Page 2 of 3

Re: moorfield HYRP - 2019 Result / 2020 Target

Posted: January 6th, 2020, 7:38 am

by moorfield

Wizard wrote:So if RE.B pays the deferred divis shortly (market seems to think that is possible given CPO price and recovery in prrf price), is that income this year or last year?

The RE.B dividend was treated as income accrued and zero cashflow last year. I posted some examples recently on how I separate income and cashflow here,

viewtopic.php?p=273738#p273738moorfield wrote:What I term Income (ntm - next twelve months) multiplies number of shares held, including bought ex dividend, by either (i) last dividends paid or (ii) last dividends paid and next dividends announced in the current year, excluding special dividends, and assumes the same will be paid in the next year. It is updated as shares are bought or sold and dividend increases or cuts are announced. This is the figure I use for computing yields and forecasting overall portfolio income. Cashflow should be self-explanatory, and includes special dividends.

Some examples from my own portfolio for this year:

Centrica (CNA) income (ntm) is 9.9p per share (final 8.4p and cut interim 1.5p) and cashflow is the same because no shares were bought or sold. CNA has already announced a dividend of 5p next year, so income (ntm) will be adjusted down to 5p on 1 January.

Imperial Brands (IMB) income (ntm) is 200.02p per share including the 72.00p to be paid on 31 December, accordingly cashflow is currently 128.02p, no shares were bought or sold. IMB has already announced a dividend of 72.01p to be paid in March 2020, so income (ntm) will be adjusted up to 206.57p on 1 January.

REA Holdings (RE.B) has deferred, but not cancelled (yet), it's cumulative dividend. Income (ntm) remains 9.0p per share but cashflow is zero. (If the arrears are paid up next year I might expect a cashflow of 18.0p)

RIO Tinto (RIO) was bought in tranches this year, some ex dividend. Income (ntm) excluding its specials is 259.28p per share but cashflow was higher including the specials paid on the shares bought cum dividend.

TUI (TUI) was bought ex dividend, and pays its dividend once a year, so cashflow this year is zero. It has since announced a 25% dividend cut so income (ntm) will be adjusted down accordingly on 1 January.

Also I see the link to the chart I posted above last year has been dropped but was reposted here,

viewtopic.php?p=266580#p266580moorfield wrote:A strategy of sorts. I may be unique here in extrapolating into the future (to 2031) an income schedule that I want my whole portfolio to be generating each year, through the combined effects of dividend growth and reinvestment. I have posted this chart before on

Portfolio Management & Review.

Essentially, If the yellow line falls short of the red line at year end I take that as a cue to reorganise the portfolio. That hasn't happened, yet. My hunch is three full dividend cuts in one year from 20 holdings would certainly necessitate action; the evidence I can offer is that at least four dividend cuts I remember (CNA twice, CLLN, VOD), and associated collapses of capital value, in the last five years hasn't. The trick here with the extrapolation is to use a reasonable growth rate, I use +7.2% pa.

In that respect, this month's tinker of LGEN, AZN and SAN is a pre-emptive one.

Re: moorfield HYRP - Benchmarking against CTY

Posted: June 7th, 2020, 10:35 pm

by moorfield

Benchmarking against CTY (City of London IT)I have advocated here on LF using CTY as a benchmark for the minimum performance one should accept from an DIY HYP, so I felt it would be remiss of me not to apply it to my own progress. Using the same contributions since 2008, I have built a single "paper" holding of CTY, buying more shares with each contribution and then rolled up dividends at the start of each year, also using the same transaction, custody, and stamp duty rates. Historical share prices and dividends used were sourced from

https://markets.ft.com/data/investment- ... ?s=CTY:LSE and

https://www.stockopedia.com/share-price ... dividends/ .

The relative capital and income positions for 2019 are given below (rescaled to a HYRP value of £100000, the incomes reflect some cut HYRP dividends and ex dividend CTY purchases during the year).

With another 10-15 years to go before I reach the sharp end of having to live off this portfolio income, it's a useful "half time" health check. After 10 years investing and some car crashes along the way (CLLN, CNA, RE.B), and perhaps a little too much tinkering, progress is currently pretty much neck and neck. The effect of the Coronavirus cuts is yet to be seen, but I imagine HYRP income will almost certainly fall behind CTY this year and next.

Mind focussing stuff, but I'm not panicking - yet.

