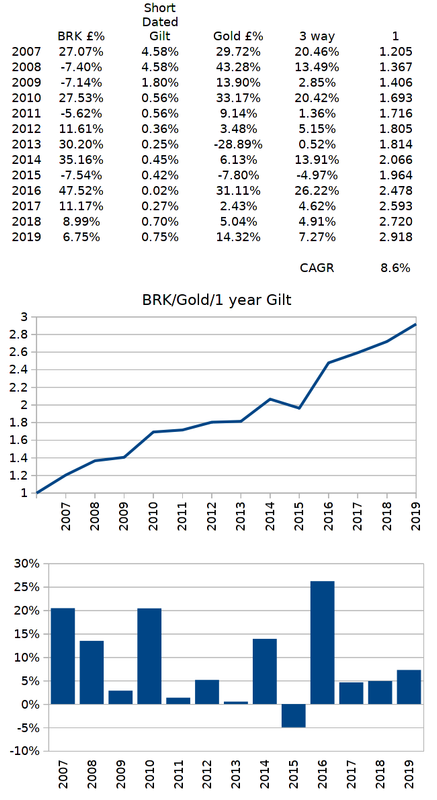

spasmodicus wrote:The strategy of a 33/33/33 equities/gold/bonds portfolio, rebalanced regularly, suggest that gold will gain when equities lose and vice versa

Just to emphasise, not every year. More of a multi-year attribute. When both are down such as in 2015, then adjacent years (either or both of prior and/or subsequent years) tend to more than compensate (above average)

Currency diversification of £ (domestic currency), US$ (primary reserve currency), gold (global currency); Asset diversification of 'bonds', commodity and stocks. Alone, holding £, $ and gold in around equal measure historically significantly reduced inflationary losses. Each of 'bonds', gold and stocks historically have decade long periods of having been the best asset. Buy and hold is no different to lump summing into the market each and every day, and to bet on one alone being the perceived better choice over the next decade could turn out to be a misplaced bet. Typically whichever does prove to have been the best over the decade will have made more than enough gains to offset the other holdings/assets - such that there is sufficient residual rewards to have excelled inflation across the whole portfolio.

Some hate cash/bonds, but in years when stocks are down -25%, cash has in effect seen its stock-purchase-power rise +33%, even if cash earned 0% interest.

-

1nvest

- Lemon Quarter

- Posts: 4401

- Joined: May 31st, 2019, 7:55 pm

- Has thanked: 690 times

- Been thanked: 1342 times

Re: Why buy UK?

This is US data, but UK data has similar characteristics. Of particular interest is the table of 'Portfolio Returns'. Note how after applying a 3% SWR the annualised reward was just 1.6% annualised less than if no SWR had been applied (7.09% vs 8.66% annualised gains respectively). Drawing 3% of the initial portfolio value, uplifted by inflation each year, reduced the portfolio annualised growth rate by just 1.6% compared to not having made any withdrawals. A element of that feature is down to how one asset each year tends to have performed relatively well, and taking some of those gains 'off the table' is better than not.

-

spasmodicus

- Lemon Slice

- Posts: 261

- Joined: November 6th, 2016, 9:35 am

- Has thanked: 65 times

- Been thanked: 117 times

Re: Why buy UK?

1nvest wrote:This is US data, but UK data has similar characteristics. Of particular interest is the table of 'Portfolio Returns'. Note how after applying a 3% SWR the annualised reward was just 1.6% annualised less than if no SWR had been applied (7.09% vs 8.66% annualised gains respectively). Drawing 3% of the initial portfolio value, uplifted by inflation each year, reduced the portfolio annualised growth rate by just 1.6% compared to not having made any withdrawals. A element of that feature is down to how one asset each year tends to have performed relatively well, and taking some of those gains 'off the table' is better than not.

You convinced me of the merits of the 33/33/34 type of portfolio macro allocation, but it begs the question, which I think was the OP's angle, as to what you can optimally put in the equity part of the portfolio. It doesn't necessarily have to be just the USA or the UK. Globally, there is a choice of quasi independent regions, e.g. UK, USA, Japan, China, India, Latin America, Africa which appear to move in lockstep in the short term, but which diverge markedly over, say, five years. I have a selection of ETFs covering these regions, mostly purchased recently in the March-May market lows, but I confess that I don't yet have a coherent strategy for deciding on their future weightings.

cheers,

S

-

seekingbalance

- 2 Lemon pips

- Posts: 163

- Joined: November 7th, 2016, 11:14 am

- Has thanked: 16 times

- Been thanked: 66 times

Re: Why buy UK?

