Got a credit card? use our Credit Card & Finance Calculators

Thanks to Wasron,jfgw,Rhyd6,eyeball08,Wondergirly, for Donating to support the site

fca's Portfolio

-

fca2019

- 2 Lemon pips

- Posts: 220

- Joined: July 18th, 2019, 8:37 am

- Has thanked: 166 times

- Been thanked: 65 times

fca's Portfolio

Afternoon folks,

I've recently done quite a lot of trading and consolidating in my portfolio, so would welcome review and feedback.

My current portfolio is as follows:

Vanguard LifeStrategy 60% - 41%

Fidelity Index World - 30%

Legal & General Global 100 - 19%

Fundsmith - 7%

Kames Monthly Distribution - 3%

I am a recent investor (2 years), apart from that we have cash savings and workplace pensions. I'm pretty different to many here as prefer OEIC funds to individual shares or IT's. Being in my 40s I'm looking for growth (total return) rather than yield.

I'm conscious that I'm overweight in VLS 60% but this is partly because I've invested heavily into my and Mrs fca's SIPPs, to maximise the tax relief, and don't like to take too big a risk there. Not so paranoid about taking risk in my ISA or dealing account.

Recent trades

We knew a correction was coming. Shame as 2019 was such a good year. This wiped out most of my gains from 2019. Got upset with the performance of UK stocks with the CV crash (like many here). I decided I had enough and sold my entire UK holdings CTY, RDSB, GSK, SMT and Invesco High Yield Bonds (UK), and a Vanguard FTSE 100 tracker.

My current thoughts are with CV19 and Brexit, the UK is a bad place to be for an investor. I was overweight in the UK and have now gone underweight. So I now have a negative home-bias, and wouldn't look to invest in the UK.

Doing this meant I took quite a hit on City of London and Shell. To partly offset that I got lucky on Glaxo. Neutral on the others. Reinvested all the proceeds in Legal & General Global 100. To my mind I haven't so much made a loss as switched funds around.

I can't decide what is better, passive or active, but am sure high yield is not for me. Fundsmith has done well last 12 months, but so has Fidelity Index World.

I worked out the current portfolio has a weighted average return (5 years annualised) of 10.6%. Which to me sounds high. I'm not sure the next 10 years will be as generous. But I do think I'm currently too conservative, so would like to increase the risk a little bit, without being too greedy. Was thinking I could put extra in Fundsmith and maybe a technology fund (Polar Capital) or one of the Baillie Gifford funds? Or would you recommend something else?

Your thoughts and feedback appreciated. Cheers

I've recently done quite a lot of trading and consolidating in my portfolio, so would welcome review and feedback.

My current portfolio is as follows:

Vanguard LifeStrategy 60% - 41%

Fidelity Index World - 30%

Legal & General Global 100 - 19%

Fundsmith - 7%

Kames Monthly Distribution - 3%

I am a recent investor (2 years), apart from that we have cash savings and workplace pensions. I'm pretty different to many here as prefer OEIC funds to individual shares or IT's. Being in my 40s I'm looking for growth (total return) rather than yield.

I'm conscious that I'm overweight in VLS 60% but this is partly because I've invested heavily into my and Mrs fca's SIPPs, to maximise the tax relief, and don't like to take too big a risk there. Not so paranoid about taking risk in my ISA or dealing account.

Recent trades

We knew a correction was coming. Shame as 2019 was such a good year. This wiped out most of my gains from 2019. Got upset with the performance of UK stocks with the CV crash (like many here). I decided I had enough and sold my entire UK holdings CTY, RDSB, GSK, SMT and Invesco High Yield Bonds (UK), and a Vanguard FTSE 100 tracker.

My current thoughts are with CV19 and Brexit, the UK is a bad place to be for an investor. I was overweight in the UK and have now gone underweight. So I now have a negative home-bias, and wouldn't look to invest in the UK.

Doing this meant I took quite a hit on City of London and Shell. To partly offset that I got lucky on Glaxo. Neutral on the others. Reinvested all the proceeds in Legal & General Global 100. To my mind I haven't so much made a loss as switched funds around.

I can't decide what is better, passive or active, but am sure high yield is not for me. Fundsmith has done well last 12 months, but so has Fidelity Index World.

I worked out the current portfolio has a weighted average return (5 years annualised) of 10.6%. Which to me sounds high. I'm not sure the next 10 years will be as generous. But I do think I'm currently too conservative, so would like to increase the risk a little bit, without being too greedy. Was thinking I could put extra in Fundsmith and maybe a technology fund (Polar Capital) or one of the Baillie Gifford funds? Or would you recommend something else?

