Got a credit card? use our Credit Card & Finance Calculators

Thanks to lansdown,Wasron,jfgw,Rhyd6,eyeball08, for Donating to support the site

Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

-

Artistxman

- Posts: 39

- Joined: September 22nd, 2017, 12:01 pm

- Has thanked: 20 times

- Been thanked: 8 times

Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

Hi all

I have searched this forum already but didn't find any straightforward answers other than a response which said just buy VWRL and leave the rest. I would like to sell my company shares slowly overtime in the Interactive Investor and convert them into a passive tracker with the allocation similar to Gone Fishing portfolio.

But I am struggling to find equivalent funds with low cost or just unable to add them to a watch list. Has anyone else tried to do this outside Vanguard. I am unable to transfer all the ISA immediately to Vanguard as I have quite a number of individual company shares. Thanks for any guidance.

I have searched this forum already but didn't find any straightforward answers other than a response which said just buy VWRL and leave the rest. I would like to sell my company shares slowly overtime in the Interactive Investor and convert them into a passive tracker with the allocation similar to Gone Fishing portfolio.

But I am struggling to find equivalent funds with low cost or just unable to add them to a watch list. Has anyone else tried to do this outside Vanguard. I am unable to transfer all the ISA immediately to Vanguard as I have quite a number of individual company shares. Thanks for any guidance.

-

mc2fool

- Lemon Half

- Posts: 7910

- Joined: November 4th, 2016, 11:24 am

- Has thanked: 7 times

- Been thanked: 3053 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

Perhaps if you were a little more explicit about what you are referring to rather than assuming everyone will know what you're talking about, folks might be a little more able to help.

Is this it? https://www.optimizedportfolio.com/gone-fishin-portfolio/

Is this it? https://www.optimizedportfolio.com/gone-fishin-portfolio/

-

kempiejon

- Lemon Quarter

- Posts: 3588

- Joined: November 5th, 2016, 10:30 am

- Has thanked: 1 time

- Been thanked: 1198 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

Artistxman wrote:I have searched this forum already but didn't find any straightforward answers other than a response which said just buy VWRL

I can improve on that, in sheltered accounts buy just vwrp. As mc2fool said what's a Gone Fishing Portfolio?

-

88V8

- Lemon Half

- Posts: 5852

- Joined: November 4th, 2016, 11:22 am

- Has thanked: 4208 times

- Been thanked: 2607 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

kempiejon wrote:Artistxman wrote:I have searched this forum already but didn't find any straightforward answers other than a response which said just buy VWRL

As mc2fool said what's a Gone Fishing Portfolio?

This

V8

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

Yes I do not know what’s up with people.Easy enough to find the book by Googling although how much use it will actually be I do not know. If it were that easy………

Dod

-

mc2fool

- Lemon Half

- Posts: 7910

- Joined: November 4th, 2016, 11:24 am

- Has thanked: 7 times

- Been thanked: 3053 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

Dod101 wrote:

Yes I do not know what’s up with people.Easy enough to find the book by Googling although how much use it will actually be I do not know. If it were that easy………

Dod

I don't know what's up with people who ask for help but expect others to google in order to find out what they're talking about, nor with people that think that's reasonable. People asking for help should try and make it as easy as possible for others to help them by providing the relevant information up front.

BTW, the "this" link above is to a glossy blurb trying to sell the book. The link in my initial reply (found by googling you know) gives the actual details of the "Gone Fishin' Portfolio" (which we assume, and are still awaiting confirmation of, is what the OP is referring to).

So, now you know that, you have the information to try and help the OP, should you wish....

