1nvest wrote:OldPlodder wrote:1nvest wrote:OldPlodder wrote:1nvest wrote:Funds such as FCIT (Investment Trust) will also have money flowing in/out, so unitisation enables overall total returns (with dividends reinvested) to be compared.

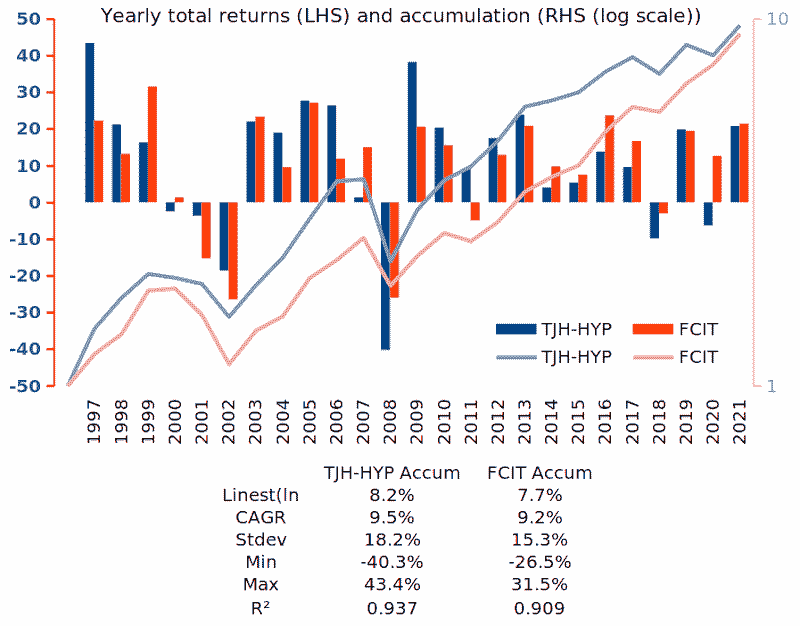

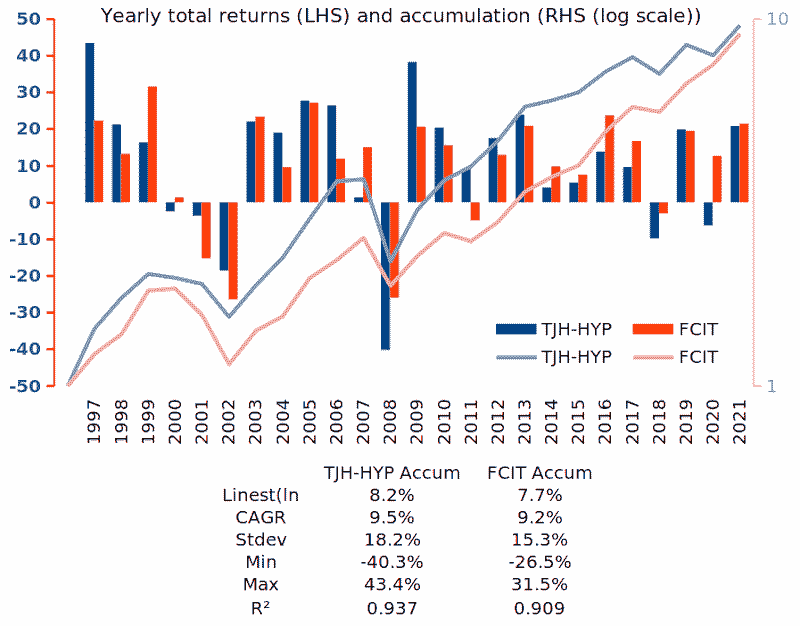

FCIT NAV based total return/accumulation versus TJH HYP accumulation (calendar years 1997 - 2021 inclusive) ...

There is something wrong here. My wife has held FCIT for longer than that, but since Sep 1997, for example, her XIRR on FCIT is well in excess of 12%.

Plodder

The FRCL now FCIT data I based the NAV based total return on (extracted from annual reports)....

I'd genuinely be surprised if FCIT had excelled TJH HYP Accumulation by the more than 3% annualised that you suggest!

Comparing those FCIT total returns with MSCI world total returns and the two align reasonably, nowhere near a significant difference, with FCIT marginally out-pacing overall.

I suspect you may have a

Beardstown Ladies error such as incorrectly accounting for additions?

Unlikely. unlike you we understand unitisation, and keep very accurate records. The lady in question worked in the City for twenty years, so her data is correct. She can plot her portfolio, or any subset of it, against TJHs data, she remains well ahead. The main reason is that she does no go near the FTSE, and she only put serious money in it when markets tank, so the time to buy is definitely not always now, as hypers are led to believe.

Regards

Plodder

You seem to be unaware that your comparison between an actual portfolio and an IT is itself flawed.

LOL! (Arrogance).

The main reason is that she does no go near the FTSE, and she only put serious money in it when markets tank

That explains it, not accounting for the waiting in time cash whilst timing deployment to only when the market tanks. You shouldn't flame others when you clearly don't understand basics.

I think it is you who do not understand basics, your opening sentence on Unitisation demonstrates this clearly.

(I any case anybody who bases his core investment philosophy on the Talmud, a you do, cannot be considered a serious investor in today's world/markets scene). Among my many friends of that 'persuasion' none of them do.

Plodder, as usual, is correct. Any investor who invests in, say, an IT such as FCIT, can get results way different from the returns of the IT itself. Some will undershoot it, the bulk will broadly get similar results to the IT, but enough of them, those who are experienced, PATIENT and awake ( and have the freedom to do so, which not all investors do, which unfortunately most retirees taking the income, thus staying mostly invested cannot do), will exceed its returns. If you look at the returns on, say, MRCH, over the last say 36 years, I doubt this IT has returned an average TR of 13.6% P.A., yet that is precisely the XIRR my mother in law has on MRCH over that whole long period, main reasons: experience, massive patience, knowing when to go in heavy or when to take a large slice of profits to feed back in later...

The individual investor has a great advantage on most fund managers, he can decide at a moment's notice to go into much cash, or some can temporarily introduce new funds when they want. It can make a very wide difference to returns. I have known Plodder and his good lady for enough years to know just how nimble they can be with markets, and in the past their businesses dealings. our shared philosophy on investing has worked well for us indeed, yet we have never held a single ounce of your favourite gold!.

Regards

Bagger

PS:The mantra of 'the time to invest is always now' is a sure recipe for banal outcomes at best.