Your thoughts and feedback appreciated. Cheers

-

mrbrightside

- 2 Lemon pips

- Posts: 139

- Joined: March 10th, 2017, 11:44 am

- Has thanked: 83 times

- Been thanked: 45 times

Re: fca's Portfolio

fca2019 wrote:Afternoon folks,

Got upset with the performance of UK stocks with the CV crash (like many here). I decided I had enough and sold my entire UK holdings CTY, RDSB, GSK, SMT and Invesco High Yield Bonds (UK), and a Vanguard FTSE 100 tracker.

Try to divorce emotion from investing and take a longer term approach.

How are those UK holdings performing now ? How to they compare with your new selections ?

-

fca2019

- 2 Lemon pips

- Posts: 220

- Joined: July 18th, 2019, 8:37 am

- Has thanked: 166 times

- Been thanked: 65 times

Re: fca's Portfolio

mrbrightside wrote:How are those UK holdings performing now ? How to they compare with your new selections ?

The sales are fairly recent, done over the past few weeks, so too early to say. I don't think I am alone in getting disillusioned with UK investing as a number of posters have mentioned on other threads. I know I am fairly new at this but have watched my home bias cause underperformance over 2 years and again with the CV19 market correction.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: fca's Portfolio

fca2019 wrote:mrbrightside wrote:How are those UK holdings performing now ? How to they compare with your new selections ?

The sales are fairly recent, done over the past few weeks, so too early to say. I don't think I am alone in getting disillusioned with UK investing as a number of posters have mentioned on other threads. I know I am fairly new at this but have watched my home bias cause underperformance over 2 years and again with the CV19 market correction.

Some would say of course that now is just the time to be investing in the UK after a few years of underperformance. In any case there are actually very few shares in the FTSE100 or maybe even the 250 that are anything like pure UK plays. For instance you mentioned selling Shell. It is certainly not a UK play and an oil company incorporated somewhere else will have very similar problems. Unilever, Diageo, Scottish Mortgage or Monks have all been good investments and will most likely remain so but they are not much invested in the UK, even although their primary quote is in London.

The disillusionment with UK investing as you put it is I think mostly from those (like me) seeking an income in the form of dividends, although if I invest outside of the UK it will be because I see another world class company that I quite like. I have not done so yet.

Dod

-

monabri

- Lemon Half

- Posts: 8427

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: fca's Portfolio

Dod101 wrote:Some would say of course that now is just the time to be investing in the UK after a few years of underperformance.

Dod

If it were the England football team, they'd have written a song about it by now......"#20 years of hurt, it's coming home, investing's coming home"

-

fca2019

- 2 Lemon pips

- Posts: 220

- Joined: July 18th, 2019, 8:37 am

- Has thanked: 166 times

- Been thanked: 65 times

Re: fca's Portfolio

Dod - point taken re FTSE 100 being global co's, and agree there are some outstanding growth investments (SMT, Monks).