I apologise for the poor choice of words. I should have said that it is incorrect to assert that adding in dividends makes the FTSE performance comparable to the main US indices.

However, saying people are wrong in their analysis, after Salvor Hardin said "That's an omission on par with looking at England's performance in a five test match series against Australia and ignoring all runs scored by Steve Smith. By ignoring dividends you've left the best bit out. If you exclude the S&P500 technology sector in the last few years, then the S&P500's performance isn't all that special." (and in what way is this not as "bad" as saying you are wrong, just more articulately and more cuttingly expressed?) and others said that if I include dividends the UK performance is similar to the US - is not exactly incorrect.

Saying someone is wrong may indeed not be a good way to foster debate, as Hariseldon (is this the Isaac Asimov appreciation society here?) said - but saying the UK is the same as the US when dividends are accounted for is simply not even close to right, and in my opinion is a big weakness of the majority of topics I see on these lemon fool forums, which still have a huge bias to the old Motley Fool, Pyad driven UK dividend shares.

As I pointed out - even including total return the S&P500 has returned more then double the FTSE and the Nasdaq more than 4 times over 11 years. And this is not isolated or cherry picked. It is pretty consistent over numerous time periods (albeit there was a long period of Nasdaq underperformance following the big ramp up in the 2000-2002 period, more than eliminated now). As Passive investing is generally meant for the long term, numbers like 90x growth in the Nasdaq total, 20+ times in the S&P total v 18 x for the FTSE total return or 4.4x for the FTSE since 1986 seems pretty clear.

Or even 4x for the Nasdaq, 3x for the S&P v 2x for the FTSE total since 2000.

I reassert my point - focusing on the UK versus a mix of UK and International, especially the US, seems a bad thing to do, so investors should consider this.

And finally, as I am not going to keep posting if my input is not required, I did take care to post this in the Passive Investing forum, so picking individual shares, picking indexes but ignoring the bad bits or the good bits do not make for a good comparison.

However, saying people are wrong in their analysis, after Salvor Hardin said "That's an omission on par with looking at England's performance in a five test match series against Australia and ignoring all runs scored by Steve Smith. By ignoring dividends you've left the best bit out. If you exclude the S&P500 technology sector in the last few years, then the S&P500's performance isn't all that special." (and in what way is this not as "bad" as saying you are wrong, just more articulately and more cuttingly expressed?) and others said that if I include dividends the UK performance is similar to the US - is not exactly incorrect.

Saying someone is wrong may indeed not be a good way to foster debate, as Hariseldon (is this the Isaac Asimov appreciation society here?) said - but saying the UK is the same as the US when dividends are accounted for is simply not even close to right, and in my opinion is a big weakness of the majority of topics I see on these lemon fool forums, which still have a huge bias to the old Motley Fool, Pyad driven UK dividend shares.

As I pointed out - even including total return the S&P500 has returned more then double the FTSE and the Nasdaq more than 4 times over 11 years. And this is not isolated or cherry picked. It is pretty consistent over numerous time periods (albeit there was a long period of Nasdaq underperformance following the big ramp up in the 2000-2002 period, more than eliminated now). As Passive investing is generally meant for the long term, numbers like 90x growth in the Nasdaq total, 20+ times in the S&P total v 18 x for the FTSE total return or 4.4x for the FTSE since 1986 seems pretty clear.

Or even 4x for the Nasdaq, 3x for the S&P v 2x for the FTSE total since 2000.

I reassert my point - focusing on the UK versus a mix of UK and International, especially the US, seems a bad thing to do, so investors should consider this.

And finally, as I am not going to keep posting if my input is not required, I did take care to post this in the Passive Investing forum, so picking individual shares, picking indexes but ignoring the bad bits or the good bits do not make for a good comparison.

-

dealtn

- Lemon Half

- Posts: 6090

- Joined: November 21st, 2016, 4:26 pm

- Has thanked: 442 times

- Been thanked: 2336 times

Re: Why buy UK?

seekingbalance wrote:I reassert my point - focusing on the UK versus a mix of UK and International, especially the US, seems a bad thing to do, so investors should consider this.

A much more reasonable statement. Investors should consider this. In doing so, they might consider what their aims are, and whether this is best achieved by focussing solely on UK funds, non-UK funds, or a mixture.

Having done so a consideration might be given to whether the future is likely to resemble the past, or not, and to what extent.

Who is online

Users browsing this forum: No registered users and 27 guests