Re: moorfield HYRP

Posted: June 7th, 2020, 11:17 pm

by 1nvest

Just observations - that may be of interest

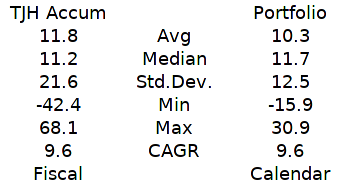

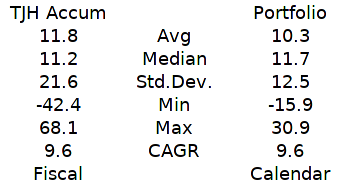

TJH HYP accumulation as a benchmark against P1 = 25% in each of FT100, FT250, S&P500, Gold

that's for years 1987 - 2019 inclusive, Fiscal years for TJH HYP, Calendar years for the other. They're all total return figures.

Digging out CTY adjusted close prices from yahoo finance

1.69 CTY gain factor 2011 to 2019 inclusive adjusted close gain

1,61 TJH HYP

2.20 P1

2.35 gain factor CTY 2009 to 2019 inclusive

3.19 TJH HYP

3.44 P1

For simplicity I use a risk/reward measure of CAGR / Std.Dev, where the higher the number the better. Somewhat like Sharpe Ratio but quicker/easier to calculate. Values of 0.44 for TJH HYP, 0.77 for P1 (for 1987 onward data).

Different dividend yields/withdrawals complicate comparisons. If two choices each provide the same total return then generally the same income could have be drawn from each to equal effect.

Re: moorfield HYRP - 2020 Result / 2021 Target

Posted: January 12th, 2021, 9:54 am

by moorfield

2020 Result / 2021 Target

Underwater. The headline number is cashflow was -26% (or 3 months) short of forecast due to several dividend cuts through the coronavirus pandemic. Acc Unit value lost -11.5%, Portfolio Xirr since inception was +8.0%.

My first concern now is to see a recovery of 2019 income (*), so target has been flattened (with an RPI guesstimate) for the foreseeable future and non/low yielders will be recycled. Using HYP1 2008-13 as a loose guide, I am hoping that recovery takes less than a few years...

(*) 2019 income has been adjusted from 1717.6p to 1599.1p to reflect the deferred RE.B dividend; although this is cumulative and should be paid in arrears I have written it off until such time.

Trading & Costs

Portfolio (11 January)

23 holdings in 18 sectors and little spare cash, a longer term aim is to reduce those to 20 or less and hold a cash minimum of 6 months target income. CNA and TUI were sold last week with the proceeds buying DLG, IMB and VOD yesterday; HSBA and RE.B continue to yield nothing until told otherwise, GTLY intends to pay a dividend for its current financial year (announced today).

Happy New Year 2021 to All, and Thankyou to Mods for keeping LF running.

M

Re: moorfield HYRP - Reconstruction

Posted: March 10th, 2021, 4:14 pm

by moorfield

2021 UpdateReconstruction. Sales of CNA, TUI, JMAT, GTLY, SGE, SLA, BRW (*) purchases of VOD, IMB, DLG, DGOC, MONY, GSK, MNG and dividend announcements to date notably RE.B, RIO all combine to bring forecast income back on (2019) target, as the chart shows. Additional top ups as cashflow follows through may increase that further, and I can resume a long term projection of income growth (+7.2% pa) next January - we'll see.

Things are looking up, until another virus emerges... Enjoy your summer all.

M

(*) HSBA gets a stay of execution as I am now "hands off" unless forecast income falls back again during the year.

Re: moorfield HYRP

Posted: March 10th, 2021, 4:58 pm

by Dod101

Quite a reconstruction! Just as well this is not on the HYP Board. Interesting that you should buy Imperial Brands. I see from the income point of view but although I hold it, it is not a share that I think I would be buying. I can quite see that the yield is very attractive though.

Like you I am hoping that my dividend income will be back to more or less 2019 levels this year. It is though a big ask because of the fall in dividend income from Imperial and Shell and ironically their cuts were at best only indirectly due to Covid so I cannot expect a quick reinstatement.

Dood

Re: moorfield HYRP

Posted: March 10th, 2021, 5:40 pm

by moorfield

Dod101 wrote:Quite a reconstruction! Just as well this is not on the HYP Board. Interesting that you should buy Imperial Brands. I see from the income point of view but although I hold it, it is not a share that I think I would be buying. I can quite see that the yield is very attractive though.

Like you I am hoping that my dividend income will be back to more or less 2019 levels this year. It is though a big ask because of the fall in dividend income from Imperial and Shell and ironically their cuts were at best only indirectly due to Covid so I cannot expect a quick reinstatement.