-

monabri

- Lemon Half

- Posts: 8432

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3446 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

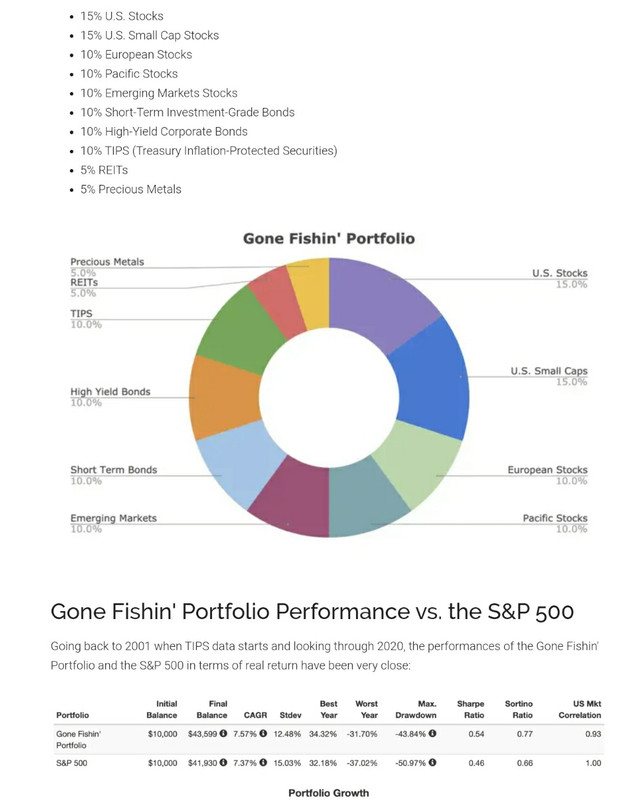

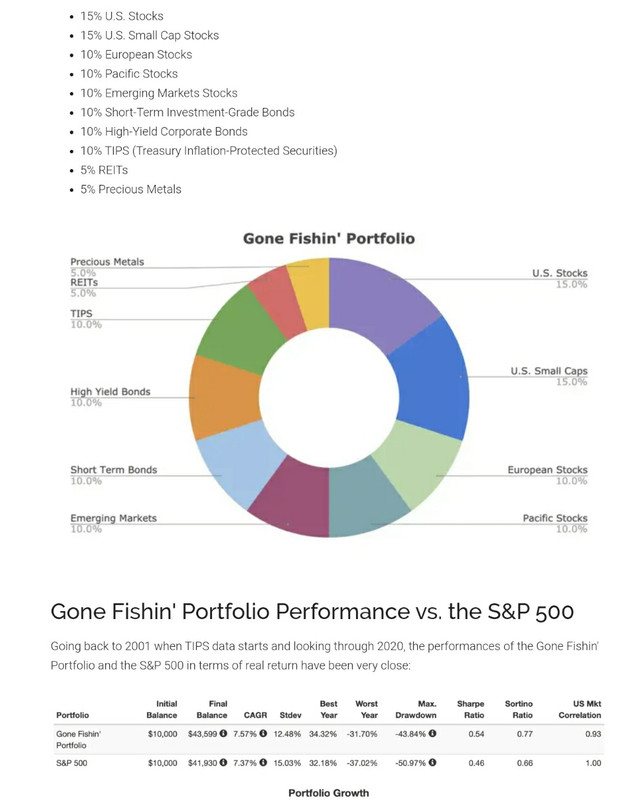

Source: https://www.optimizedportfolio.com/gone ... portfolio/

One could buy the various Vanguard or iShare ETFs in those proportions...see the Vanguard or iShares website.

One could buy the various Vanguard or iShare ETFs in those proportions...see the Vanguard or iShares website.

-

EthicsGradient

- Lemon Slice

- Posts: 586

- Joined: March 1st, 2019, 11:33 am

- Has thanked: 34 times

- Been thanked: 235 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

I assume the thread starter is British; do they want a portfolio using American bonds, or are they looking for someone to suggest British- (or European?) alternatives?

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

That is the problem with this sort of book. They are usually US oriented and if they held the answer, we would all be doing it.