Monabri -

Monabri -

-

TUK020

- Lemon Quarter

- Posts: 2046

- Joined: November 5th, 2016, 7:41 am

- Has thanked: 763 times

- Been thanked: 1179 times

Re: fca's Portfolio

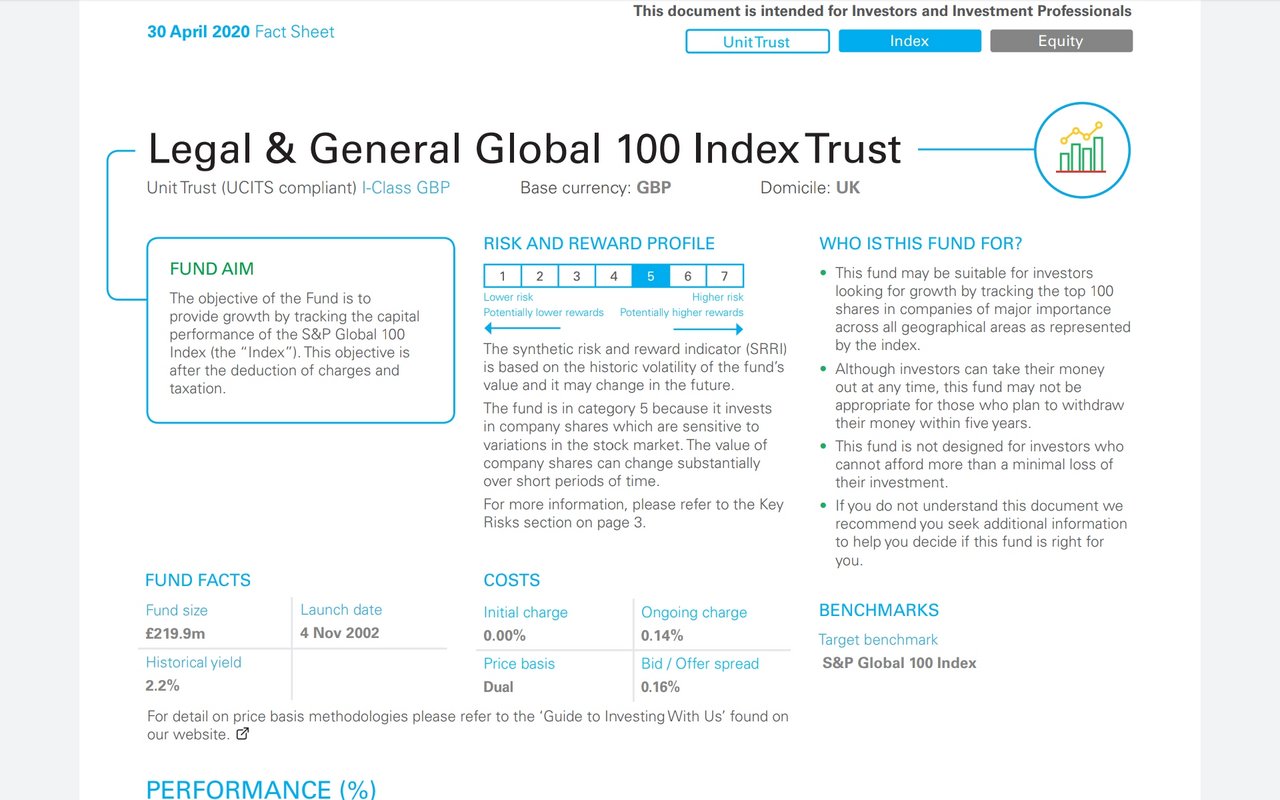

Provided you are not too fussed about income, L&G Global 100 has a lot going for it.

- big secure companies

- global spread

- very low costs

From memory, about 50% US, about 5% UK markets

Probably the lowest cost route to 'buying the world' index to wait for and ride the recovery

Compared to FTSE100, which is 70% international earnings, and 30% UK domestic market.

Bigger problem is that it is skewed in terms of sector, has a high degree of concentration (Oil, Pharma,etc) and misses some sectors almost entirely (tech).

- big secure companies

- global spread

- very low costs

From memory, about 50% US, about 5% UK markets

Probably the lowest cost route to 'buying the world' index to wait for and ride the recovery

Compared to FTSE100, which is 70% international earnings, and 30% UK domestic market.

Bigger problem is that it is skewed in terms of sector, has a high degree of concentration (Oil, Pharma,etc) and misses some sectors almost entirely (tech).

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: fca's Portfolio

Thanks for that TUK. The latest fact sheet shows the US content as 65% and generally all the big names from around the world are there. I was surprised that the costs were not lower for a passive tracker. I would not call 0.52% very low.

I wonder if L & G give any special deals for their shareholders?

Dod

I wonder if L & G give any special deals for their shareholders?

Dod

-

monabri

- Lemon Half

- Posts: 8427

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: fca's Portfolio

L&G Global 100 Index

https://www.legalandgeneral.com/investm ... dex-trust/

From the factsheet - link above

Company & % holdings

Microsoft Corp 10.8

Apple Inc 9.7

Amazon.Com Inc 8.0

Alphabet Cl A 3.2

Alphabet Cl C 3.2

Johnson & Johnson 3.1

Nestle 2.5

JPMorgan Chase & Co 2.4

Procter & Gamble Company 2.3

Intel Corp 2.1

Country %

United States 70.6

Switzerland 7.2

United Kingdom 7.0 (isn't this a heavy % for UK - see text below?)

France 4.4

Japan 3.5

Germany 3.4

Korea 1.7

Netherlands 1.1

Spain 0.7

Australia 0.5

UK Holdings - From the annual report - I'd say that the UK holding is predominately "HYP-type" shares. They list 17 companies including HSBA/BP/GSK/AZN/NG/PRU/RIO/AV./DGE/RDSAx2/RDSB/VOD/STAN/BARC + (AAL and AON for completeness).