Hence my preamble right at the (re)start of this thread, yes this is certainly where I deviate from HYP - I am not afraid to make wholesale changes albeit infrequently I hope. But I do now intend to pursue a state of HYP like calm - as alluded to on

Gengulphus' interesting examination of HYP1 recently, the red line is my "hands-off/hands-on" switch - there is no need to sell anything else for now. There may be three or four further top ups later this year.

I hold both tobaccos, with regards IMB that particular purchase brought it to roughly half sector weight, I don't envisage any more top ups for the next couple of years at least.

Re: moorfield HYRP

Posted: March 10th, 2021, 10:09 pm

by tjh290633

You have got rid of some non-payers, and replaced them with payers, which makes sense. Whether the same result might be obtained with no change, but looking forward a little, is a moot point.

You have achieved your objective of restoring income levels, and on that you cannot be criticised.

TJH

Re: moorfield HYRP

Posted: March 11th, 2021, 7:44 am

by moorfield

tjh290633 wrote:Whether the same result might be obtained with no change, but looking forward a little, is a moot point.

Agree it is moot which is why I thought

Gengulphus' work on "reinvestment" HYP1 interesting, but to use a sailing analogy I prefer to keep a steady hand on the tiller rather than rely on being steered by the winds and currents towards my destination.

Re: moorfield HYRP

Posted: March 11th, 2021, 11:43 am

by 77ss

Dod101 wrote:.....Interesting that you should buy Imperial Brands. I see from the income point of view but although I hold it, it is not a share that I think I would be buying. I can quite see that the yield is very attractive though.......

Dood

I was looking at IMB the other day - thinking about realising some losses to offset XS capital gain.

I checked out shorting. There appears to be none. There may of course be a lot of unreportable sub 0.1%s, but it has made me wonder whether IMB is deemed to be at the bottom, from which the only way is up.

As you say, the yield is very attractive. Seems to me that something has to give - a further dividend cut or a rising share price. I may look elsewhere for my losses (no shortage of options!)

Re: moorfield HYRP

Posted: March 11th, 2021, 11:56 am

by Dod101

77ss wrote:Dod101 wrote:.....Interesting that you should buy Imperial Brands. I see from the income point of view but although I hold it, it is not a share that I think I would be buying. I can quite see that the yield is very attractive though.......

Dood

I was looking at IMB the other day - thinking about realising some losses to offset XS capital gain.

I checked out shorting. There appears to be none. There may of course be a lot of unreportable sub 0.1%s, but it has made me wonder whether IMB is deemed to be at the bottom, from which the only way is up.

As you say, the yield is very attractive. Seems to me that something has to give - a further dividend cut or a rising share price. I may look elsewhere for my losses (no shortage of options!)

I almost sold after it went ex div last month but decided just to keep it but I am a bit concerned at the yield given the current general shortage of dividends in the market. The market is usually right and it is definitely signalling another cut but I really do not see why they should. I am actually well on the right side with Imperial having extracted my original buying price long ago. In any case mine is held in an ISA so no tax to consider.

Dod

Re: moorfield HYRP

Posted: March 11th, 2021, 5:20 pm

by TUK020

77ss wrote:Dod101 wrote:.....Interesting that you should buy Imperial Brands. I see from the income point of view but although I hold it, it is not a share that I think I would be buying. I can quite see that the yield is very attractive though.......

Dood

I was looking at IMB the other day - thinking about realising some losses to offset XS capital gain.

I checked out shorting. There appears to be none. There may of course be a lot of unreportable sub 0.1%s, but it has made me wonder whether IMB is deemed to be at the bottom, from which the only way is up.

As you say, the yield is very attractive. Seems to me that something has to give - a further dividend cut or a rising share price. I may look elsewhere for my losses (no shortage of options!)

When you short a share, in effect you borrow it, and sell it, with the intention of buying it back later at a lower price to return to owner.

In the meantime, you have to pay the owner the dividend.

For a share on IMB's yield, shorting entails expensive ongoing cost - you have to be really sure it is going to go further south, by a lot, and soon.

Suspect IMB is now at the level no one is prepared to bet that it is going to go down enough from here, fast enough to make it worthwhile. i.e. if not the bottom, then getting close.

VF is another matter..........4.5% stock shorted.

I hold both, but am much more nervous about VF.

Re: moorfield HYRP

Posted: March 13th, 2021, 10:20 am

by Dod101

I have just checked the trailing yield for Imperial Brands now that the last big payment before the cut made on 31 March 2020 is dropping out of the picture. The trailing yield is now be 9.8% at the current price. That definitely seems too high but maybe the market is simply accepting that there is not much scope to increase the dividend in the near future with the emphasis now on debt reduction, squeezing a bit more out of the business and, it seems, making investment in NGPs more focussed.