Dod

Dod

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

mc2fool wrote:Dod101 wrote:Yes I do not know what’s up with people.Easy enough to find the book by Googling although how much use it will actually be I do not know. If it were that easy………

Dod

I don't know what's up with people who ask for help but expect others to google in order to find out what they're talking about, nor with people that think that's reasonable. People asking for help should try and make it as easy as possible for others to help them by providing the relevant information up front.

BTW, the "this" link above is to a glossy blurb trying to sell the book. The link in my initial reply (found by googling you know) gives the actual details of the "Gone Fishin' Portfolio" (which we assume, and are still awaiting confirmation of, is what the OP is referring to).

So, now you know that, you have the information to try and help the OP, should you wish....

OK I take your point but it is not that hard to find and I guess the OP had other things on his mind. I am in any case very sceptical about books like that As I said if it were that easy........

Anyway I cannot answer his question.

Dod

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

These sort of passive portfolios are very common -many variations available if you just look

If you move from a global equities index tracker plus a global bond index tracker then many portfolios become possible for the amateur investor to set up ,work with constantly ie rebalancing etc etc

Whether the game is worth the candle is seems doubtful

If vast sums of money are available the a broker can set up whatever portfolio you desire but costs etc mean that a better overall performance is unlikely

For most of us keeping it simple cheap and leaving well alone is the most likely way of achieving a descent return

xxd09

If you move from a global equities index tracker plus a global bond index tracker then many portfolios become possible for the amateur investor to set up ,work with constantly ie rebalancing etc etc

Whether the game is worth the candle is seems doubtful

If vast sums of money are available the a broker can set up whatever portfolio you desire but costs etc mean that a better overall performance is unlikely

For most of us keeping it simple cheap and leaving well alone is the most likely way of achieving a descent return

xxd09

-

monabri

- Lemon Half

- Posts: 8432

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3446 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

Here's a list of Vanguard's funds available for UK residents.

VFEM: FTSE Emerging Markets

VAPX: FTSE Asia Pacific excluding Japan

VERX: FTSE Developed Europe excluding UK

VUSA: S&P 500

VNRT: FTSE North America

VJPN: FTSE Japan

VEUR: FTSE Developed Europe

VWRL: FTSE All-World

VEVE: FTSE Developed World

VHYL: FTSE All-World High Dividend Yield

VETY: EUR Eurozone Government Bond

VUKE: FTSE 100

VEMT: USD EM Government Bond

VUTY: USD Treasury Bond

VUCP: USD Corporate Bond

VECP: EUR Corporate Bond

VMID: FTSE 250

VGOV: UK Government Bond

The Blackrock iShares offerings are more numerous. One can appropriate the portfolio requirements by selecting tracker funds from these two companies.

( VWRL or the accumulation version is not the same as the required portfolio - eg no bonds.)

VFEM: FTSE Emerging Markets

VAPX: FTSE Asia Pacific excluding Japan

VERX: FTSE Developed Europe excluding UK

VUSA: S&P 500

VNRT: FTSE North America

VJPN: FTSE Japan

VEUR: FTSE Developed Europe

VWRL: FTSE All-World

VEVE: FTSE Developed World

VHYL: FTSE All-World High Dividend Yield

VETY: EUR Eurozone Government Bond

VUKE: FTSE 100

VEMT: USD EM Government Bond

VUTY: USD Treasury Bond

VUCP: USD Corporate Bond

VECP: EUR Corporate Bond

VMID: FTSE 250

VGOV: UK Government Bond

The Blackrock iShares offerings are more numerous. One can appropriate the portfolio requirements by selecting tracker funds from these two companies.

( VWRL or the accumulation version is not the same as the required portfolio - eg no bonds.)

-

mc2fool

- Lemon Half

- Posts: 7910

- Joined: November 4th, 2016, 11:24 am

- Has thanked: 7 times

- Been thanked: 3053 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

monabri wrote:Here's a list of Vanguard's funds available for UK residents.