Annual report

https://www.legalandgeneral.com/_resour ... -trust.pdf

I reckon most of the L&G Global 100 gains are coming from the US holdings (unsurprisingly) - if we compare to Vanguards 0.07% charging VUSA fund

VUSA https://www.hl.co.uk/shares/shares-sear ... etf-usdgbp

The L&G Global 100 total return is currently being hampered by the UK & Euro holdings, perhaps?

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Link to comparison tool.

https://www.hl.co.uk/funds/fund-discoun ... ion/charts

https://www.legalandgeneral.com/investm ... dex-trust/

From the factsheet - link above

Company & % holdings

Microsoft Corp 10.8

Apple Inc 9.7

Amazon.Com Inc 8.0

Alphabet Cl A 3.2

Alphabet Cl C 3.2

Johnson & Johnson 3.1

Nestle 2.5

JPMorgan Chase & Co 2.4

Procter & Gamble Company 2.3

Intel Corp 2.1

Country %

United States 70.6

Switzerland 7.2

United Kingdom 7.0 (isn't this a heavy % for UK - see text below?)

France 4.4

Japan 3.5

Germany 3.4

Korea 1.7

Netherlands 1.1

Spain 0.7

Australia 0.5

UK Holdings - From the annual report - I'd say that the UK holding is predominately "HYP-type" shares. They list 17 companies including HSBA/BP/GSK/AZN/NG/PRU/RIO/AV./DGE/RDSAx2/RDSB/VOD/STAN/BARC + (AAL and AON for completeness).

Annual report

https://www.legalandgeneral.com/_resour ... -trust.pdf

I reckon most of the L&G Global 100 gains are coming from the US holdings (unsurprisingly) - if we compare to Vanguards 0.07% charging VUSA fund

VUSA https://www.hl.co.uk/shares/shares-sear ... etf-usdgbp

The L&G Global 100 total return is currently being hampered by the UK & Euro holdings, perhaps?

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Link to comparison tool.

https://www.hl.co.uk/funds/fund-discoun ... ion/charts

-

fca2019

- 2 Lemon pips

- Posts: 220

- Joined: July 18th, 2019, 8:37 am

- Has thanked: 166 times

- Been thanked: 65 times

Re: fca's Portfolio

Dod101 wrote:I was surprised that the costs were not lower for a passive tracker. I would not call 0.52% very low.

Hi there - the ongoing cost for the L&G Gloabl 100 Index I Acc is 0.14%, which compares favourably to the costs for the other investments I have.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: fca's Portfolio

That's more what I would have expected. I got my 0.52% from some so called fact sheet. Thanks anyway fca.

Dod

Dod

-

monabri

- Lemon Half

- Posts: 8427

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: fca's Portfolio

At first glance...pretty similar.

A Google search lead me to this ( I class are discussed at the end of the thread).

https://forums.moneysavingexpert.com/di ... lass-units

A Google search lead me to this ( I class are discussed at the end of the thread).

https://forums.moneysavingexpert.com/di ... lass-units

Last edited by monabri on June 18th, 2020, 11:39 am, edited 1 time in total.

-

Alaric

- Lemon Half

- Posts: 6068

- Joined: November 5th, 2016, 9:05 am

- Has thanked: 20 times

- Been thanked: 1419 times

Re: fca's Portfolio

monabri wrote:At first glance...pretty similar.

As often wih OEICs, there is more than one class of units. In this case it's I (for Institutional presumably) with the low charge and R (for retail) with the higher charge. If you are buying through a platform the class of units may depend on arrangements between the provider and the platform. The I class is likely to have restrictions on the minimum size of holdings and minimum deal size.

-

monabri

- Lemon Half

- Posts: 8427

- Joined: January 7th, 2017, 9:56 am

- Has thanked: 1549 times

- Been thanked: 3445 times

Re: fca's Portfolio

Thanks. I don't hold OEICs ( no reason, just don't) so this was an "exercise in understanding".

-

77ss

- Lemon Quarter

- Posts: 1277

- Joined: November 4th, 2016, 10:42 am

- Has thanked: 233 times

- Been thanked: 416 times

Re: fca's Portfolio

fca2019 wrote:Afternoon folks,

I've recently done quite a lot of trading and consolidating in my portfolio, so would welcome review and feedback.

My current portfolio is as follows:

Vanguard LifeStrategy 60% - 41%

Fidelity Index World - 30%

Legal & General Global 100 - 19%

Fundsmith - 7%

Kames Monthly Distribution - 3%

I am a recent investor (2 years), apart from that we have cash savings and workplace pensions. I'm pretty different to many here as prefer OEIC funds to individual shares or IT's. Being in my 40s I'm looking for growth (total return) rather than yield.