I will most likely hang on to what I hold but am unlikely to increase my holding even although it is comparatively modest.

Dod

Re: moorfield HYRP

Posted: March 13th, 2021, 12:10 pm

by moorfield

Dod101 wrote:I have just checked the trailing yield for Imperial Brands now that the last big payment before the cut made on 31 March 2020 is dropping out of the picture. The trailing yield is now be 9.8% at the current price. That definitely seems too high but maybe the market is simply accepting that there is not much scope to increase the dividend in the near future with the emphasis now on debt reduction, squeezing a bit more out of the business and, it seems, making investment in NGPs more focussed.

As you may know I stop buying when yields exceed twice that of CTY (5.1%), it is certainly flirting with that level a further 3-4% drop on the SP (relative to CTY) would do it. I think the free cashflow it generates is undervalued currently and, I'm speculating, is beaten down because it doesn't rank highly on wokesters' ESG scorecards. It will be interesting to see if IMB start making noise about cannabis products as BATS has done. We'll see.

Re: moorfield HYRP

Posted: March 13th, 2021, 12:53 pm

by 77ss

moorfield wrote:...It will be interesting to see if IMB start making noise about cannabis products as BATS has done. We'll see.

They have been investing in this area for a couple of years now. But may have been burnt by Auxly. I expect there are other priorities.

Re: moorfield HYRP

Posted: August 6th, 2021, 7:21 pm

by moorfield

2021 Update #2

Recovery. Income ntm is comfortably back on track, and with today's dividend from VOD cashflow to date has exceeded last year's (and at least ~50% more to come). Other than a handful of top ups, I am aiming to leave the portfolio alone for the next sixteen months, and may skip January's update.

Portfolio (6 August)

23 holdings / 18 sectors and 3 months of (2021) target income in cash.

(*) For GSK I am factoring in a dividend of 19p + 19p + 23p (financial year 2021) + 19p*55/80 (post-split aggregate) = 74.0p, but this will continue to reduce next year.

Re: moorfield HYRP

Posted: December 31st, 2021, 2:09 pm

by moorfield

2021 Result / 2022 Target Trading & Costs

Trading & CostsThere have been no changes in the portfolio since last posted (other than some weights and yields).

Happy New Year 2022 to All, and Thankyou to Owners and Mods for keeping LF running.

M

Re: moorfield HYRP

Posted: March 31st, 2022, 10:57 pm

by moorfield

Budget Report for 2021/22 Tax Year

For the first time I have used Microsoft Money's budget planner to track dividend income received versus forecast over the last tax year, split quarterly. The budgeted figure taken was overall forecast income at 31/03/21. Since I normally exclude specials from that and have also been reinvesting dividends, it is not too surprising to see a surplus for the year, +15.7%. The fourth column expresses the shortfalls as months of budgeted income to give an estimate of minimum cash reserve needed assuming surplus income was spent, 2 months. All numbers presented are pence per accumulation unit (which has not changed, and is thus an easy way of redacting real values), and have been rounded (hence the apparent mis-totals!).

Re: moorfield HYRP

Posted: April 1st, 2022, 8:11 pm

by 88V8

moorfield wrote:

Vive la difference!

V8

Re: moorfield HYRP

Posted: December 31st, 2022, 12:36 pm

by moorfield

2022 Update

Revolution. This year I have turned over the portfolio significantly, 52%, by recycling lower yield shares into higher yield investment trusts. The ratcheting effect of this has seen a significant milestone reached years earlier than planned - a natural yield income exceeding the higher rate income tax threshold (£50270). Acc Unit value gained +4.9%, Portfolio Xirr since inception (Nov 2008) was +8.4%. I turn 50 this year, for the next five years at least that income will continue to be reinvested into ITs (boring!), and it is not inconceivable that it might double again at +7.2%pa before I turn 60 (with the help of further contributions). We shall see, but I can now start thinking seriously about stopping working full time by 55-57 and broadening out IT holdings.

Trading & Costs

Portfolio Leavers

WPP, AZN, GSK, BA, ULVR, AV, NG, UU, SDRC, SSE, SHEL

Portfolio Joiners

EAT, CSH, HFEL, SMIF, NCYF, THRL, CHI, APAX, AEI, HHI, JLEN, FSFL, SOI, MYI

All that remains to write as usual is:

Happy New Year 2023 to All, and Thankyou to Owners and Mods for keeping LF running.

M