VFEM: FTSE Emerging Markets

VAPX: FTSE Asia Pacific excluding Japan

VERX: FTSE Developed Europe excluding UK

VUSA: S&P 500

VNRT: FTSE North America

VJPN: FTSE Japan

VEUR: FTSE Developed Europe

VWRL: FTSE All-World

VEVE: FTSE Developed World

VHYL: FTSE All-World High Dividend Yield

VETY: EUR Eurozone Government Bond

VUKE: FTSE 100

VEMT: USD EM Government Bond

VUTY: USD Treasury Bond

VUCP: USD Corporate Bond

VECP: EUR Corporate Bond

VMID: FTSE 250

VGOV: UK Government Bond

The Blackrock iShares offerings are more numerous. One can appropriate the portfolio requirements by selecting tracker funds from these two companies.

( VWRL or the accumulation version is not the same as the required portfolio - eg no bonds.)

That's just Vanguard ETFs, and not even all of the ones offered on the sanitised UK Vanguard Investor site (https://www.vanguardinvestor.co.uk/what-we-offer/etf-products).

There's also their OEICs/UTs and a heck of lot more of both those and ETFs if you look at their "professional" site. https://www.vanguard.co.uk/professional/product

(And it's not just "exotics", e.g. for some reason unknown Vanguard only lists VWRL on their sanitised site and not the accumulation version, VWRP)

-

Artistxman

- Posts: 39

- Joined: September 22nd, 2017, 12:01 pm

- Has thanked: 20 times

- Been thanked: 8 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

Thank you all and apologies for not posting link- which I see was done by others here(sorry for assuming people knew...I thought I was late discovering the book). I agree the book focuses on the US based investors- however it recommends a more global strategy even for the US investors. I have an ISA account and this is where I am starting to consider a similar strategy of passive index trackers and the rationale is I am starting to realize the time I have doesn't allow me to keep an eye on the whole list of companies I bought over the last 10 years. In particular, some of them have fallen prey to the high debt they carry and hence went down all the way to bankruptcy.

I do invest in active funds and some are doing well, but some are still negative or just in the positive territory. I also do regular investing. But it seemed, with the return which is well balanced against the risk the portfolio suggested by the author is good and backed up be evidence(during the good years and historical years).

Therefore, I wanted to see if I can just gradually shift my shares(by selling over time) to a passive index tracking portfolio(which follows a strategy) in the interactive investor. I tried to find the funds which are similar however, they are very difficult to identify with regards to cost vs what they offer and representative of suggested portfolio in the book.

With regards to the book, there is a good summary people can get most of what the book advocates here: https://www.oxfordclub.com/wp-content/u ... 017263.pdf

Regarding the book itself, I know there are various threads on good books to read- I believe this book is one of them and I think it makes a lot of good(obvious to many and advocated by most of you) points. May be I just realising it bit late. Sorry about lack of details again. So, the question if anyone constructed similar portfolio outside Vanguard(which will be easier and I intend to do that from this ISA year), then please let me know.

Thank you

I do invest in active funds and some are doing well, but some are still negative or just in the positive territory. I also do regular investing. But it seemed, with the return which is well balanced against the risk the portfolio suggested by the author is good and backed up be evidence(during the good years and historical years).

Therefore, I wanted to see if I can just gradually shift my shares(by selling over time) to a passive index tracking portfolio(which follows a strategy) in the interactive investor. I tried to find the funds which are similar however, they are very difficult to identify with regards to cost vs what they offer and representative of suggested portfolio in the book.

With regards to the book, there is a good summary people can get most of what the book advocates here: https://www.oxfordclub.com/wp-content/u ... 017263.pdf

Regarding the book itself, I know there are various threads on good books to read- I believe this book is one of them and I think it makes a lot of good(obvious to many and advocated by most of you) points. May be I just realising it bit late. Sorry about lack of details again. So, the question if anyone constructed similar portfolio outside Vanguard(which will be easier and I intend to do that from this ISA year), then please let me know.