......Was thinking I could put extra in Fundsmith and maybe a technology fund (Polar Capital) or one of the Baillie Gifford funds? Or would you recommend something else?

Your thoughts and feedback appreciated. Cheers

Perhaps I misunderstand something, but looking for TR, I would not put a penny into the Vanguard one. Look at the 5 year TR of 44.34%. Compare with dull old ULVR - 90.76%.

You mention PCT. This, and its peer, ATT have delivered 245.58% and 260.2% respectively.

The past etc...., but even so.

-

xeny

- Lemon Slice

- Posts: 450

- Joined: April 13th, 2017, 11:37 am

- Has thanked: 235 times

- Been thanked: 154 times

Re: fca's Portfolio

fca2019 wrote:

I'm conscious that I'm overweight in VLS 60% but this is partly because I've invested heavily into my and Mrs fca's SIPPs, to maximise the tax relief, and don't like to take too big a risk there. Not so paranoid about taking risk in my ISA or dealing account.

You're in your 40s, so likely not able to touch pensions until you're 57 at a minumim. You can get at your ISA or dealing account at any point.

Surely you want your highest equity % in you pension and then decreasing volatility into the ISA and then lowest volatility inthe dealing account?

-

fca2019

- 2 Lemon pips

- Posts: 220

- Joined: July 18th, 2019, 8:37 am

- Has thanked: 166 times

- Been thanked: 65 times

Re: fca's Portfolio

77ss wrote:Perhaps I misunderstand something, but looking for TR, I would not put a penny into the Vanguard one. Look at the 5 year TR of 44.34%. Compare with dull old ULVR - 90.76%.You mention PCT. This, and its peer, ATT have delivered 245.58% and 260.2% respectively.The past etc...., but even so.

Thanks, useful will be looking at PCT and ATT. I've got the Vanguard one primarily for the two SIPPs I run one for me and Mrs fca. My thinking for the SIPPs is that I am more concerned with capital preservation and getting the tax relief, than investment returns. However I also have VLS60 in dealing account as well so thinking of re-investing that at some point, but 2020 market turmoil has stopped me. 2019 was so much easier, it was like shooting fish in a barrel

-

jackdaww

- Lemon Quarter

- Posts: 2081

- Joined: November 4th, 2016, 11:53 am

- Has thanked: 3203 times

- Been thanked: 417 times

Re: fca's Portfolio

fca2019 wrote:77ss wrote:Perhaps I misunderstand something, but looking for TR, I would not put a penny into the Vanguard one. Look at the 5 year TR of 44.34%. Compare with dull old ULVR - 90.76%.You mention PCT. This, and its peer, ATT have delivered 245.58% and 260.2% respectively.The past etc...., but even so.

Thanks, useful will be looking at PCT and ATT. I've got the Vanguard one primarily for the two SIPPs I run one for me and Mrs fca. My thinking for the SIPPs is that I am more concerned with capital preservation and getting the tax relief, than investment returns. However I also have VLS60 in dealing account as well so thinking of re-investing that at some point, but 2020 market turmoil has stopped me. 2019 was so much easier, it was like shooting fish in a barrel

====================

worth considering SMT MONKS ATST FCIT .

all have lower charges and are similar faangs type .

-

fca2019

- 2 Lemon pips

- Posts: 220

- Joined: July 18th, 2019, 8:37 am

- Has thanked: 166 times

- Been thanked: 65 times

Re: fca's Portfolio

Coming out of UK equities worked out well in June. Also added gold to my portfolio. June was a good month, US stocks up 1.5% in month cf. FTSE 100 down 0.5%. Gold up 2%. Continuing the trends since CV19 crash... US stocks, gold, Tesla and SMT outperform. UK stocks continue to underperform.

-

Dod101

- The full Lemon

- Posts: 16629

- Joined: October 10th, 2017, 11:33 am

- Has thanked: 4343 times

- Been thanked: 7536 times

Re: fca's Portfolio

fca2019 wrote:Coming out of UK equities worked out well in June. Also added gold to my portfolio. June was a good month, US stocks up 1.5% in month cf. FTSE 100 down 0.5%. Gold up 2%. Continuing the trends since CV19 crash... US stocks, gold, Tesla and SMT outperform. UK stocks continue to underperform.

The trouble is one month (even if it is June!) does not make a summer. Where do you think your portfolio will be in five years?

Dod

Return to “Portfolio Management & Review”

Who is online

Users browsing this forum: No registered users and 34 guests