Thank you

-

GeoffF100

- Lemon Quarter

- Posts: 4773

- Joined: November 14th, 2016, 7:33 pm

- Has thanked: 178 times

- Been thanked: 1379 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

mc2fool wrote:And it's not just "exotics", e.g. for some reason unknown Vanguard only lists VWRL on their sanitised site and not the accumulation version, VWRP)

Vanguard does not have any accumulating ETFs on its own platform. They have been asked why, but they have never given an answer AFAIK.

-

mc2fool

- Lemon Half

- Posts: 7910

- Joined: November 4th, 2016, 11:24 am

- Has thanked: 7 times

- Been thanked: 3053 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

Artistxman wrote:Therefore, I wanted to see if I can just gradually shift my shares(by selling over time) to a passive index tracking portfolio(which follows a strategy) in the interactive investor. I tried to find the funds which are similar however, they are very difficult to identify with regards to cost vs what they offer and representative of suggested portfolio in the book.

At first glance I'm not sure why you're finding it difficult to find ETFs/OEICs here that are representative of the Gone Fishin' portfolio ones; I'd hazard a guess that Vanguard and/or iShares has equivalents to all of them.

If you're looking at costs, well I'd suggest that comparing costs of US ETFs/funds with UK ones isn't helpful as, unless you can find a broker that will accept you as a professional investor (I don't know if II will), you can't buy any US ETFs/funds here, so it's only useful to compare the costs of ones that you can buy.

-

Artistxman

- Posts: 39

- Joined: September 22nd, 2017, 12:01 pm

- Has thanked: 20 times

- Been thanked: 8 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

Thank you all, I will review the posts here and do a bit of research and come back. I may need ton educate myself a bit more…

-

Hariseldon58

- Lemon Slice

- Posts: 838

- Joined: November 4th, 2016, 9:42 pm

- Has thanked: 124 times

- Been thanked: 514 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

A Vanguard Life Strategy fund might be much simpler….

The longer you invest the more you realise how little you actually know, broadly diversified equities and bonds is pretty much the simplest leave it alone portfolio.

Bonds have a torrid last couple of years but of course that makes them much more attractive now…

My personal choice is an equity global tracker combined with a mix of nominal and inflation protected UK & US government bonds ( $ bonds are unhedged by choice)

The longer you invest the more you realise how little you actually know, broadly diversified equities and bonds is pretty much the simplest leave it alone portfolio.

Bonds have a torrid last couple of years but of course that makes them much more attractive now…

My personal choice is an equity global tracker combined with a mix of nominal and inflation protected UK & US government bonds ( $ bonds are unhedged by choice)

-

JonnyT

- Lemon Pip

- Posts: 83

- Joined: November 7th, 2016, 8:54 am

- Has thanked: 11 times

- Been thanked: 27 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

I'd argue the only realistic hedge to stocks is Gold, not bonds.

-

Artistxman

- Posts: 39

- Joined: September 22nd, 2017, 12:01 pm

- Has thanked: 20 times

- Been thanked: 8 times

Re: Trying to follow Gone fishing portfolio in Interactive Investor- but not easy!

Funny that since I started the thread...I planned to prune my stocks a bit to re-allocate them towards passive trackers, they all fell down and so as usual human emotions came into play and I am reluctant to sell to reinvest(particularly as I am undecided on what trackers to buy)

I do have a regular investment into some active funds- almost 60% and I am talking about the rest 40% is what I was trying to slowly re-allocate. But agree with comments here- more I learn- the more I have realised I don't know enough. Still doing my research and even tempted to leave the shares as is and just use it as a comparison tool for the trackers which I will be focusing on from now on!

I do have a regular investment into some active funds- almost 60% and I am talking about the rest 40% is what I was trying to slowly re-allocate. But agree with comments here- more I learn- the more I have realised I don't know enough. Still doing my research and even tempted to leave the shares as is and just use it as a comparison tool for the trackers which I will be focusing on from now on!

Who is online

Users browsing this forum: No registered users and 9 guests